DNY59

Investment Thesis

NIO Inc. (NYSE:NIO) will likely be testing its May lows soon, with the worsening bearish sentiments already plunging the S&P 500 Index by -23% YTD. The Fed’s hawkish commentary during its recent 75 basis point hike does not alleviate recessionary fears as well, notably pointing to more pain ahead. The upcoming September CPI rate released by early October would prove to be critical to the market’s response then, potentially triggering a brief respite from the overly pessimistic circumstances now. We shall see.

In the meantime, NIO investors concerned about the potential delisting should be encouraged by the Chinese government’s active participation in the upcoming ten-weeks long audit in Hong Kong. The Chinese government has also tried to boost the slowing economy with a record-high $139B stimulus in infrastructure spending, due to the high likelihood of lower GDP growth in 2022. These funds may be channeled into its extended EV subsidies through 2023, previously expected to expire by 2022. Therefore, further sustaining the robust demand for EVs in China, with 580K units expected to be sold in September, indicating an impressive growth of 9.6% sequentially and 73.7% YoY.

In addition, the insatiable demand for EVs would likely remain elevated through 2023, with the China Passenger Car Association projecting a record high “double-digit millions,” double from the 2022’s projected 6M sales. As a result, it is evident that the term “Destruction Of Demand” does not apply to this sector, since the global EV market is also expected to grow tremendously from $163.01B in 2020 to $823.75B in 2030 at a CAGR of 18.2%. Impressive indeed.

NIO Delivered, But The Market Pulled Back Instead

S&P Capital IQ

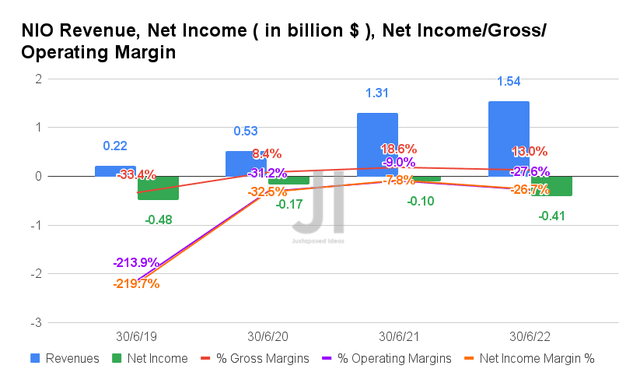

In FQ2’22, NIO reported revenues of $1.54B and gross margins of 13%, representing an increase of 17.55% though a decline of -18.6 percentage points YoY, respectively, with the latter attributed to the rising costs of batteries. However, we expect these to be temporary headwinds, given the massive support from the Chinese government underway, ensuring continuous supply and fair prices ahead.

In the meantime, NIO’s elevated operating expenses of $698.2M in the latest quarter, representing a massive increase of 13% QoQ and 85.86% YoY, have contributed to its rising operating margins of -27.6%, compared to -22.1% in FQ1’22 and -9% in FQ2’21. Naturally, NIO reported deepening net losses of -$0.41B and net income margins of -26.7% in FQ2’22, representing a YoY decline of 410% and -18.9 percentage points, respectively.

Nonetheless, we are encouraged by the visible improvements in NIO’s deliveries thus far. Though Q2 deliveries of 25.05K indicated a 2.8% QoQ decline/ 14.4% YoY increase, we expect to see massive improvement for Q3, with an estimated sum of up to 32.62K (though the management guided up to 33K). It would indicate an excellent growth of 30.21% QoQ and 33.51% YoY. Assuming a similar cadence, we may see NIO report up to 119.13K deliveries in FY2022, indicating an impressive 30.29% increase YoY, despite the impact of Shanghai’s lockdown earlier this year.

S&P Capital IQ

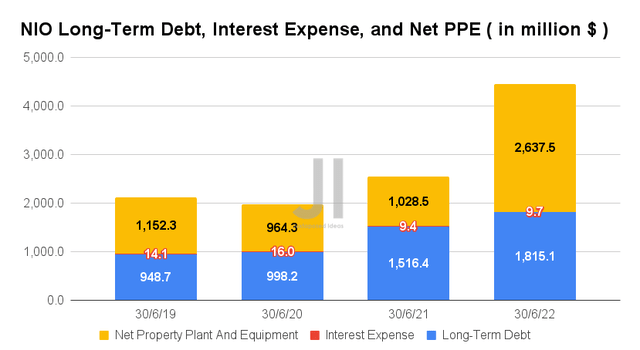

It is evident that NIO continues to invest in its capabilities, with capital expenditures of $641.82M in FY2021, leading to the impressive YoY growth of 257.84% in its net PPE assets to $2.63B by FQ2’22. Its reliance on long-term debts remains reasonable at $1.81B for the latest quarter, indicating a minimal 3.42% QoQ and 19.86% YoY increase for now.

Unfortunately, the same cannot be said for NIO’s Share-Based Compensation (SBC) at $73.2M, due to the massive 3.7% QoQ and 95.1% YoY increase reported in FQ2’22. Thereby, leading to the continuous share dilution of 4.41% YoY, otherwise, an eye-popping 56.32% since its IPO in 2018. However, investors must also note that these are common practices for many legacy auto/ EV companies, with Tesla (TSLA) reporting $1.81B, XPeng (XPEV) $92.38M, and Ford (F) $292M of SBC expenses in the last twelve months (LTM). These contrasted heavily against their net incomes of $9.51B, -$7.28B, and $11.67B, respectively, over the same period of time. Thereby, not a significant concern for now.

S&P Capital IQ

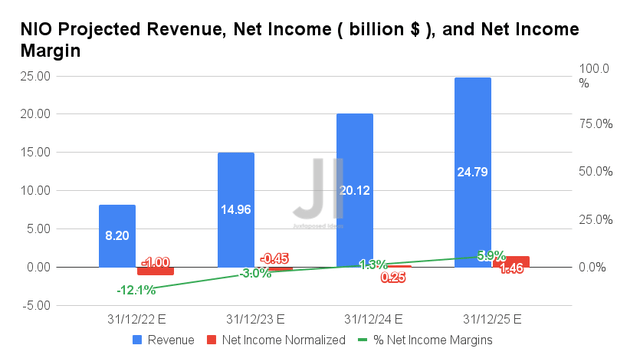

Over the next four years, NIO is expected to report revenue growth at a CAGR of 44.54%, while possibly reporting net income profitability of $1.46B in FY2025. That would represent projected net income margins of 5.88% then.

Meanwhile, consensus estimates that NIO will report revenues of $8.2B, net incomes of -$1B, and net income margins of -12.1% in FY2022, representing tremendous YoY growth of 44.36%, 39.75%, and 17.2 percentage points, respectively, despite the temporary headwinds. Nonetheless, it is also essential to note that these numbers represent a notable estimate downgrade of -17% and -10.38% since our analysis in April and June 2022, respectively, indicating Mr. Market’s lowered optimism thus far.

In the meantime, we encourage you to read our previous article on NIO, which would help you better understand its position and market opportunities.

- NIO Could Fail In FQ2 2022 – But The Patient May Be Rewarded By H2 2022

- NIO: Down 55% With Supercharged Growth – Time To Buy Now

So, Is NIO Stock A Buy, Sell, or Hold?

NIO 3Y EV/Revenue and P/E Valuations

S&P Capital IQ

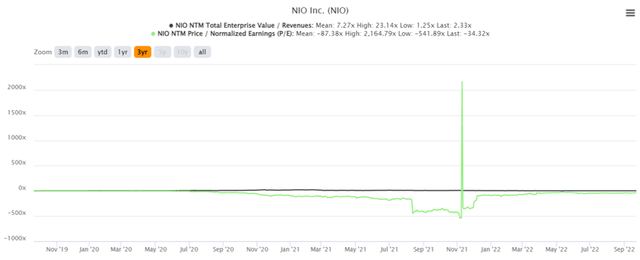

NIO is currently trading at an EV/NTM Revenue of 2.33x and NTM P/E of -34.32x, lower than its 3Y EV/Revenue mean of 7.27x though massively improved from its 3Y P/E mean of -87.38x. The stock is also trading at $17.64, down -60.15% from its 52-week high of $44.27, though at a premium of 51.15% from its 52-week low of $11.67. Nonetheless, consensus estimates remain bullish about NIO’s prospects, given their price target of $30.00 and a 70.07% upside from current prices.

NIO 3Y Stock Price

Seeking Alpha

In the short term, we expect NIO to continue underperforming, mainly due to the volatile geopolitical relationship between China and the US. This is mainly due to the ongoing semiconductor war, escalating Taiwan military tension, and the perceived ‘discriminatory’ EV tax breaks from the Inflation Reduction Act. As China’s Zero Covid Policy further disrupts global supply chain recovery, we do not expect to see things improving over the next few months. President Xi Jin Ping’s re-election and the US midterm elections in November 2022 would also serve as the main catalysts for massive volatility, with things remaining uncertain despite the two world leaders’ first face-to-face meeting at the end of the year.

As a result, investors should obviously avoid adding NIO now. Speculatively, a bottom may occur by early or mid-November for maximum long-term returns. Naturally, the stock is only suitable for those with a higher risk tolerance and a rather long-term trajectory, since NIO would always come with a certain geopolitical risk, combined with the lack of meaningful profitability through FY2025.

Be the first to comment