Marko Geber/DigitalVision via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the ProShares Online Retail ETF (NYSEARCA:ONLN) as an investment at the current market price. This fund takes an approach to own retailers that principally sell online or through other non-store channels, rather than traditional brick-and-mortar retailers.

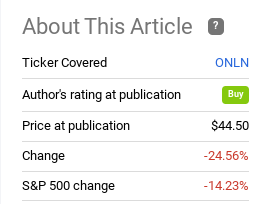

Generally, I saw the sell-off in retail stocks a bit opportunistically earlier this year. Yet, the market didn’t share my view, and this sector has been pummelled. In fact, retail is one of the worst-performing sectors across the market, and ONLN in particular is having a very difficult 2022:

YTD Performance (Seeking Alpha)

This drop certainly piques my interest. It suggests the market is extremely bearish on this investment idea, which opens up a potential contrarian play. Of course, this contrarian play had also materialized a few months ago when I last covered ONLN and had a buy rating on the fund. In hindsight, this was very poorly timed. The sell-off in Tech and growth names pushed into the online commerce sector as well punished ONLN in the process:

Fund Performance (Seeking Alpha)

This reality led me to revisit this ETF and the rating I had placed on it. I never shy away from admitting when I was wrong, and this is certainly one such instance. Retail positions have been burned at almost every entry point so far this calendar year. This makes me cautious, and I see too many persistent headwinds to continue to be bullish at this juncture. Inflation, consumer sentiment, and negative real wages are all taking their toll on American households. Until we see some light at the end of the tunnel, I would suggest remaining cautious on retail plays in the short term.

ONLN Is A Bet On Two Companies That Are Having A Tough Year

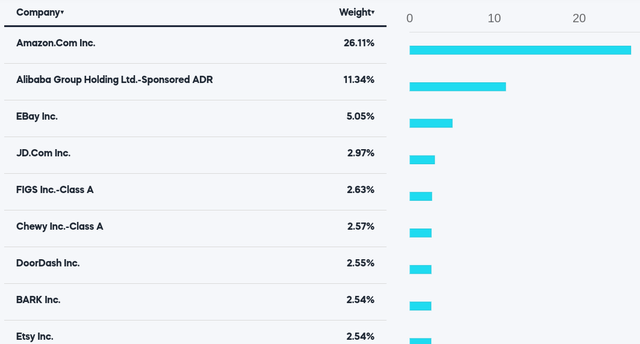

As a reminder, ONLN is a sub-sector ETF that offers investors exposure to online retail plays. This is a bit more specific than the broader retail space, which can be a good or bad thing depending on the environment. While it is slightly diversified given that it does have 38 individual holdings, readers should recognize that is primarily a play on two specific companies. These are Amazon (AMZN) and Alibaba Group (BABA), which combine to make up almost 38% of total fund assets:

Now, this is not inherently “good” or “bad”, but it is not ideal for me personally if I want a sector ETF. In my mind, the point of an ETF is to give you a diversified basket in a particular area. ONLN does this to be sure, but it is too overweight AMZN and BABA for my liking. Simply put, if I wanted to buy ONLN, I would probably just buy AMZN and BABA and save myself the expense ratio. But I digress, because ONLN does offer slightly more diversification than doing that, and it does allow investors to benefit if these two popular companies catch some positive momentum.

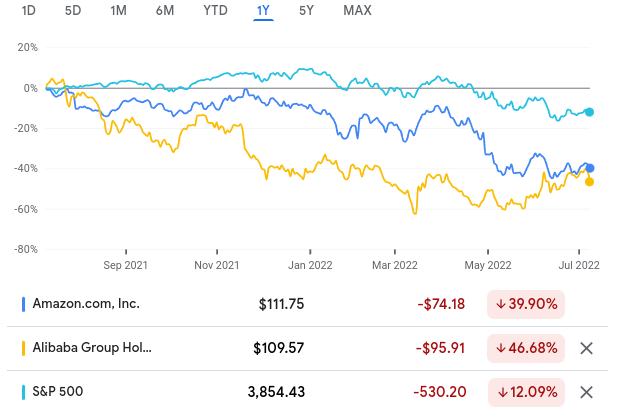

The bad news is that has not been the case of late. In fact, over the past year, both of these tickers have dramatically underperformed the broader market:

1-Year Performance (Google Finance)

This illustrates very well why buying such a top-heavy ETF can work against you. The diversification benefit is largely negated. When the market forces turn against the top holdings – watch out. That has been the reality for ONLN over the past year, which means that macro-conditions probably need to change in order for this fund to perform well. The current environment clearly is not working for it.

ProShares Online Retail ETF Is Not Cheap

Of course, the past performance is less important than the future performance. In fact, seeing such a sharp, negative drop can often open up a reasonable buying opportunity. When quality names drop by disproportionate amounts, that often makes for good long-term buys. ONLN could be such a case, given that it is down over 40% this year alone. If the fund or sector gets some momentum behind it, there could be strong gains ahead.

This reality is what keeps me from placing a “bearish” rating on this fund. The potential for upside is certainly present, so I think a sell/bearish rating is a bit too risky. But I am reluctant to buy it because, despite the large drop in share price, the fund actually isn’t that cheap.

To understand why, consider that many of the names in the fund are high-flyers, trading with aggressive P/Es or having very little earnings (or both). The end result is that even after a whopping 40% drop in share price, the fund’s current P/E still sits above 42, which is more than twice what the S&P 500 is currently trading at:

ONLN Fund Facts (ProShares)

The concern is that even after this bear market move in ONLN, it is not representing real “value”. This means that while the performance graphic may suggest ONLN is ready for a big bounce, we have to tread cautiously because it is still trading at a lofty valuation. This alone tells me that readers would be wise to continue to approach any buy decisions cautiously.

Isn’t Online Retail The Future? Yes, But Growth Has Normalized

So far, I haven’t taken a very positive tone in this review. But I reiterate this is not an outright sell to me at these levels. One of the primary reasons for this is because the online/e-commerce trend remains an area investors probably want some exposure to. This is a trend that has been growing for years and is likely to continue to. Ultimately, the world is moving more and more to e-commerce, and consumers are growing more accustomed to (and demanding of) e-commerce options.

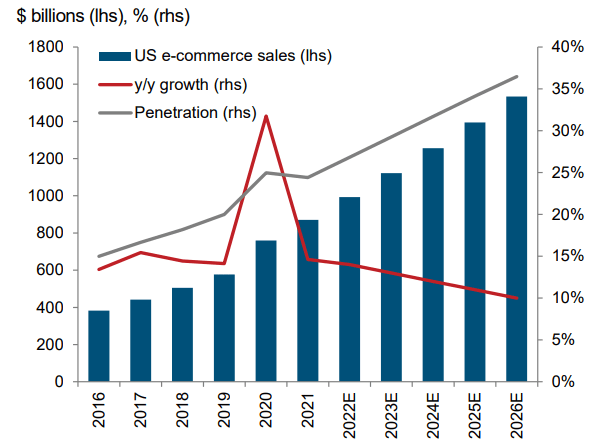

This is good news for ONLN. The bad news is that, in the immediate term, we may not see a lot of growth in this space. How can that be, since the trend is so clearly moving in that direction? The answer is because during the onset of the pandemic and during the lockdown phases, a substantial amount of retail activity took place online. This gave a big shot of adrenaline to what was a steadily growing movement. This was a big positive while it lasted, but now annual growth is moderating again as economies have opened up. This means we will probably see negative year-over-year growth for e-commerce sales as a percentage of retail sales over 2021, and possibly 2022:

E-Commerce Stats (U.S. Census Bureau)

Ultimately, we cannot count on massive annual growth rates for e-commerce to send share prices higher in the next few quarters. With the boon of 2020 and early 2021 fading for this sector, growth rates are going to slow and normalize. This does not mean the longer-term trend isn’t positive, because I believe it is. But the fact is we cannot count on these metrics alone to boost shares any time soon.

The American Consumer Is Feeling Pressured

I now will shift the discussion to the retail environment as a whole. This is important when we are talking about ONLN or any retail ETF for that matter. The state of the U.S. consumer and American households, in general, is important for how strong the retail outlook is going to be. If people are optimistic and spending, that is going to help out both e-commerce and traditional brick-and-mortar retail plays. But the opposite is also true.

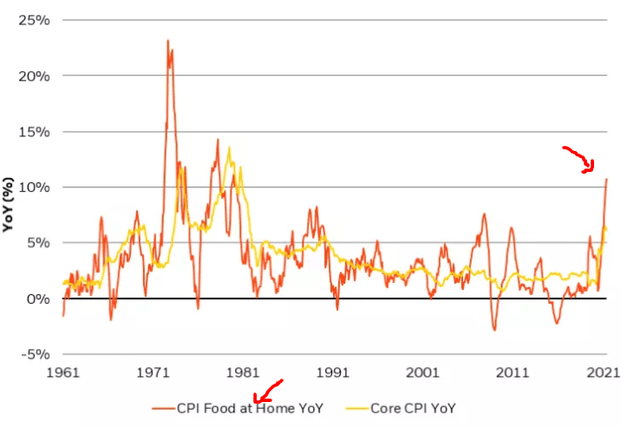

It is the latter that we, unfortunately, have to focus on now. The big story is inflation, of course, and that is hurting consumer spending and the ability to spend on discretionary items. Likely everyone reading this review is well aware of this fact. The problem is that inflation has not cooled off as it was supposed to (and “smart” people told us it would). We are seeing energy and food prices spike at higher levels than broader inflation metrics – meaning consumers are being forced to fork over a greater percentage of income on basic necessities. This leaves left spending power for discretionary items that fuel profits for the underlying companies in ONLN:

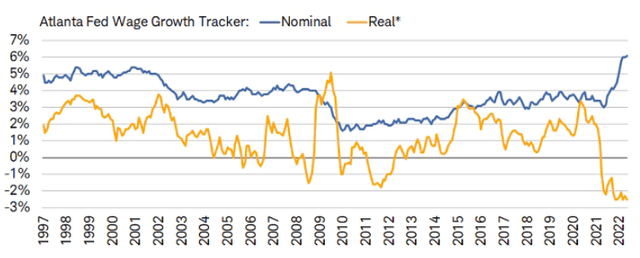

But wait, you might say, wages are rising. Shouldn’t that be keeping consumers in a reasonable spot?

This is another area that, unfortunately, is a problem spot. Wages are rising, yes, but not at the same pace as inflation. This means that while wages may be seeing annual growth, real wages, which account for inflation, are actually negative, as shown below:

Real Wages Are Seeing Negative Annual Growth (Charles Schwab)

This should help illustrate my current state of caution. If workers and households have less in “real” terms, they are going to buy fewer goods and services. This is a net negative for retail and suggests that this probably isn’t the best place to park cash at this point in time.

Consumer Sentiment Is A Drag

A final point from me on the state of the retail market concerns consumer sentiment. This is a metric that by itself isn’t the most reliable because sentiment does not always reflect reality when it comes to sales. Consumers may say they are worried, but spend like they are not, or vice versa. So it should be taken with a grain of salt and used in addition to other metrics.

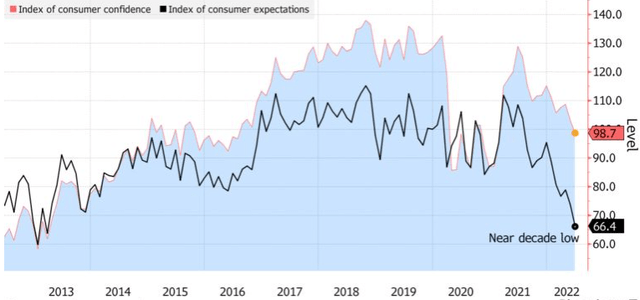

However, sentiment is still a reasonable indicator of how retail sales and consumer spending are going to hold up in the short term. While not always reliable, it can be indicative of whether or not a current trend will continue. In this case, given the backdrop of rising fuel prices, food inflation, and negative real wages, it is consistent with what I would expect would be a weaker consumer backdrop. Unfortunately, that is the case, with consumer sentiment getting dinged sharply:

Consumer Sentiment Indices (Conference Board)

The takeaway here is, don’t expect consumer spending to be a major bull catalyst for the time being. With fuel and food costs grabbing a large wallet share, retailers are going to have to cut prices or accept lower sales volume. Beyond inflation concerns, Americans have to also contend with the Federal Reserve raising interest rates – which are set to climb again later this month. While this may help curb price pressures, it will also inevitably lead to higher borrowing costs, negating some of the potential benefits from declining inflation. This is especially true of higher-margin, big-ticket items.

Bottom Line

ONLN has been a straight-up disaster over the past year, there is no getting around it. While it may be tempting to buy in at what looks like a cheap level, I would urge caution. The consumer picture is very mixed. The economy continues to add jobs and wages are on the rise. These are positives. Alas, these are not the only attributes to evaluate. Wages, while rising, are rising slower than inflation. This is keeping spending power in check. Further, sentiment has dropped measurably and e-commerce sales are moderating. These present challenges for an e-commerce fund like ONLN. The end result of this is a mixed bag, forcing me to play a “hold” rating on the fund at this time.

Be the first to comment