jetcityimage

Published on the Value Lab 10/13/22

The iShares Convertible Bond ETF (BATS:ICVT) contains, as you’d expect, convertible bonds, which means bonds that have an option to convert into a certain amount of equity, usually at a price that implies a premium to whatever the equity price traded at the bond’s issuance. ICVT is lots of tech bonds, and whatever price they were trading at when the bonds were issued are quite likely to be a lot higher than where they’re trading now, meaning the convertibles are far away from being economically convertible into equity. On the other hand, there is still time for volatility to work to the upside as market continues to speculate on the inflation peak over the next months to a year. Those options, while out of the money, have some value. The YTM of the ICVT bonds don’t seem to imply that. We think it could be a buy.

ICVT Breakdown

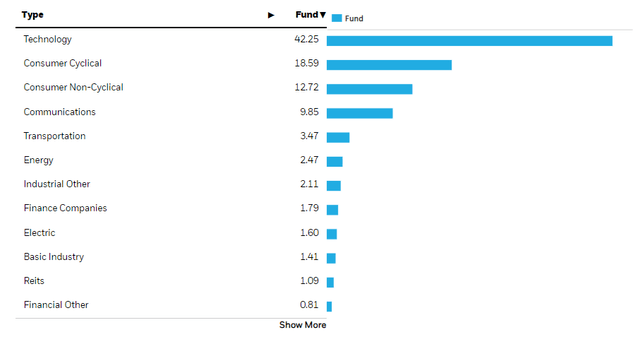

Let’s start with the sectoral breakdown.

The bonds issued are primarily from tech companies, but also consumer cyclical which together account for 60% of the ETF’s allocations by sector. Both sectors are levered somewhat meaningfully to economic activity, at least in their stock prices. While tech businesses can often be resilient in a recession in terms of fundamentals, they carry high betas due to their high multiples and the sensitivity of those multiples to the degree of the growth assumptions. Cyclical stocks really do see fundamental hits in a downturn. We’ll discuss the importance of the sectoral allocations in a moment.

Other salient figures are the YTM, which is at 5%, and the duration of the portfolio, which is at 1.8 years.

Remarks

Firstly, we acknowledge the lack of duration risk in the portfolio. With all signs pointing to further hikes, this is a godsend for any portfolio. While 1.7x factor sensitivity to rate changes isn’t nothing, it’s by no means bad at all compared to other bond ETFs.

The more relevant figure to our discussion is the YTM however. Based on the 2y Treasury rate, the ICVT YTM premium is actually only about 70 bps. That is consistent with a BBB rating. That’s a pretty good rating. Not even junk, and that’s more or less the rating of the bonds in ICVT.

But remember, convertible securities aren’t just bonds, they have an option in them too. So if on a credit risk basis, the bond portion alone already accounts for the market value of the bond, then the option is being given no value. While tech stocks and cyclicals have taken a major hit, and are indeed very out of the money at the moment, volatility can drive the value of the convertible option. While rates are going to rise for a little longer for sure, it becomes harder to call further out. If the inflation really is supply side, and major indicators of supply side pressure (barring energy which is driven by geopolitics now) are on the decline, then maybe we will see peak inflation quite soon. Markets have been speculating a lot on peak inflation. When signs of it come, markets will likely rocket, especially those levered to a downturn like the companies in the ICVT portfolio. Therefore those options should have some value, because within the average duration of the portfolio, where final maturities are substantially above 2 years in length, the option could get into the money thanks to volatility. While a longer horizon than 2 years would be better for the option value, 2 years alone is still pretty good.

It would seem that the options are being given zero value in ICVT, therefore it could be a buy. Although investors should be aware that the 1.8 years of weighted average duration does lever the ICVT a little to further increases in rates. So maybe it’s best to wait out the next hike or two which is very likely to cause pain.

Be the first to comment