Joe Raedle/Getty Images News

Elevator Pitch

I maintain my Buy investment rating for Walmart Inc.’s (NYSE:WMT) shares. In my earlier article for WMT published on November 30, 2021, I reviewed Walmart’s Q3 FY 2022 (YE January 31) earnings. With this latest article, I assess if WMT is a good investment candidate following its post-Q1 FY 2023 results announcement share price correction.

Based on my analysis, I think that Walmart is a Buy during the dip. Its current valuations are attractive following the post-results announcement stock price correction. WMT’s future financial performance should be better than what the market expects, according to the results of a recent pricing survey and management’s latest comments.

WMT Stock Key Metrics

WMT’s recent stock price performance is closely linked to its key metrics disclosed as part of the company’s most recent Q1 FY 2023 financial results released on May 17, 2022, before the market opened.

Walmart’s non-GAAP adjusted earnings per share, or EPS, decreased by -23% YoY to $1.30 in the first quarter of fiscal 2023 as per its recent quarterly results presentation slides. Moreover, WMT’s Q1 FY 2023 EPS came in -12% below the Wall Street’s consensus bottom line estimate of $1.48 per share. In contrast, WMT’s net sales increased by +2% YoY to $140.3 billion in Q1 FY 2023, and this was roughly +2% above market expectations.

As such, the company’s earnings miss in the first quarter of this year was largely attributable to below-expectations margins or profitability.

Walmart’s gross profit margin contracted by -0.87 percentage points YoY to 23.8% in Q1 FY 2023. Prior to the recent quarterly earnings announcement, the sell-side analysts had forecasted a much milder -0.34 percentage point decline in WMT’s gross profit margin on a YoY basis according to S&P Capital IQ. WMT’s selling, general, and administrative (SG&A) expenses as a proportion of revenue also rose by +0.45 percentage points YoY in the recent quarter, and this was worse than the sell-side’s consensus expectations of a +0.34 percentage points increase in SG&A as a percentage of sales for Q1 FY 2023.

At the company’s Q1 FY 2023 results briefing on May 17, 2022, WMT explained that higher-than-expected “wage expense” and “fuel costs”, and higher-margin “general merchandise” contributing “a lower percentage of total sales” (as compared to lower-margin grocery) were responsible for the company’s bottom line miss in the first quarter.

Why Did Walmart Stock Dip?

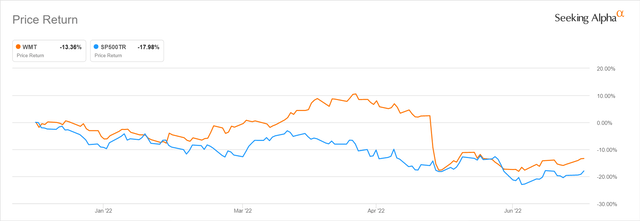

Walmart’s shares have declined by -13.4% in this year thus far, which is still better than the S&P 500’s -18.0% drop over the same period as per the chart below. But there was a significant dip in WMT’s stock price after it reported its Q1 FY 2023 earnings. Walmart’s share price fell by -11% from $148.21 as of May 16, 2022, to $131.35 as of May 17, 2022. WMT’s last traded price was $125.32 as of July 7, 2022, implying that its shares have remained weak and pulled back by -15% on a cumulative basis since its first-quarter results were released.

WMT’s 2022 Year-to-date Share Price Chart

As I have highlighted in the preceding section, Walmart’s Q1 FY 2023 earnings were a disappointment for investors. To make things worse, there are fears that WMT’s financial performance for the rest of fiscal 2023 could also possibly take a hit based on the company’s revised full-year FY 2023 guidance.

In tandem with the announcement of Q1 FY 2023 results, WMT revised the company’s FY 2023 EPS growth guidance from a mid-single digit increase to a -1% decline. This translates into an expected EPS of $6.38 for the full year, which fell short of the market’s consensus bottom line projection (at the point of Q1 FY 2023 earnings release) of $6.76 per share by -6% as per S&P Capital IQ.

It is also noteworthy to observe the change in wording for Walmart’s Q4 FY 2022 and Q1 FY 2023 financial results presentations. In its Q4 FY 2022 earnings presentation, WMT highlighted that its FY 2023 guidance assumes that “the U.S. consumer remains in a generally favorable economic position.” For its most recent Q1 FY 2023 earnings presentation, Walmart noted instead that its fiscal 2023 “guidance assumes a generally stable consumer in the U.S.” Using the word “stable” instead of “favorable” suggests that WMT is now more wary of how slower economic growth could potentially impact consumer spending.

In a nutshell, Walmart’s stock price has dipped in the past two months, as its recent quarterly bottom line and full-year FY 2023 outlook have failed to meet investors’ expectations. The market is now worried about the negative effects of macroeconomic weakness and cost pressures on WMT’s future financial performance.

Is Walmart Expected To Go Up Again?

Walmart’s shares should go up again in my opinion, based on the company management’s comments at recent investor meetings and the results of a recent grocery pricing survey.

At an executive Q&A (Questions & Answers) session for the investment community hosted on June 3, 2022, WMT stressed that “not a lot has changed since we released our results” in May 2022, and noted that “we don’t really see anything strategically that concerns us.” In other words, things haven’t gotten worse in the view of company management, and a Q2 FY 2022 earnings miss seems less likely.

Walmart specifically emphasized at the June 3, 2022, executive Q&A session that “we’ll continue to flow through what we need to, to fairly price and protect the margins” and still “make sure that our customers get the right value versus the rest of the market.” Management’s point of view that it is able to pass on cost increases to consumers while remaining competitive appears to be validated by a recent pricing survey.

A June 27, 2022, Goldman Sachs (GS) research report (not publicly available) titled “Grocery Pricing Survey Shows A Sequential Uptick In Prices In June” highlighted that Walmart raised the prices of dry grocery, frozen foods and dairy products by +20.0%, +6.2% and +1.0%, respectively in late-June as compared to a month ago. Notwithstanding the price increases, WMT still boasted “the lowest prices” in these three product categories as compared to its retailer peers according to GS’ survey.

Separately, Walmart is confident in the company’s ability to achieve a gradual improvement in profitability and cash flow over the remainder of fiscal 2023. At its annual general meeting on June 1, 2022, WMT guided for a “turn around in Q2, Q3” of FY 2023 from its first-quarter negative operating cash flow. WMT also added that it “will work through” the “excess inventory over the next quarter or two”, and it mentioned that the increase in costs relating to containers and storage are “fairly short term” which it will “pass through in the next few quarters.”

In conclusion, I am of the view that WMT’s stock price can rise again. On the revenue side, consumers in general might tighten their purse strings as the economy weakens, but customers looking for bargains and value are likely to turn to Walmart. In terms of costs, markdowns on excess inventories might result in pressure on Walmart’s margins in the near-term but this should be a short-term issue, and WMT has the pricing power to offset inflationary cost pressures.

What Is WMT’s Target Price?

My positive expectations of a recovery in WMT’s share price going forward are supported by Wall Street analysts’ consensus price target for the stock and its appealing valuations.

The mean sell-side target price for Walmart is $153.43, and this is equivalent to a +22% capital appreciation potential for WMT based on its last done share price of $125.32 as of July 7, 2022. WMT’s median analyst price target of $155 as per S&P Capital IQ implies a higher expected upside of +24%.

Separately, Walmart currently trades at a consensus forward next twelve months’ normalized P/E of 19.0 times according to S&P Capital IQ valuation data, which is close to three-year historical lows. WMT’s three-year trough forward P/E multiple was only 6% lower at 17.9 times.

I think WMT’s consensus target price and its implied upside are reasonable as supported by its current valuations.

Is WMT Stock A Buy, Sell, Or Hold?

I rate WMT stock as a Buy. The stock’s recent dip as a result of below-expectations first-quarter results offers a good entry point for investors.

Be the first to comment