Kobus Louw

Investment Thesis

Emerson Electric Co. (NYSE:EMR) is a technology and engineering company. The company is experiencing strong demand from its end markets and has record backlog orders. The company is also trying to achieve a higher growth rate by making its portfolio more efficient by acquiring a business that can complement its current business.

About Emerson Electric

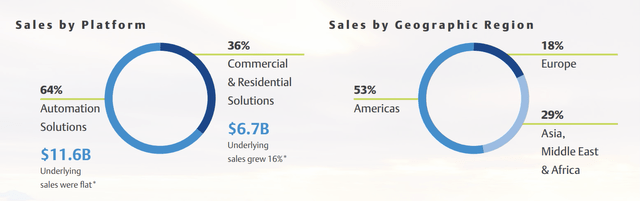

EMR is a technology and engineering company that designs and produces products and distributes services to offer innovative solutions to clients from global industrial, consumer, and commercial markets. The company operates its business through two segments: Automation Solutions and Commercial & Residential Solutions. The Automation Solutions segment provides process control software and systems, industrial valves and equipment, and measurement and analytical instrumentation. The Commercial & Residential Solutions segment provides solutions for residential and commercial heating and cooling systems, including reciprocating and scroll compressors, flow control devices & system protectors, and standard, programmable, & Wi-Fi thermostats. The company earns 64% of the total revenue from the Automation Solutions segment, while 36% is generated from the Commercial & Residential Solutions segment. It earns most of its revenue from USA customers as it generates 53% of total revenue from the USA. The company generates 18% of the total revenue from Europe, 12% from China, and 17% from other Asian, Middle East & African regions.

Sales by Segment and Geography (Annual Report of EMR)

The company sells its products to the nine end markets, which are as follows: oil & gas, residential, chemical, power, discrete & industrial, commercial, cold chain/refrigeration, refining, and life sciences & medical. The largest chunk, which is 17% of the total sales, comes from oil & gas.

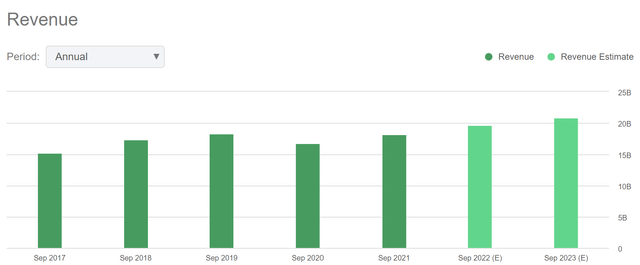

Sales and Earnings Trends

As we can see in the above chart, the company’s sales growth is flat. The revenue has grown 7.67% in FY2021. Over the last five years, the revenue did not grow much – from $15.26 billion in FY2017 to $18.24 billion in FY2021 resulting in a 5-year CAGR of 3.63%. I believe low sales growth shows that the company is facing a slower demand from the end markets. The company reported an EPS of $4.10 in FY2021, which is a 24.62% growth compared to the EPS of FY2020. I believe that, despite the slow revenue growth, the solid EPS growth indicates that the company’s operations are becoming more efficient. The long-term EPS growth is not impressive either, as the 5-year CAGR of EPS is 9.2%. I think things are changing for the EMR as in the recent conference call, the management has stated that the company is experiencing a solid demand from all the end markets, and it has record backlog orders. The company is also experiencing a demand recovery from China after Covid-19. After considering all these factors, I think the company’s organic sales growth might be strong in the coming years. The company is also acquiring new business to achieve an efficient and enhanced portfolio which can give a higher growth rate.

Diversified and Efficient Portfolio

Recently, the company’s subsidiary AspenTech announced that it has entered into an agreement to acquire Micromine. The acquisition can help AspenTech in entering in metals and mining market. Micromine provides end-to-end mining software which offers solutions essential to each stage of the mining process, including assessment, exploration, development, planning, manufacturing, and optimization. I believe this acquisition could be a significant contributor to the solid growth of EMR in coming years as Micromine’s software is used at more than 2,000 mining sites and gives EMR entry into Australia’s Metals & Mining Software market. The company has sold its InSinkErator Business to Whirlpool Corporation. InSinkErator is a manufacturer of food waste disposers and instant hot water dispensers. The company has decided to sell the business of InSinkErator as it does not synergize with the other businesses of EMR. The company has sold InSinkErator to whirlpool for $3.0 billion, which is 18.1x EBITDA of InSinkErator. The effect of this transaction might transpire in the financials of FY2023. I believe this transaction might significantly impact the financials as it can boost the earnings by approximately $5.07 per share in the coming years. I think the company might distribute some part of it as a special dividend and use the remaining part to acquire the new business, improving the portfolio structure. Recently, the company has made a strategic investment in Spearix Technologies. EMR has decided to incorporate Spearix technology into its product line of industrial wireless mesh networks and related software products. I think the direct impact of this investment might not be seen in the short term as, currently, Spearix Technologies is in the early growth phase, but in the long-term, the impact might be significant as it can expand its IIoT capabilities and strengthen its position in IIoT wireless communication market. After considering all these factors, I believe the company is trying to achieve a higher growth rate in the coming years by creating a diversified and synergized portfolio in coming years. The factor that can significantly hinder this growth is the availability of raw materials and components.

What is the Main Risk Faced by EMR?

Availability of Raw Materials and Components

The company’s primary raw material needs are steel, cast iron, electronics, rare earth metals, aluminum, brass, and chemicals derived from petroleum. To avoid being overly dependent on just one or a small number of suppliers, the organization looks for numerous sources of supply for each of its essential requirements. However, calamities, pandemics, epidemics, or other occurrences could stop the flow of resources or other goods. The prices, operating expenses, margins, and competitive position of goods and services could be impacted, which could have a negative impact on EMR’s operational and financial results. This risk could negatively impact operating results even though the company closely monitors the market prices of the commodities to limit price exposure through hedging operations. Due to supply chain disruption and geopolitical tension, the company is facing volatility in raw material prices and availability. If prices of the raw materials increases or there is a shortage of any raw material in coming years, it can contract the margins and negatively affect the financial results of the company.

Valuation

The solid demand from the end market, record backlog orders, and efficient portfolio can drive the growth of the EMR in the coming years. The company currently trades at $78.21 with a trailing P/E ratio of 15.86x. After considering the strong demand from the end market, recovery of demand from China, record backlog orders, and increasing portfolio efficiency, I think the full-year EPS of FY2023 might be $6.10, which gives the forward P/E ratio of 12.82x. I have not considered the earnings from the sale of InSinkErator while estimating full-year EPS of FY2023 as it is a one-time EPS boost that might be distributed to investors in the form of a special dividend or utilized to acquire new business. After comparing the forward P/E ratio with the sector median of 15.40x, we can clearly say that the company is undervalued. The company has a tendency to trade above its sector median as its five-year average P/E ratio is 20.48x, but I believe due to the volatility of raw material prices and availability driven by geopolitical tension and supply shortage, the share might fail to gain momentum and exceed sector median P/E ratio. After considering all these factors, I think the company might trade at the sector median P/E ratio, which is 15.40x. With a P/E ratio of 15.40x and EPS of $6.10, the investors can expect a target price of $93.94, representing a 20.1% upside from the current share price. The company has a long history of dividend payments. The company can pay a 2.63% forward dividend yield in coming years, which gives a total return of 22.73%.

Conclusion

The company’s management has stated that EMR is experiencing robust demand from all end markets. The backlog orders have reached record levels, and the disrupted demand from China is recovering. The company is restructuring its portfolio to achieve an efficient and synergized portfolio to achieve a higher growth rate in the coming years. After considering all these factors, I assign a buy rating for EMR.

Be the first to comment