Brian Koellish

I don’t know about you, but one of the ways that my parents love most to relax is to take a boat ride. Whether you’re going fast or slow, you can have a great experience for all on board. It’s generally safe and, in exchange for a rather large upfront investment, you have the opportunity to create joy and memories for many years. One company that’s dedicated to retailing marine products is OneWater Marine (NASDAQ:ONEW). Over the past few years, the company has achieved remarkable growth. Sales and profits have risen nicely as a result of strong demand for their products and because of continued acquisitions. You would think that a company growing as fast as this would be trading at rather high multiples. But between fears about the broader economy and the nature of investing to sometimes not recognize value for an extended timeframe, shares of the business are trading at very affordable levels. With no downturn even being hinted at based on the firm’s financial results and shares trading on the cheap, I cannot help but to rate the enterprise a ‘strong buy’, reflecting my belief that the business should significantly outperform the broader market for the foreseeable future.

Taking a cruise with OneWater Marine

According to the management team at OneWater Marine, the company operates as one of the largest and fastest-growing marine retailers in the US. As of the end of the second quarter of the current fiscal year, the company operated 96 retail locations, 10 distribution centers and warehouses, and an unspecified number of online marketplaces, all across 19 states. The largest presence for the company is in Florida, where, as of the end of its 2021 fiscal year, it generated 49.4% of its sales. Examples of other key markets include Texas, Alabama, Georgia, Ohio, and more.

The company does not seem to focus on just any boats, however. They claimed to be a market leader by volume in the sale of premium boats in many of the key markets in which they operate. They also generate sales from other activities, such as selling related products like finance and insurance, parts, and more. They also generate some of revenue by providing boat-related services for their clients. As of the end of its latest fiscal year, the company generated 11.3% of its sales and 25.8% of its gross profits from non-boat sales. While this disparity in profitability relative to sales may not make sense at first glance, it’s worth noting that finance, insurance, maintenance, and other related activities all generally carry strong margins to their sales.

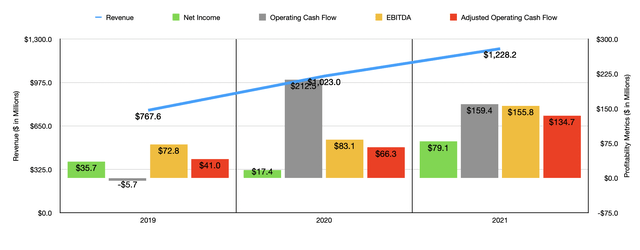

Over the past three years, the management team at OneWater Marine has done a really good job growing the company’s top and bottom lines. Revenue rose from $767.6 million in 2019 to $1.02 billion in 2020 before soaring again to $1.23 billion last year. The rise in revenue in 2021 of 20.1% was driven in part by a 9.7% rise in same-store sales. This was because of an increase in the average selling price of new and pre-owned boats, as well as the model mix of boats sold. Management also attributed some of that rise to an increase in finance and insurance sales, as well as a rise in services, parts, and other related revenue. This is not to say that there weren’t other factors involved. In fact, the company did benefit rather significantly from five different acquisitions that it made during the 2021 fiscal year.

This rise in revenue brought with it an increase in profitability. Consider net income. After falling from $35.7 million in 2019 to $17.4 million in 2020, it shot up to $79.1 million last year. Other profitability metrics followed a similar trajectory. Operating cash flow went from negative $5.7 million in 2019 to positive $212.5 million in 2020. But then, in 2021, it fell to $159.4 million. If we adjust for changes in working capital, however, the metric would have risen consistently, climbing from $41 million in 2019 to $134.9 million last year. Another profitability metric worth looking at is EBITDA. According to the data available, it rose from $72.8 million in 2019 to $155.8 million last year.

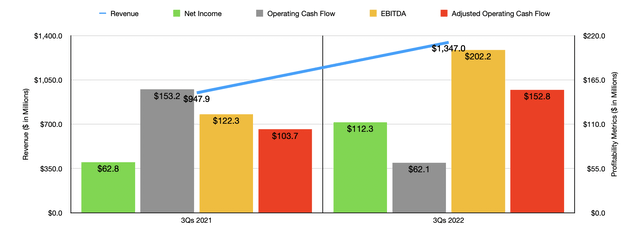

Growth for the company has continued into the current fiscal year. This 42.1% increase in revenue for the first nine months of its 2022 fiscal year was driven by a 14.2% rise in same-store sales. Higher average selling prices for new boats, an increase in pre-owned boat unit sales, and a change in product mix, as well as stronger finance and insurance sales and a rise in services, parts, and other related activities, all contributed to this. All of the rest of the revenue increase was driven by the various acquisitions the company made. The firm has been very active this year, making no fewer than seven different purchases. The most recently announced purchase involves a company called Taylor Marine Centers. Though terms were not disclosed, it alone is responsible for $29 million in revenue per year. The largest purchase it made this year was of another publicly traded company called Ocean Bio-Chem, a leading supplier and distributor of appearance, cleaning, and maintenance products for the marine industry. It also operates in the automotive, power sports, recreational vehicles, and outdoor power equipment markets. That particular entity was purchased for $125 million.

When it comes to profitability, growth has continued to be robust so far this year. Net income of $112.3 million dwarfs the $62.8 million generated at the same time last year. Operating cash flow did decline, dropping from $153.2 million to $62.1 million. But if we adjust for changes in working capital, it would have risen from $103.7 million to $152.8 million. We also saw an increase in EBITDA, with that metric climbing from $122.3 million in the first nine months of its 2021 fiscal year to $202.2 million the same time this year.

When it comes to the 2022 fiscal year as a whole, management has not provided any guidance on revenue. But they did say that same-store sales should rise in the low single-digit rate range. They did say also that EBITDA should be between $240 million and $250 million. Earnings per share, meanwhile, should be between $9.20 and $9.60. At the midpoint, that would translate to net income of $136.4 million. If we assume that adjusted operating cash flow will increase at the same rate that EBITDA should, then we should anticipate a reading this year of $211.8 million.

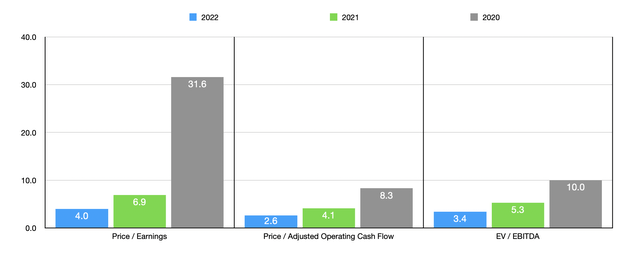

Thanks to this data, valuing the company is very simple. On a forward basis, the price-to-earnings multiple is just 4. This compares to the 6.9 reading that we get using data from 20 of 21 and is down considerably from the 31.6 reading that we get using data from 2020. The price to adjusted operating cash flow of multiple should be 2.6. That compares favorably to the 4.1 reading using results from last year and the 8.3 reading using data from 2020. And when it comes to the EV to EBITDA approach, the multiple should be 3.4. That compares to 5.3 using data from last year and 10 using data from 2020.

As part of my analysis, I did compare the company to five similar businesses. Using the 2021 figures for each one, we can see that these companies ranged between a low point of 4 and a high point of 11 when it comes to the price-to-earnings approach. In this case, two of the five firms were cheaper than OneWater Marine. Using the price to operating cash flow approach, the range is between 4.6 and 30.3. In this case, OneWater Marine was the cheapest of the group. And when it comes to the EV to EBITDA approach, the range is between 2.2 and 7.6. In this scenario, three of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| OneWater Marine | 6.9 | 4.1 | 5.3 |

| MarineMax (HZO) | 4.0 | 4.6 | 2.2 |

| Malibu Boats (MBUU) | 7.3 | 7.0 | 4.9 |

| Brunswick Corporation (BC) | 9.3 | 15.2 | 7.0 |

| Marine Products Corp. (MPX) | 11.0 | 30.3 | 7.6 |

| MasterCraft Boat Holdings (MCFT) | 6.3 | 8.1 | 4.4 |

Takeaway

Based on all the data provided, I will say that OneWater Marine is looking remarkable right now. I understand that investors are worried about a potential slowdown. That could come to pass. But even if the company were to revert back to the kind of profitability that it generated in 2020, shares would still look somewhat undervalued from a cash flow and EBITDA perspective. And it’s worth considering that the number of acquisitions the company has made in recent years may make it very difficult for sales and profits to drop even that much. All things considered, the business strikes me as significantly undervalued and I would make the case that it should warrant some nice upside moving forward. Because of that, I’ve decided to rate the enterprise a ‘strong buy’.

Be the first to comment