zoranm

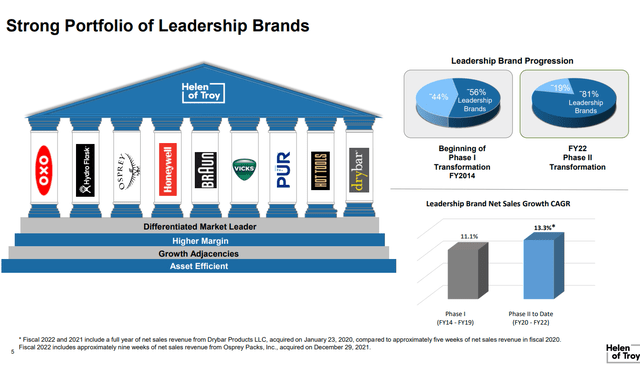

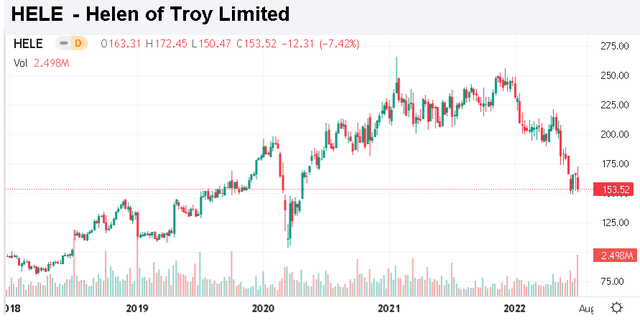

Helen of Troy Limited (NASDAQ:HELE) controls a portfolio of consumer product brands covering areas like home goods, health & wellness, and beauty appliances. “Honeywell”, “OXO”, “Braun”, “PUR”, and “Osprey” and others are recognized as market share leaders in their categories. From a long history of steady growth through acquisitions, the challenge for the company this year is the shifting macro-environment defined by record inflation pressuring consumer spending along with supply chain disruptions adding to costs. Indeed, shares are down by nearly 40% this year.

The company just reported its latest quarterly result, which beat headline expectations but was clouded by a revision lower to full-year guidance, highlighting the ongoing uncertainties and confirming the poor sentiment towards the stock. Retailers cutting back on orders amid signs of an industry-wide inventory glut suggests continued operating difficulties. We expect the volatility in the stock to continue.

HELE Key Metrics

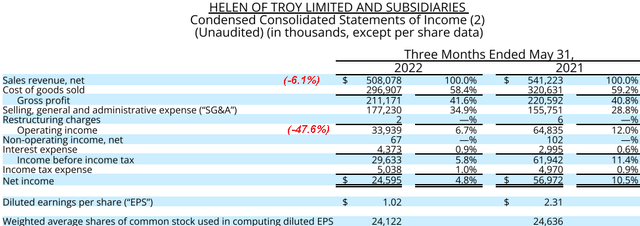

This was the company’s fiscal 2023 Q1 report with EPS of $1.02, which declined from $2.31 in the period last year. Revenue of $508 million was down 6.1% year-over-year, although the figure here includes a boost from the company’s December 2021 acquisition of “Osprey” and “Curlsmith” this April which together contributed $54 million in revenue. By this measure, the “organic” sales trends were weaker, declining by 15.5% y/y.

The context considers what was an exceptionally strong comparison period in 2021 at the early stages of the pandemic recovery. The company was already expecting some slowdown this year, although inflationary cost pressures adding to expenses have been a new twist. The weaker top-line result-pushed SG&A as a percentage of revenue to 34.9% from 28.8% in the period last year. The trend is evident through a 48% y/y decline in operating income, while the adjusted operating margin at 13.6% was down by 3.9 percentage points.

It’s worth mentioning Helen of Troy’s relationship with Revlon Inc. (REV) which has made headlines with the company filing bankruptcy. In this case, Helen of Troy makes it clear that it only licenses the rights to produce Revlon branded hair appliances and is technically unaffiliated with the corporate group. With an understanding that Revlon plans to restructure, there is no impact expected on a day to day availability of the consumer branded products.

Management highlighted some of the positives, including data suggesting its “leadership brands” have gained market share over the past year, which is part of the company’s long-term strategy. Nevertheless, the takeaway was a recognition of the more difficult economic environment, with retail customers pulling back on spending. From the earnings conference call.

Since our April earnings release, it has been well publicized that the macroeconomic environment has changed significantly. Consumers are shifting their buying patterns and adapting to a number of factors, including the impact of higher than expected inflation, and interest rates rising more rapidly than previously signaled by central bankers. In response, many of our major retail customers announced actions to rebalance their inventory, stemming from rapid revisions to their sales forecasts. Our revised fiscal year outlook reflects our current assessment of the impact from these new headwinds on our business.

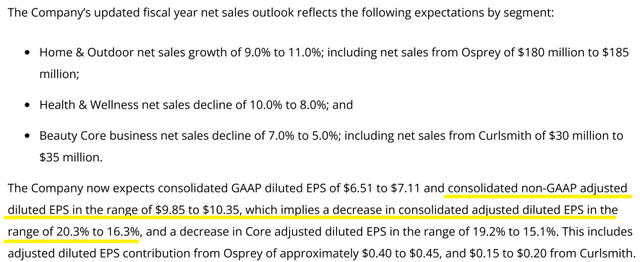

The result was a revision lower to full-year guidance. Helen of Troy now expects full-year non-GAAP EPS between $9.85 and $10.35 which compares to the old midpoint estimate closer to $12.85. In other words, the company now sees adjusted EPS declining in the range of 20.3% to 16.3% y/y, compare to a prior expectation for a small increase. As it relates to sales, the full-year target for total revenue in the range of $2.15 billion to $2.2 billion, implies a consolidated decline of 3.3% to 1.0%, also revised lower. The reversal in guidance explains much of the weakness in the stock, with shares selling off nearly 10% on the report.

HELE Stock Price Forecast

The setup in Helen of Troy paints a mixed picture. Even with a more somber outlook, the company remains profitable, with its long-term outlook secured by a portfolio of high-quality brands that have earned a reputation for quality. Long term, the company is fine. This is good.

On the other hand, the near-term headwinds have broken the company’s progression in its long-running “transformation” since 2014. Fiscal 2023 is set to be the first year over the period with a decline in growth and earnings. Compared to the strategy of looking for margin expansion, the effort now is to look for cost savings and maintain position.

The greatest difficulty we see is that the operating trends are largely at the hands of retailers, who have been reporting a glut of inventory. This suggests it will take time for existing merchandise, including from Helen of Troy brands, to clear from shelves. From a high level, even in a scenario where the economy outperforms expectations, we see the segments and categories the company has exposure to as struggling over the next several quarters.

According to consensus, the forecast for a full-year decline in revenue of around 2% and 18% lower EPS are in line with guidance. We see this baseline as fair. For fiscal 2024, the market expects growth to recover towards 3% while EPS rebounds in the 11% range. All in all, we see downside to these estimates, particularly on the earnings side, pressured by margins with more discounting in retail as a broader theme.

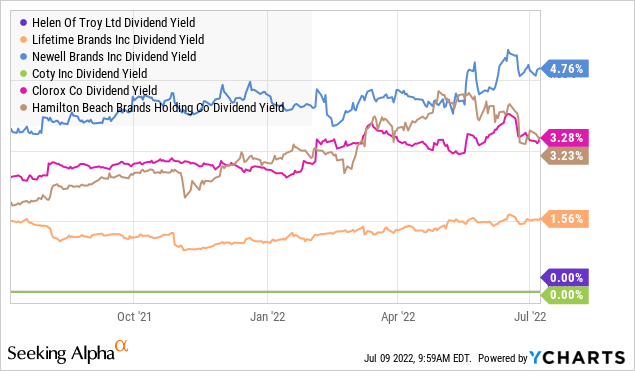

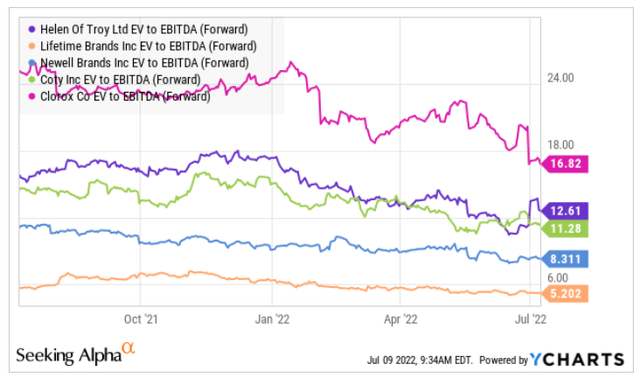

As it relates to valuation, we don’t see much to get excited about. HELE trading at a forward P/E of 15x against effectively flat growth and declining earnings is hardly something to write home about. We can also bring up a list of comparable consumer household products, wellness, and beauty brand companies like Lifetime Brands Inc. (LCUT) with “KitchenAid”, Newell Brands Inc. (NWL), Coty Inc. (COTY), and even Clorox Co. (CLX) with the “Brita” water filter product. HELE trading at a forward EV to consensus EBITDA multiple of 12.6x is slightly more expensive than the group average.

Another distinction here is that HELE does not currently pay a dividend. Investors can find an attractive yield in NWL approaching 5% while CLX and Hamilton Beach Brands Holding Inc. (HBB) offer a yield of around 3.3%. While all these companies have key differences, we make the case that they all follow similar macro trends, with HELE just another player in the group.

Final Thoughts

We rate HELE as a hold with a price target for the year ahead of $150 balancing our otherwise bearish view with a sense that the selloff has already priced in much of the weakness. From here, we expect the volatility to continue and won’t be surprised if shares trade lower over the next several months. Getting into 2023, an improving macro outlook with a stronger operating environment may be enough for shares to stabilize.

Be the first to comment