Leon Neal

Today I will be completing a deep-dive on Meta (NASDAQ:META). Within, I will provide a succinct overview of the opportunity that the company has in front of it in the coming years, delve into its various business segments and ambitions, and attempt to address the controversial capital allocation strategies that have undoubtedly plagued the company of late. In addition, I will jump into the company’s financials, and discuss the models I used to give me greater insight into the company’s potential future trajectory.

Introduction

The technology sector is full of polarizing personalities, many of whom stand at the helm of some of the largest companies in the world. Whether that be with the brash antics and lofty ambitions of Elon Musk, the undoubtable brilliance tainted by Bitcoin Maximalism exhibited by Jack Dorsey, the SEC-challenging Twitter threads blasted by Brain Armstrong, or the naivety potentially falsely portrayed by Vlad Tenev, there is no shortage of individuals that, love or hate, you can’t help but pay attention to. Mark Zuckerburg is one of those people. The man that steers the ship of Metaverse has clear technical aptitude, a far cry away from the resume full of consulting experience and MBAs possessed by a lot of modern C-suite executives. This assertion is corroborated when one starts to dig deeper into his youth. Using Atari Basic, Mark programmed a full-fledged messaging application for his father’s dental office, software that allowed for communications to occur between secretary and boss without the need for screams to echo across the workspace. In high school, Mark created a music program called “Synapse”, software that ended up receiving purchase offers from AOL and Microsoft. Flashing forward a few years, Mark’s code made waves on Harvard’s campus, with his notorious FaceMash program almost resulting in his expulsion from the school, and his involvement with an early social media prototype, Harvard Connection, laying the foundation for ideas that blossomed into what Meta is today.

When one thinks about some of the greatest technological innovations, a few things come to mind. The printing press sprang into existence in the fifteenth century, altering the very manner in which information could be disseminated, arguably spurring a knowledge revolution that the world had never seen. In 1876 Alexander Graham Bell was granted a US patent for transmitting speech by the telegraph, an invention that would alter communication, commerce, and global society as a whole permanently. The Internet, spurred by the workings of ARPA in the late 60s, arguably led to a further transformation in our species. This technology, when combined with smartphones, arguably intertwines man with bits in a manner that is almost science-fiction-like. Social Media, in my mind, though contingent on these early innovations to even exist in the first place, is similar in stature. This technology altered human behaviour patterns, changed the way in which presidential elections were conducted, allowed for contact to occur in a manner that all but nullifies the concept of geographic constraints, altered advertising, and general business processes, and gave voices to anyone that dares to engage in a few coordinated thumb movements. Mark Zuckerberg’s technology played a big role in changing the world.

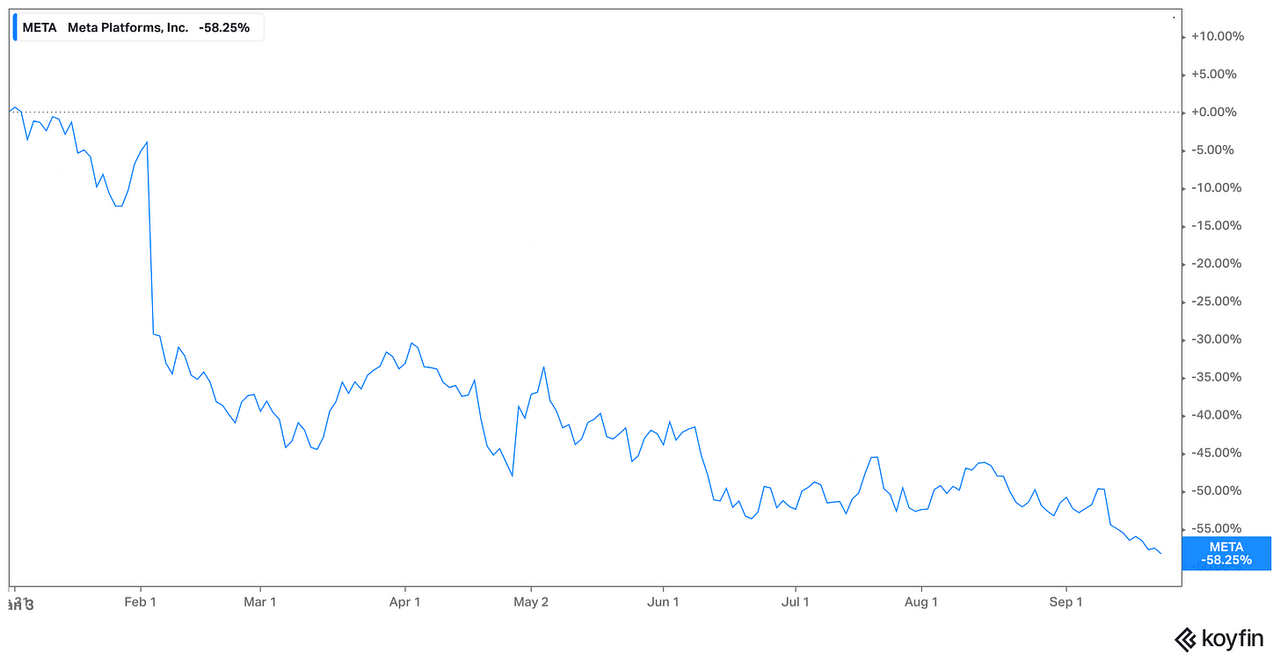

From the company’s IPO in May of 2012 to its peak in September of 2021, Meta barely felt the effects of gravity, with its share price appreciating 800%+, more than a 20% CAGR. Today, we sit at a fork in the road, a spot in the company’s journey that may be looked back upon as a critical juncture for the long-term trajectory of the firm. Amidst a market environment that has been all but deleterious to the general wellbeing of most of the Technology sector, Meta is down more than 55% on the year, a price-action that would have surprised even the most inquisitive investor if they were to have gained a glimpse into the future only a year prior to today.

Meta YTD Returns (Koyfin)

Existential threats are no doubt sinking their teeth into Meta. The competitive forces exhibited by TikTok have wreaked havoc on the social media space as a whole, begging the question as to whether or not Meta’s portfolio will be able to transition successfully into a short-form video content-loving world. Apple’s (AAPL) ATT changes have resulted in a similarly sized headwind, diminishing the effectiveness of Meta’s advertising business. Lastly, Meta’s prodigal leader has intertwined the company’s trajectory with the fate of the metaverse, a bet that has resulted in billions of dollars of capital expenditures and his overall sanity now being up for debate. In short, Meta is fighting for its life.

In my deep dive today I will attempt to determine just how bad off Meta is and whether or not I am comfortable allocating capital to a potential fallen angel.

Opportunity

When completing my research for this piece, I tried to complete a top-down view of what the company’s main focus points seem to, and arguably should be for the coming years. I arrived at the three main points. Firstly, the overall success of the company’s lofty metaverse ambitions is obviously contingent on a series of technological trends going in their favor. The concept of the metaverse in general is nothing new, having been depicted in various forms of science fiction and real-world applications over the last few decades. In the novel Snow Crash, the author depicts the story of Hiro Protagonist, a hacker who jumps back and forth between a dystopian version of Los Angeles and a virtual world. In Ready Player One, the author weaves the tale of a teenager that escapes from the harsh realities of the world he inhabits into a haptic-sensor-driven video game world, embodying the role of a “Gunter”, attempting to solve a series of 80s-themed challenges in order to obtain the fortune left behind by a billionaire tech genius. Second Life, an enormously popular video game that was first released in 2003, exists as a “Second Plane” where players can create an avatar for themselves and interact with a virtual world. Arguably the entire modern video game industry exists as a metaverse of sorts for its users. The commonality between all of these things is clear; they either depict or provide an outlet of sorts to escape from our physical world into a digital one. The creation of a metaverse, one where users actually spend time, conduct social interactions and engage in various forms of commerce within is lofty, but is it actually unrealistic?

As Ben Thompson argues in this piece from a few years ago, we are arguably at the end of a journey from batch to continuous computing. Initially, individuals had to put card readers into a mainframe and wait for the results to be computed, a result of the I/O layer being directly linked to the application and data layers. Later, computers resulted in the I/O, application, and data layers being pulled apart. Lastly, where we are today, cloud computing and mobile have resulted in applications and data can being able to be connected from anywhere, allowing continuous computing to arise. Rather than there being some world-changing innovation that is set to change this phenomenon, technology such as AR/VR hardware is likely just an extension of continuous computing. As the years have progressed and we find ourselves more and more ingrained with the technology we use in everyday life, it is rather likely that our ability to interact with said technology in new and more engaging ways increases with time. Zuck’s whole spiel seems to be centered around the concept of “presence”. Facebook’s technology in the past has been contained around creating social experiences using apps, something he hopes to interchange by putting people at the center of these experiences instead. I hold my fair share of skepticism for this playing out exactly as Zuck intends. However, with the emergence of a digital-first world spreading far and wide, and the very manner in which people conduct their livelihoods, engage in social interactions, and interact with entertainment sources being moved to the land of bits, whose to say that we won’t see a rise in interactivity in the coming years. Only time will tell if these ambitions turn out to be sheer lunacy or early signs of prophetic genius.

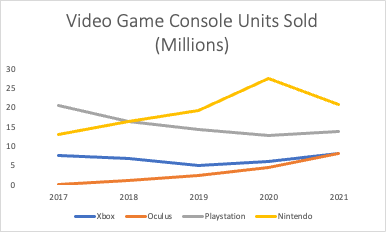

Going forward, I would argue that success in this area is reminiscent of how Apple transitioned a large part of its focus into becoming a “services company.” Through the creation of products that play a large part in the daily lives of customers, Apple was able to intertwine both hardware and software in a truly special way. Looking at Meta’s metaverse ventures thus far, they are arguably following a similar path, with Meta using hardware sales as a user entrance of sorts into the ecosystem, which they can then leverage to collect fees from creators on the Meta Quest and Horizon Stores. Though in their infantile stages, the company has already had success on the hardware front, surpassing Xbox in unit sales in 2021 and closing the remaining gap between themselves, Nintendo, and PlayStation as outlined below:

Author

Going forwards, the % of VR users is expected to grow modestly from 61.5M to 75.4M in the US, increasing from 18.4% of the population to 21.9% during that same time period. With e-marketer estimating that Meta has around 90% market share in this area, it will be critical that this lead is maintained as new entrants exert competitive efforts against the company, as well as for Meta to expand VR/AR use cases away from a market that is relatively niche at the moment.

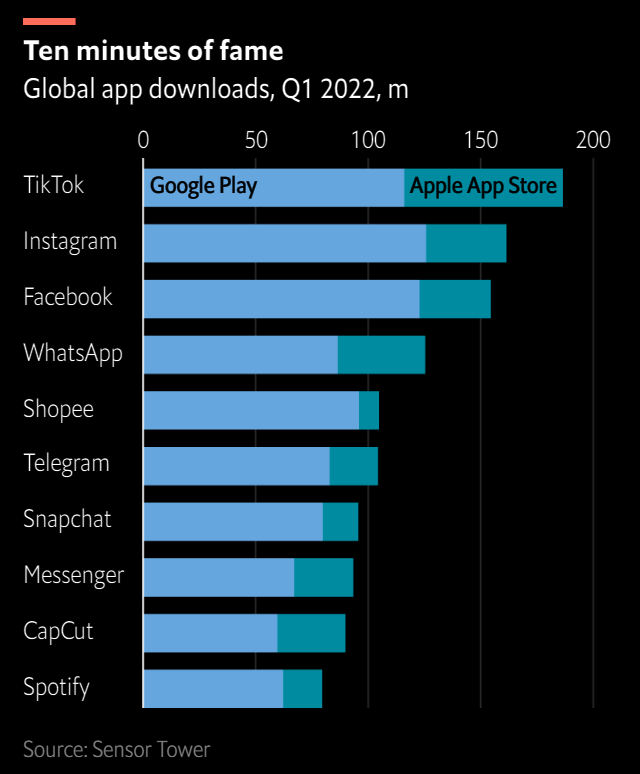

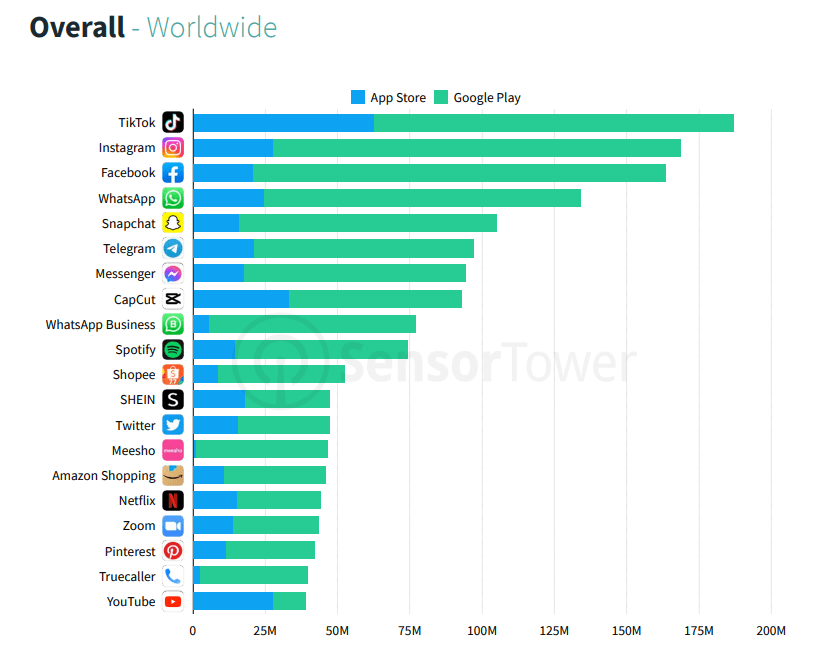

The second and third opportunities I believe are paramount to Meta’s long-term prosperity is the ability for the company to maintain the strength of its FOA portfolio, and to continue to make substantial investments in its AI/ML infrastructure. Starting off with the former, even despite the competitive headwinds Meta is feeling as a result of TikTok, their apps are still putting up commendable download numbers in both the first and second quarters of this year:

App Downloads Q1’22 (Sensor Tower) App Downloads Q2’22 (Sensor Tower)

Despite the strong download behavior, time spent in-app, at least for the early part of this year has greatly favored TikTok. At the end of Q1’22, users in the US were averaging approximately 46 minutes spent in-app on TikTok, in comparison to the approximately 30 minutes spent on Facebook and Instagram, respectively. Put simply, Meta is first and foremost an advertising business, a phenomenon that results in ad revenue being largely proportional to in-app time. Although the company is addressing this with the move towards short-form Reels video content on Instagram, there is still a ton of work that needs to be done in order to wane this exogenous threat, something that analysts should keep in mind going forwards.

Lastly, moving over to the latter, the headwinds induced by Apple’s ATT decision may be able to be worked around with consistent and dedicated investment in AI/ML infrastructure. IDFAs, which acted like a cookie of sorts on mobile devices, allowing for advertisers to precisely track users within apps on iOS devices and gauge the overall effectiveness of their advertisements, have had their effectiveness largely dampened. Put simply, advertisers within the Meta ecosystem are now unable to measure ad effectiveness nowhere near as efficiently pre this happening. As a solution, Meta has been directing billions in capital expenditures at AI/ML, mainly attributable to server costs, at these issues. The impact of these tracking headwinds has been evident in the company’s recent top-line results, and it will likely be many a quarter before we start to see any real progress made in this area. However, if Meta is able to successfully navigate these choppy waters, they are likely to be in a good spot from an advertising strength perspective, once the cycle turns in its favor. In summary, I believe these three factors are the ones that investors should have at the forefront of their minds going forwards.

Business Breakdown

Since most investors are relatively familiar with what exactly Meta does, I will provide a succinct overview of the various components of the company’s business, and delve deeper into the areas I feel are most critical to its future success. As of the end of last year, Meta has two reporting segments that house their various products and offerings, Reality Labs and Family of Apps (FoA). Starting off with Reality Labs, the important products contained therein can be split into three distinct components, those associated with Reality Labs, Meta Quest and Facebook Portal. With the first item, there are a ton of large projects underway under the RL banner, which I could not do justice to in this post. I believe the two main pieces of technology that are representative of the company’s efforts within this area are fully represented by their AR glasses and wristbands. Within recent blog posts, Meta outlined their vision for what the future of human-computer interfaces (HCI) look-like. In order for AR to be completely ubiquitous, pieces of technology that are low-friction, always available, and intuitive are essential. These AR interfaces will ideally be proactive rather than reactive and turn intentions into actions, giving users both agency and the ability to stay present at the same time. The glasses would theoretically replace the need for one to carry around a computer or smartphone, would provide the user with a context-driven AI that would help with world navigation, and provide access to 3D virtual information without the need to pull the user away from reality with a periphery like a smartphone.

In order to interact with this digital world, the technology itself would require input from the user. This is where the haptic wristbands would theoretically come in; existing as sources of low-friction input, leveraging EMG technology to create sensors that translate electrical motor nerve signals into commands that can be used to control the function of a device. I believe these two pieces of tech are the closest to real-world applications, however, the company has employed a vast array of skilled scientists that are currently working on mechanisms to intertwine immersive sound experiences, and brain-computer interface commands with these preexisting pieces of technology, more ambitious endeavours to say the least. If this sounds far-fetched, it’s because it is. These areas of the RL business will most likely take years, if not a decade to fully develop in order to arrive at an experience that is truly capable of transforming the way humanity thinks about computing.

The other areas of RL are more tangible. With Meta Quest, users can access pieces of hardware such as the Meta Quest 2, which they can leverage to play and engage with a series of games and experiences. In this business segment, Meta primarily generates revenue through the sale of Oculus hardware and accessories, as well as through take-rates associated with the content made available to customers on both the Horizon World and Meta Quest stores, of which are approximately 17.5% for items contained within the former, and 30% fee for the latter, respectively. Lastly, Meta offers customers Meta Portal, a family of video-calling devices that contain AI-powered tech to pan and zoom interactively depending on user movement, creating immersive video calling experiences as a result. Before moving on to the FOA, I believe it is worth discussing, spurred on by a 2021 Business Breakdown episode I recently immersed myself within, how HCI has evolved with time and how, going forwards, the RL is Meta’s attempt at instilling a call-option on what the next phase of computing will be within their operations. Meta started off as a desktop-based application, where they were able to capture a large component of the market and cement a relatively strong position. The mobile phone spurred on an environment where Apple and Google (GOOG) (GOOGL) were the impromptu gatekeepers to the ecosystems therein, essentially controlling which applications were able to find success with users, and which were not. This evidently caused concern as to whether or not Facebook would be able to successfully manage the transition to mobile. As we all know, they ended up finding success, this time needing three applications instead of one in order to cement their position. Meta’s big bet going forwards, in the RL area, in particular, is the ability to predict the ecosystem that arises post-Apple and Google app stores. The company is betting this will be AR/VR and only time will tell if these beliefs are substantiated.

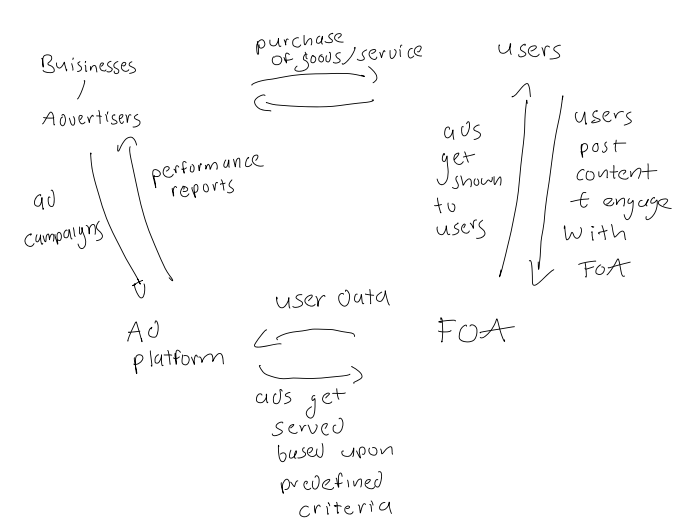

Moving on to the FOA, this business segment contains the company’s portfolio of four applications: WhatsApp, Facebook, Instagram, and Messenger. Starting off with WhatsApp, this messaging platform allows people and businesses to both communicate and transact around the world. The application makes money in two primary manners, first off, if businesses decide to leverage the WhatsApp API for sales and support, they are charged based upon messaging volume, with each message under 250,000 costing approximately $0.0085, and above 10 million messages costing approximately $0.0058 (there are tiers in between but these are illustrative examples). Secondly, WhatsApp generates revenue through its payment services, similar in nature to the likes of PayPal. Users can send money to other counterparties, and a 4% transaction fee is charged to the recipient. Moving on to the remainder of the portfolio, Meta generates revenue within Facebook, Instagram, and Messenger primarily from advertising. For messenger, ads can be placed and found within Stories, the home tab of the inbox, and with sponsored messages. Within Facebook, the news feed, marketplace, video feed, right column (desktops only), business explore, stories and reels, in-stream results, search results, and instant articles are all the pieces of real estate that are fair game for placements. Lastly, for Instagram, the Feed, Explore, Shop, Stories, and Reels are primarily where ads are placed and associated revenue is generated. When zoomed out upon, these advertising-centric products combine to function as follows (excuse my chicken scratch writing):

How the FOA advertising business functions (Author)

Although the majority of Meta’s FOA revenue is attributable to Facebook, in the coming years this is likely to be surpassed by Instagram, a phenomenon that is contingent on high-level execution by this product. Looking back at Instagram’s history, it is clear that this portfolio company has gone through a series of hugely transformative transitions. Instagram started off as a filter app, one that eventually evolved into one of the world’s biggest networks after allowing users to share their edited photos through their app in addition to on Facebook and Twitter. After dominating the photo-sharing space, the company then introduced videos, a critical fixture that allowed Instagram to surpass the capabilities of legacy media sources that were traditionally constrained by certain mediums. Additionally, Instagram transitioned from time-based home feeds to algorithmic ones, allowing for the app itself to leverage user data to make content suggestions, increasing the entertainment prospects of the app as a whole. Lastly, the company fought off the competitive forces attributable to a young upstart that was Snapchat, leveraging the breadth and scale of its network to create a Stories feature that has become enormously popular since.

Today, with Instagram, even despite all of these wins, we find ourselves at a similar cross-road. The company has been getting a ton of flak of late as a result of the recent changes they’ve made, occurrences that are not new by any means if you look back at the company’s past, but worth discussing nonetheless. As mentioned earlier, the company successfully navigated the change from image-centricity, into an app with video capabilities. Now they are navigating the next wave of interactive content, focusing on reels and short-form video content, hopefully paving the way for a level of in-app immersion that precedes RL’s continued expansion into the tech surrounding the metaverse. Similar to TikTok, and a further step in the direction of algorithmic feeds that the company transitioned to years ago, the company has started to show users an increased amount of content from individuals that sit outside their immediate vicinity, a phenomenon that parallels and mimics the overall virality of the TikTok ecosystem. Lastly, in the social media space as a whole, we’ve transitioned away from click-based interaction, to scrolling, to tapping, to swiping, and, through some mediums, autoplay, again something that Instagram has and will likely continue to adopt in the coming years. With all of these platform changes in mind, I believe it will be pertinent to monitor sentiment as well as user data in order to determine whether these changes are well-received, or if adoption falters as a result of the mimicry of a competitor they aren’t able to fight off completely this time around.

With that in mind, let’s get more quantitative and take a look under the hood of Meta’s business as a whole.

Financials

Within this section, I will be diving into Meta’s most recent Income Statement, Balance Sheet, and Cash Flow Statement. All dollar values mentioned herein are in millions of USD.

Income Statement

Revenue

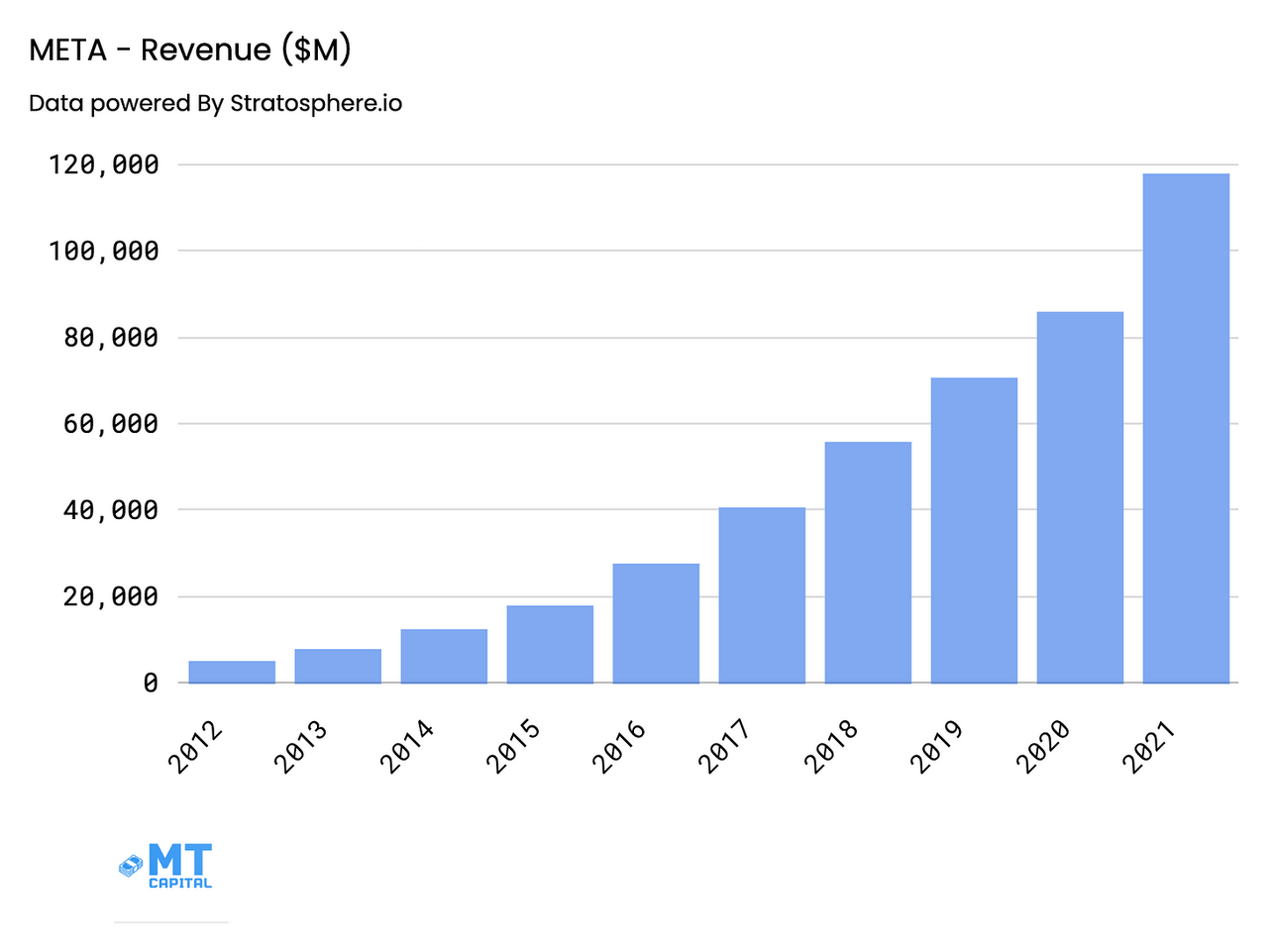

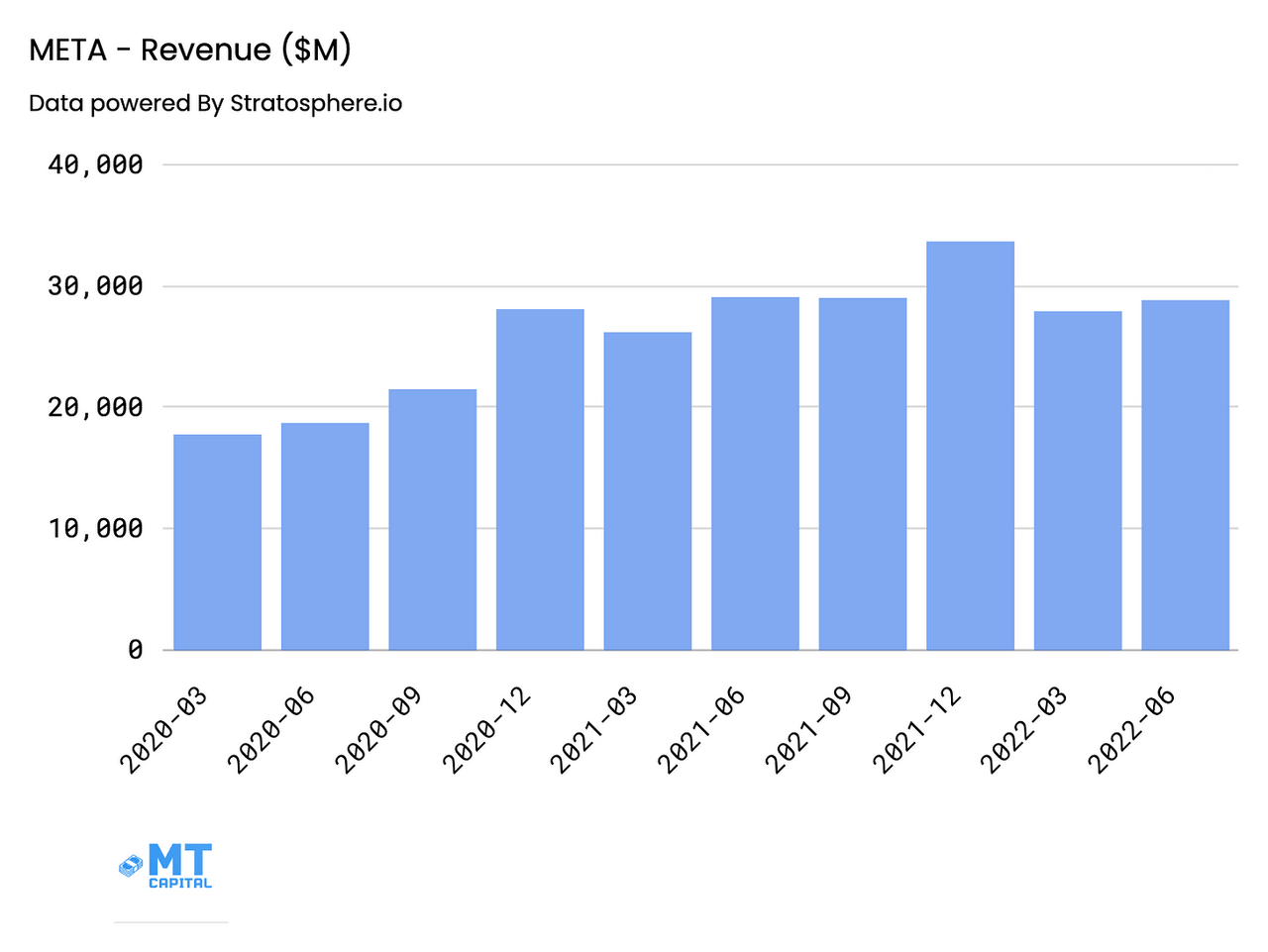

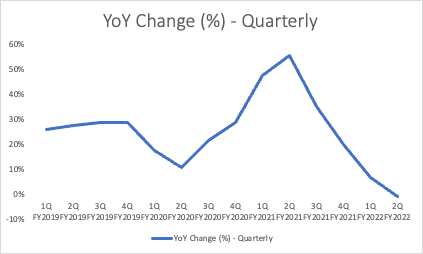

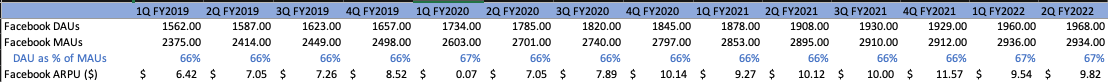

Meta’s top line has grown tremendously over the years. On an annual basis, revenue came in at approximately $118B for FY’21, representing a 37% YoY increase and a 42% CAGR from 2012 to 2021. On a quarterly basis, the story is more negative, with the metric showing strain from a combination of macroeconomic hardship affecting advertising spending, combined with continued IDFA headwinds. Q2’22 saw revenue of approximately $28B, representing Meta’s first YoY decline on a top-line quarterly basis of -1% and a Yo2Y increase of 54%, respectively.

Author Author Author

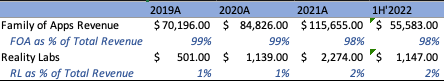

As alluded to earlier, Meta is still an advertising-centric company, a phenomenon that is corroborated by the fact that for H1’22 approximately 98% of FOA top-line was attributable to advertising, as well as the distribution between Total Revenue into its two constituents that is almost solely attributable to the FOA:

Author

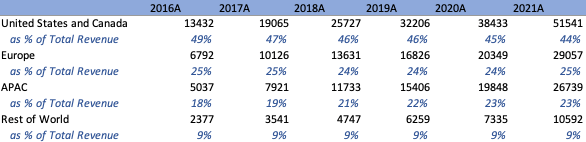

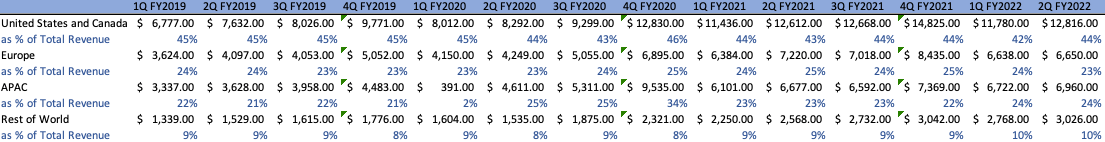

The majority of the company’s revenue is attributable to the United States and Canada, however, from 2016 onwards, we’ve seen an increased share attributable to APAC, with relatively little change elsewhere, holding constant on a quarterly basis as well:

Author Author

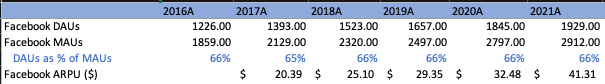

Digging deeper, we can gauge DAUs, MAUs, and ARPU as well as their associated distribution over different geographies to get a sense of how Facebook as a fixture of the app portfolio is performing. Both overall DAUs and MAUs as well as associated ARPU have trended upwards on an annual basis and engagement as measured by DAUs/MAUs has stayed consistent. From a quarterly POV, this holds largely true with DAU and MAUs continuing to grow, signalling engagement staying consistent, however, ARPU has started to decline slightly from when compared with Q2’21, the main driver behind the company’s top-line results in this segment:

Author Author

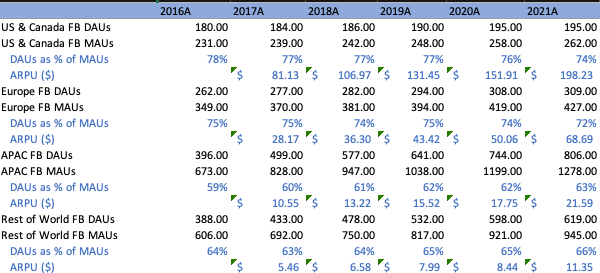

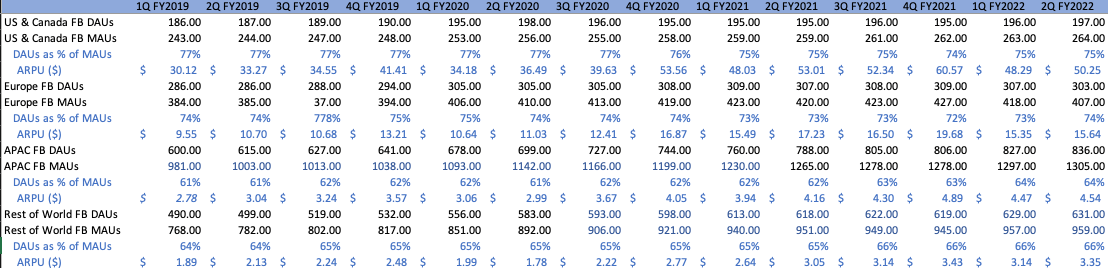

When split by geography, we can make some additional inquisitions.

Author Author

On both an annual and quarterly basis, growth in the US and Canada DAUs and MAUs has started to decelerate, engagement has faltered, and ARPU has increased on an annual basis but decreased YoY in Q2. From an engagement perspective, this is problematic if it continues since it is the most valuable region for Meta. Europe exhibits similar behaviour despite an ARPU increase over the last few years. Both APAC and the Rest of the World continue to improve in tandem but are less valuable from a revenue-generation POV.

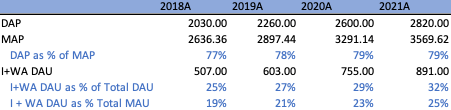

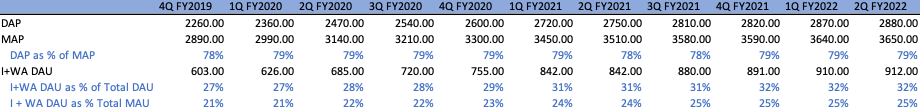

We can also look at both DAPs & MAPs as well as Instagram & WhatsApp away from Facebook and Messenger (DAU-DAP = Instagram and WhatsApp DAU). Annually, user growth has been steady, portfolio-level engagement has been steady, and Instagram and whats-app are becoming an increasingly large component of that:

Author

Quarterly, however, the growth is less pronounced and signs of stagnation are starting to appear, a phenomenon that will have to be monitored in the coming quarters:

Author

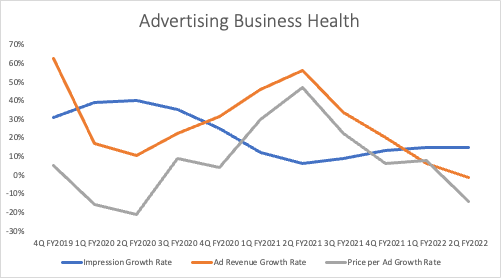

Lastly, we can perform one last gauge on the overall health of Meta’s advertising business. Over the last few quarters, growth in ad revenue, impressions, and price per ad has all but faltered. In this environment where economic conditions and sentiment have all but decreased, this is expected. Nonetheless, it is disconcerting and will require continual monitoring.

Author

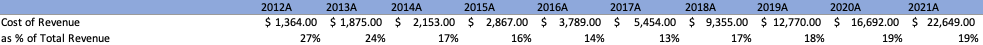

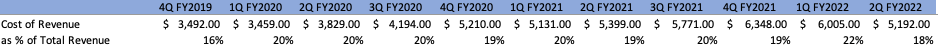

Cost of Revenue

COR came in at approximately $22.65B for FY’21, representing a 20% of top-line and a 37% CAGR since 2012. On a quarterly basis, COR came in at (4)% YoY and 36% Yo2Y increase, coming in at approximately 18% of top-line:

Author Author

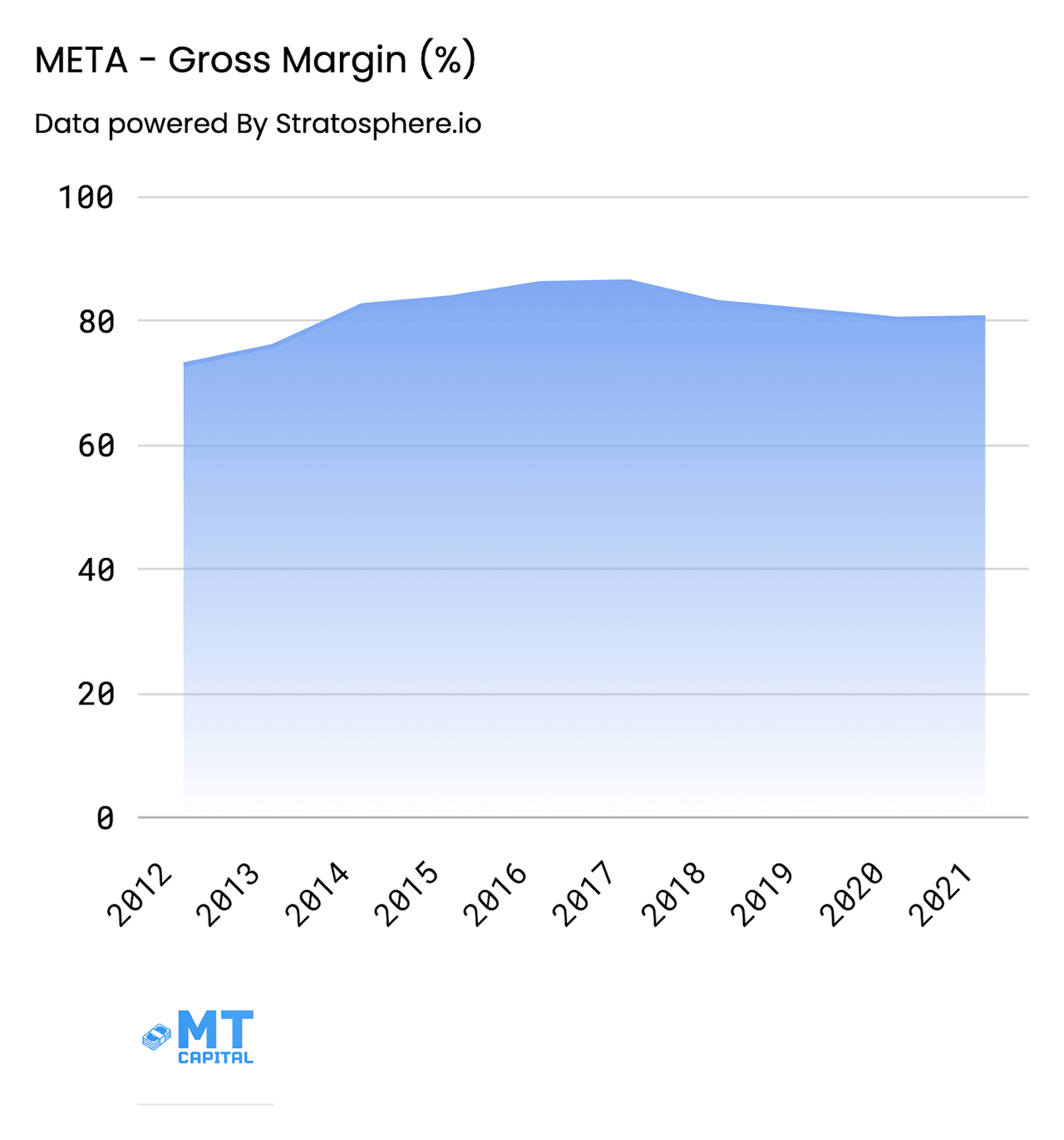

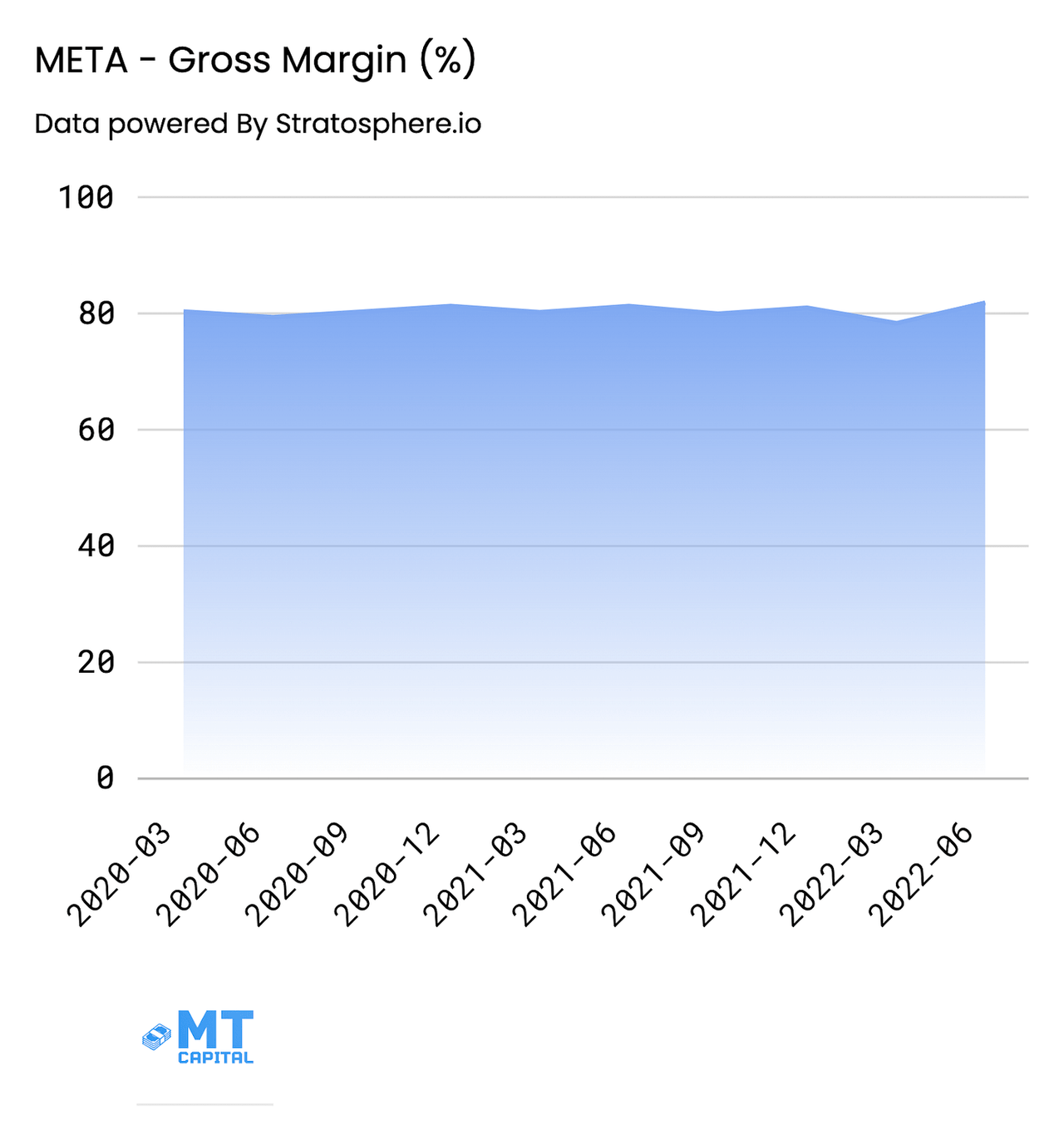

Gross Margins have remained relatively stable over the years, stagnating at approximately 81% for FY’21 and increasing slightly YoY at 82% for Q2’22 as a result of diminished loss estimates on Meta Quest 2 that arose as a result of price increases.

Author Author

These values should be monitored to ensure that core infrastructure investments and content-related costs don’t get out of hand in a poor environment where Meta is aiming to both tackle RL and advertising headwinds.

Operating Expenses and Margins

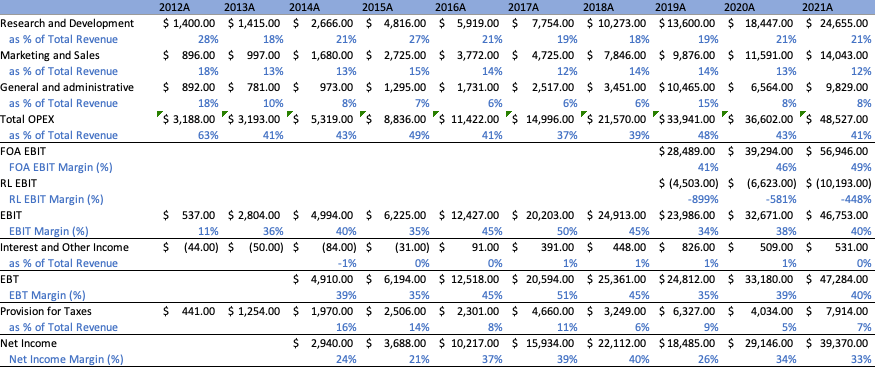

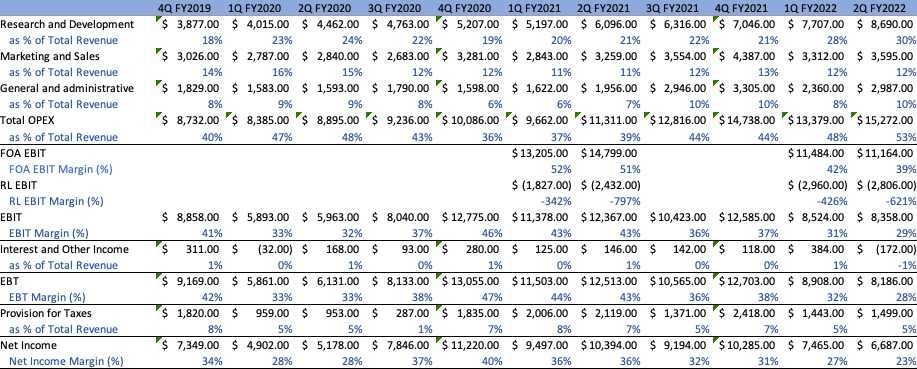

On both an annual and quarterly basis, the breakdown of Meta’s various operating expenses and margins can be seen outlined below:

Author Author

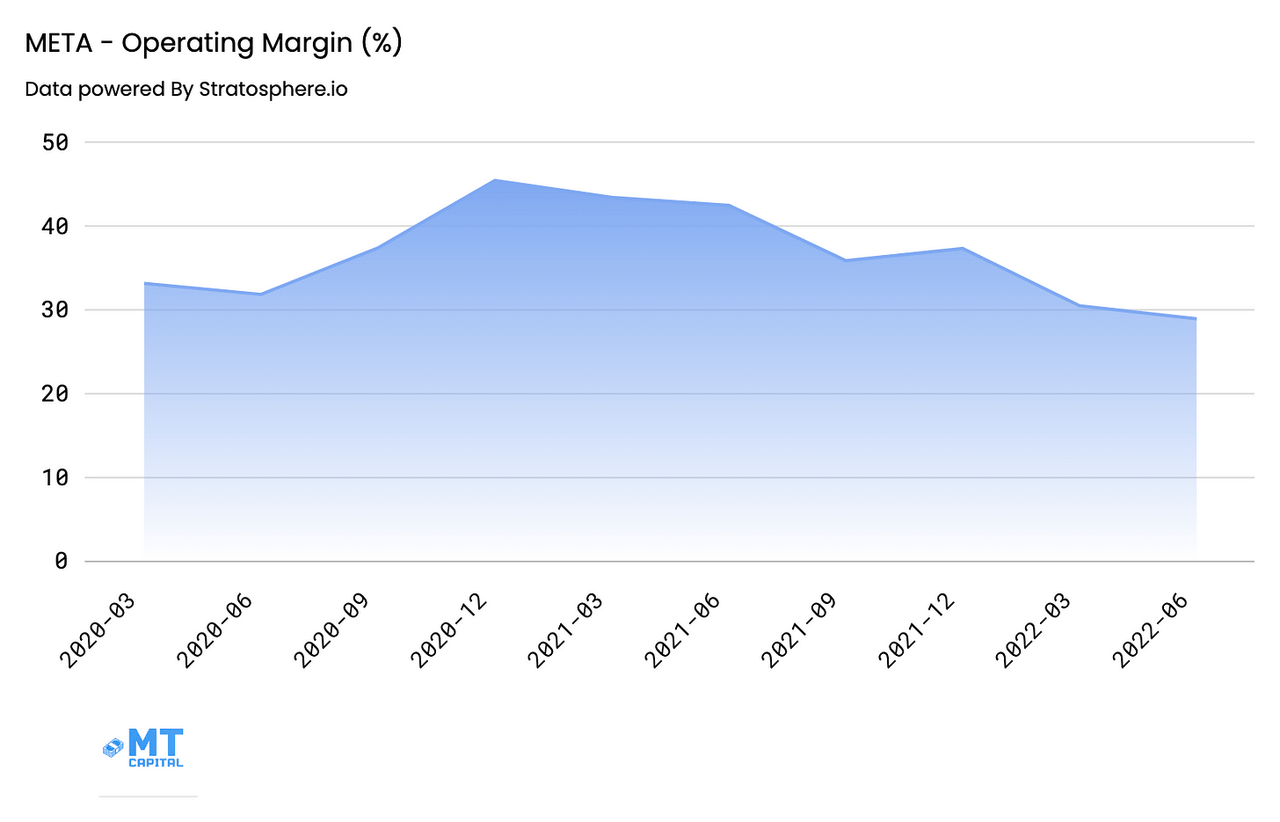

Honing in on the quarterly results, we are quite evidently seeing a substantial increase in R&D expenses relative to top-line, marked increases in G&A as a result of legal and payroll cost increases, and an overall increase in Total OPEX relative to top-line that resulted in this value increasing approximately 22% YoY in comparison to the YoY decline in the company’s revenue during the same period. As a result, both FOA EBIT, total EBIT, and Net Income took a dive in the most recent quarter. Quite evidently, RL from an EBIT perspective is nowhere near profitable and will not be for some time. Again, these will be areas that will require continual monitoring to ensure investments in the future are not made at a continued cost to the company’s general financial wellbeing, especially if the company is unable to ramp up user engagement metrics and the general health of the advertising ecosystem in a noticeable manner while doing so. So far, the impact on the company’s EBIT margins have been on a slippery slope downwards when displayed within a figure:

Author

Balance Sheet

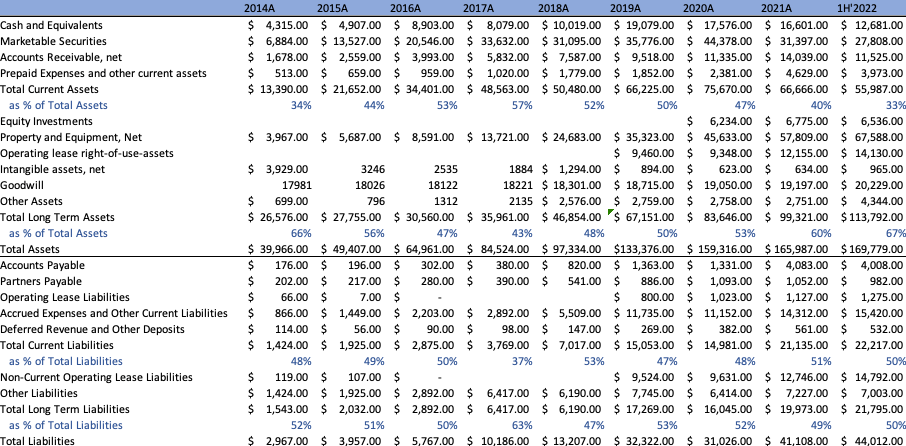

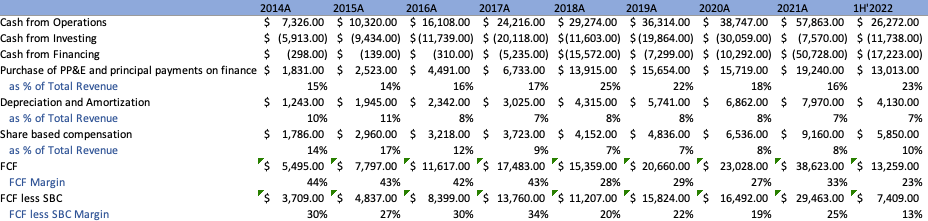

The change in the company’s balance sheet from FY’21 to 1H’22 can be seen outlined below:

Author

The company has a tank of a balance sheet, with 33% of Total Assets being more liquid in nature, consisting primarily of Marketable Securities, Cash, and Equivalents, Accounts Receivable and Prepaid Expenses in Descending order. Total Long Term Assets on the other hand consist predominantly of PP&E, Goodwill, and Operating Lease assets. Liabilities are evenly split between primarily liquid and less liquid, with Current Liabilities consisting primarily of Accrued Expenses and Accounts Payable and Long term assets consisting primarily of Non-current operating lease liabilities and Other liabilities. The balance sheet is unlikely to be a source of hindrance going forwards. Even with heightened investment activity, the company still generates a plethora of FCF and should continue to do so in the coming years.

Cash Flow Statement

The structure of the company’s FCF over the last few years and for the 1H’22 can be seen outlined below:

Author

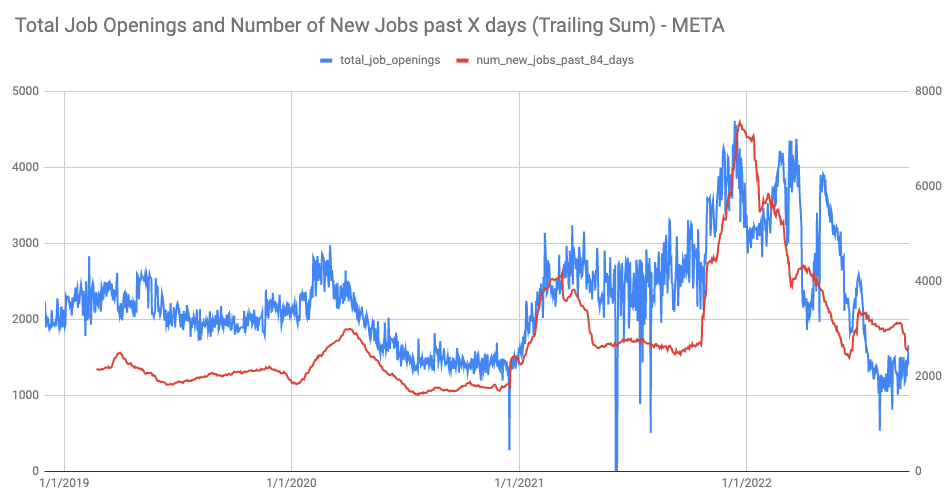

For 1H’22 CFO came in at approximately $27B. CFI came in at approximately $(13)B, attributable primarily to ~$(16.5)B in marketable securities and PP&E of $(8.944), offset mainly by the sales of marketable securities and maturities of debt securities. CFF came in at approximately $(13.7)B, attributable primarily to approximately $(11)B in Class A common stock repurchases and $(2.43)B in taxes paid for net share settlement of equity awards. As a result of the expense profile detailed earlier, we are seeing a dip in the FCF and FCF margin generated by Meta, a phenomenon that may continue unless expenses are controlled as mentioned above. Lastly, FCF less SBC is slightly dipping relative to the slight uptick in SBC on a relative basis. This value should normalize given the company’s plans to slow down hiring into the remaining end of the year, a phenomenon that is corroborated when looking at revealera job opening data as well as the news stories we’ve been seeing lately regarding Meta leaning out their operations.

Author

Discussion

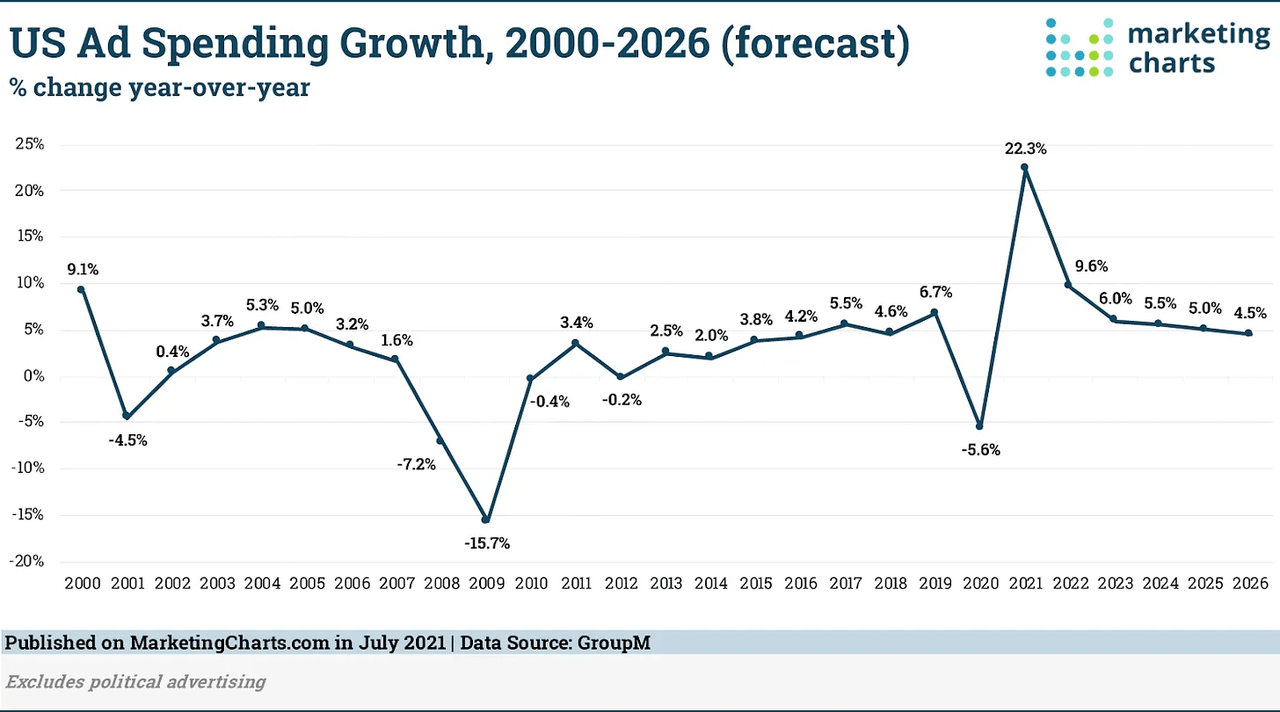

Looking forward into the future, there are clear short-term struggles that Meta has to overcome before getting back onto a commendable growth trajectory. The first is quite clearly the glaringly negative macroeconomic environment we find ourselves in at the moment. With approximately ¾ of economic activity in the US associated with consumer spending of some kind, an environment with sentiment and inflation as high as they are at the moment is going to have an impact on corporate profits, the effectiveness of advertising since people will be holding onto their dollars more, and the size of advertising budgets as a result. I cannot and will not pretend to have a good idea of where the macroeconomic environment is going, but to me, I think it is only logical to anticipate a headwind to Meta’s advertising business in conjunction with the negative pressures they are already facing from the likes of IDFA. Take past financial crises as an example, we saw noticeable slowdowns in ad budgets during periods of financial turmoil, something I would not be surprised to see continue heading into the remainder of this year and next:

Author

In addition, Meta not only has to deal with the competitive threat posed by TikTok but also other entrants making headway in the short-form video space as well. Take YouTube as an example, YouTube Shorts have been increasingly promoted within their app this year, disclosed that these content forms have over $1.5B monthly viewers already, and have begun sharing profits via the YouTube partner program, where 55% of associated as sales go to creators that have amassed over 10M views and 1000 subscribers. From my own perspective as a user, I have found much more enjoyment from YouTube Shorts than the likes of TikTok or Reels, but that may be my own unique anecdote. Regardless, it is clear that the social media space is as competitive as always, and Meta will need to continue to execute if they want the FOA to stay on top for the next decade.

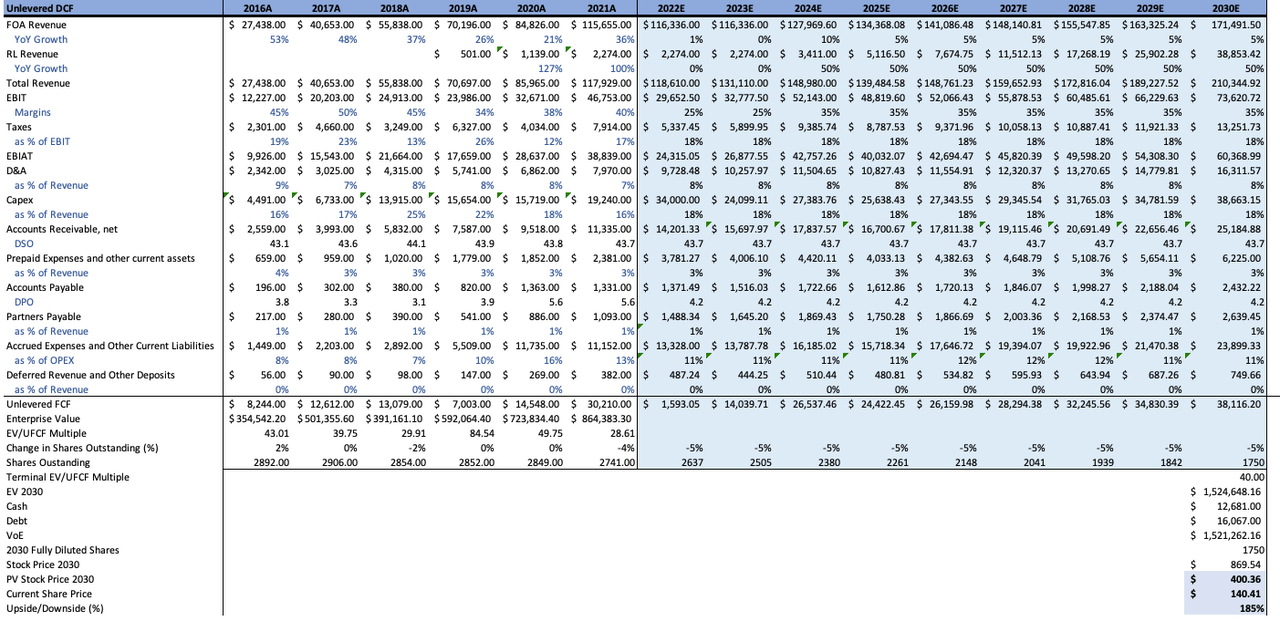

With that in mind, how exactly am I thinking about Meta’s future? To get a sense of two possible scenarios, I completed two UDCF analyses. The first I believe is a best-case situation, where Meta’s RL really takes off and achieves 50%+ growth into 2030 after being basically flat in the recessionary environment we find ourselves in today. In addition, I assume that the headwinds facing the advertising side of the business are dealt with by 2024, when the company then resumes a slow pace of top-line growth in this area, reflecting the relative maturity of its app portfolio as it sits. I assume EBIT headwinds as a result of heavy RL investments similar to what we’ve seen this year heading into a period of normalization starting in 2024 where they return to 35%, a 5% reduction in total shares outstanding each year, and an EV/UFCF multiple in the terminal year that is on-par with what we’ve seen over the last few years, where the sentiment surrounding the company has been nowhere near as negative as it today. With a 9% discount rate, I arrive at the following scenario:

Author

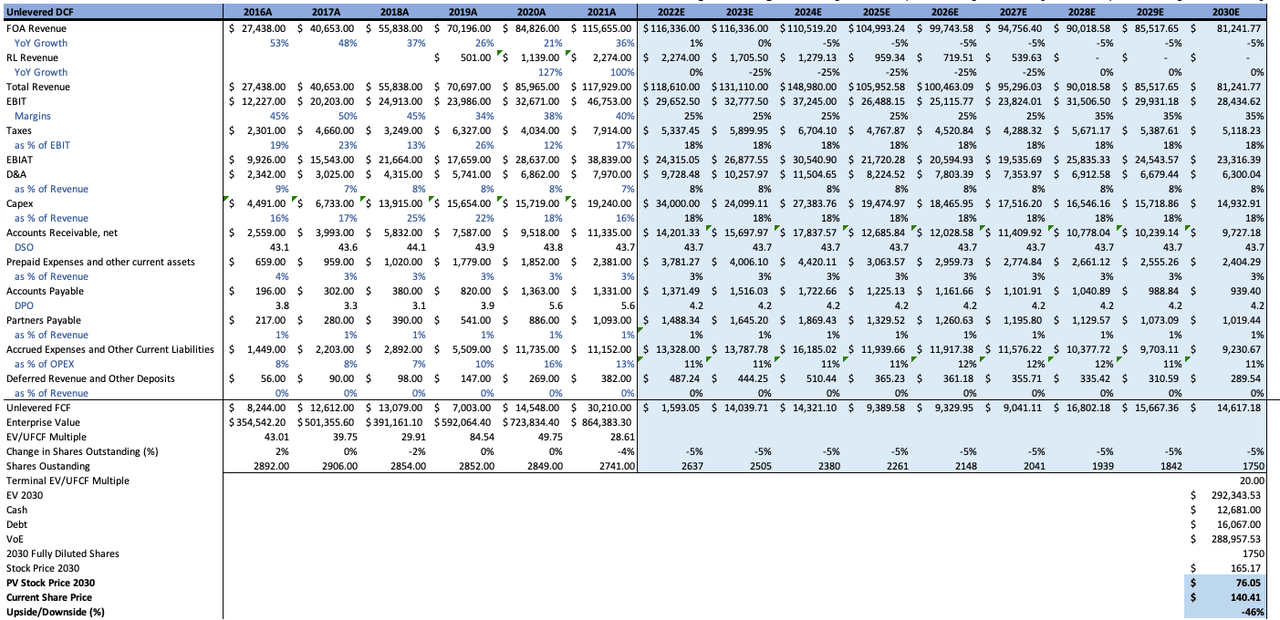

I will be the first to acknowledge the inaccuracy of models, however, I believe this illustrates that at today’s prices, there is significant upside for those that are patient if the company has a high degree of execution after they deal with these difficult times. On the opposite side of the coin, there is room for further downside as well. In the negative scenario, I outline the same opening period for 2022 and 2023 but assume the FOA of business starts to feel the pressure of both competitive forces and is unable to leverage the massive investments being made into AI/ML infrastructure to combat the recent uncertainty surrounding advertising tracking efficiency. As a result, I assume that the 5% decline continues into 2030. In addition, I assume that RL is a massive failure, showing declining adoption and poor EBIT performance until the company decides to shutter the business in 2028, where the EBIT then normalizes back to more efficient levels. With a 5% reduction in SO across that time period, and a very depressed EV/UFCF multiple in the terminal year that I believe would arise as a result of declining business prospects and negative associated market sentiment, I arrive at the following scenario:

Author

Though this is not how the scenario would likely play out, I believe this illustrates, for the sake of thought experiment, a Meta investor’s worst fear, i.e. declining prospects in both of the company’s new business segments, with a realistic spin on the fact that FOA would still be a highly cash-generative business even despite lower adoption. I land somewhere in the middle. Looking at Meta’s past, the company has dealt with headwinds before. Many an analyst thought mobile would kill them and they ended up expanding their portfolio in a manner that made them all the better business. Zuckerburg, despite his polarizing personality, has a nifty habit of guessing where technological trends are going and placing his chips on the table at the forefront of these developments. Looking back over the course of the last two decades, I don’t think many technology analysts would’ve been able to predict the general direction of computing, or how deeply ingrained social media and technology have become in our daily lives. AR/VR seems to be a logical next step for these developments, but only time will tell if they end up coming into fruition in the manner that Meta predicts.

Conclusion

This market environment has created many opportunities in the tech sector and I believe Meta presents itself as one. Taking a realistic stance here, there is relatively clear asymmetry. Either Meta fails yet maintains some degree of effectiveness, which I believe presents a 50% haircut, or the company executes in the manner that they have hypothesized to reasonable effectiveness, which would clearly position them as an entrenched platform that would make today’s positioning look laughable. I will continue to cover this company to see which one of those outcomes ends up coming to fruition. Thank you for reading my research.

Disclaimer: The information and research contained herein is all my own opinion and should not be used as a substitute for proper due diligence. Please consult your financial advisor and evaluate your financial circumstances before making any investment.

Disclosure (as of September 24, 2022): MT Capital Research holds no position in the securities discussed herein and does not anticipate to initiate a position in the forthcoming five days.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment