alvarez

The Company

I am initiating coverage on Broadmark Realty Trust (NYSE:BRMK) as it has been at a compelling valuation over the past few months although it is not without risks.

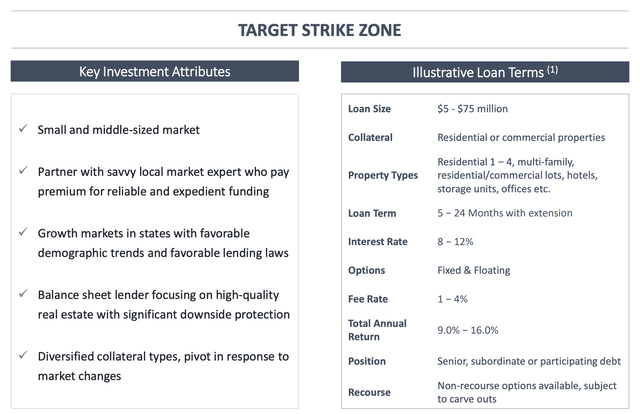

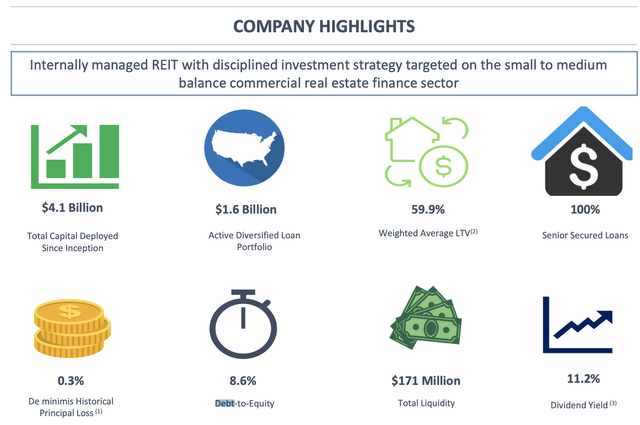

BRMK has been around since 2010 but is fairly new to the capital markets as it issued its IPO in 2019. BRMK is an mREIT which I’m not usually a fan of as I believe it takes incredible skill manage interest rate risk to not have material adverse changes in NAV. BRMK is not an exception to this, but less exposed (this will be discussed further in this article). BRMK is considered a “hard money lender” to real estate developers who urgently require capital. The company is essentially a private equity versus cash flow lender as it focuses on the collateral (what it can realize in the event of default) versus business cash flows which you would see with a chartered bank. Loan sizes do not typically exceed $75MM and are short-term as they don’t exceed 18 months.

Supplemental Earnings Presentation Second Quarter 2022 (Broadmark Realty Capital Inc.)

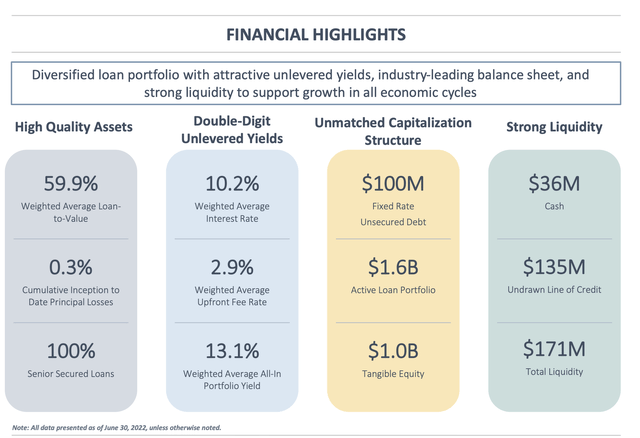

As a result of this lending being higher risk than traditional commercial real estate lending, interests rates are between 10-12% before underwriting fees are even taken into account. As a result BRMK’s weighted average all in yield often comes in around ~13%. In addition LTV on properties typically don’t exceed 70% with the Q2 2022 weighted average LTV at ~60%. Loans are also 100% senior secured.

Supplemental Earnings Presentation Second Quarter 2022 (Broadmark Realty Capital Inc.)

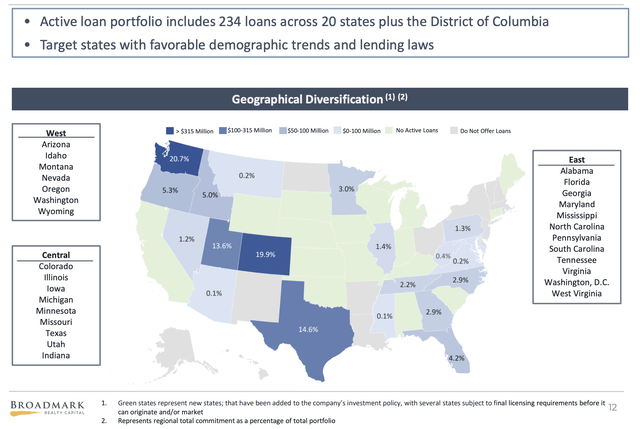

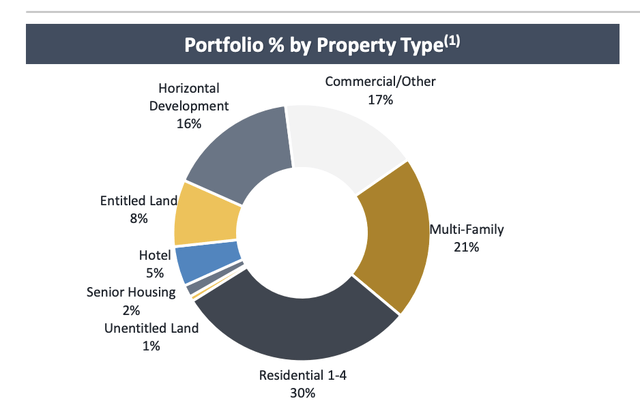

BRMK is diversified throughout the USA with loans in 19 states, although the three largest states account for 56% of total outstanding loans which are Washington, Texas, and Colorado. Residential and multi-family housing account for 51% of the portfolio.

Supplemental Earnings Presentation Second Quarter 2022 (Broadmark Realty Capital Inc.) Supplemental Earnings Presentation Second Quarter 2022 (Broadmark Realty Capital Inc.)

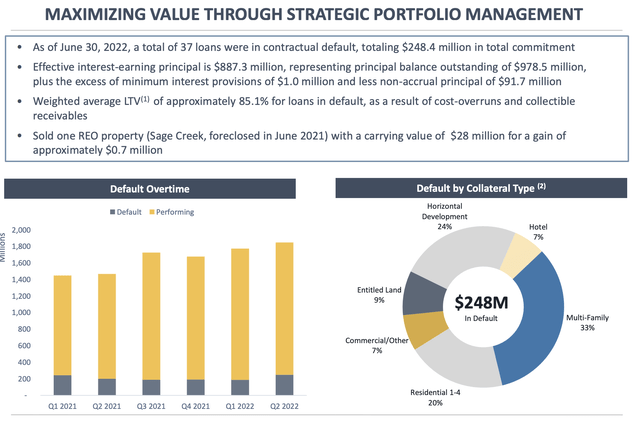

BRMK has only produced $12MM in losses from a total historical portfolio of $3.8 Billion, which comes to around 0.3%. As of Q2 2022 there were 37 loans in default which account for $248MM in total commitments. The weighted average LTV on these properties is 85%. As a result of stable land prices I don’t expect to see major principal losses on these loans. In fact, BRMK sold a foreclosed property at $0.7MM above carrying value which was on their Sage Creek property.

Supplemental Earnings Presentation Second Quarter 2022 (Broadmark Realty Capital Inc.)

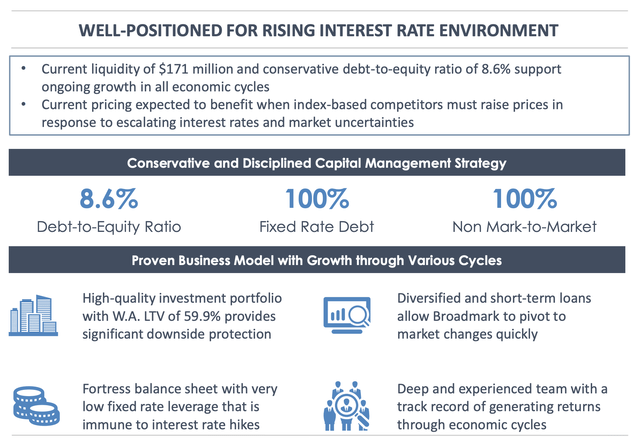

We are all well aware of the recent increases in interest rates by the Fed to combat inflation and are likely to continue their hawkish stance. This has led to a dramatic reduction in the market capitalization of banks and mREITs. BRMK has the lowest debt equity ratio of all mREITs at less than 10% which is $100MM of senior unsecured notes. Interest on the notes accrues at the fixed rate of 5.0% per annum. In addition, the short-term financing model makes them less exposed to interest rate risk. Therefore, BRMK is much less exposed to rising interest rates than its mREIT and bank counterparts.

Supplemental Earnings Presentation Second Quarter 2022 (Broadmark Realty Capital Inc.)

Outlook

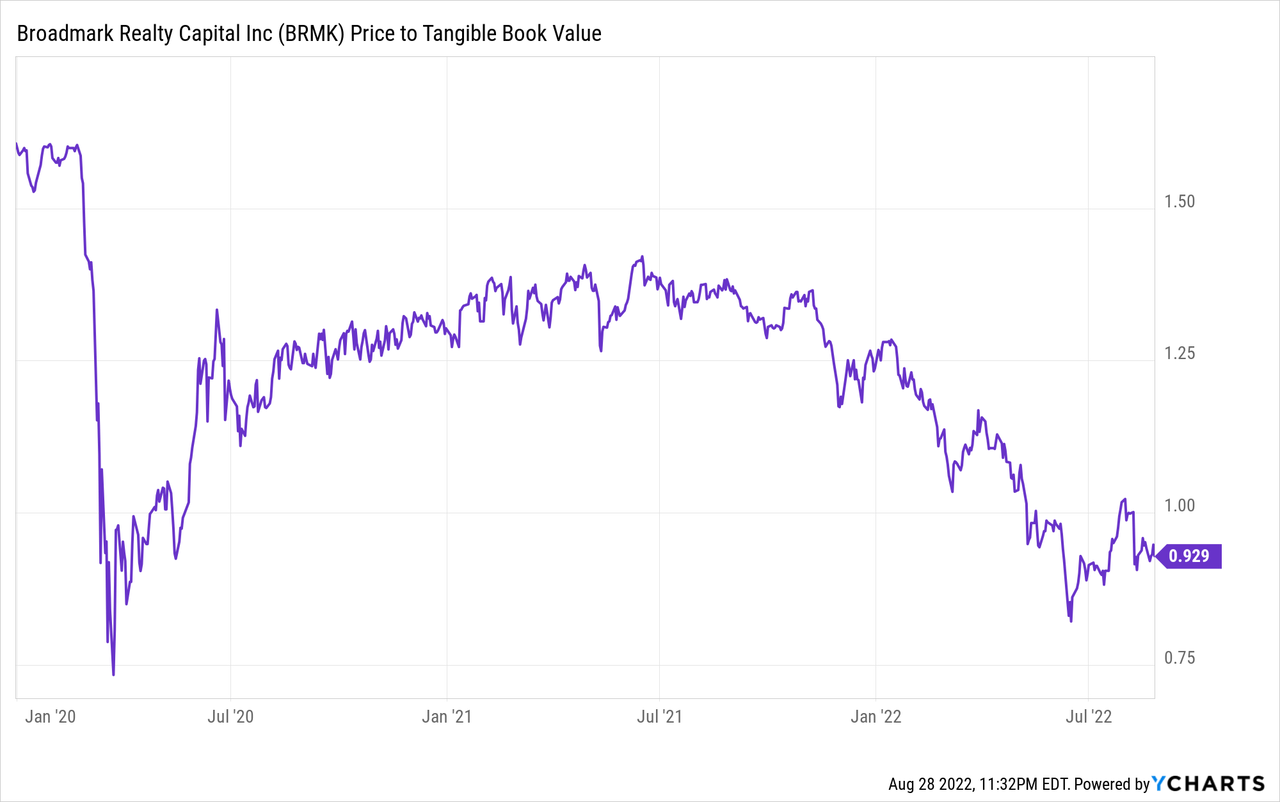

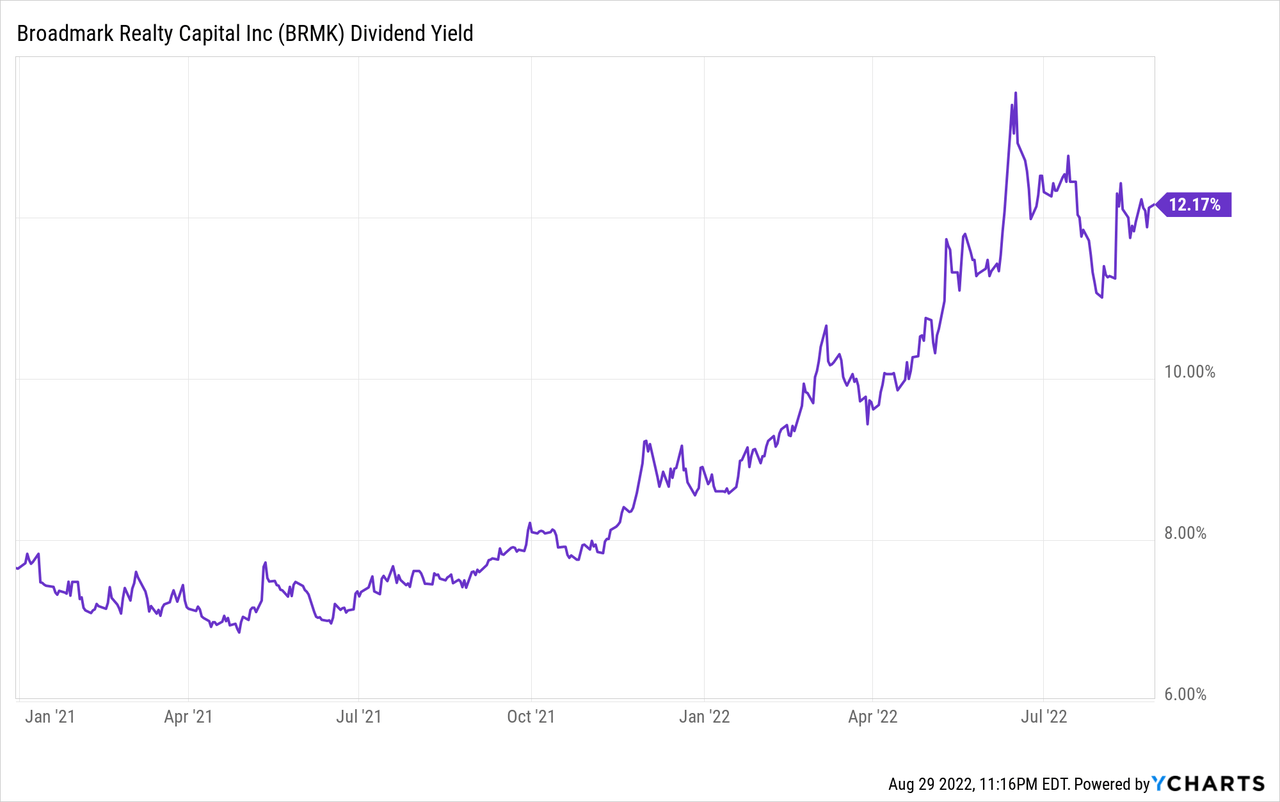

The slides from the Q2 2022 investor presentation make BRMK look like the greatest company since Apple (AAPL). The stock is not without risk which is why it trades at a hefty 12% dividend yield and a 10% discount to TBV which is among the cheapest it has traded at since its IPO.

Supplemental Earnings Presentation Second Quarter 2022 (Broadmark Realty Capital Inc.)

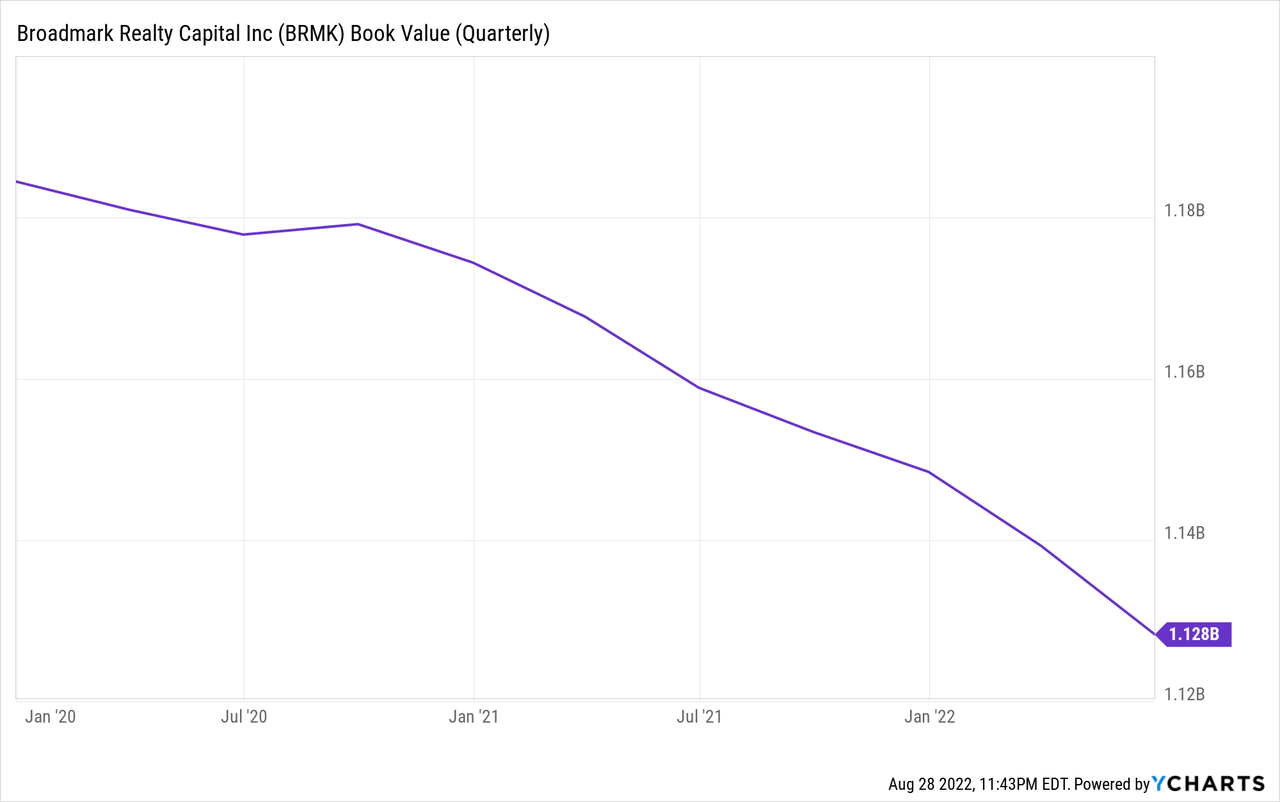

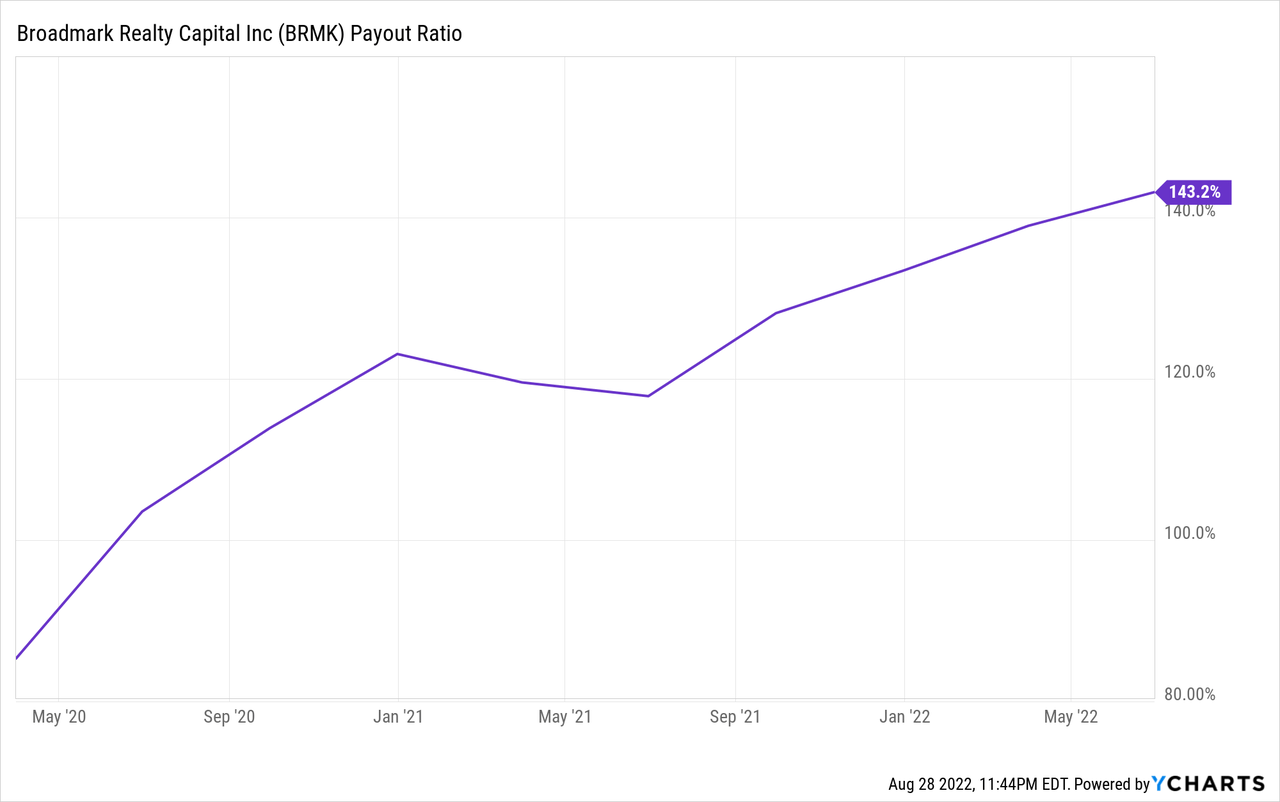

Overall I would argue this is a very competent management team that are good stewards of capital but for one major fault which is their decisions when it comes to returning capital to shareholders via dividends. Don’t get me wrong, this is why I invest, but like most investors I get nervous when it’s just being recycled back to me and it depleting BV.

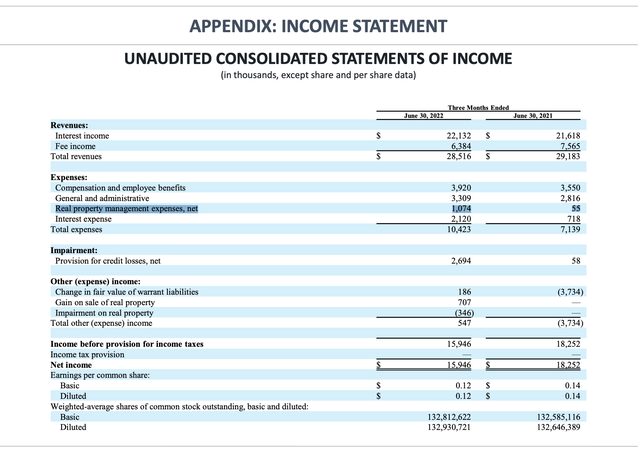

Distributable earnings is the preferred measure to assess dividend coverage rather than basic net income as it accounts for non-cash expenses such as stock based compensation, provision for credit loss, and impairment charges. Either way, BRMK has failed to produce enough income on a quarterly basis to fully cover their $0.07/month dividend with the payout ratio reaching its highest level of 131% at Q2 2022.

My thoughts on why management has chosen not to cut back on the dividend is threefold. One, which ties into my second point is BRMK realized a $1.1MM real estate management expense in Q2 2022 which was much higher than previous quarters. This expense was as a result of moving ~$30MM in loans from mortgage receivables to owned real estate (REO). Under GAAP accounting once this occurs R&M expenses can no longer be capitalized but have to be expensed in the period. This expense was irregularly high and will be recouped when the property is sold and in its absence would add back $0.01/share in quarterly income. This is would only bring the payout ratio down to 123% however.

Supplemental Earnings Presentation Second Quarter 2022 (Broadmark Realty Capital Inc.)

Two, as result of stable real estate prices, BRMK likely expects to realize at least carrying value on the REO properties as they did on their Sage Creek property. This assumption is likely reasonable and likely under states BV as these properties account for 7% of total assets. Third, current liquidity of $171 million between cash, short-term investments, and the LOC could cover the dividend payment more than one year. As a shareholder I would prefer to see the excess liquidity go towards growing the loan book and reap the earnings from the assets.

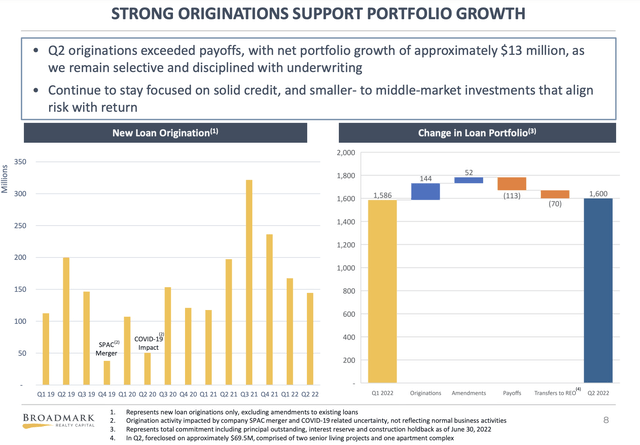

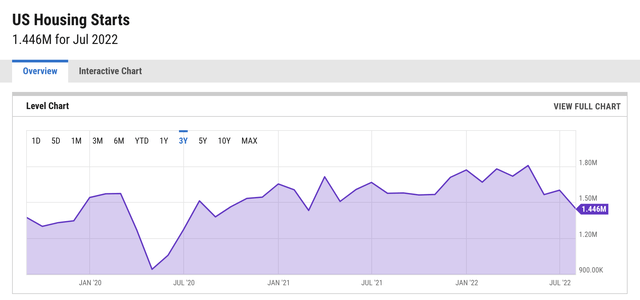

The question isn’t if the dividend gets cut but when. New loan originations have been on a steep decline since 2021 YE and at Q2 2022 barely covered the portfolio runoff. This is a result of slowing housing starts in the U.S. which have reached the lowest point since July 2020 which is looking like the beginning of the pain that rising interest rates will inflict on this market. It would seem the only way to increase earnings is to raise rates or charge higher fees and there is some room to do this with contractual defaults at only 15% of the total book, but don’t forget that the highest level of principal was moved into default in Q2 since the pandemic so there is only so much room to paddle before the shore arrives. There is also no guarantee they can keep realizing carrying value on these properties if the housing market begins to crack.

Supplemental Earnings Presentation Second Quarter 2022 (Broadmark Realty Capital Inc.) YCharts (US Housing Starts)

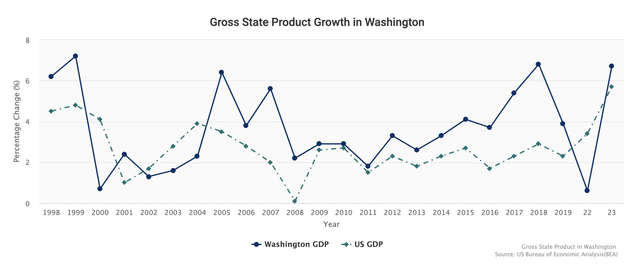

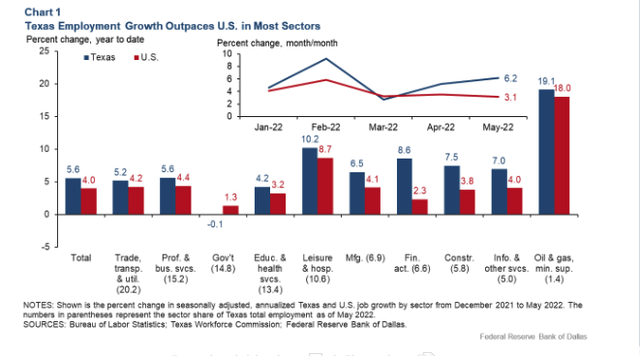

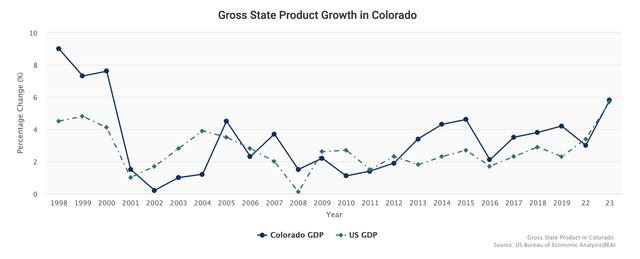

BRMK’s primary markets have among the highest growth rates in the USA as all three being Washington, Texas, and Colorado have been experiencing greater economic growth than the country as a whole the last few years which should at least keep origination growth high enough to at least meet runoff. It would seem that loan book growth will slow tremendously over the next few quarters however and therefore make the dividend payment unsustainable.

IBIS World (Washington – State Economic Profile) Dallas Fed (Employment Increases in May) IBIS World (Colorado – State Economic Profile)

Conclusion

The Q2 2022 earnings report provides a pretty good picture of what can be expected over the next few quarters earnings wise at the loan book stagnates at $16MM. $0.17/share in quarterly earnings ($0.68/ annualized) will be insufficient to cover $0.84/share in quarterly dividends and will continue to drain liquidity annually by $21MM. A monthly dividend cut of 24% would be required to stop the decrease in BV as a result of the dividend. A decrease to as much as $0.05/share is looking inevitable but the payout ratio would fall to ~88%. This would still generate an enticing ~9% yield at the current price of $6.90/share which is nothing to balk and seems to be baked into the current market price as the yield has typically been between 7.5-9%.

Despite the likelihood of a dividend cut, I still think this stock represents tremendous value at a 10% discount to TBV which is likely understated because of the REO properties. There is no telling how the market will take the dividend cut, so selling put options may be the best play for those concerned about near-term volatility. The low leverage position and astute management should guide this ship through economic turbulence, making it a good long-term investment. I expect double-digit returns in the long run as the market eventually forgives management for being paid too much in dividends, as the company has mostly traded at a premium to TBV in its short life on the public market. Investors can still enjoy a juicy yield while they wait for capital appreciation, whatever it ends up being.

Be the first to comment