goncharovaia/iStock Editorial via Getty Images

“A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty…”

Winston Churchill

So Mr. Bear has exited his hibernation, padded down to the stream and is scarfing down all the investor fish in sight. Beyond the current market swoon, we have the growing consensus among nail-biting pundits guessing just when the recession bacillus will infect the already stressed economy.

Add to this the imminent expectation that the Fed is poised to keep attacking inflation with rate rises. Otherwise, Washington sits apparently dumbfounded with a finger up its rear-end anatomy frozen in empty rhetoric. It may be too little too late for rate increases to take a mean swat at inflation any time soon. But one thing is certain, too many scared money investors are yet to see a real price discovery function hidden among the misery to come.

Yes, there is money to be made in this colossal economic mess. The market from here could wiggle up or down short term, but long term, the outlook seems now like a dead-end street. When and if we will see capitulation can be brooded about endlessly by the pundits. But gaming stocks we follow seem to us to pose a margin of safety despite the misery to come.

To wit, we submit a scenario for one of our favorites in the gaming sector, a business in which we have been a denizen for over 35 years at the c-suite level. We look at a few key metrics here in the light of what has become a terrible market. We readily confess our conviction is going against a broad and deep grain of macro market consensus going forward.

The Case for MGM Resorts International (NYSE:MGM) Now

We’ll lay down our foundational thesis with a look at some selected metrics you may or may not believe can buck the current bearish outlook. But they are the underlying measures I believe that express a company whose management you want in your foxhole as the recession artillery begins zooming over your head. It’s going to take a lot of suspended disbelief going forward as Mr. Market begins dropping daily ordnance on valuations, decimating stocks already beaten up. But courage, there is a rationale for this stock that in operating realities is something of a fortress.

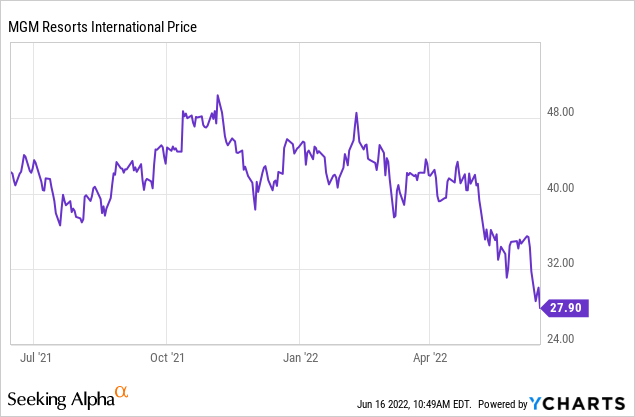

Price at writing: $27 wriggling up or down a few bucks here.

According to our DCF analysis, we estimate the stock is worth ~$40 a share, making it undervalued ~28%. Taking our most aggressive bull case scenario to a 5- year terminal (which assumes a modest recovery in Macau within that period), we get to $67 a share.

5-year exit analysis:

- Revenues: To rise from $14.7b in 2022 to $20b in 2027.

- We see net margin rising from ~6.2% to 9.9% in 2027.

- Net income projects from $865m this year to $2b in 2027.

- The company’s debt ratio will stabilize at 36.9% through.

Wall Street analyst consensus target is $45 average, moving to $55 assuming certain earnings begin to flow from Macau and Bet MGM at the tail end of 1Q23.

CAGR: 16.5% our estimate.

Current ratio: 1.25.

We understand that DCF valuations can vary depending on the formula applied. We will spare readers a detailed review of the formula we used, but note only that it pretty much follows that of most purveyors of such insights in the financial world. But that, we believe, trumps every metric ever invented by the investment community as to bringing a real-world insight into the prospects of a company and its potential returns- especially in a bear market atmosphere likely to resist big rallies anytime soon. There will be spikes and dips within a narrow range for certain going forward. But the prospects for MGM as we now review their business to us, remain bullish. That makes the stock cheap in our view.

The Las Vegas Component: Recovery is well on the way despite labor shortages, inflationary pressures on costs, and potential revenue hits due to the coming recession. Conceding there may be some resilient skepticism about the Las Vegas business prospects stubbornly clinging to bad news, we submit in evidence this question of cynics:

The Vegas strip is getting healthier post-pandemic every quarter. MGM sits at the crossroads of improving occupancies and gaming win.

Question: If investors worry about the viability of the Vegas market due to all the artillery hitting it from all sides as noted above, please tell us why we see the following:

The shares of MGM and other Vegas leaders remain dead pooled. Bearish sentiment suppresses the shares, but at the same time, many of the same analysts bearish on MGM, are all-in on the REIT that owns most of its realty: VICI Properties Inc. (VICI). The underlying case for VICI rests on the foundational premise that casino buildings are unique realty, unlike any other in that they are licensed premises to begin with.

The bullish conviction about Vici is almost entirely based on confidence that the ability of its casino tenants to meet rent obligations over time will not be compromised by passing economic disruptions. And if they do, the VICI pass-through of earnings REIT structure assures holders of reliable dividend flow. Furthermore, even with interest rates on the move, presumably shrinking VICI’s ability to borrow cheap money and convert it to reality, one must believe the core story: casinos will continue to pay their rent even if there is a recession.

Supporting that view is the 2008/9 financial crisis as a case in point. Here are the strip gaming revenues during the period:

- 2007: $6.8b, the leading edge of decline not yet felt.

- 2008: $6.1b – down 10.28%, y/y the recession begins to bite.

- 2009: $5.5b – down another 9% reflecting full force recession.

- 2010: $5.7b – stabilization arrives showing 4.8% rise.

For context, 2021 strip gaming revenue hit a record: $7.07b rebounding from $3.7b due to pandemic closures, etc. An 89% increase.

The Takeaway:

During this entire period, all casino properties with REIT landlords met their rent obligations. (In the case of Penn National Gaming, Inc. (PENN), it, in 2020, did a (GLPI) for rent credits due on the Tropicana Las Vegas for a lease on its Morgantown, PA expansion. Penn continued to operate the Trop. But what is important is that the property did not close down and the REIT came out with another rent deal).

So what’s the investor logic, or lack of it here? Quite simply, if you assume the value of casino realty can endure mostly because, regardless of conditions, it can meet its rent obligations, you have an excellent rationale to buy Vici stock. It’s that investment model Vici lives on and will continue to thrive on regardless of what may come in the macro-environment.

Yet at the same time, investors have bid the shares of Vici’s principal tenant, MGM, down out of many concerns. The pandemic for certain took its toll, inflation, labor shortages, gas prices – you name it, are the selected culprits to suppress the stock. Add too without question, the lingering travel bans that continue to plague the Macau market where MGM has two properties. But its exposure there, compared with peers is relatively low.

If you believe in Vici’s valuation at $27, which is based on its casino tenants’ ability to meet rent obligations, why would you be a skeptic about the operating revenue base of casinos in good and bad times? MGM’s strip properties produced $4.7b in 2021 revenue, a 110% increase over the 2020 crisis year.

The company also produced a 74% y/y increase in its regional properties and moved to a 29% share of market with its BetMGM sports and IGaming platform business reaching an estimated $850m to $1b in revenue this year. The company said it expects its sports betting unit to turn profitable by sometime next year.

The heart and soul of the case for MGM’s valuation being too low is that Mr. Market is valuing the shares of its landlord VICI at $27 and MGM at $27/$28 at writing. Bear in mind, VICI is the landlord for Caesars Entertainment, Inc. (CZR) as well. Its business is built on the proven reliability of casino cash flow come rain or shine:

Vici: Market cap: $27.4b Shares outstanding: 963m.

- MGM Market cap: $12.24b Shares outstanding: 426m.

Clearly, the disparity is directly linked to the outstanding, equilibrating that on an apples-to-apples basis, a VICI outstanding comparable to MGM could value its shares at ~25% of what MGM trades at today. But it is in the business model where we find the valuation of MGM now as low regardless of the total outstanding number of shares it may have compared with Vici, or any other gaming industry peer.

MGM has set down a footprint in the rapidly recovering Las Vegas market with sheer capacity, diversity of customer segments, diversity of pricing options for consumers which will stand it in good stead recession notwithstanding.

It also has a sprinkling of regional properties which have shown a 74% y/y increase in revenue in 2021 vs the pandemic year.

Though it has a long way to go, it will eventually participate in the recovery of Macau by sometime in 2023 with two very viable properties. Its pre-pandemic share of that market was around 9.5%. It is now estimated to have risen to ~11%.

Above all, MGM now has a smartly aggressive top management tier with a clear-eyed view of gaming’s present, post-pandemic potential, and longer-term participation in digital gaming through BetMGM. Far too many managements tend to ossify when their companies grow so much they can be unwieldy. They can get paralysis of decision-making. That’s not the case here. So if you take as we did, a conservative analysis of its DCF prospects, you should arrive at a mindset that implies a significant runway ahead for the shares from where they now trade. And it is led by a ground-up savvy gaming management.

Conclusion:

Even as recession looms, I would be a holder of both VICI and MGM, as both will participate in the industry recovery. Yet I do believe that MGM at under $30 a share is simply too good to pass up if you are not cowering these days under the covers awaiting capitulation.

Be the first to comment