zorazhuang

Investment thesis

Agora (NASDAQ:API) has shown resilience in the face of adversity, surviving a crackdown on the academic tutoring sector in China, which once made up the majority of its revenue. The company has been able to make up for the shortfall by growing its revenue in markets outside of China. Agora’s increased investment in R&D, led by its technical founder Tony Zhao, is likely to strengthen its business moat. Tony Zhao has doubled down on Agora and recently committed personal funds of US$30 million to share buybacks. This is in addition to a US$200 million share repurchase program already implemented by the company earlier this year. While cash flow is still negative, Agora’s ample cash reserves guarantee many years of runway.

Non-financial metrics

Excluding Easemob, active customers were 2877, an increase of 17.5% yoy. Dollar-based net expansion rate (DBNER), which measures the percent increase in revenue from existing customers on a year-over-year basis, was 130% for US and international customers and 80% for China customers. This means that, on a year-over-year basis, revenue from US and international customers has been increasing, while revenue from China customers has been decreasing. Given that China comprised 70% of revenue in 2021, it is no surprise then that Agora has had trouble growing revenue.

Financial analysis

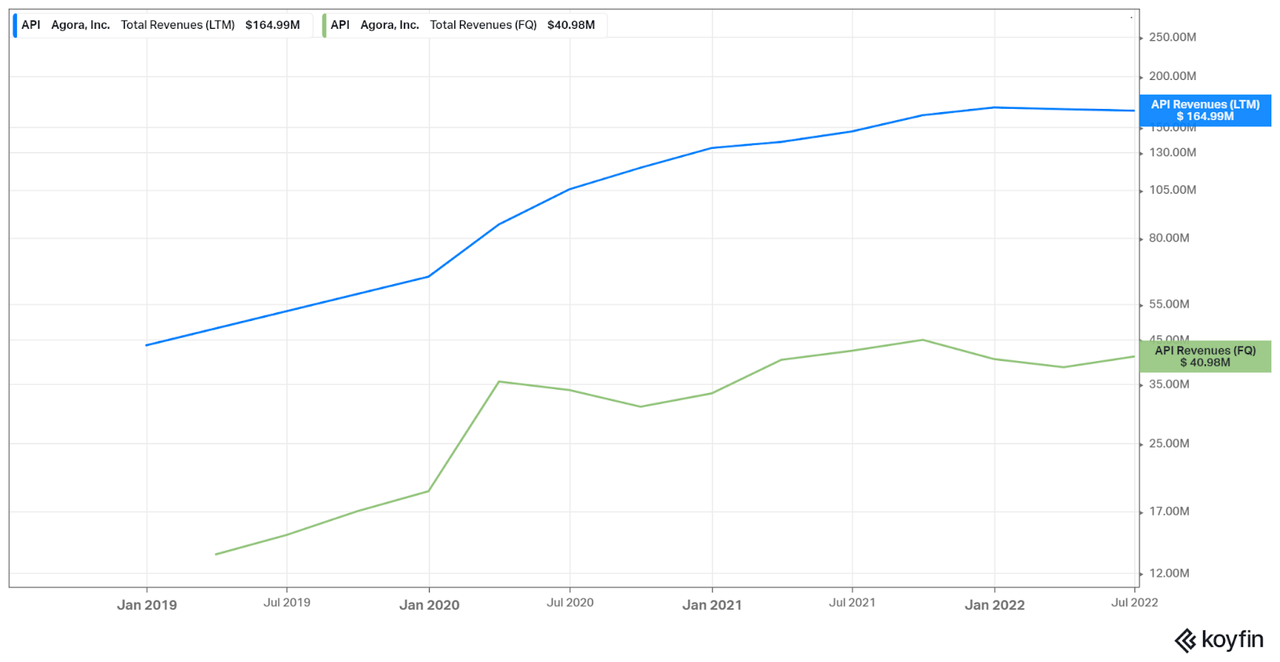

While total revenue slightly rebounded quarter-on-quarter to US$41 million, the rebound was insufficient to prevent a slight decline on a TTM basis. Management attributes this to decreased usage in the K-12 academic tutoring sector in China, which in 2021 made up more than 70% of all revenue. The silver lining in this is that future revenue impact due to decreased usage will be minimal, as revenue contribution from the K-12 academic tutoring sector in China declined to US$1 million in 2022Q2 from US$12 million last year.

Koyfin

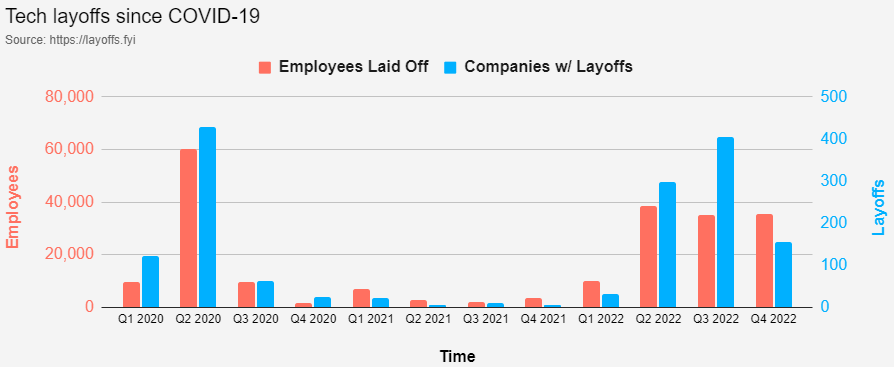

Unlike revenue, operating expenses have continued to climb. As a percentage of revenue, quarterly TTM opex reached 126% of revenue, increasing by 6% qoq and 34% yoy. Management has attributed this to increased personnel costs in all 3 opex categories. Increasing personnel costs run counter to the general trend in the tech industry, which has seen increasing layoffs since the start of 2022.

layoffs.fyi

Of the 3 opex categories, R&D expenses increased the most, reaching 74% of revenue on a TTM basis. R&D expenses are likely to remain elevated in the future, as CFO Jingbo Wang revealed in the earnings call that steady state R&D will be around 30% of revenue, higher than most SAAS or PAAS businesses. Soaring opex contributed the most to net loss, which continued its downward trend and, at -US$31 million, broke new lows this quarter.

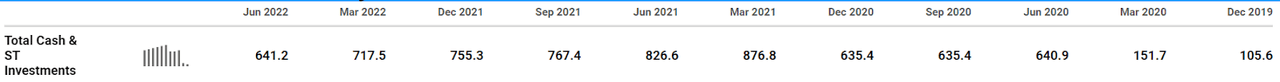

Unsurprisingly, free cash flow also continued its downward trend and reached new lows this quarter. Of note was a US$34.2 million purchase of land use rights in Yangpu district, Shanghai for the purpose of building new headquarters. This was the biggest item on the cash flow statement and resulted in an unlevered free cash flow of USD -$78.4 million. On the positive side, the company has plenty of cash. Cash and short-term investments were at US$641 million, meaning that the company is unlikely to run out of cash anytime soon.

Seeking Alpha

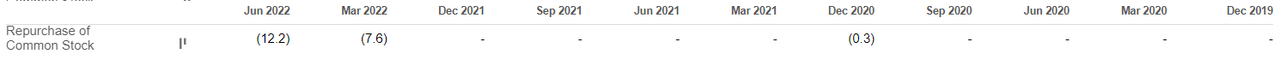

Share-based compensation has continued to climb, both absolutely and as a percentage of revenue. Share-based compensation as a percentage of revenue was 4.2% in 2019Q4 but quintupled to 22% in 2022Q2. On a positive note, the company has started to step up its share repurchase program, first announced in Feb 2022.

Seeking Alpha

Repurchase of common stock increased to USD $12.2M from USD $7.6M last quarter. Interestingly, founding CEO Tony Zhao recently announced that he would use his personal funds to buy up to USD $30M worth of ordinary shares, signaling the CEO’s belief that the company’s current share prices are undervalued.

Valuation

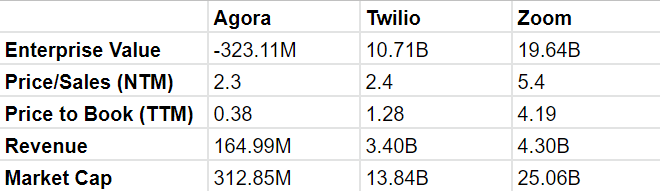

We compare Agora to Twilio (TWLO) and Zoom (ZM), two tech companies that provide similar services, to get a sense of how it should be valued. Agora’s enterprise value (EV) is USD -$314M, due to cash holdings greatly exceeding the sum of its market capitalization and total debt. Thus, we will look at Agora’s price/sales ratio instead of its EV/sales ratio.

Author

Compared to Twilio and Zoom, Agora seems to be the more attractive investment. Its price/sales and price-to-book ratios are the lowest of the three companies, at 2.3 and 0.38 respectively. Seeking Alpha’s Quant Factor Grades also thinks favorably of Agora’s present valuation, assigning it an A+ rating. An important caveat here is that Agora’s revenue and market cap are magnitudes lower than those of Twilio and Zoom.

Risks

Weak Macro Environment

In the US, Fed interest rate hikes have battered the stock market. Since the last Fed meeting, futures traders have raised expectations for the terminal rate to reach 5%. Powell communicated clearly that there would not be any dovish pivot in the foreseeable future, as the unemployment rate had not risen and the growth rate had not fallen below trend. Expectedly, stock markets tanked after Powell’s announcement. While the stock market rallied last Friday following a dovish CPI print, more pain may be lurking around the corner, as the treasury yield-curve inversion reached a four-decade high, signaling a possible recession.

In China, where Agora derives more than 70% of its revenue, stock markets rallied on news of COVID easing. The news came as China reported more than 5000 new, locally transmitted cases, the highest number since May 2, when the country’s commercial capital of Shanghai was put under a crushing lockdown. However, the Chinese economy continues to be under pressure, with its property market, the largest asset class in the world, continuing to underperform. Repeated lockdowns across China’s major cities have disrupted supply chains and dampened consumer spending. Urban unemployment remains at historically high levels, increasing to 5.5% in September 2022 from 5.3% in August.

In Europe, the likelihood of a recession continues to rise. Eurozone composite PMI fell to a 23-month low of 47.3 in October, with new orders and future output PMIs suggesting that worse is yet to come. According to Eurostat, inflation is expected to reach a record high of 10.7% in October, driven mainly by energy prices, which have risen more than 40% year-on-year. Eurozone GDP growth is expected to be negative between 2022Q3 and 2023Q1, and stagnant in 2023.

Delisting

Delisting remains a risk for Agora, having been added to the conclusive list of issuers identified under the HFCAA in May 2022. However, Agora’s likelihood of being delisted has been somewhat reduced since China agreed to let PCAOB inspectors audit Chinese companies listed on US Exchanges. Additionally, Agora could follow in the footsteps of NIO and list by way of introduction on the HKEX. Doing so would reduce the liquidity impact of delisting, since US ADRs and Hong Kong shares are fully fungible. However, the liquidity impact of delisting would not be completely eliminated, given the large difference in liquidity between the Hong Kong and US stock markets.

Conclusion

We like the fact that Agora has been successful at recovering lost revenue from the academic tutoring sector in China. Given that the sector only contributed USD $1M in 2022Q2, we believe that Agora’s revenue decline (on a TTM basis) will soon reverse. While Agora’s free cash flow continues to worsen, its cash balances are more than sufficient to provide many years of runway. Agora’s growing opex has been mainly due to increased investment in R&D which, given CEO Tony Zhao’s technical background, should increase its business moat over time.

On the other hand, we do not like the fact that Agora has been increasingly passing on costs to investors in the form of increased SBC. Additionally, the macro environment is weak in the US, Europe, and China. In the US, a recent dovish CPI print weakened the Fed’s resolve, and the implied terminal rate remains just under 5%. In China, a new wave of COVID outbreaks threatens to set off a fresh round of lockdowns. In the Eurozone, high inflation and low PMIs suggest that growth is likely to be negative in 2023.

In the next few quarters, we would like to see the 130% DBNER for US and international regions translate into revenue growth. We would also like to see SBC and opex growth slow or stop completely. Until then, we assign a hold rating to Agora.

Be the first to comment