Sundry Photography

Based on Lam Research Corporation’s (NASDAQ:LRCX) latest earnings briefing, management highlighted and confirmed that the company will be impacted by the increased restrictions by the US government on semiconductor sales to China with the capability of producing chips below 14nm. Additionally, Lam Research could be affected by the US government’s new restrictions to sell memory semicon equipment to Yangtze Memory Technology Co according to Reuters. Hence, in this analysis, we identified the players in the semicon equipment market and alternative suppliers in the Chinese market to determine if the company could maintain its market position. We then analyzed the potential revenue impact on its foundry and memory segments.

Minimal Impact on Lead Position in Deposition & Etch Equipment

Company Data, SEMI, Khaveen Investments

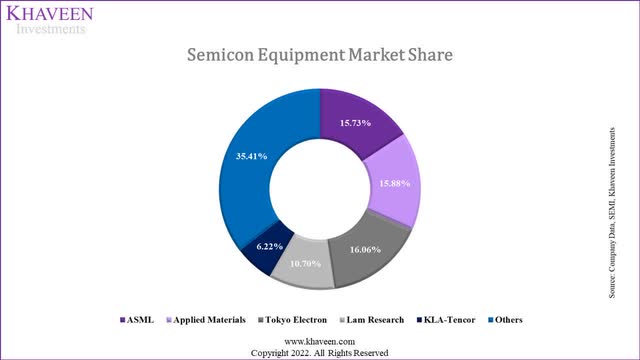

As seen in the market share above compiled based on each company’s 2021 revenue, Lam Research is the fourth largest segment equipment manufacturer with a share of 10.7% behind market leader Tokyo Electron (OTCPK:TOELF), ASML (ASML) and Applied Materials (AMAT). Although Lam Research is only the 4th largest semicon equipment company by market share of the total semicon equipment market, the company specializes in Deposition and Etch semiconductor equipment types which it has the highest market share according to South China Morning Post.

In the deposition and etch market, only 3 companies account for a large portion of the market share including Lam Research, Tokyo Electron and Applied Materials. Based on the market share data from The Information Network, Lam Research had strengthened its market share which increased to around 50% by 2017 and was the market leader followed by Tokyo Electron (20% market share in 2017) and Applied Materials in the third position (below 20% share). In China, smaller companies with deposition and etch equipment include Naura, Advanced Micro-Fabrication Equipment and Shenyang Piotech.

According to Reuters, the US government could be imposing new restrictions on the company for semicon equipment sales to Chinese memory semiconductor companies which includes YMTC. Additionally, WSJ reports that equipment makers including Lam have halted supply to YMTC.

Thus, we estimated the potential revenue impact on Lam Research based on its revenue breakdown from its NAND segment and YMTC’s market share of 5% of the NAND market.

|

Lam Research ($ mln) |

|

|

NAND Segment Revenue % (‘a’) |

40% |

|

Lam Research Total Revenue (‘b’) |

17,227 |

|

YMTC Market Share (‘c’) |

5% |

|

Estimated Revenue Impact (‘d’) |

344.54 |

|

% of Revenue Impact |

2.0% |

*d = a x b x c

Source: Lam Research, Khaveen Investments

Besides its memory segment, we determined the potential revenue impact for the company’s foundry segment as both Lam Research had confirmed that the US government was increasing restrictions on the sale of equipment to Chinese foundries with the capability of manufacturing chips below 14nm according to South China Morning Post. We estimated the revenue impact for its Foundry segment based on its foundry revenue as a % of total revenue and SMIC’s (OTCQX:SMICY) foundry market share of 5.6% and our estimate of its revenue breakdown by 14nm process node of 9.3% to derive an estimated revenue impact of only 0.2%.

|

Lam Research ($ mln) |

|

|

Foundry Segment Revenue % (‘a’) |

32% |

|

Lam Research Total Revenue |

17,227 |

|

SMIC Foundry Market Share (‘b’) |

5.6% |

|

SMIC Estimated 14nm Share of Revenue % (‘c’) |

9.30% |

|

Estimated Revenue Impact (‘d’) |

29 |

|

% of Revenue Impact |

0.2% |

*d = a x b x c

Source: Lam Research, Khaveen Investments

Overall, we calculated our total estimated revenue impact for Lam Research due to the US restrictions on Chinese memory chipmakers and foundry customers. However, we believe the impact on the company to be minimal at only 2.2% of revenues. Thus, we believe that the company could continue to maintain its market position as the leader in the Etch and Deposition equipment market.

|

Lam Research ($ mln) |

|

|

Revenue Impact (YMTC) |

344.54 |

|

Revenue Impact (SMIC) |

29 |

|

Total Revenue Impact |

373 |

|

Lam Research Revenue |

17,227 |

|

% Revenue Impact |

2.2% |

Source: Lam Research, Khaveen Investments

Higher Impact on Memory Segment if Stricter Restrictions

Although the ban could affect the company’s business with China-based chipmakers such as YMTC, the restrictions could also impact foreign chipmakers manufacturing in China which includes Samsung (OTCPK:SSNLF) and SK Hynix which are also customers of the company based on its annual report. However, the company did not disclose the % breakdown of these customers but the company’s largest revenue by segment is Memory accounting for 61% of revenue.

Also, according to Reuters, the ban could also affect South Korean chipmakers such as Samsung and SK Hynix which have manufacturing facilities in China. In this case, we estimate the potential revenue impact to Lam Research based on the total memory capacity share breakdown of China at 14% according to SIA. Based on the company’s total Memory segment at 61%, we estimate an impact of 8.5% of its total revenues.

|

Lam Research |

|

|

Total Memory Segment Revenue (DRAM and NAND) % (‘a’) |

61% |

|

Lam Research Total Revenue (‘b’) |

17,227 |

|

China Memory Capacity Share (‘c’) |

14% |

|

Revenue Impact (‘d’) |

1,471 |

|

% of Revenue Impact |

8.5% |

*d = a x b x c

Source: Lam Research, Khaveen Investments

Thus, we estimate the company to have a higher revenue impact of 8.5% if the restrictions include foreign chipmakers manufacturing in China as well which is higher than our estimate of the restrictions on YMTC at only 2% of revenue impact. However, we believe the impact on the company to be limited overall while Samsung and SK Hynix could divert their shipments and incur higher costs to avoid the restrictions. We view this scenario as having a lower probability, and it is also recently reported that Samsung and SK Hynix could be spared from the U.S. placed restrictions.

Restrictions on SMIC Not Affecting Lam Research

The company confirmed in its latest earnings briefing that the restrictions for equipment sales to Chinese fabs were increasing to 14nm and below. Moreover, the company also highlighted that it has taken the impact of the restrictions into account in its guidance for the next quarter. The company’s revenue guidance for its next quarter is higher than its previous quarter’s guidance of $4.2 bln.

We were recently notified that there was like – there was to be a broadening of the restrictions of technology shipments to China for fabs that are operating below 14-nanometer. And so that’s the change I think that people have been thinking might be coming. And our – we’re prepared to fully comply. We’re working with the U.S. government and any impact on Lam’s business it’s contemplated in the September guidance that we just gave. – Tim Archer, President and Chief Executive Officer

We previously analyzed the potential impact on SMIC in our previous analysis of the company where we expect it to affect its revenue growth. However, SMIC had been placed on the US entity list by the US Commerce Department for its alleged ties to the Chinese military which requires US companies to apply for export licenses to continue doing business with SMIC. Previously, it was reported that US equipment manufacturers including Lam Research, KLA and Applied Materials had applied for the license but were believed to struggle in obtaining the licenses. Thus, we believe this could have a limited impact on Lam Research’s revenues.

Though, based on the company’s annual report, its revenue exposure to China had increased over the past 3 years from 22% in 2019 to 31% in 2020 and 35% in 2021. However, the geographic revenue breakdown in its annual report is based on the location of its customers’ facilities instead of where its customers’ headquarters are from. Thus, we believe its revenue breakdown by geographic location is not reflective of its growth from China-based customers.

Furthermore, we examined the company’s quarterly revenue growth (calendar year) following the inclusion of SMIC to the US Entity List on 18 December 2020 based on the press release by the US Commerce Department.

|

Lam Research Revenue ($ mln) |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

Average |

|

Revenues |

3,456 |

3,848 |

4,145 |

4,305 |

4,227 |

4,060 |

4,636 |

|

|

Growth % |

8.8% |

11.3% |

7.7% |

3.8% |

-1.8% |

-3.9% |

14.2% |

5.7% |

Source: Lam Research, Khaveen Investments

In Q1 2021, Lam Research’s revenue grew by 11.3% even after SMIC was included in the US Entity List in the previous quarter. In Q4 2021 and Q1 2022, management attributed the growth decline due to issues in the supply chain. All this indicates that the ban on SMIC did not affect Lam Research.

Overall, we expect the impact on Lam Research’s foundry segment with the restrictions on equipment sales to SMIC for 14nm to be minimal as the company was placed on the US Entity List in 2020 but the company’s revenue decline was attributable to supply disruption instead of the restrictions. Also, we believe its revenue increase in China is not reflective of its exposure to Chinese customers following the SMIC inclusion in the US Entity list. Moreover, the company increased its revenue guidance for its next quarter thus we believe it to have a minimal impact on the company’s revenue despite the new restrictions.

Risk: Stricter Restrictions

With the reported ban on Semicon equipment exports to Chinese chipmakers, we estimated the company to see a revenue impact of only 2%. However, if the restrictions are stricter and encompass all chipmakers manufacturing in China such as Samsung and SK Hynix, we expect the company to see a larger impact of 8.5% of revenues.

Verdict

All in all, despite the increased restrictions on Lam Research by the US government, we believe the impact on Lam Research to be minimal at an estimated revenue impact of only 2.2% of total revenues with 2% from its exposure to Chinese memory chipmaker YMTC and 0.2% for the expanded restriction on SMIC for equipment with nodes below 14nm. Though, we believe its revenue impact on its memory segment could be higher at an estimated 8.5% if the restrictions include foreign chipmakers manufacturing in China. Additionally, we believe its foundry segment’s impact from the restrictions on SMIC for 14nm and below could be minimal following its inclusion in the US Entity list. We believe it did not significantly impact the company as its revenue growth increased even after SMIC was included in the US Entity List.

Although its revenue exposure to China increased, we believe it not to be reflective of the company’s sales to Chinese customers based on its annual report breakdown. Moreover, the company also raised its revenue guidance higher for the next quarter compared to its previous quarter. Hence, contrary to the view of Bank of America that Lam could be one of the most affected companies by the restrictions, we instead believe the impact on Lam would be minimal. Overall, we rate the company as a Buy based on the analyst consensus price target of $563.24 at an upside of 25.9% which is in line with our previous price target of $546.49.

Be the first to comment