Kimberly White/Getty Images News

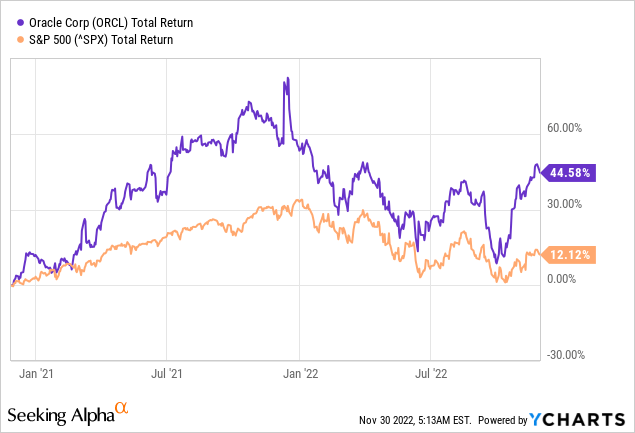

For a very long time Oracle Corporation (NYSE:ORCL) has been largely ignored and thought of as a business that is slowly becoming irrelevant. It turns out, however, that this popular opinion was wrong and ORCL is now on track to continue outperforming the broader market.

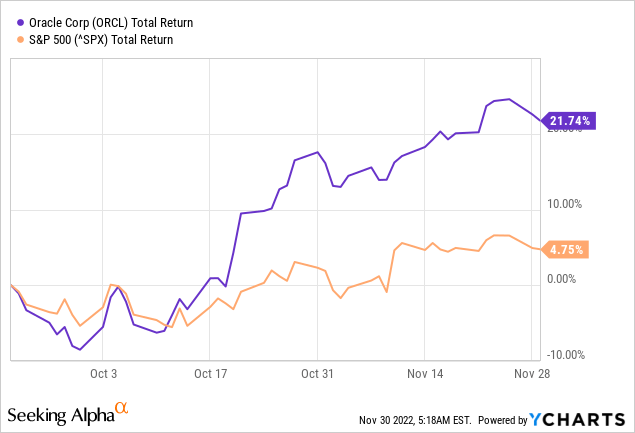

Given the volatility in Oracle’s share price over the past year, long-term investors recently had the opportunity to increase positions at much lower levels. Back in September of this year, I highlighted this opportunity to my subscribers of The Roundabout Investor and since then Oracle has returned more than 21%, compared to less than 5% for the broader market.

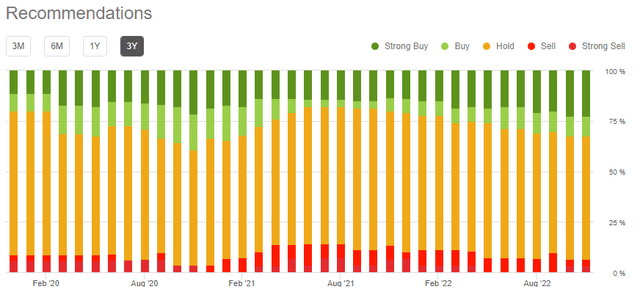

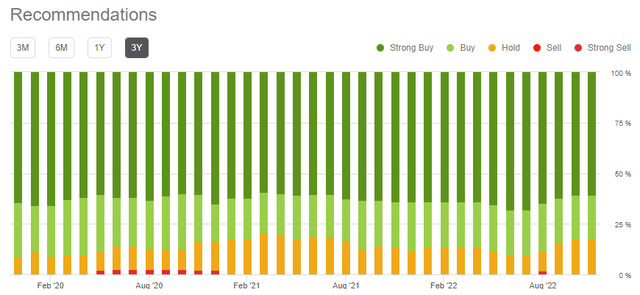

Even though Oracle’s business continues to perform and the long-term strategy is already paying off, the consensus on Wall Street has not changed materially in recent years.

Seeking Alpha

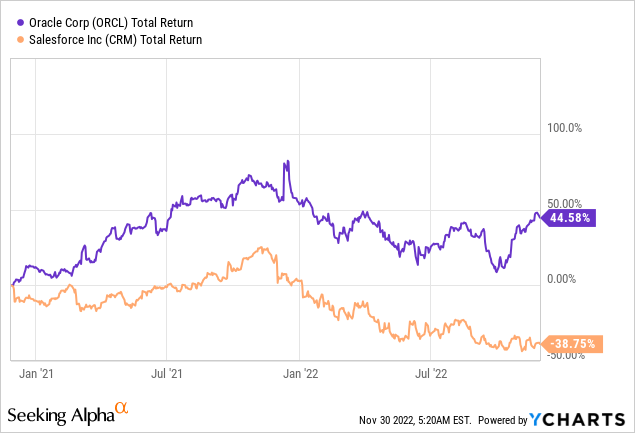

At the same time, Salesforce (CRM) which lost nearly 40% of its value over the same time period, remains one of Wall Street’s favourites.

Not only that, but analysts have barely changed their views on CRM, even though it is becoming increasingly clear that the too aggressive M&A strategy is bringing significant risks for shareholders.

Seeking Alpha

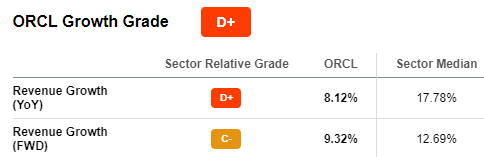

In a nutshell, it appears that the market has not yet caught up with Oracle’s new competitive positioning. Even though its topline growth rate is accelerating, margins are expected to improve and the business has solidified its existing competitive advantages, Oracle’s share price remains unloved by Wall Street. Although long-term investors should not be swayed by the prevailing analysts’ sentiment, they should also have a clear view of what to expect during next week’s earnings release.

A Pivot In Topline Growth

After years of sluggish topline growth rate, Oracle’s business seems to be finally entering a new chapter. The company has built a unique ecosystem of strong cloud applications portfolio, infrastructure and database which create a significant competitive advantage for Oracle as we enter the so-called ‘multicloud era’.

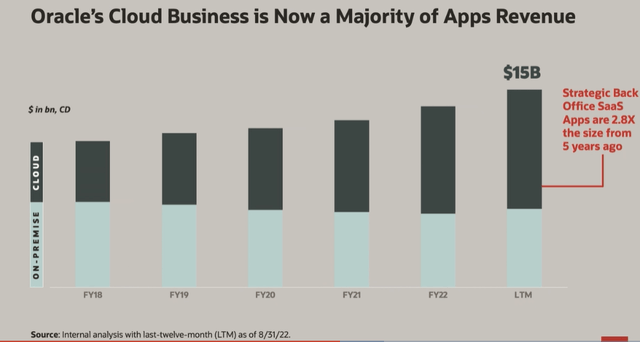

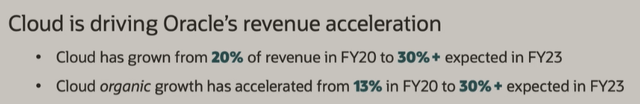

Moreover, the high-growth cloud business now makes up the majority of Oracle’s apps business revenue and with that will have a much larger impact on the company’s topline.

Oracle Investor Presentation

The software-as-a-service segment continued to grow at exceptionally high rates over the last reported 3-month period, while cloud infrastructure and the autonomous database revenues grew at an even faster pace.

Our strategic back office cloud applications now have annualized revenue of $5.8 billion and grew 33% in constant currency, including fusion ERP, which was up 38%. NetSuite ERP up 30% and Fusion HCM up 26%. That means that SaaS revenues, excluding Cerner were $2.2 billion, up 20%.

Infrastructure cloud service revenue was up 58% in constant currency. Excluding legacy hosting services, infrastructure cloud services grew 70% with an annualized revenue of $3.2 billion, including OCI consumption revenue, which was up 103%. Cloud@Customer consumption revenue, which was up 92%, and Autonomous Database, which was up 56%.

Source: Oracle Q1 2023 Earnings Transcript

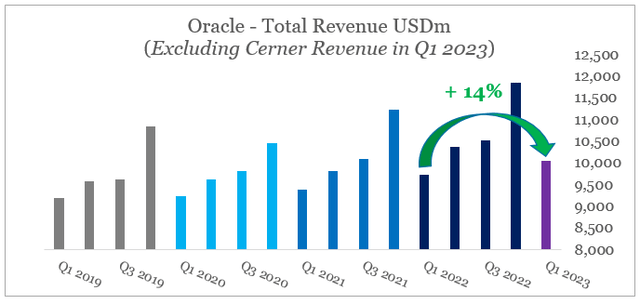

Given the seasonality of Oracle’s revenues and the nature of its business model, sales growth for the fiscal year 2023 will likely come at double digit rates.

prepared by the author, using data from SEC Filings

However, it appears that analysts are still not convinced that Oracle could achieve all that given the wide gap between analysts’ expectations (see below) and the management guidance for the next quarter.

Seeking Alpha

So now to guidance. Total revenues for Q2, including Cerner are expected to grow from 21% to 23% in constant currency, and are expected to grow from 15% to 17% in USD. Total cloud growth, again including Cerner, is expected to grow from 46% to 50% in constant currency, 42% to 46% in USD. I expect that total cloud growth for the fiscal year excluding Cerner will be above 30% in constant currency.

Source: Oracle Q1 2023 Earnings Transcript

The higher share of cloud revenue, however, will make the task of Oracle’s management far easier than most analysts expect, while at the same time scaling of the cloud business will drive higher margins.

Oracle Investor Presentation

Looking further ahead, management also expects Oracle to reach the ambitious target of $65bn worth of annual sales by 2026 with operating margins at roughly 45%.

The IT services giant said at its annual analyst day that it expects $65B in revenue by 2026. (…) The Larry Ellison-founded company also said it expects operating margins of roughly 45%, including its recent acquisition of Cerner, which had negatively impacted operating margins.

Source: Seeking Alpha

Short-term Profitability Headwinds

Although revenue growth will likely continue to accelerate, the path to higher margins is unlikely to be a straight line. For example, margins will remain under pressure over the coming months as restructuring following the Cerner deal continues.

Non-GAAP EPS growth is expected to grow between 1% to 5% and be between $1.23 and $1.27 in constant currency, again due to currency headwinds, non-GAAP EPS is expected to decline 1% to 5% and be between $1.16 and $1.20 in USD. As I’ve said before, Cerner will be accretive to earnings this year, including in Q2.

Source: Oracle Q1 2023 Earnings Transcript

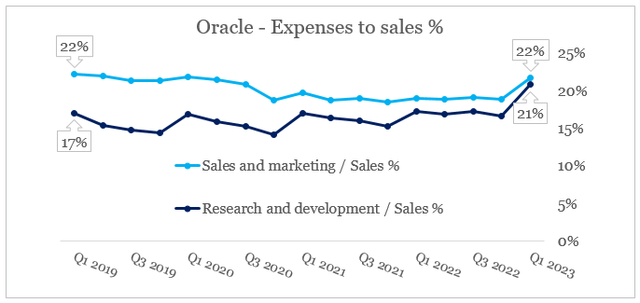

The Cerner deal was also responsible for the recent jump in fixed costs as a share of revenues, but as synergies and economies of scale are fully realized the share of sales and marketing and research and development expenses should come down.

prepared by the author, using data from SEC Filings

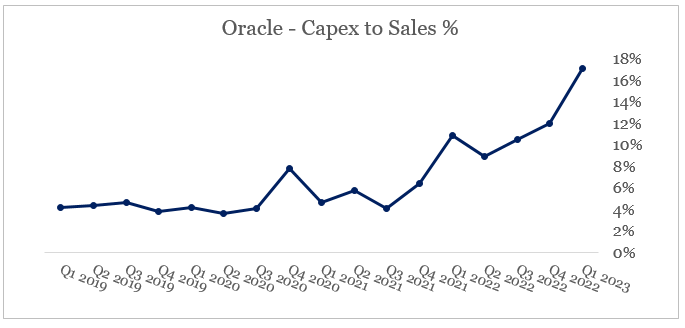

Currently, Oracle is also experiencing unprecedented demand for its cloud infrastructure services. That is why the amount of capital expenditure has also skyrocketed in recent quarters and should remain elevated for the time being.

prepared by the author, using data from SEC Filings

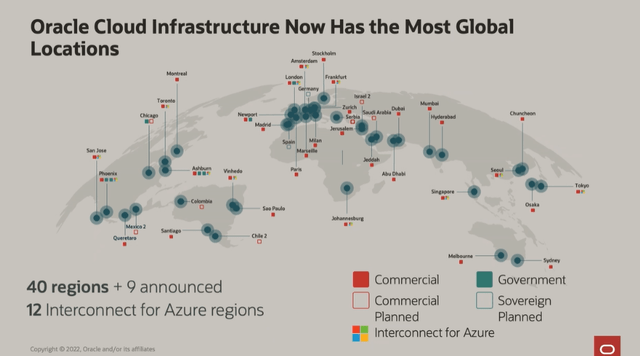

As a result, Oracle’s niche positioning in the segment is improving and Oracle Cloud Infrastructure now has a significant competitive advantage in terms of global footprint as well as all the cross-selling opportunities from the company’s other services mentioned above.

Oracle Investor Presentation

Conclusion

In spite of its stellar performance over recent years, Oracle remains unattractive among Wall Street analysts. In the meantime, however, the company’s topline growth is accelerating and the company is well-positioned to improve margins over the coming years. Having said that, short-term headwinds for profitability are to be expected as Oracle’s management pursues its ambitious long-term strategy.

Be the first to comment