SolStock

Elevator Pitch

I continue to rate Pearson plc’s (NYSE:PSO) shares as a Hold.

I last wrote about PSO in an article published on October 12, 2021, and I discussed about Pearson’s digital textbook platform and the company’s portfolio optimization plans in that earlier update.

Pearson’s 1H 2022 performance wasn’t as good as what headline numbers imply. PSO’s Assessment & Qualifications business delivered solid growth as examinations were no longer delayed or cancelled due to COVID-19 restrictions. But Pearson’s digital growth metrics, which are a key indicator of the company’s progress in pivoting towards digital learning, were below expectations. In the medium term, PSO’s revenue growth will likely slow as a result of lower-than-expected enrollments, but this will be offset by better-than-expected profitability thanks to the success of its cost optimization initiatives. This suggests that a Hold rating is the most appropriate for Pearson.

Good Recovery From The Pandemic

Pearson did reasonably well in the first half of the current year. The company’s revenue and core operating income expanded by +6% YoY and +22% YoY to £1,788 million and £160 million, respectively in 1H 2022 as per its most recent interim results press release.

PSO’s Assessment & Qualifications business segment benefited from a low base in 1H 2021 when the business division was negatively affected by COVID-19 related lockdowns. With the relaxation of pandemic restrictions, the Assessment & Qualifications business saw its core revenue and operating income grow by +16% YoY and +34% YoY, respectively in the most recent interim period.

Notably, Pearson’s Assessment & Qualifications segment contributed 86% of the company’s core operating profit in 1H 2022, which meant that the recovery of this business segment was the main reason for Pearson’s strong growth in the first half of the year.

Pearson highlighted at its 1H 2022 results call that “exam timetables returned to normal”, which helped its Assessment & Qualifications business to perform well for the first six months of 2022. In comparison, examinations were disrupted last year due to new COVID-19 waves.

Digital Growth Metrics Were A Disappointment

It will be misleading to conclude that all is well at Pearson based on the company’s good headline financial metrics (revenue and operating income) as mentioned in the preceding section. This is because investors are more concerned about Pearson’s long-term growth outlook in a post-pandemic environment, and they are watching the progress of Pearson’s push into digital learning very closely.

In that respect, Pearson’s metrics relating to digital revenue growth would have most probably disappointed the majority of investors. As indicated in the company’s 1H 2022 earnings media release, PSO’s Higher Education US digital registrations declined by -9% YoY from 5.3 million in the first half of 2021 to 4.8 million in the recent interim period. Also, OPM (Online Program Management) student enrollments for its Virtual Learning segment came in at 143,000 for 1H 2022, which represented a -0.7% contraction as compared to 1H 2021.

The weak operating metrics for Pearson’s Virtual Learning and Higher Education business segments translated into poor financial performances for these two business divisions in the most recent interim financial period. Core operating income for PSO’s Virtual Learning business fell by -21% YoY in 1H 2022, as increased investments more than offset a modest +3% YoY rise in segment revenue over the same period. Pearson’s Higher Education business segment turned from a positive operating profit in 1H 2021 into an operating loss for 1H 2022, as the division was hurt by a -4% YoY decrease in segment sales and negative operating leverage.

Mixed Outlook

The intermediate term financial outlook for Pearson is mixed.

Based on the analysts’ consensus financial estimates taken from S&P Capital IQ, PSO’s top line expansion is forecasted to slow from +8.7% in fiscal 2022 to +4.2% and +4.3% for FY 2023 and FY 2024, respectively.

As I indicated earlier, PSO’s solid +6% revenue growth for 1H 2022 was helped by the fact that 1H 2021 was a low base for the company as a result of pandemic disruptions. As such, it isn’t a surprise that Pearson’s top line growth will moderate in the subsequent years ahead. Moreover, Pearson has guided for “increased pressure on enrolments in OPM and Higher Ed (Education)” going forward as per its management comments at the 1H 2022 earnings briefing. Specifically, PSO acknowledged at its interim results call that “there is an enrolment issue”, considering that “many people who have yet to finish their college degrees because they were impacted by the pandemic.”

On the other hand, the sell-side’s consensus financial projections point to Pearson’s EBIT margin improving from 11.6% in FY 2022 to 14.6% for FY 2023 and 15.4% for FY 2025.

The analysts’ projections are aligned with PSO’s updated management guidance. At its 1H 2022 investor call, Pearson noted that “the mid-teens (adjusted operating) margin we expected in 2025 will be achieved in 2023”, as it has been able to achieve better-than-expected “synergies and efficiencies” with its cost savings initiatives as detailed below.

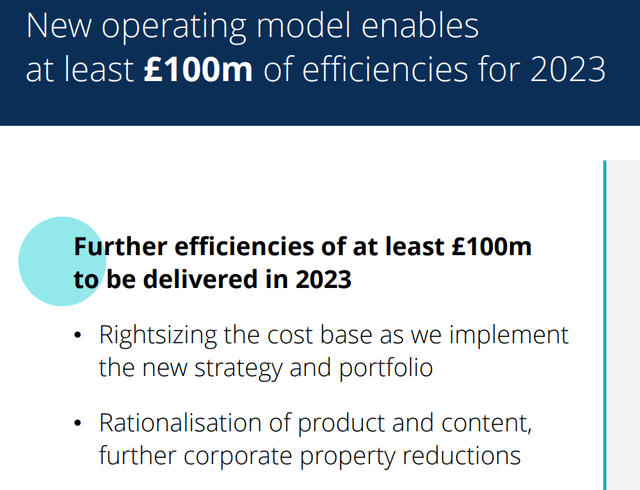

Pearson’s Cost Savings Initiatives And The Expected Financial Impact For FY 2023

Pearson’s 1H 2022 Earnings Presentation

In a nutshell, higher operating profit margins for Pearson in the next two fiscal years will be negated by a more moderate pace of revenue expansion over the same period.

Closing Thoughts

Pearson is rated as a Hold. PSO’s headline financial performance for the first half of the year was good thanks to the robust growth for its Assessment & Qualifications business segment which recovered well from pandemic headwinds last year. On the flip side, Pearson disappointed investors with its worse-than-expected digital revenue growth metrics for 1H 2022. Looking ahead, positive expectations of improved profitability are offset by a normalization of revenue growth, translating into a mixed outlook for PSO warranting a Hold rating.

Be the first to comment