Bet_Noire/iStock via Getty Images

Introduction

After heavily reducing their once formidable dividends way back in early 2016, ConocoPhillips (NYSE:COP) opted to pursue a variable shareholder returns policy that ebbs and flows with the prevailing operating conditions. Following the recent share price rally on the back of surging oil and gas prices, this sees their current dividend yield at a low 2.34% but when looking ahead, one way or another, higher shareholder returns are coming.

Executive Summary & Ratings

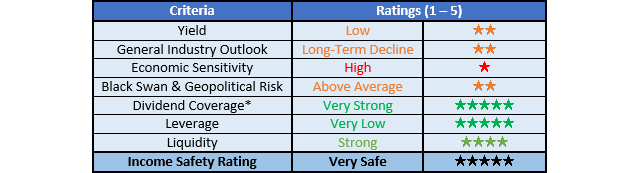

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

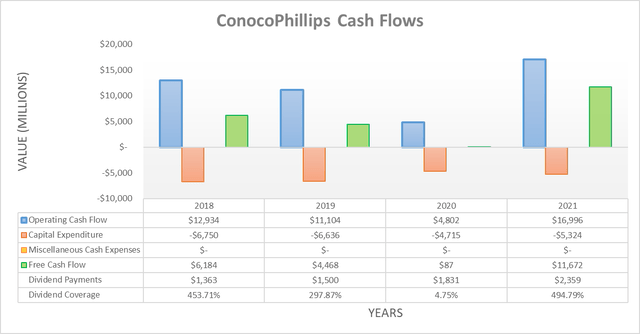

Following the severe downturn of 2020 that slammed their cash flow performance, the strong oil and gas prices of 2021 saw a recovery that lifted their operating cash flow to $16.996b, thereby sitting well above their result of only $4.802b during 2020. Whilst this partly stems from their acquisition of Concho Resources in January 2021, it nevertheless marks a very positive change versus the severe downturn of 2020 and saw their free cash flow reach a massive $11.672b during 2021, which eclipsed any recent year since at least 2018. Unsurprisingly, this easily funded their $2.359b of dividend payments and a further $3.623b of share buybacks, which made for total shareholder returns of $5.982b that appears poised to grow higher during 2022 thanks to these very strong oil prices and their accompanying guidance, as the table included below displays.

ConocoPhillips Fourth Quarter Of 2021 Results Presentation

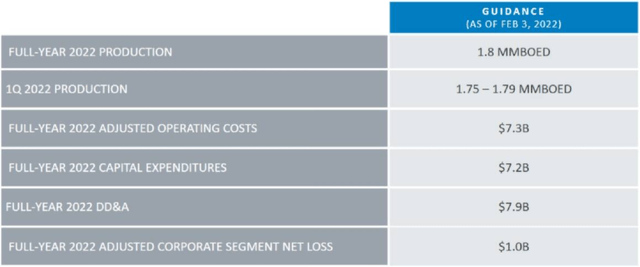

Whilst the volatility of oil and gas prices makes it impossible for management to provide earnings guidance, they can still provide production guidance, which for 2022 is forecast to reach a very impressive 1.8mmboe/d and thus 17.88% higher year-on-year versus their 1.527mmboe/d production during 2021, as per their fourth quarter of 2021 results announcement. Theoretically, their operating cash flow broadly should scale accordingly with their production and thus if oil and gas prices were to average the same as during 2021, their operating cash flow should increase near 18% year-on-year to circa $20b during 2022, thereby seeing shareholder returns of $6b+ given the minimum 30% payout ratio of their variable shareholder returns policy. Despite being positive, there are prospects for even higher shareholder returns during 2022 and beyond given these very strong oil prices and their sensitivities, as the slide included below displays.

ConocoPhillips Fourth Quarter Of 2021 Results Presentation

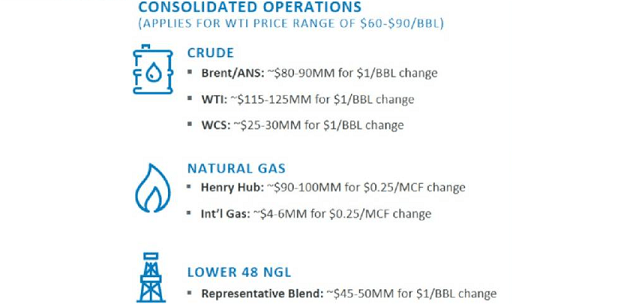

It can be seen that for every $1 per barrel that Brent oil prices increase, their operating cash flow increases by $85m with Western Texas Intermediate and Western Canadian Select grades also seeing $120m and $27.5m increases respectively. Following the heavily discussed Russia-Ukraine war further tightening an already tight oil market, Brent prices averaging circa $100 per barrel now seems to be the baseline outlook during 2022, thereby representing an increase of circa $30 per barrel against their average during 2021, as per data from the EIA.

Since most grades of oil tend to move in tandem, it means that oil prices averaging $30 per barrel higher versus 2021 should see their operating cash flow increase by circa $7b, thereby totaling approximately $27b. Once subtracting their guidance for capital expenditure of $7.2b during 2022, it would leave a massive circa $20b of estimated free cash flow. When compared to their current market capitalization of approximately $130b, this amounts to a very high free cash flow yield of slightly over 15%. Whilst gas prices have also rallied during 2022 and stand to benefit as Europe seeks supply outside of Russia, their cash flow performance is more influenced by oil prices and thus these were assumed to remain at their 2021 levels to provide a margin of safety.

Circling back to their shareholder returns, their minimum 30% operating cash flow payout ratio would see this result in record shareholder returns of circa $8b, which would provide a high shareholder yield of slightly over 6% on their current market capitalization. They also expect a further circa $1b of shareholders returns via share buybacks as a result of selling shares in Cenovus Energy (CVE), as per slide seven of their December 2021 investor presentation, although in my eyes, the appeal is minimal since it stems from the sale of an asset. If they were to stick to their minimum shareholder returns, it would also leave circa $12b of free cash flow retained, although given the state of their financial position, they are likely to opt to pay more than the minimum or alternatively, future years will see relatively higher shareholder returns as there would be essentially no ability for further deleveraging.

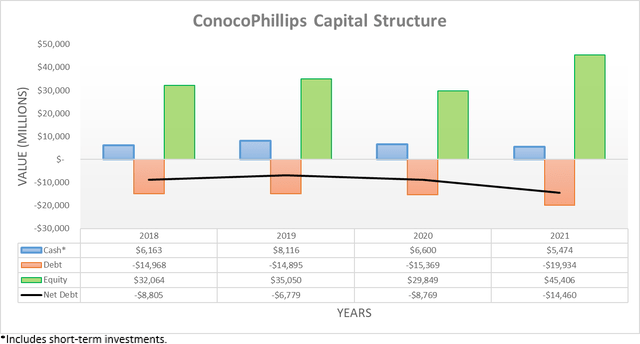

Despite their free cash flow easily exceeding their shareholder returns, their net debt still increased a significant $5.691b or 64.90% during 2021 to end the year at $14.46b versus the $8.769b where it ended 2020. This stems from a year of acquisitions that saw them start 2021 by acquiring Concho Resources in January before ending the year with a large shale acquisition from Shell (SHEL). When looking ahead, their variable shareholder returns policy ensures that net debt trends lower and whilst the extent will depend upon whether they opt for minimum shareholder returns, if so, their circa $12b of retained free cash flow would almost eliminate the entirety of their net debt.

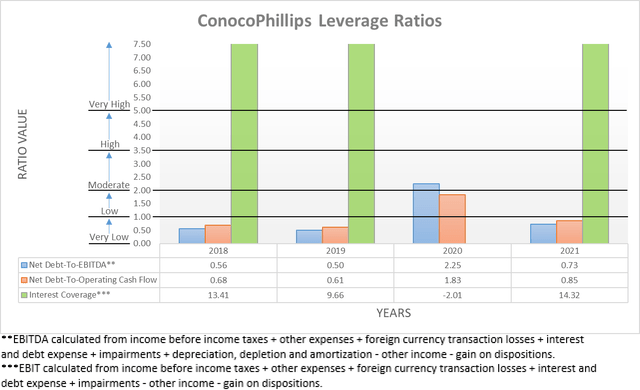

Even though their net debt increased significantly during 2021, their strong financial performance ensured that their leverage remained very low with their net debt-to-EBITDA of 0.73 and net debt-to-operating cash flow of 0.85 both sitting under the threshold of 1.00 for the very low territory. Rather unsurprisingly, their interest coverage is effectively off-the-charts at 14.32 and thus they have no issues servicing their debt. Whilst their leverage would increase if they were faced with a sudden downturn since their net debt is significantly higher than its recent historical levels, thankfully this does not appear likely within the foreseeable future and thus provides time to see their net debt reduced.

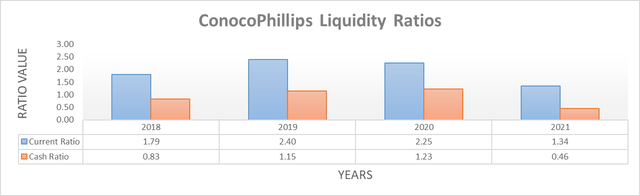

It was positive but not overly surprising to see strong liquidity accompanying their very low leverage with their current and cash ratios at 1.34 and 0.46 respectively. When looking ahead, their immense free cash flow and variable shareholder returns policy should this maintained and despite their debt swelling from their acquisition spree during 2021, thankfully their large operational size means they should retain easy access to debt markets to refinance any maturities as required, even if central banks tighten monetary policy.

Conclusion

Notwithstanding the saddening loss of life in Eastern Europe, they face a tidal wave of free cash flow to be split between shareholder returns and retained for deleveraging. If they opt to favor the former, their shareholders could see anywhere from a high 6% to a very high circa 17% shareholder yield across dividends and share buybacks. Alternatively, if they opt to favor the latter, it would see most of their net debt eliminated and thus mean relatively higher shareholder returns are essentially guaranteed in coming years and thus one way or another, higher shareholder returns are coming and as a result, I believe that a buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from ConocoPhillips’ SEC filings, all calculated figures were performed by the author.

Be the first to comment