Marco Bello

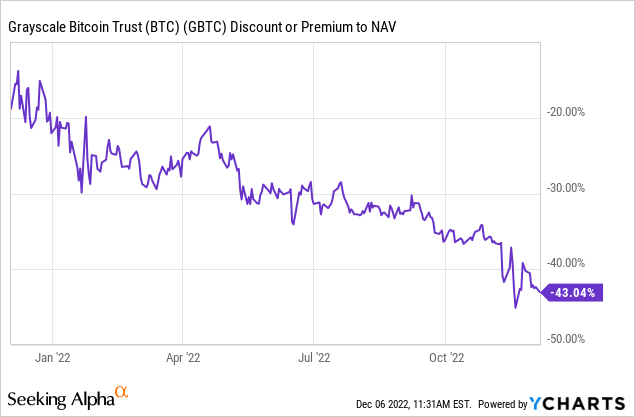

Two new fears directly related to the FTX collapse are extending the discount to NAV of the Grayscale Bitcoin Trust (OTC:GBTC). These fears have exacerbated basic price declines from the ongoing correction in Bitcoin (BTC-USD) as well as declines related to the Trust’s regulatory setback this past summer. But much maligned Cathie Wood is maintaining her conviction in the blockchain thesis and the Trust; Ark Invest has tactically added about 450,000 shares of the Trust to its holdings since the FTX bankruptcy filing.

From my perspective Wood’s timing on the GBTC adds is almost right. This is especially true for those with a longer-horizon allocation to digital assets and as an earmarked portion of core Bitcoin holdings. And the article below details three arguments of why the current discount to NAV represents an opportunity for those willing to forgo self-custody:

- Questions concerning the Trust’s reserves are unwarranted and the extensive recent FUD from both crypto and mainstream media is overblow. Coinbase (COIN) Custody is a literal and figurative fortress. From a trust point of view, Coinbase has simply been vetted differently than FTX.

- The Trust’s discount to NAV likely eventually reverses. There are a couple of mechanisms, but one reasonably probable and near-term solution relates to the Trust’s litigation against the SEC concerning its proposed transition to an ETF. Legal pundits think the Court may find the SEC discriminated against the Grayscale transition to an ETF when compared to “similarly situated” Bitcoin futures ETFs.

- Both Grayscale and Genesis are subsidiaries of the Digital Currency Group. The lending arm of Genesis is facing a liquidity event and rumored bankruptcy. Genesis is also reportedly facing a securities investigation that is likely related to their lending activities. Uncertainty and bad news rein, but the direct blowback onto Grayscale and the Trust’s pricing long-term may be somewhat overblow and limited for legal, technical and practical reasons.

Grayscale Bitcoin Trust: Trusting Coinbase Custody

A November 18th blog and email from Grayscale set off a firestorm of criticism when the company stated they would not be publicly providing a proof-of-reserves for their funds.

Due to security concerns, we do not make such on-chain wallet information and confirmation data publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

Safety, Security, and Transparency, grayscale.com, November 18, 2022

In the days following the collapse of FTX, Binance CEO Changpeng Zhao had argued industry participants should eventually publicly provide a Merkle tree-style proof-of-reserves and begun the process by providing wallet addresses, quantity and block heights for Binance’s large-cap holdings.

All assets underling Grayscale’s digital asset products are held by Coinbase Custody. Coinbase has already been using a more traditional means of proving assets, though they do use some cryptographic proofs as well. As a publicly listed, U.S. based company their financials are externally audited on a quarterly basis and an extensive annual statement is provided to the SEC.

When external auditors come in to look at our cold storage reserves, they randomly sample addresses that we claim to own, and require us to move those funds to demonstrate ownership, going through our key signing ceremony.

How crypto companies can provide proof of reserves, coinbase.com, November 8, 2022

Coinbase was founded in 2012 by Brian Armstrong. Both the company and Armstrong have been scrutinized over a relatively long period. There is no record of credit losses from any financing activities or a record of exposure to customer or counterparty insolvencies. There is also no real fear the Grayscale assets could become entwined in a Coinbase bankruptcy. Consider the following:

- Coinbase is not going bankrupt. Beyond maintaining strict 1:1 customer holdings, at the end of Q3 the company itself had $5.6 billion in near cash assets and over $600 million in digital assets. Liabilities total just over $4 billion of which $3.4 billion is conservatively financed, longer-term debt. Lastly and importantly, it now appears highly likely Coinbase will operate within its $500 million EBITDA loss guardrail for this year.

- If Coinbase were to go bankrupt, the probable interpretation of the Uniform Commercial Code Article 8 would be that customer assets are not the property of Coinbase and not claimable by its creditors.

- Custody style assets may be further siloed from creditors by not being balance sheet listed, like platform user assets are under Staff Accounting Bulletin 121 from the SEC.

Coinbase has been and is safely storing Grayscale’s digital assets.

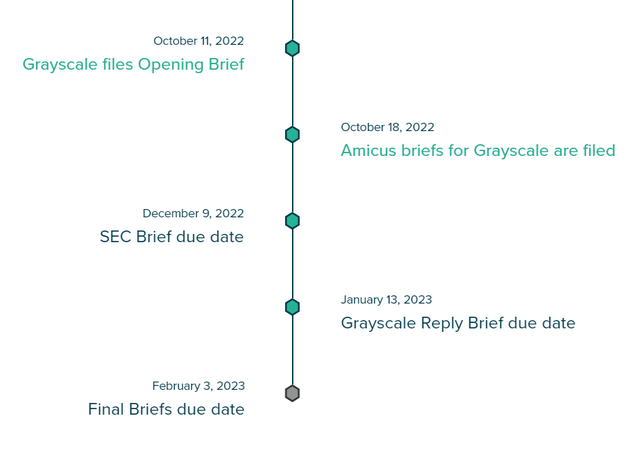

Grayscale’s Lawsuit Against The SEC

Over the summer, the SEC disapproved of Grayscale’s proposed conversion of their Bitcoin Trust to a spot backed Bitcoin ETF. Trading as an ETF would provide a mechanism for the product’s price to align with the holdings value and remove the 43% discount to NAV. Grayscale has filed for review of the SEC decision at the United States Court of Appeals for the D.C. Circuit. If Grayscale wins the lawsuit, the SEC disapproval order would be vacated and the Trust likely would be allowed to convert to an ETF.

Grayscale’s main argument in the lawsuit is that the SEC is acting arbitrarily because their conversion proposal is being treated differently than “similarly situated” Bitcoin futures ETFs. In their opening brief, Grayscale’s explains:

When approving bitcoin futures ETPs, the Commission necessarily determined -as the Exchange Act requires- that the risk of fraud or manipulation in the spot bitcoin market (which bears directly on the price of bitcoin futures) was sufficiently low that bitcoin futures ETPs could be approved without creating unacceptable risks for investors. But that risk is exactly the same for spot bitcoin ETPs like the one proposed by the Trust. It was entirely arbitrary for the Commission to conclude that any such risk was no obstacle to approving bitcoin futures ETPs and then to reverse course and find the identical risk to be too great to allow approval of spot bitcoin ETPs.

Grayscale v. SEC, Brief of Petitioner, 10/11/22, p. 24

Put differently and more succinctly, Grayscale has argued the following:

If the Exchange’s surveillance-sharing agreement with the CME is sufficient to detect and deter fraudulent or manipulative activity in spot bitcoin markets, then spot bitcoin ETPs and bitcoin futures ETPs are equally protected from such activity.

Grayscale v. SEC, Brief of Petitioner, 10/11/22, p. 32 (link above)

Grayscale’s argument above has received meaningful support from neutral legal pundits. However, in prior filings the SEC has not directly, or at least in any length, addressed this “discrimination” idea. The Commission’s first reply brief to the Court is now due December 9th. And it will be necessary for Trust investors to closely examine and weigh any new and more direct language from the SEC on this key and likely determinative topic.

grayscale.com

But in any case and no matter the outcome of the lawsuit at this level, for longer-term holders there are a couple of theoretical future scenarios that could drive a reversal in the discount, such as redemptions. And overtime there is natural tendency for a financial product to trade at the price of its underlying holdings. So the Grayscale Bitcoin Trust is offering an interesting time arbitrage opportunity at its current 43% discount to holdings value.

Grayscale: The Genesis Connection

Digital Currency Group is a crypto sector venture capital company and the parent of both Grayscale and Genesis. Genesis is one of the largest OTC trading desks in the space and sizeable institutional lender; in 2021 the company handed over $170 billion in trade volume and had $130 billion in loan originations.

On November 16th the lending arm of Genesis suspended redemptions and new loan originations. DCG CEO Barry Silbert explained the action in a letter to shareholders. The letter is via CNBC and can be found included here.

…market turmoil sparked unprecedented withdrawal requests. This is an issue of liquidity and duration mismatch in the Genesis loan book.

Letter to DCG Shareholders, Barry Silbert, November 2022 (link above)

In the days following the collapse of FTX there was a general move in the sector characterized by investors taking their crypto off trading platforms and removing them from yield programs; put differently, the FTX collapse led to this cycle’s “not your keys, not your crypto” moment.

Of note, Genesis is the lending partner of the Gemini exchange’s Earn program. So retail investors whose digital assets were engaged in the Earn program at Gemini are not able to redeem their funds.

So how is Grayscale implicated in all this? Though nuanced, Genesis is now a meaningful creditor of DCG.

….DCG has borrowed money from Genesis Global Capital in the same vein as hundreds of crypto investment firms. These loans were always structured on an arm’s length basis and priced at prevailing market interest rates. DCG currently has a liability to Genesis Global Capital of ~$575 million, which is due in May 2023.

…You may also recall there is a $1.1B promissory note that is due in June 2032. As we shared in our previous shareholder letter in August 2022, DCG stepped in and assumed certain liabilities from Genesis related to the Three Arrows Capital default.

Letter to DCG Shareholders, Barry Silbert, November 2022 (link above)

Note Three Arrows filed for bankruptcy in July as a result of the crypto sector sell-off spurred by the collapse of LUNA (LUNC-USD) in May. So while DCG technically owes Genesis, the parent assumed the troubled Three Arrows assets from the subsidiary and is now on the creditors’ committee of the Three Arrows liquidation proceedings.

DCG and its subsidiaries are themselves reportedly holding about a billion dollars of the Bitcoin Trust. So there is fear in the market that shares could be liquidated in order to accelerate repayments to Genesis and allow them to meet short-term obligations. The size of these sales would be substantial enough to both move the Bitcoin price and extend the Trust’s discount.

But I think it is unlikely DCG will be forced to sell their Trust holdings at a discount. DCG is a large, robust and longstanding member of the space. In addition to Genesis and Grayscale, other subsidiaries include the Foundry, which runs one of the largest Bitcoin mining pools, as well as CoinDesk, a top media company in the crypto sector. DCG is also invested in over 200 companies and funds, a breakdown can be found here.

Interestingly, Gemini updated their Earn customers and explained how the situation may playout.

Liquidity issues can be solved in a variety of ways including raising capital, raising debt, and/or restructuring existing debt. Raising capital could, for example, involve Genesis selling equity in exchange for cash. Restructuring debt could, for example, involve DCG agreeing to pay down its loans to Genesis sooner. All of these possibilities can take time.

Gemini Earn Updates, gemini.com, 12/6/22

Fears of large sales by DCG of their Grayscale Bitcoin Trust holdings may prove overblown as Genesis and DCG have other means of raising liquidity.

Grayscale Bitcoin Trust Rating

The Trust’s discount to NAV has grown since the SEC’s July disaproval order for its conversion to an ETF. Contagion from the FTX collapse has further accelerated this divergence.

But Grayscale’s current lawsuit against the SEC is a first bite at the reversal apple. And fears sparked out of the FTX drama may prove overblow. First, Grayscale’s digital assets are safe and secure with Coinbase Custody, despite not providing a public, Merkle tree-style proof. Second, Genesis and DCG may successfully raise capital or debt rather than sell their holdings in the Trust at a discount for short-term liquidity.

I am moving my rating for the Trust from hold to buy based of the now 43% discount to NAV. This rating applies for those with a long-horizon allocation to Bitcoin and who choose not to self-custody.

Be the first to comment