Yingko/iStock via Getty Images

The world is at the beginning of the most telegraphed recession ever. While it’s unclear whether we have a soft landing or hard landing, there are two things that seem pretty likely:

- Commercial Real Estate growth is slowing

- Residential Real Estate growth is slowing

Now you may ask “Didn’t you mean to say crashing?”. Maybe, but to avoid being hyperbolic, let’s just agree that the range of outcomes over the next 12 months is somewhere between slowing down and falling off a cliff.

Falling off a cliff? (thesubversivearchaeologist.com)

If you disagree with this sentiment, then you might want to take the other side of this trade, either way, read on. There are some quite obvious shorts for slowing real estate, with Opendoor Technologies (OPEN) and homebuilder stocks are some of the most obvious, but if it’s obvious there is generally no money to be made and /or high risk. Shorting OPEN at $1.36 seems like a slam-dunk, unless some apes get on board and then it’s rocket emojis and huge losses for those short.

You want an under the radar name, and for me that name is Oshkosh Corp (NYSE:OSK).

Oshkosh Corporation Logo (SEC)

Growing or shrinking earnings?

OSK reported their third quarter earnings on October 27, 2022.They have a diversified business, solid balance sheet, and an impressive and growing backlog that extends to late 2023. In fact their biggest challenge seems to be they can’t make product fast enough. This all sounds a bit reminiscent of an electric car company (TSLA) that lost half its market cap in 2022, doesn’t it? And while TSLA is quite different as it’s market cap was stratospheric, I do believe that some of the drop is due to an expectation that the unlimited demand for $50-100k electric passenger vehicles is going to be more limited in a global recession.

The main takeaway here is that it’s not necessarily about whether a company is making money now or not, it’s about the expected rate of change. How quickly will that backlog go from growing to shrinking? How long is that shrinking going to last? Is this a new trend? When will this show up in earnings?

Oshkosh is a diversified manufacturer. Why Oshkosh?

It’s true that Oshkosh is diversified, but what’s most important to know is what contributes to their Earnings Per Share (EPS). Based on Oshkosh 2025 projections, here is their projected revenue breakout by product segment. Just in case you were wondering, the Next Generation Postal Vehicle (NGPV) is included in the Defense Segment.

|

Access |

48% |

|

Defense |

26% |

|

F&E |

15% |

|

Comm |

12% |

The Access and Commercial segments are heavily dependent on construction activity being strong, and makes up 60% of Oshkosh revenue. Access Equipment makes scissor and boom lifts that are sold mainly to big rental companies. The main brand is JLG, which is the #1 player in many parts of the world. The Commercial segment is primarily concrete mixers and refuse (garbage) trucks. These are the businesses that are most likely to trend towards softening. For an extreme example, in Q2 2009, Access Equipment backlog was down 89.1% and Commercial was down 46.7%. The stock also reached a low of $4, but that was mainly due to the poor balance sheet at the time, so I wouldn’t expect anything that dramatic this time around.

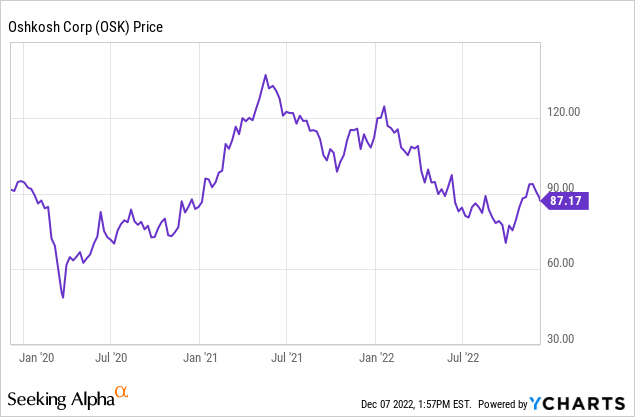

Let’s take a look at the chart:

The peak of around $124 was following the award of the NGPV, and OSK shares had a recent low of $70.29. The current price at time of writing is $87.49. For this trade the first target we’d be looking to revisit is the $70 September lows. This would be about a 20% trading gain on the short side if directly shorted. If you’re like me you’ll play it with options which does increase the risk but juices it up a little.

The play I took here is the Dec 15 2023 $145 put for around $47.90 ($4790 per contract). This gives us plenty of time and about 37% upside if we hit the $70 target. The implied volatility on this name is much lower than other names, which I believe makes this trade superior to many others.

What would make me close this trade?

- If the Federal Reserve starts cutting interest rates or signals large cuts,. This doesn’t seem likely in the first half of 2023, but definitely possible.

- If housing and commercial real estate shows significant and lasting signs of improvement

- A large contract windfall similar to NGPV

Be the first to comment