pcess609/iStock via Getty Images

Business

ARC Document Solutions (NYSE:ARC) is a digital printing company that provides digital printing and document-related services mainly in the US.

Digital Printing (60% Sales): General and specialised business documents for marketing, advertising, engineering and construction industries as well as highly-customised display graphics of all types and sizes. ARC doesn’t produce high-volume, low-margin commodity offset or lithographic printing but is mainly focused on short-run customised, high-quality digital printing services. Hence it should not be compared to conventional printers that are slowly going out of business.

Digital Printing Segment (Company’s Presentation)

Print Services (27% Sales): Renting ARC-owned or -leased printing equipment and software placed in offices. Per-use minimum charges are often part of the service agreement. ARC operates more than 10,780 (Dec-21) managed print services locations, ranging in size (up to hundreds of pieces equipment in offices around the world). ARC also provide proprietary software to customers to control their print expenses and connect their remote employees.

Scanning & Digital Imaging (6% Sales): Scanning of documents and adding digital search features for digital document management. Documents are indexed to optimise search and can be hosted on ARC cloud services. ARC is also compliant with the Health Insurability Portability and Accountability Act of 1006 (HIPAA) so can convert documents that include protected health information.

Equipment & Supplies (6% Sales): Sell equipment a supplies to a small segment of customer base. ARC also provide ancillary services such as equipment service and maintenance in order to generate recurring revenue in addition to one-time sale.

ARC operates in major metros in North America and selected locations around the world (Canada, UAE, China, India, and the UK) and serves more than 40,000 customers in a wide variety of markets including retail, technology, energy, adulation, hospitality and public utilities. ARC drives 89% of sales from the products and services delivered in the US of which 33% from California. The Company also perform work for a majority of the largest design, engineering and construction firms in North America. No individual customer accounts for more than 2.5% of sales.

Client Examples (Company’s Presentation)

Market & Competition

According to management, ARC is the largest digital printing provider to the architectural, engineering and construction industry as measured by revenue, number of customers and number of service centres. The level of competition varies according to the market but is mainly single-serves firms (quick printers, copier dealers or scanning bureaus). Local copy shops are often aggressive competitors for digital printing but rarely offer the breadth of document management and logics services that ARC offers. Similarly, ARC competes against small and regional scanning companies which generally lack infrastructure and footprint to effectively compete.

Capital allocation

Management is returning shareholder value via quarterly dividends (c. $8.5m per year) and stock repurchases. In FY21 and FY20, ARC repurchased 0.8m shares for $1.9m ($2.38 per share) and 2.6m shares for $3.2m ($1.23 per share) respectively. BoD has approved a stock repurchase program of up to $15m of outstanding shares until Mar-23 while management has executed c. 50% until now ($7.2m shares since 1Q19), equals to 10% of outstanding shares. Total shareholder return for FY22 will probably exceed $10m (9% expected return).

Regarding M&A, management clarified that they haven’t come across of any good opportunity yet. During the 3Q22 earnings call they confirmed that there is no need to add any new locations but they might look to add new customers through M&A. Management also made clear that they are not willing to increase leverage in the current environment fact that possible shows a conservative approach that I like.

Risks

Office and Digitalisation: Even management recognises that the need for printing equipment and MPS engagement will be lower in the future due to the permanent adoptions of hybrid work models and sustainability. However, the number of MPS locations that the Company serves is the highest in history reaching 10,780 locations in FY21 from 7,000 locations in FY13. Overall sales could be impacted but that comes from a broader customer/location base and that is kind of reassuring. On top of that, by recognising the slower MPS engagement, management is acquiring less equipment and signs fewer leases for that equipment fact that support cash flow generation.

Cyclical AEC: ARC generates c. 50% of sales from design, engineering and construction industries (down from nine year-average of 76%). The cyclical nature of the sector could depress sales in an interest rate increasing environment. I don’t think that the company reports the % of sales linked to the residential market any more but for the FY09-11 period it was close to 9% on average. That should be the most cyclical part of the segment. Otherwise, big infrastructure projects should be considered less cyclical and probably supported by the infrastructure bill. According to management, only 26% (down from 40-50% historically) of the overall cost is fixed hence there should be some operational flexibility to protect the business during a downturn.

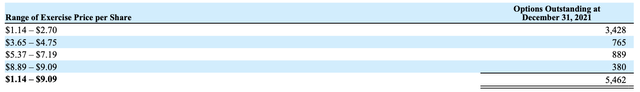

Stock-Based Compensation: SBC for FY21 and FY20 was $1.7m and $1.6m, respectively. The weighted average fair value at the grant date for options issued in FY21 and FY20 was $1.14 and $0.6, respectively. As at Dec-21, the total unrecognised SBC expense related to non-vested shares was $2.3m which is expected to be recognises over the next 2.2 years. In total there are c. 5.4m outstanding options that could dilute shareholders in the future.

FY21 Outstanding Options (FY21 Annual Report)

Floating Debt: 5-year revolving facility of $70m with floating interest rate at LIBOR + 1.25% which matures in Apr-26. As per the 3Q22 Earnings call, management confirmed that the $50.7m C&CE help managing interest rate exposure of the $42.5m outstanding RCF.

continue to use available cash to manage our interest expense. As a result, we don’t think of ourselves as having any bank debt or exposure to variable interest rates. – 3Q22 Call Transcript

Investment Thesis

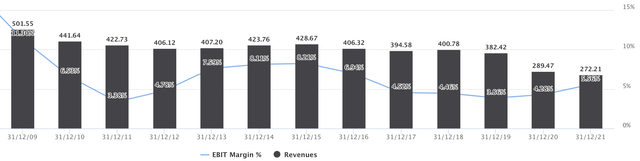

FY19 was a challenging year for ARC as management was focused on reconfiguring product and service portfolios to adapt to a transforming market. Management went through a restructuring exercise that resulted in $10m permanent annual savings, $3.5m of which realised in FY19 and $6.5m in FY20. Sales declined modestly in the US and more significantly in China, which was responsible for 33% of the sales decline in the year. FY20 was a particular year for everyone. However, despite the sales drop by 24% mainly due to Covid, operating margins increased to 4.3% from 3.9% in FY19. According to management, the portfolio restructuring and the alignment of cost structure with the new revenue model supported higher margins. Engineering print expertise allowed ARC to win contracts for other multibillion-dollar entities such as utility company and large public entities. Data shows that % of sales from Architecture, Engineering and construction drop to 69% in FY20 from 76% average over the previous nine years. That strategy reduced dependency in the more cyclical construction sector but also helped margins. Worth noting that increasing margins after a 24% sales drop is a remarkable achievement.

When we reconfigured this business in the third quarter of 2019, the plan was to create a company that was smaller but held more potential for the future. We thought the changes we made were significant, far reaching and impactful. Little did we realize what awaited us in 2020. The precipitous decline in revenues due to the effects of the pandemic compelled us to dig even deeper into this strategy to become more adaptable to the environment and the customers’ needs. – 4Q20 Earnings Call

FY21 was a Covid recovery year, with sales remaining broadly flat but operating margins improving further to 5.6%. Expansion into new markets was a surprise even for the management team, which managed to decrease AEC/O % of sales further to 50%. Worth noting that, traditional customers in the construction market significantly increased their appetite for services well beyond digital plan printing.

Apparently the execution of the strategy is bearing fruits. Over the past 3 years, ARC has managed to grow customer verticals from 15 to more than 40. That definitely adds more defensive characteristics to the business model.

Sales & EBIT% (TIKR)

LTM Sales are trading higher than FY21 sales and GP% has increased by at least 90bps. Operating margins also should be higher than FY21 based on the current run-rate. It takes a really bad 4Q22, historically the weakest quarter, to derail margins. Management doesn’t believe that inflation has a material impact on profitability since price increased for raw materials, such as paper and fuel charges, typically have been and expect will continue to be passed on to customers.

Finance lease payment continue to decrease as need for new MPS equipment is decreasing. Currently, c. $25m capital lease sit on the balance sheet with a pre-payment penalty attached to them. This number should decrease with time since management is adding new lease of c.$8m per year but paying down a higher number. That should further support cash generation that could be returned to the shareholders.

“As projected, finance lease payments for equipment continue to fall as our need for equipment declines. The third quarter finance lease payments of $3.8 million, representing $600,000 or 13.5% decrease from prior year. All of this makes it easy to return shareholder value through our annual dividend of $0.20, which based on our current stock price is yielding more than a 7.5% return.” – 3Q22 Earnings Call

“Cash outflows continue to drop as the need for new MPS equipment has decreased, and we leverage our existing production fleet to accommodate growth and digital color printing. All of this increases the funds available to return shareholder value.” 3Q22 Earnings Call

Due to historical NOLs, ARC should not pay significant taxes for the foreseeable future. Management is estimating that cash tax should be lower than $0.5m per year ($300k for FY21) or c. 3-4% of earning before tax. That is a hidden value in the balance sheet that allows for higher cash generation.

Company held $55.9m in C&CE of which only $16.3m (As at Dec-21) is outside of the US. The majority of the cash ($15.4m) outside the US held in China.

Management has repeatedly emphasised the focus on protecting cash flows and use excess cash to return value to shareholders. Management holds c. 19.8% of outstanding shares and is incentivised based on revenues, EPS and cash flow from operations, the latter of which is most heavily weighted. Significant insider ownership and bonuses linked to per share and CF matrices makes me more confident about the rational and shareholder-friendly behaviour of the management.

All in all, ARC should be able to generate $12-13m in FCF (Including leases) going forward. That should justify a price above $4 per share which gives at least a 55-60% upside potential from the current level. Downcycle could potently impact the business but the operational flexibility and the healthy balance sheet offer the luxury of time. While I would probably wait for a lower price, with a risk to lose it completely, I think it offers a good risk reward profile at this level. ARC generates cash, has a conservative balance sheet and a management keen to return cash to the shareholders. Statistically this should be a good recipe for success.

Be the first to comment