Justin Sullivan/Getty Images News

Thesis

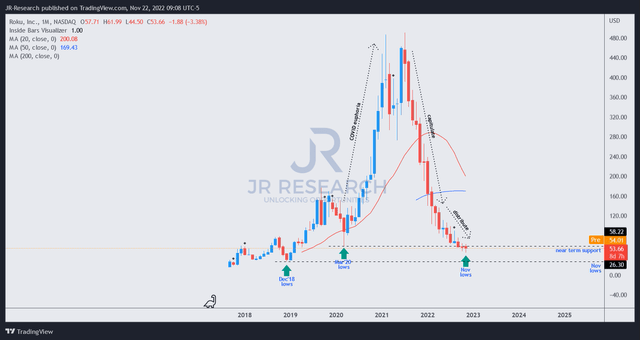

Roku, Inc.’s (NASDAQ:ROKU) FQ3 earnings release led to an initial panic selloff which buyers at ROKU’s long-term bottom rejected. We presented in our previous article suggesting that ROKU has likely bottomed out, as seen in its long-term chart.

Therefore, we aren’t surprised by the buyers’ rejection as it stanched further downside that had attempted to break ROKU’s long-term lows decisively.

Moreover, the selloff came after management highlighted highly disappointing guidance (albeit not unexpected). Notably, its FQ4 guidance was way below the Street’s already downgraded estimates on both lines (revenue and adjusted EBITDA). As such, it likely led to weak holders and bearish investors attempting to force further downside breaks but had not proved successful.

Accordingly, ROKU recovered its post-earnings losses through early November, even though it has given back some of those gains. However, ROKU’s long-term bottoming thesis remains intact. Therefore, with de-risked forward guidance and slashed consensus estimates after Roku’s earnings, we believe it forebodes well for Roku’s medium-term recovery.

Roku’s Q3 Metrics Suggest Recovery Could Be Underway

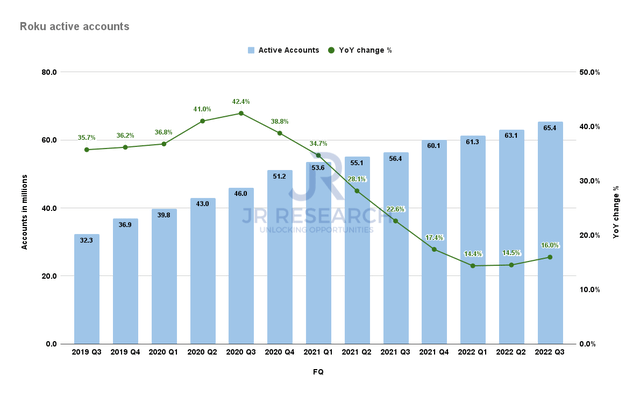

Roku active accounts change % (Company filings)

Roku posted a 16% increase in its active accounts in FQ3, corroborating our observation that its normalization has likely stabilized relative to Q2’s 14.5% growth. Hence, we urge investors to pay attention to whether Roku could sustain its recovery through H1’23 as it fully laps challenging FY21 comps by the end of Q4’22.

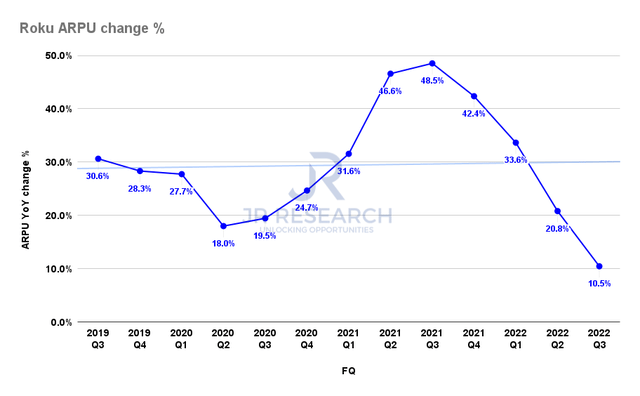

Roku ARPU change % (Company filings)

However, the moderation in its ARPU has continued to fall significantly. As seen above, Roku posted a 10.5% uptick in Q3’s ARPU, down significantly below Q2’s 20.8% increase. It was also the company’s fourth consecutive quarter of decelerating growth, falling well below its trendline.

We believe its ARPU has been hampered by the headwinds in the ad market as advertisers pulled back spending significantly. Thus, Roku’s competitive moat has proved to be more cyclical than we had anticipated. Furthermore, the company seems to be substantially impacted by the ad scatter market, worsening its underlying headwinds.

However, if the ad headwinds could subside moving ahead, it should put Roku in a better position to reaccelerate growth, given the steep moderation seen in its monetization metrics.

Downgraded Estimates Suggest Recovery By H2’23

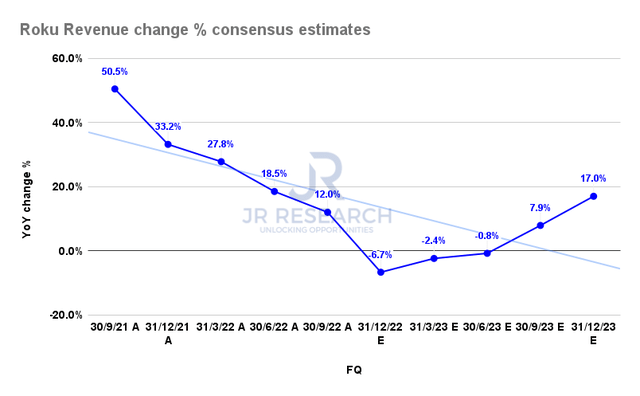

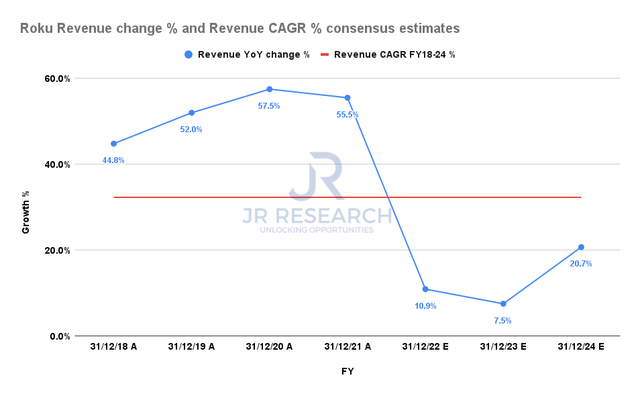

Roku Revenue change % consensus estimates (S&P Cap IQ)

Roku highlighted a miss against the previous consensus estimates for its FQ4 outlook, as the company saw worsening risks to the ad scatter market. As such, the revised consensus estimates have also been slashed to reflect the company’s de-risked guidance.

Notwithstanding, Roku is still projected to climb out of its malaise from H2’23, with growth reaccelerating through FQ4’23.

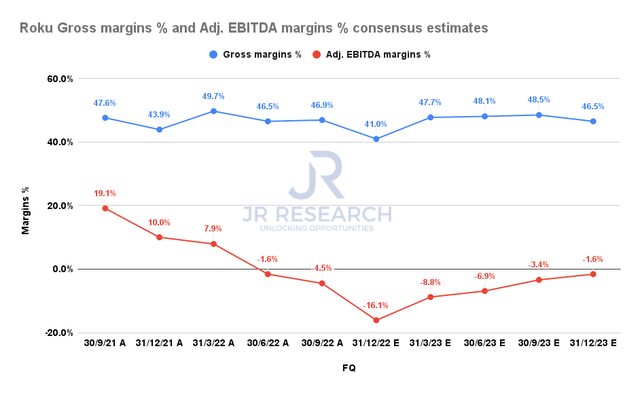

Roku Gross margins % and Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

However, the company is not expected to report adjusted EBITDA profitability in FY23, which could hamper any sustained rally, given the weak macro environment.

Therefore, even though Roku could have formed its long-term bottom, it could continue to move sideways in an extended consolidation zone. As such, investors should consider “playing” the range approach by buying its support and selling its resistance while establishing appropriate risk management protocols.

Is ROKU Stock A Buy, Sell, Or Hold?

Roku Revenue change % consensus estimates (by FY) (S&P Cap IQ)

We gleaned that Roku’s revenue growth could increase at a CAGR of about 32% from FY18-24. However, Roku is not expected to post above-average growth through FY24, suggesting that investors should not expect ROKU to reach levels seen in FY21 in the short- to medium term.

Furthermore, ROKU is not expected to return to adjusted EBITDA profitability until FY24, which could introduce more volatility in its stock as bulls and bears battle to value it accordingly.

ROKU price chart (monthly) (TradingView)

As seen above, ROKU buyers supported its long-term bottom, even though the initial post-earning selloff had attempted to derail it.

Therefore, we postulate that ROKU’s long-term bottoming thesis remains intact. Furthermore, with a de-risked outlook that had not caused its stock to collapse, we believe it’s constructive for its consolidation zone.

Maintain Buy with a medium-term price target of $70.

Be the first to comment