FG Trade/E+ via Getty Images

National Retail Properties Inc. (NYSE:NNN) is a well-managed, nationally active real estate investment trust with a sizable and expanding real estate investment portfolio.

The trust has a strong track record of dividend growth and covers its dividend payout with funds for operations, providing passive income investors with not only a high yield but also a clear path to a carefree retirement.

National Retail Properties is currently trading at a favorable AFFO-multiple.

Diversified, Stable And Safely-Positioned Real Estate Investment Portfolio

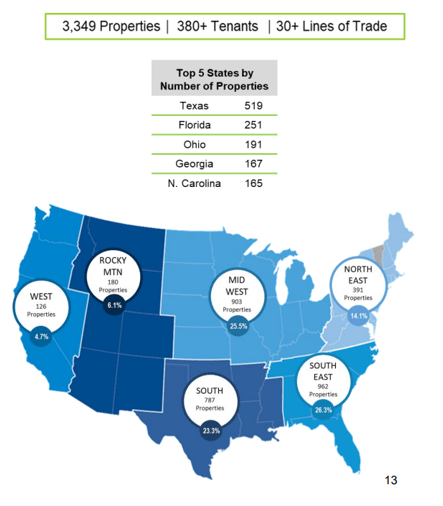

National Retail Properties is a net lease real estate investment trust with 3,349 properties in its portfolio as of September 30, 2022, totaling 34.3 million square feet of lease space. The trust specializes in single-tenant retail real estate and has investments in 48 states.

National Retail Properties primarily rents its properties to large retail companies on long-term leases that protect the company from the inherent fluctuations in the real estate market.

Top 5 States By Number Of Properties (National Retail Properties)

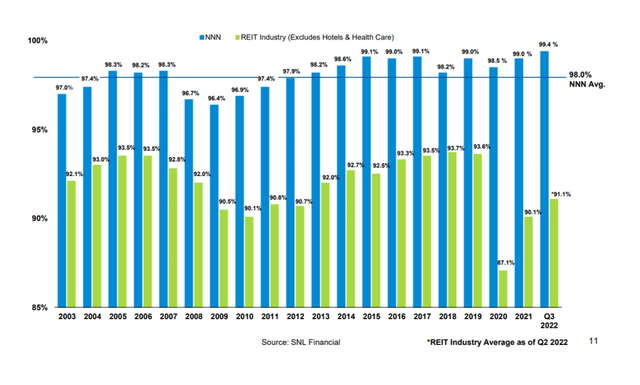

Investors can examine a real estate investment trust’s historical occupancy trend to determine the quality of its portfolio. This is a simple and instructive exercise in the case of National Retail Properties, which provides occupancy data for the last two decades.

At the end of the September quarter, the real estate investment trust’s occupancy was 99.4%, with an average annual occupancy of 98.0% over the previous two decades. This means that the trust’s asset and management quality is very high, which translates into predictable rental income from its real estate portfolio.

REIT Industry Occupancy Trend (SNL Financial)

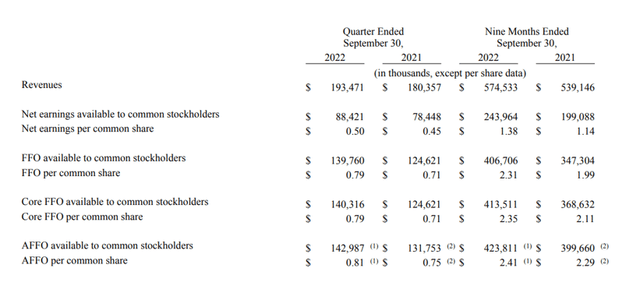

Dividend Covered By AFFO

National Retail Properties’ dividend is covered by funds from operations, and the pay-out ratio is very low, making NNN an excellent candidate for inclusion in a retirement portfolio.

In the third quarter, the trust paid $0.55 per share and earned $0.81 per share in AFFO, implying a pay-out ratio of 68%. The pay-out ratio in the first nine months of 2022 was 67%, so National Retail Properties provides a well-covered dividend that has a high margin of safety.

AFFO (National Retail Properties)

Valuation And AFFO Multiple To Realty Income

National Retail Properties anticipates earnings of $3.18 to $3.20 per share in adjusted funds from operations in 2022, up from a previous range of $3.14 to $3.19 per share.

National Retail Properties has a valuation ratio of 14.5x based on the new guidance (based on AFFO). Realty Income Corporation (O), the REIT to which National Retail Properties is most likely compared, forecasted $3.87 to $3.94 per share in AFFO in 2022, implying a P/AFFO-ratio of 16.6x.

The Value For Retirees

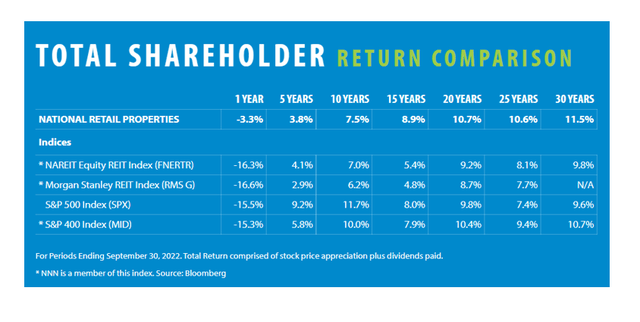

National Retail Properties has a long track record of outperformance, having outperformed the NAREIT Equity REIT Index over a 10-year period for a previous generation of passive income investors who bet on the net lease trust for their retirement.

In the last thirty years, the trust’s stock has returned an average of 11.5% per year, with a large portion of that coming from the payment of a predictable and growing dividend.

NAREIT Equity REIT Index (Bloomberg)

Slow And Steady Wins The Game

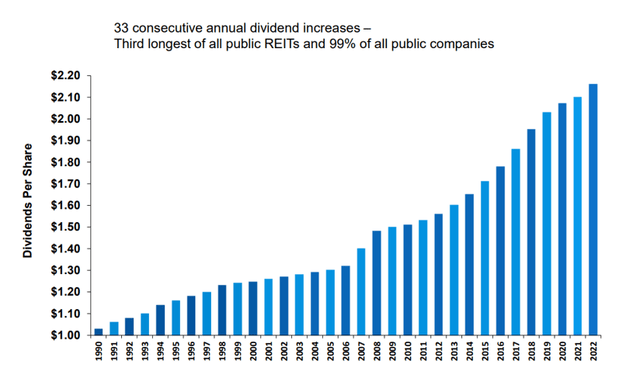

Passive income investors, in my opinion, can win with National Retail Properties if they play the long game. In 2022, the trust raised its dividend for the 33rd time since 1990, and the trust’s steadily growing dividend will account for a large portion of National Retail Properties’ total return in the long run.

National Retail Properties pays a stock yield of 4.7% with a current dividend of $0.55 per share per quarter and the possibility of a rising dividend and yield given NNN’s history.

Dividends Per Share (National Retail Properties)

What Risks Are Affecting An Investment In NNN?

National Retail Properties is diverse and well-managed, as evidenced by the trust’s two-decade occupancy history. Trusts that have consistently high occupancy are obviously of higher quality than trusts that cannot demonstrate such a record.

Having said that, a real estate recession could (and most likely will) have an impact on National Retail Properties’ ability to raise capital in the equity markets in order to complete new real estate deals.

Furthermore, changes in the real estate market may have a greater impact on National Retail Properties’ AFFO multiple than on the underlying lease business.

My Conclusion

National Retail Properties is a well-managed and broadly diversified real estate investment trust with a compelling value proposition for passive income investors in or nearing retirement.

The real estate investment trust has very good dividend coverage (pay-out ratio below 70%), meaning its dividend is supported by adjusted funds from operations and has room to grow.

National Retail Properties has paid a growing dividend for more than two decades, during which time it has also consistently increased its payout.

NNN, in my opinion, is a dependable dividend grower that passive income investors should consider adding to their retirement portfolios.

Be the first to comment