Prostock-Studio/iStock via Getty Images

Summary Q3 results

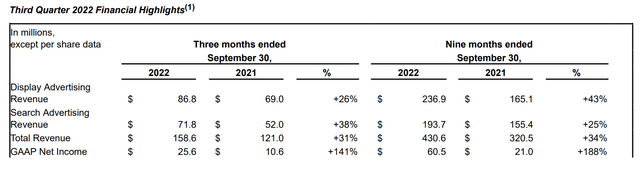

Perion Network (NASDAQ:PERI) delivered, as investors have grown accustomed to, a great set of results:

- Revenue +31%

- Non-GAAP Net Income +94%

- Cash from operations +145%

Not only did these results again beat analyst expectations, Perion also raised its full-year outlook (slightly) from $630M (midpoint) to $632.5M (midpoint) in revenues and from $102M to $120M in adjusted EBITDA.

I see two main driving factors that have emerged in the past quarter. I suspect both will continue to dictate Perion’s performance in the quarters to come. Let’s dive into them.

Perion benefits from shifting ad budgets

Revenue growth per division (Perion Q3 results)

While I already called out Perion as a strong beneficiary of the rise of Connected-TV (CTV revenue up 134%) and cookieless advertising (SORT revenue up 25% quarter-over-quarter) in a prior article, a third positive trend has emerged: the shift away from advertising on Facebook towards alternatives (being ‘search’ and ‘video’).

One such alternative is “search”. As a major partner of Microsoft handling advertising on Bing, Perion noticed an increased interest in search advertising, boosting the division’s revenues by 38%. Also, not only is CTV doing great, Perion’s video-marketing division is doing great overall. Revenue increased no less than 209%. The acquisition of, among others, Vidazoo is paying off. Video ads now represent 44% of Display revenue, or 24% of total revenue. Going forward, revenue growth should slow down, as I believe $10-15M of the incremental video ad-revenue is thanks to the acquisition of Vidazoo. I believe organic growth will be closer to ~50% (increase in revenue from existing video platform users was +67%), also driven by CTV and the continued trend of marketeers shifting ad spend away from Facebook. Now that the video platform is almost a quarter of total revenue, its high growth rate will have even more impact on total revenue growth.

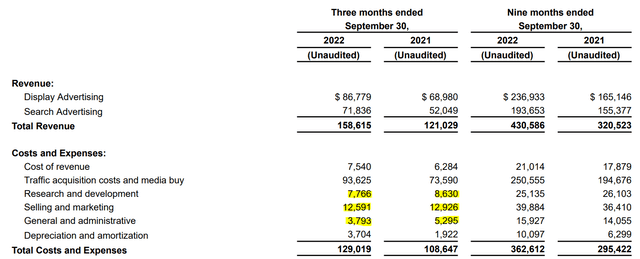

Perion is cutting costs

While revenue is increasing left and right, R&D (-10%), Marketing (-3%) and Administrative costs (-29%) have come down.

Perion cuts costs (Perion Q3 results)

I think this is a very important signal: Perion is, unlike many other tech firms, able to effectively lower its costs, while keeping its growth rate above 30% and through cost inflation. This is a strong example of managerial discipline, and leads me to believe that further revenue growth will continue to result in (even) stronger earnings growth!

Conclusion

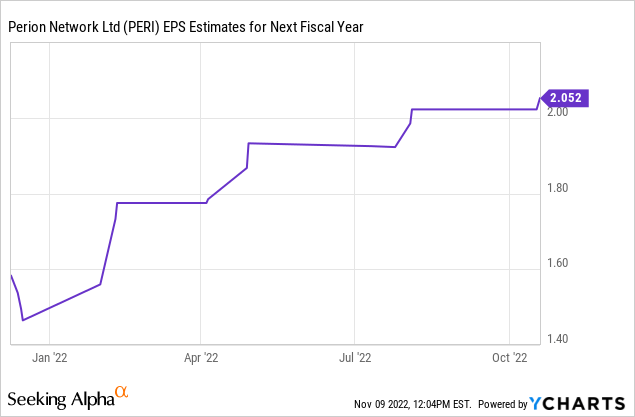

Perion earned a record GAAP earnings per share of 53 cents this quarter. Over the next twelve months, revenue growth will continue, while costs will stay at the current level. Yet, Wall Street currently estimates PERI to only make $2.05 a share in 2023. I believe this is a gross underestimation.

Yes, there is (likely) a recession. No, Perion does not seem to be affected; on the contrary.

Even if correct, at $2.05 a share, PERI trades at ~11x earnings. That’s far too low.

Be the first to comment