Jose Luis Pelaez Inc/DigitalVision via Getty Images

Although most investors are probably aware of the OTC market or have even purchased stocks off-exchange, very few have stopped to consider the business behind the proliferous inter-dealer trading system. OTC Markets Group (OTCQX:OTCM) provides the largest U.S. marketplace for unlisted securities, with over 12,000 companies available currently.

Three segment flywheel

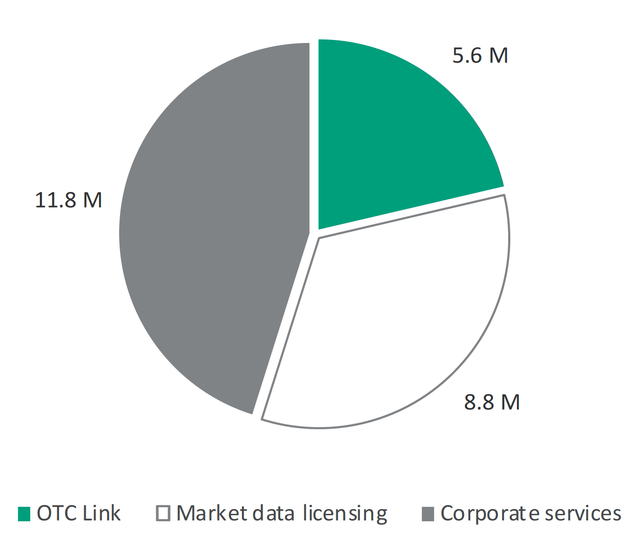

The company generates revenue from three main business lines related to trading, market data, and corporate solutions. Their OTC Link consists of three Alternative Trading Systems (ATS) that enable the trading of unlisted stocks for FINRA member broker-dealers. Leveraging the market data collected from the ATSs, they also offer licensing products for a wide range of individual and enterprise users. Finally, they operate the OTCQX Best Market and OTCB Venture Market, giving companies access to a suite of investor relations, compliance and disclosure services.

Revenue mix FY21 (Fourth Quarter and Full Year 2021 Earnings Presentation, OTCM)

Historically, stock exchanges have made for exceptionally strong and resilient businesses, especially once reaching monopoly status. Despite not operating a national exchange, OTC Markets Group benefits from the same durable, competitive advantages as ICE, CME, and NDAQ, namely barriers to entry, wide margins, and pricing power. The only way to trade unlisted shares is OTC and the OTC Markets brand is synonymous with this form of exchange. At a much smaller market cap, it also has a greater runway for growth, with the flywheel effect of greater transparency driving liquidity which in turn drives the data segment and ultimately more liquidity.

This moat is clearly visible in the financials, with revenue compounding at an average rate of 12.5% over the past 10 years and growth hastening more recently. Profit margins have increased from 16.5% to 30.5% and an EPS has grown at a CAGR of 18.8% over the same period.

Pushing through headwinds

In 2021, OTCM saw explosive revenue growth of 45% as a result of record levels of trading activity in the market and an influx of new corporate services and market data clients. While this year, trading volumes across the markets have fallen precipitously, the company has managed to maintain revenues thus far due to sticky demand for the two latter lines. This demonstrates the advantages of the company’s business mix, which offers protection from the cyclicality of stock market liquidity whilst allowing them to benefit during peak periods.

In addition, the company is mostly insulated from the current macroeconomic challenges facing other firms, with wage inflation being the most pertinent. Regardless, despite a rough first quarter this year, operating margins have begun converging back to their 10-year average in Q2 and Q3. This is in part due to management’s incremental price increase initiative for corporate service clients starting this year. With no debt, the company is also well positioned in the rising interest rate environment.

Management excellence

Free cash flow has consistently been positive and growing with a CAGR of 22.3% since 2012 and cash gradually building on the balance sheet. One of the most attractive characteristics of the stock from an investor perspective is the sustained high ROE and ROIC (see table below) exhibited over the past decade and a history of dividend raises and share buybacks. This indicates that management has a strong record of efficient capital allocation and a continued alignment with shareholder interests.

They are also not afraid to strategically deploy cash when opportunities present themselves, such as with the acquisitions of Blue Sky Data Corp. assets in May of this year and most recently EDGAR Online last month. While the effects of these acquisitions remain to be seen, from a strategic standpoint they make sense and are directly accretive to the market data segment.

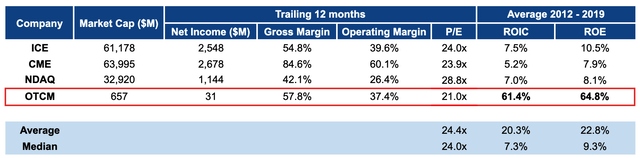

After benefiting from the increased market liquidity during COVID-19, the past year of sideways trading is most likely the result of current market conditions and investor cynicism concerning future earnings. While unprofitable and debt-ridden companies are being punished and may continue to be as uncertainty prevails, cash flow generative businesses are more attractive than ever. The table below compares several key metrics for relevant peers across the financial exchange industry.

Peer analysis, financial exchange industry (Author)

It should be noted that compared to other industries, shares trade at high multiples due to wide margins and high returns on capital. Although the comparison between peers is not strictly apples-to-apples, it can be seen that OTCM appears to be relatively undervalued based on these metrics. Whether or not the discount is earned, due to differing characteristics such as listing format, market cap, or business mix, could be debated. Most importantly, the TTM P/E is significantly lower than the historic 5-year average P/E of 24.2, at a time when business is better than ever and EPS looks set to remain stable through 2023 and to grow beyond.

Undervalued on an absolute basis

Rather than relying on multiples for a relative valuation, the predictability of cash flows allows us to make some growth rate assumptions and calculate an absolute intrinsic value. If we expect free cash flow to be slightly lower in 2022 (based on TTM data after Q3), then continue to grow at the historic rate before COVID of 12.3%, and assume a sustainable growth rate of 3.8%, based on the industry average ROE in the same period (9.5%), and convergence to a long term retention rate of 40%, we obtain a terminal value per share of $154. Discounting back the terminal value and annual FCF yield with a required return on equity of 10% (expected S&P index return), we get a final value per share of $93. This implies that the stock is currently undervalued by approximately 65%, should our forecast prove to be accurate.

For this intrinsic value to be realized, management will need to keep the flywheel turning to maintain double-digit FCF growth for the next decade. Should OTCM’s acquisitions in the market data space perform well, then these expectations may well be exceeded. Any strong results reported in the market data business line or a positive inflection in general investor sentiment should act as a catalyst going forward. Even if things do not go as well as planned, investing in cash flow positive, unleveraged companies such as OTCM offers some assurance to the downside.

Due to current market conditions, stock prices in general may remain suppressed for an extended period of time. Less liquidity will also continue to impact the company’s trading services segment. If market turmoil persists beyond 2023, the number of corporate and data clients may begin to dwindle as a result of a widespread lack of interest in capital markets. This would challenge the previous growth trajectory of the company and justify the current discount to historic multiples. Furthermore, OTCM operates in a highly regulated industry and is vulnerable to future changes in regulatory framework materially impacting the business. Unlike peer markets, OTCQX, OTCQB and Pink markets are not national securities exchanges, which may limit the pool of available investors and offer less protection against competition.

Conclusion

OTC Markets Group, like other financial market companies, is an excellent business with a durable moat. What sets it apart, however, is the proven capital allocation efficiency of management over the past 10 years, as well as a drive to maximize shareholder value. OTCM is undervalued based on relative and absolute value. Buying the stock today, investors could expect a return of 65% based on intrinsic value should our assumptions hold true.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through Dec. 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment