David Ryder

Investors largely went into Amazon’s (NASDAQ:AMZN) second quarter earnings with reasonably low expectations, given weakening consumer sentiment due to heightened macroeconomic challenges, as well as a shifted Prime Day timeline this year that has led to a tough PY comp. However, the company’s surprise sales and operating income beats provided a much-needed boost to investors’ confidence in the stock, as well as the underlying business’ resilience against ongoing macro uncertainties. Amazon’s shares rose as much as 14% in post-earnings late trading Thursday evening, outpacing the 10% overnight slump observed in April after its lackluster first quarter earnings release.

Unlike the previous quarter, we believe Amazon’s second quarter results and forward guidance have demonstrated that there is more to like than dislike about its growth outlook. While excess fulfilment capacity continues to be the big idiosyncratic overhang on Amazon’s core commerce business, the deceleration observed in related incremental costs during the second quarter corroborates management’s diligence in reducing controllable costs and optimizing operational efficiency ahead of what looks to be a worsening economic downturn. A solid forward guidance backed by tangible evidence of resilience observed in July’s Prime Day consumer activities, as well as robust cloud service take-rates observed across both the enterprise and public sectors also demonstrates that Amazon will outperform peers amid deteriorating economic conditions, despite its significant exposure to the slowing consumer end market.

Recap of 2Q’22 Performance

Consolidated first quarter sales beat consensus estimates and exceeded the top range of management’s previously provided guidance. Amazon generated total sales of $121.1 billion (+7% y/y; +4% q/q) in the second quarter, compared with average consensus estimate of $119 billion (+5% y/y; +2% q/q) and management’s upper range guidance of $121 billion (+7% y/y; +4% q/q). The second quarter sales beat had already taken into consideration 320 bps of FX headwind and 400 bps of unfavorable impact from the shifted Prime Day timeline.

The incremental cost headwinds stemming from inflationary pressures, excess fulfilment capacity, and fixed cost leverage has also decelerated from $6 billion in the first quarter to $4 billion in the second quarter. Although the unfavorable incremental costs indicate that the internal impact of inefficient productivity related to overstaffing and excess capacity built from the booming pandemic era remains a lingering overhang on Amazon’s margins, the deceleration observed in the second quarter underscores improvement in managing controllable costs outside of unfavorable external impacts (e.g. inflation, FX, etc.).

As a result, operating income came in stronger-than-expected at $3.3 billion (-57% y/y; -10% q/q), beating average consensus estimates of $1.8 billion (-77% y/y; -51% q/q) and management’s upper range guidance of $3 billion (-61% y/y; -18% q/q). The softened second quarter margins also reflect a “seasonal step-up” in stock-based compensation expenses as guided by management during Amazon’s first quarter earnings call.

Consolidated earnings per share came in at -$0.2, missing Wall Street consensus of $0.12 by a far cry again due to the ongoing risk-off environment in public markets. Specifically, the results included a $3.9 billion negative impact related to non-operating, mark-to-market losses on its Rivian investment during the second quarter (vs. -$7.6 billion in Q1).

Everything We Like and Dislike About Amazon’s 2Q’22 Results

1. Macro Headwinds

What We Did Not Like: Persistent macroeconomic challenges are being felt across all industries, and not just Amazon. However, the $4 billion in incremental costs reported in the second quarter also implies that Amazon is still dealing with the aftermath of inefficient network productivity and excess capacity built during the pandemic-era boom.

Recall that in the first quarter, incremental costs totaled $6 billion, with only $2 billion attributable to unfavorable external economic conditions, and while underutilized capacity accounted for $4 billion. In the second quarter, it is likely that underutilized capacity remains a core driver of the $4 billion in incremental costs. Specifically, Amazon’s fulfilment network OPEX remained flat compared to PQ, representing an increase of 14% from the prior year. Margins are also expected to remain soft in the third quarter, with management only guiding a range of $0 to $3.5 billion, a far cry from the average consensus estimate of $4.4 billion. This implies there is still much work to be done when it comes to “unwinding the pandemic-era expansion” as demand slows.

What We Liked: However, the deceleration in incremental costs is still a win we will take. It is not the most ideal situation, but it shows that there has not been any additional idiosyncratic risks to Amazon’s margins. It means Amazon is still defending its market leadership across both its core commerce and cloud businesses, with controllable cost efficiencies only improving from here on out.

The results also provide validation to the achievability of management’s guide on sequential cost improvements of $1.5 billion in the third quarter, as well as CEO Andy Jassy’s positive commentary that the company is “making progress on the more controllable costs…, particularly improving the productivity of [its] fulfilment network”. Paired with the anticipated increase in volumes from Prime Day shopping events in both Q3 and Q4, as well as the winter holiday shopping season, we see incremental costs stemming from internal inefficiencies to decline rapidly in 2H with increased absorption of excess capacity, as well as improved scale.

Amazon has also yet to see significant discounting of inventory values, despite similar concerns raised by big-box retailers like Walmart (WMT) and Target (TGT) amid worsening consumption trends as inflationary pressures remain elevated. This is definitely a competitive advantage for Amazon, and corroborates that the e-retailer’s consumer-base is less saturated with lower-income households like those of Walmart, which is seeing a substantial “shift to lower-margin categories” due to heightened sensitivity to pricing changes.

2. AWS Margins

What We Did Not Like: AWS has typically been the poster child at Amazon and across the cloud-computing industry, which few investors have raised concerns about. However, the unit’s latest operating income miss is risking the reversal of this autonomy it has historically enjoyed away from the public eye.

AWS posted strong top-line growth in the 30% range for the sixth consecutive quarter, but operating income missed consensus estimates by 5% (actual: $5.72 billion vs. consensus: $6.04 billion). Despite built-in expectations for a seasonality step-up in stock-based compensation expenses during the second quarter, related spending was actually higher-than-expected in AWS due to pronounced “wage inflation in high demand areas, including engineers and other tech workers”.

With AWS being the cash engine in supporting Amazon’s broader business – especially as core commerce margins falter amid the inflationary environment – the segment’s margin miss draws “intrigue” about its profitability prospects. Although AWS remains a cash cow for Amazon despite the recent miss on operating income, the situation begs questions over how much of the impact is related to temporary investments in related infrastructure build-out and near-term macro pressures, as well as whether the record-setting 35% margins in the first quarter are still within reach.

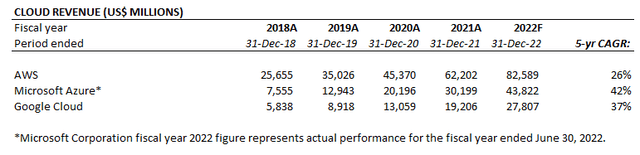

What We Liked: AWS’ continuation of growth in the 30% range and a sustained multi-year CAGR of more than 20% provides confidence that the second quarter margin miss is only a temporary showing. The segment commands 33% of opportunities within the global cloud-computing market still, representing the industry’s largest share and far ahead of runner up Microsoft Azure’s (MSFT) 21%.

Cloud Computing Revenue Comp (AMZN, MSFT, GOOG/GOOGL Historical Financial Statements)

The robust demand environment for cloud-computing solutions across the enterprise and public sectors, paired with AWS’ aggressive investment cycle on building out related infrastructure to capitalize on growing opportunities are expected to support the continuation of a double-digit multi-year CAGR over the longer-term. Cloud spending has remained resilient despite the looming economic downturn, as the modernization of technology stacks continues to be viewed as a critical enabler of operational and economic efficiency. Defying the odds of an economic downturn, cloud infrastructure investments are expected to increase by 22% in the current year to more than $90 billion, marking “the highest annual growth rate since 2018”. This accordingly bolsters AWS’ ability in maintaining its market leadership despite rising competition, and drive the scale required to bring margins back to the high-30% within the near-term.

3. Core Commerce & Ads

What We Did Not Like: Outside of macro headwinds and the lingering overhang of underutilized capacity as mentioned in earlier sections, there is not much to not like in Amazon’s core commerce and rapidly expanding advertising business.

What We Liked: Despite being the two most recession-prone businesses at Amazon, core commerce and advertising sales demonstrated resilience in the second quarter with y/y and sequential growth (except 1P online sales):

- 3P Seller Services: 3P vendors accounted for 57% of all merchandise sold on Amazon during the second quarter, which is favorable to the commerce segment’s bottom-line as related revenues generate higher margins. Specifically, related revenues generated from fees charged on third-party vendor sales, as well as fulfilment via FBA (i.e. storage and delivery) currently drive higher margins compared to Amazon’s 1P sales. According to data disclosed by Forum Brands, an aggregator of Amazon’s 3P FBA vendors, Amazon’s fee charged on 3P sales range from 8% to 15%, with fulfilment taking another 8% to 23%.The segment’s acceleration in sequential growth observed in the second quarter also showcases increasing recognition by 3P sellers of value in Amazon’s fast and free shipping capabilities, which bodes well with the company’s continued efforts in optimizing utilization of fulfilment capacity. Increased 3P sales have also helped Amazon diversify its product selection, and accordingly diversify its consumer-base, reducing concentration within specific demographics like lower-income households to offset recession risks.

- Subscription Services: Related revenues grew 10% y/y (+14% y/y cc), which implies a positive balance between Prime churn and take-rates during the second quarter despite recent membership fee hikes. Recall that Amazon had increased Prime membership fees in North America earlier in the year to account for rising input costs. As discussed in our recent coverage on the stock, which dives into the competitive advantage of Prime’s cost-value structure to all of Amazon, its consumers, and vendors, the feature is likely to benefit from robust demand in the near-term due to continued inflation-driven deal hunting ahead of tightening economic conditions. The growing list of Prime member benefits, like new and improved content on Prime Video, as well as perks like free GrubHub delivery are also expected to help reduce churn when consumers dial back on unnecessary subscriptions and recurring expenses due to tighter budgets. The upcoming Prime Day 2.0 in Q4, as well as the holiday shopping season are also expected to reinforce subscription growth as consumers become increasingly enticed to bargains and deals on discretionary goods (e.g. consumer electronics and Amazon devices, which were the best-selling products during July’s Prime Day) as recession risks grow louder. Continued commitment to providing fast and free shipping is another plus for Amazon in securing new and existing Prime memberships – more than three-quarters of online shoppers have indicated fast delivery times as a core driver of purchase decisions, while free shipping remains the dominant preference. The results imply that Amazon has achieved pricing power through Prime, with the service contributing positively to its unique position in remaining resilient against the near-term consumer slowdown.

- Advertising: Amazon’s high-margin advertising revenues of $8.8 billion (+18% y/y or +21% y/y cc; +11% q/q) in the second quarter also beat consensus estimates of $8.6 billion (+15% y/y; +9% q/q), despite a broad-based slowdown in related spending across the industry. This indicates that outside of external economic headwinds, demand for Amazon’s ad services remains strong. The results are consistent with our previous discussion on how Amazon’s vast trove of first-party data on consumer behavior and purchase habits garnered from its retail business makes a strong competitive advantage. Amazon currently sits in third place behind Google (GOOG/GOOGL) and Meta Platforms (META) in the race for market share in digital ads, and is slated to expand beyond its current 10% share in related opportunities over coming years, as it continues to attract advertisers with rising traffic on its core commerce site. Additional value-add services like Prime Video and Amazon Music have also created new ad distribution channels for Amazon to capitalize on growth opportunities ahead within the digital advertising sector. The upcoming Prime Day and holiday season sales are also expected to position Amazon well for a meaningful share of the limited ad dollars this year, and help offset some of the headwinds to its bottom-line.

All of the above strengths observed during Amazon’s tough second quarter provide confidence in the viability of management’s solid revenue guidance for the third quarter, and foreshadows a strong close to the year. Paired with Amazon’s limited discount risks as discussed in earlier sections, the company demonstrates solid resilience despite significant exposure to the weakening consumer end market.

Final Thoughts

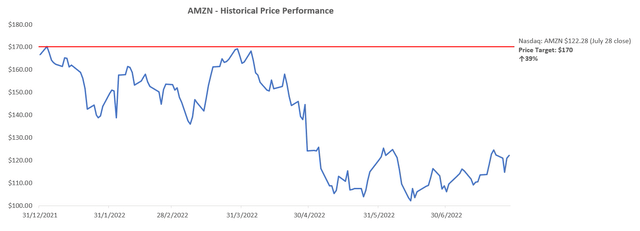

Given the overall positive sentiment from Amazon’s second quarter results and forward guidance, we are maintaining our price target of $170 for the stock. This represents upside potential of 24% based on the stock’s post-earnings price of about $137 apiece in late trading July 28th.

The valuation assumptions applied in our analysis remain consistent with those discussed in our previous coverage to reflect Amazon’s continued demonstration of strength in upholding its robust growth profile, despite the near-term macroeconomic challenges.

Amazon Valuation Analysis (Author)

Amazon_-_Forecasted_Financial_Information.pdf

Amazon’s proven resilience against softening consumer spending is also underpinned by robust Prime Day demand observed in July, with its home-brand Amazon Devices benefiting from record-setting sales, while discretionary goods like consumer electronics made one of the best-selling categories. The results also imply that demand will remain resilient against the external headwinds into the fourth quarter with similar holiday season and Prime Day 2.0 deals, while also contributing positively to ongoing efforts to minimizing the impact of internal headwinds pertaining to fulfilment network inefficiencies.

Amazon’s continued AWS and e-commerce moat remains intact, given the robust Q2 save from its Q1 slump. The results also underscore a strong 2H, restoring investors’ confidence that Amazon’s overall bullish narrative has not been materially altered as a result of ongoing market and economic uncertainties.

Be the first to comment