Elena Bionysheva-Abramova

While the general market has been pummeled, with its correction exceeding 28%, the Gold Miners Index (GDX) has suffered a ‘real’ bear market. This is evidenced by a 53% correction from its 2020 highs, despite only a 21% decline in the gold price. Given that bear markets require time and damage to eradicate bullish sentiment entirely, the more fertile ground for looking for new ideas is in the gold sector, where the 27-month cyclical bear market has ground any remaining optimism to a pulp. With arguably the most attractive mid-tier producer still on the sale rack with significant increases in production/margins on deck later this decade, I see Alamos as a top-5 buy-the-dip candidate.

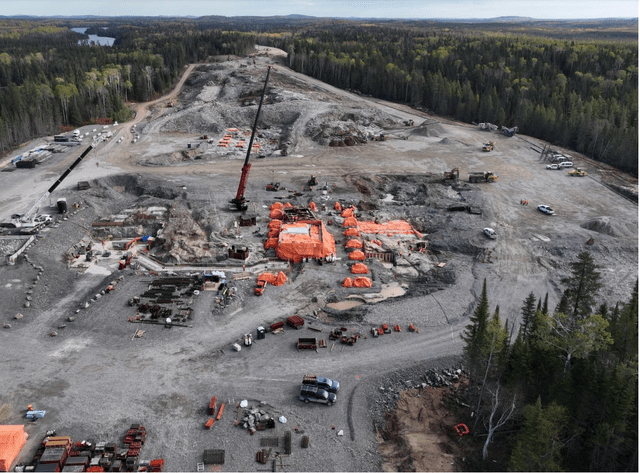

Island Gold Shaft Construction (Company Presentation)

Q3 Production & Sales

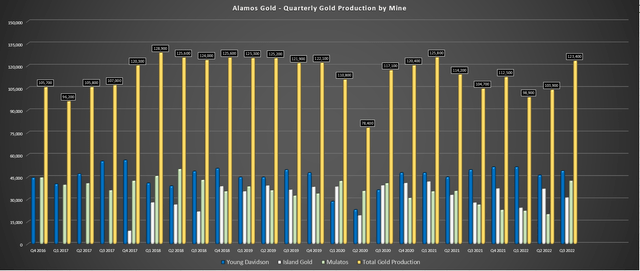

Alamos Gold released its Q3 results last month, reporting quarterly production of ~123,400 ounces, an 18% increase from the year-ago period. The higher production was driven by a full quarter of production from the high-grade La Yaqui Grande Mine (Mulatos) and higher grades and throughput at Island Gold. Meanwhile, Young-Davidson also had a solid quarter producing ~49,300 ounces despite lower mining rates, impacted by replacing headropes at the Northgate Shaft, scheduled downtime, and an increased frequency of energy reduction during periods of peak provincial electricity demand (cost savings initiative).

Alamos – Quarterly Production By Mine (Company Filings, Author’s Chart)

As the chart below shows, this led to the second-best quarter in years for the company, just shy of the ~125,800 ounces produced in Q1 2021. On a year-to-date basis, this has pushed production to ~326,200 ounces, and with higher stacking rates expected in Q4 and higher grades at Island Gold, Alamos is well on track to meet its annual guidance of 440,000 to 480,000 ounces. Assuming the company comes in at the mid-point of its Q4 outlook (125,000 to 135,000 ounces), we would see FY2022 gold production of ~456,200 ounces, right near the mid-point of annual guidance despite heavy rain at Mulatos (Q3) and colder conditions at Island in Q1 which impacted ore handling on the surface.

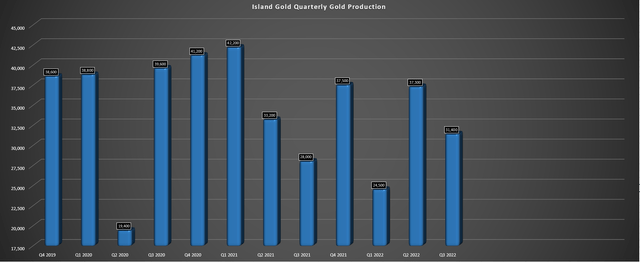

Island Gold – Quarterly Production (Company Filings, Author’s Chart)

Digging into operations at Island Gold, the mine had another solid quarter in Q3, with ~31,400 ounces produced at all-in-sustaining costs of $944/oz. The higher production was related to higher grades mined and milled and much higher throughput (~121,600 tonnes vs. ~99,400 tonnes), with 10,000 tonnes of stockpiled ore trucked to the Young-Davidson mill. Year-to-date, Island Gold has produced over 91,500 ounces of gold at all-in sustaining costs of $941/oz and is on track to meet its guidance of 130,000 ounces at the mid-point, helped by what’s expected to be a very strong finish to the year.

Meanwhile, at Mulatos, the asset saw a 60% increase in production with a full quarter of contribution from the much lower-cost and higher-grade Ya Laqui Grande Mine. During the quarter, La Yaqui Grande stacked ~794,100 tonnes at an average grade of 1.23 grams per tonne of gold, 62% higher than grades at the Mulatos Pit, coupled with much higher recovery rates (81% vs. 56%). Given the much higher grades, La Yaqui Grande’s all-in-sustaining costs came in at industry-leading levels of $699/oz. Production should improve further in Q4, with stacking rates expected to average design capacity of 10,000 tonnes per day.

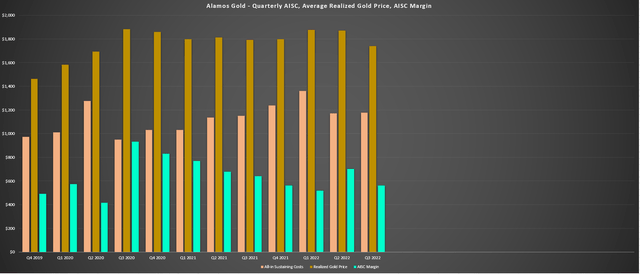

Costs & Margins

Moving over to costs, Alamos saw an increase in operating costs on a year-over-year basis, with cash costs of $868/oz (Q3 2021: $788/oz) and all-in-sustaining costs [AISC] of $1,178/oz vs. $1,152/oz in the year-ago period. On a year-to-date basis, all-in-sustaining costs are sitting at $1,231/oz, up from $1,102/oz in the first nine months of 2021. This can be attributed to inflationary pressures with costs for cyanide, reagents, grinding media, and fuel, offset by slightly lower sustaining capital and a weaker Canadian Dollar. However, Alamos is expecting to deliver into its FY2022 AISC guidance of $1,190/oz to $1,240/oz with a much lower-cost quarter ahead, with the potential to come in near the low end of this guidance.

Alamos Gold – Quarterly All-in Sustaining Costs, Gold Price, AISC Margins (Company Filings, Author’s Chart)

While Alamos’ estimated FY2022 all-in sustaining costs of $1,210/oz is only slightly below the industry average ($1,260/oz+), it’s worth noting that the company should see lower costs going forward as it enjoys a full year of contribution from La Yaqui Grande (shown below). For those unfamiliar, this asset is expected to have sub $675/oz all-in sustaining costs ($699/oz in Q3 2022), well below costs at Young-Davidson and Island Gold pre-expansion of ~$1,100/oz and ~$900/oz, respectively. So, with La Yaqui Grande bringing down costs at its Mulatos District Operations and moderation of inflationary pressures, we could see Alamos’ AISC dip below $1,150/oz next year and head closer to $1,050/oz in 2024 – meaning that this year will likely mark peak all-in-sustaining costs for the company.

La Yaqui Grande (Company Presentation)

If we look out longer-term, the cost profile is expected to get even better, with costs likely to dip below $950/oz in FY2025 as production begins to ramp from the Island Phase 3 Expansion. So, although inflation has resulted in rising costs for producers and difficulty offsetting much of these costs due to their stickiness in some areas (meaning most producers will have much higher costs in FY2025 vs. FY2020), Alamos could actually see its costs drop over $100/oz in the period (~$930/oz vs. $1,046/oz) and nearly 30% below the industry average.

Post-2025, and with ~50% of consolidated production coming from a mine with sub $700/oz all-in sustaining costs, Alamos’ costs should remain below $980/oz, even assuming Ya Laqui Grande is winding down. So, the Alamos of the future will look much different than the Alamos of today, and investors can count on this being the case for over a decade, given the continued reserve growth at Island and consistent exploration success at depth. To summarize, Alamos has found a way to buck the sector-wide trend of rising costs, making it a story one can count on for margin expansion even if the gold price refuses to cooperate, which has been the case over the past year.

Financial Results

Looking at the financial results, Alamos reported revenue of $213.6 million in Q3, an 8% increase from the year-ago period. This was related to higher sales volume (~122,800 ounces sold) offset by a slightly lower average realized gold price ($1,740/oz vs. $1,792/oz). Unfortunately, the company saw slightly lower cash flow from operations ($74.0 million vs. $82.4 million) due to inflationary pressures and the lower gold price, which offset the higher sales volume in the period. That said, the company was free-cash-flow positive in the period despite much higher spending as the company began pre-sinking of its Island shaft in August, with Alamos noting that shaft pre-sinking is 90% complete while concrete foundation work has commenced, as has detailed engineering on the paste plant.

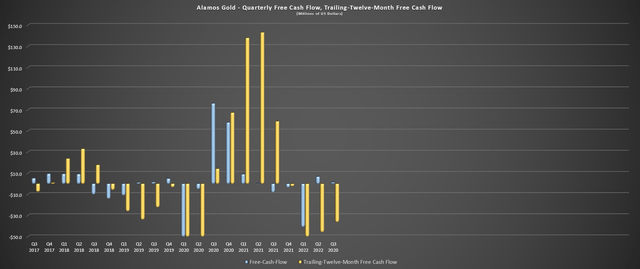

Alamos Gold – Quarterly Free Cash Flow, Trailing-Twelve-Month Free Cash Flow (Company Filings, Author’s Chart)

While the lack of free cash flow generation (Q3 2022: $1.4 million) is disappointing, it’s important to note that this has been a very difficult year due to rising costs and a lower gold price, and Island has ramped up spending (Q3 2022 growth capital: (+) 83% year-over-year) with work beginning on a transformational project. Once complete, this project is expected to generate an average annual free cash flow of $237 million in its first six years (2026-2031), even assuming a conservative gold price of $1,650/oz. So, while Alamos will generate limited free cash flow this year, we should see a significant improvement in its free cash flow profile going forward.

Valuation

Based on ~392 million shares outstanding and a share price of US$8.00, Alamos Gold trades at a market cap of ~$3.14 billion or an enterprise value of ~$3.02 billion. If we compare this valuation to a net asset value of ~$4.12 billion, Alamos trades at a P/NAV multiple of 0.76x, which may seem steep compared to some of its peers. However, I would argue that Alamos can easily command a premium valuation. This is based on six key attributes:

- a predominantly Tier-1 jurisdictional profile

- ownership of one of Canada’s most profitable mines post-expansion

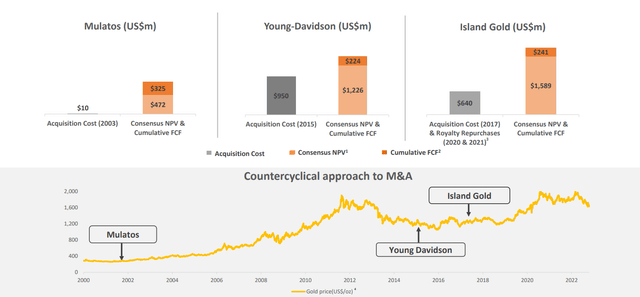

- a disciplined team that doesn’t overpay for assets like some peers

- a slightly more inflation-resistant business model (grid power, high grades)

- a path to becoming one of the lowest-cost producers globally post-2025

- industry-leading mine lives (17 years at two core assets)

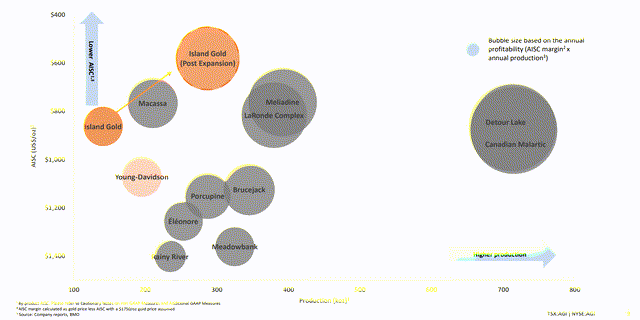

Island Gold Mine vs. Other Canadian Mines (Company Presentation) Alamos M&A History & Value Added (Company Presentation)

Given these unique attributes, I see a fair P/NAV multiple for Alamos being 1.05, translating to a fair value of US$11.05 per share. From a cash flow standpoint, I see a slightly higher fair value, with Alamos historically trading at ~12.4x cash flow and could easily command a multiple of 12.0x cash flow today, given that the business has never been stronger (three high-quality mines with one solid development project). If we multiply the current FY2023 annual cash flow per share estimates ($0.96) by 12.0x, we arrive at a fair value of US$11.50. So on a blended basis (60% P/NAV fair value/40% P/CF fair value), I see a fair value for Alamos of US$11.25 – 41% upside from fair value.

While there may be producers out there with more upside to their fair value, given that Alamos has outperformed the sector, you can’t buy a Ferrari for the price of a Honda. In Alamos’ case, it’s the proverbial Ferrari in an industry with a handful of mediocre companies, and it’s difficult to find any company as well positioned within its peer group (mid-tiers, intermediates) to tackle inflationary pressures with production growth and margin expansion on deck. In fact, I would argue that the closest comparable from a consistency and discipline standpoint is Agnico Eagle (AEM), which also commands a premium valuation for a reason. To summarize, I continue to see AGI as undervalued despite its outperformance.

Technical Picture

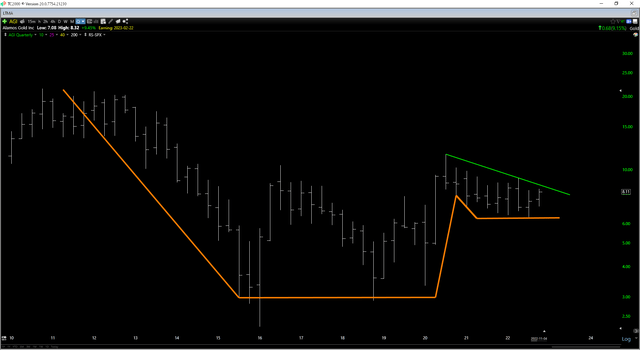

Moving to the technical picture, Alamos Gold also stands out in a massive way. This is because if one looks at the stock’s weekly, monthly, or quarterly chart and didn’t know anything about the company, it would be hard to convince them that AGI was a gold miner. Not only has the stock massively outperformed the sector (for a good reason) with a 4.0% year-to-date return, but it’s currently building a massive cup & handle base and has been making higher weekly lows since February 2022 while many miners are stuck in deep intermediate downtrends, like its neighbor Argonaut Gold (OTCPK:ARNGF) due to poor execution at Magino and cost blow-outs at its low-grade assets.

AGI Quarterly Chart (TC2000.com)

If Alamos can break out of this current handle pattern and register a weekly close above US$8.70, this would increase the probability of a move back to its multi-year highs at US$11.50 per share. Conversely, if the stock pulls back in its range to the lower portion of the handle, I would view pullbacks below US$7.80 as a gift. So, with the wind at the stock’s back and a rock-solid fundamental picture, Alamos checks all the boxes as a solid buy-the-dip candidate, and I see much higher prices for the stock over the next 18 months.

Summary

In a sector where negative surprises have become so commonplace that even some of the most loyal investors have given up on the space, Alamos is a rare breed. Not only has the company done brilliant M&A near cycle troughs to build the portfolio it has today (Aurico, Richmont, Carlisle Goldfields), but it’s added significant value to its main two acquisitions, adding significant reserves to Island and increasing production at Young-Davidson. However, the next leg of growth is by far the most exciting, with post-expansion Island set to churn out nearly 300,000 ounces per annum at ~$600/oz AISC.

Island Gold Mineralization (Company Presentation)

So, with a disciplined operator like Alamos Gold that one can count on trading at a discount to net asset value, I don’t see any reason to go fishing for ideas among many of the higher-cost and higher-risk producers sector-wide that have proven on countless occasions that they can’t be relied on to deliver consistently. Based on what I believe to be a fair value of US$11.25 for AGI, I would view any pullbacks below US$7.75 (45% upside to fair value) as buying opportunities.

Be the first to comment