da-kuk

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on December 15th, 2022.

With OPEC looking to support higher oil prices, energy investments could have another strong 2023. They see demand staying robust in 2023 due to China’s reopening, that’s despite the expectations for a recession. At the same time, they recently announced they were holding steady on oil production, that was after announcing production cuts a couple of months ago.

One way to play the energy space could be through the Tortoise Energy Infrastructure Corp. (NYSE:TYG) fund. This is a closed-end fund that’s trading at a significant discount. They also aren’t entirely exposed to one area of the energy market overall because they are a diversified energy infrastructure play. The majority of their exposure is through natural gas, with a healthy portion dedicated to midstream players.

Additionally, they complement that with renewables and power infrastructure to take advantage of the longer-term trend of the energy transition. That puts them in a position that is more flexible going forward to adapt to changing energy environment.

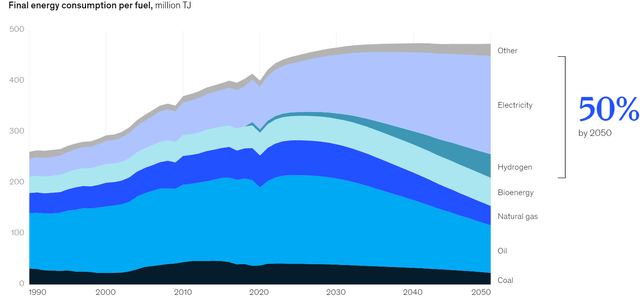

Fossil fuels will remain vital for decades, especially with world energy usage only set to continue to grow. The continued push of renewables as a source of supply that energy demand is only expected to continue to grow.

Energy Consumption Estimates (McKinsey)

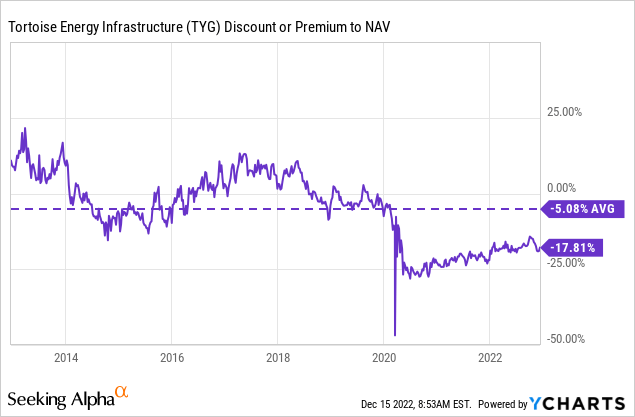

Since the last time we covered TYG, they’ve completed their tender offer. For those that participated, it was a successful play either by cashing out at higher than the current market price or cashing out and reinvesting the proceeds back into the fund. Next year they are looking to make a similar offering based on a similar trigger of the fund trading at a deep discount. Despite this shareholder-friendly move, the fund remains at a wide discount.

The Basics

- 1-Year Z-score: 0.05

- Discount: 17.81%

- Distribution Yield: 8.53%

- Expense Ratio: 1.47%

- Leverage: 23.07%

- Managed Assets: $622.4 million

- Structure: Perpetual

TYG mentions that the fund is designed to have “exposure to energy infrastructure, long-lived and essential, midstream power and renewable assets.” These companies include those that “generate, transport and distribute electricity as well as process, store, distribute and market natural gas, natural gas liquids, refined products, and crude oil.” It also has an investment objective to seek a “high level of total return, emphasizing current distributions.”

In the closed-end fund structure, there is no K-1 or unrelated business taxable income (UBTI). That means they can be more appropriate for “IRA and tax-exempt suitability.”

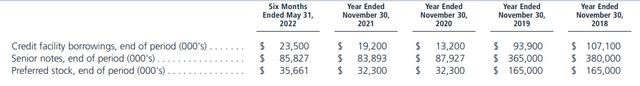

The fund utilizes leverage, and that has gotten them in trouble in the past. Most notably, the COVID crash saw them reduce their credit facility, senior notes, and preferred stock dramatically. They were forced to deleverage as energy, and the entire market came crashing down. That causes permanent damage to the fund.

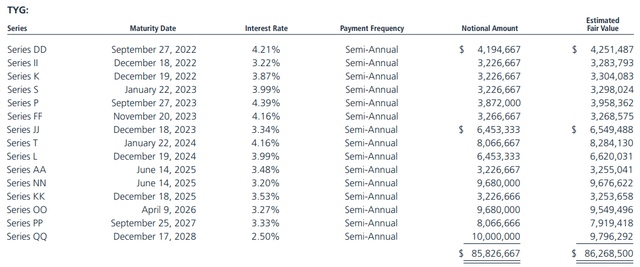

With a credit facility, they are also paying interest based on a floating rate. For TYG, it is 1-month LIBOR plus 1.10%. The senior notes, on the other hand, are fixed rates. While they were a more expensive form of leverage when interest rates were 0%, now they are saving the fund money as LIBOR explodes higher.

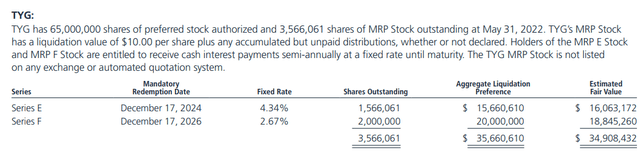

They also have preferred shares that are outstanding. These are also fixed-rate.

TYG Preferred Leverage (Tortoise)

Overall, the majority of their debt is based on fixed rates. So the hit by higher interest rates isn’t as impactful as it can be for some other CEFs.

The fund’s expense ratio is 1.47%. When adding the leverage expenses, it comes to a fairly hefty 2.56%. Of course, the leverage, in this case, is hopefully generating higher returns and paying for itself.

Another important note we highlighted last time we covered the fund was that they would aim to qualify as a regulated investment company. This is an important distinction because previously, they were a C-corp. That allowed them to invest more than 25% in MLPs.

That also meant they paid taxes at the fund level. When including those expenses, the leverage ratio came to 3.99%. Then investors were taxed on top of that for a portion of the distributions they received. If they can qualify for RIC status, that tax expense will be gone, and distributions will only be taxed once, at the individual level.

The fund intends to qualify as a Regulated Investment Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as a RIC, the fund must meet specific income, diversification and distribution requirements. See Note 2E to the financial statements for further disclosure.

Performance – Attractive Discount

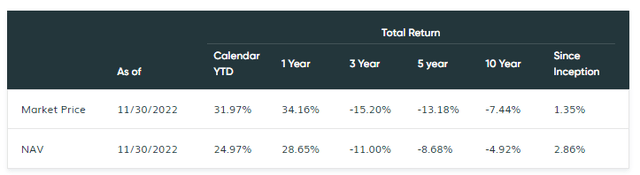

As we know, the energy space wasn’t a thriving sector from most of 2015 to 2020. 2020 was essentially the finale that saw crude oil futures go negative – to reiterate and remind us how bad things were during that period. Therefore, I don’t think anyone will be bragging about the annualized returns of TYG over the longer term. However, it is also basically the same thing you’ll see on any energy-focused fund.

TYG Annualized Returns (Tortoise)

After 2020, that’s when they added more flexibility to the fund, so it’s not exactly the same fund it was back then, anyway. Despite the changes and the reversal in energy fortunes, TYG is met with a deep discount on the fund. It might be hard to imagine, but this fund had traded at premium levels before. It was through extended periods of time, too, not just briefly.

YCharts

The discount was slowly chipping away, but after the latest volatility in crude oil prices picked up again, things sunk again. This is also coinciding with the fund’s tender offer ending this year. So perhaps a bit of both playing a role in the widening out of the discount again.

Distribution – 7 to 10% Managed

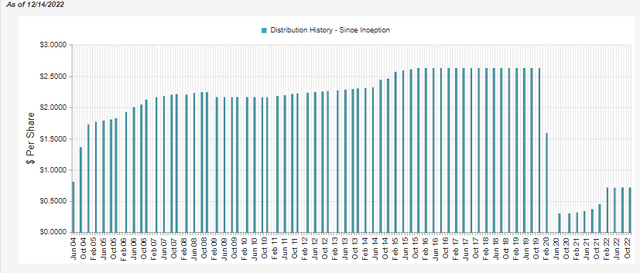

Going along with the difficult times in 2020, it is no surprise that the volatility reflected in its share price and performance is also reflected in the fund’s distribution. They held steady through many difficult years but succumbed and wielded the axe, slashing the payout in 2020.

TYG Distribution History (CEFConnect)

They then began building the distribution back up, but it isn’t likely to ever reach the pre-COVID levels. That would be due to the permanent damage of deleveraging of the fund.

The distribution policy for TYG is to distribute between 7 to 10% of “the average week-ending NAV per share for the prior fiscal semi-annual period.” That means it can be adjusted both upwards and downwards depending on the trajectory of the NAV. They anticipate the distribution resets will be in February and August – while holding the May and November distributions flat.

While that means it can be a variable distribution, it also provides for predictability. Predictability because we know when an adjustment can happen and the trigger for such an adjustment.

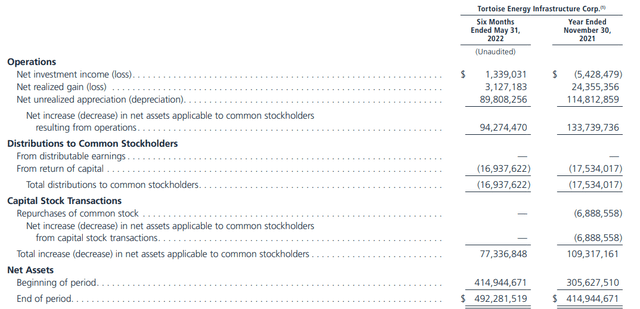

In terms of distribution coverage, we’ll get a better look in early February when they release their next annual report. We can go off the semi-annual report for the six months ending May 31st, 2022. At this point, it is quite dated but can give us a good sense of coverage.

TYG Semi-Annual Report (Tortoise)

At first, net investment income coverage looks incredibly light. Based on the above, it would only show around an 8% NII coverage.

However, since the fund held and still holds a meaningful allocation to MLPs and other midstream C-corps, they receive return of capital distributions. These are adjusted when they come up with the total investment income. The ROC distributions the fund received itself came to $7,101,916. If we add that back into the NII, we see that net distributable income or NDI coverage comes to around 50%.

This is where higher expenses can eat away at the coverage for common shareholders. Still, this is a higher coverage than other equity-focused CEFs. The sector exposure of TYG in the energy space naturally means there is higher exposure to dividend payers that can often have larger relative yields.

For tax purposes, most of the distribution was considered qualified dividends in the prior years. However, with the RIC status, that could be changing. We could see the ROC and capital gains distribution classifications passed on to shareholders.

That being said, it doesn’t appear that this year will be when we see that happen. They highlighted that for tax purposes, they are estimating 80 to 100% will be dividend income again this year. No official classification will be known until early in 2023.

For tax purposes, 80 to 100% of TYG’s 2022 distributions, 55 to 75% of NTG’s 2022 distributions, 10 to 30% of TTP’s 2022 distributions, 35 to 55% of NDP’s 2022 distributions and 20 to 40% of TPZ’s 2022 distributions are expected to be characterized as dividend income, with the remainder as return of capital. A final determination of the characterization will be made in January 2023, and you will receive a form 1099-DIV for each fund in which you are invested.

TYG’s Portfolio

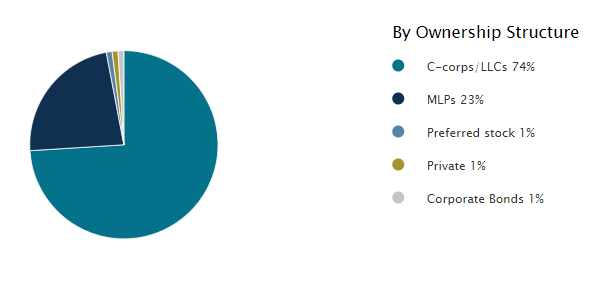

Naturally, as they transitioned into more renewables in 2020, the turnover ratio picked up in that fiscal year. Since then, things have moderated back down. The last reported turnover ratio came to 9.51%. That should mean that the portfolio doesn’t change drastically from one update to the next. At the end of September 2020, C-corps made up the largest portion of the fund. MLPs were a meaningful 23% allocation.

TYG Ownership Structure (Tortoise)

This is consistent with what we saw earlier this year. There was a small climb in MLP exposure and a reduction in the preferred stock and private investments. Both preferred stock and private investments comprise only a minimal portion of their portfolio.

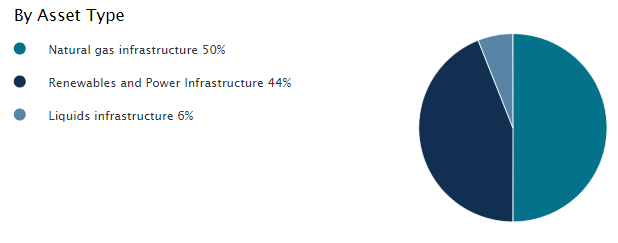

Those structures being held are broken up primarily into natural gas and renewables exposure. The liquid infrastructure here is a minor weighting. Again, consistent with what we saw earlier this year. However, earlier this year, they had allocated a grand total of 1% to “energy technology.” This has seemingly been removed from the portfolio, not a drastic change overall to the fund, though.

TYG Asset Type (Tortoise)

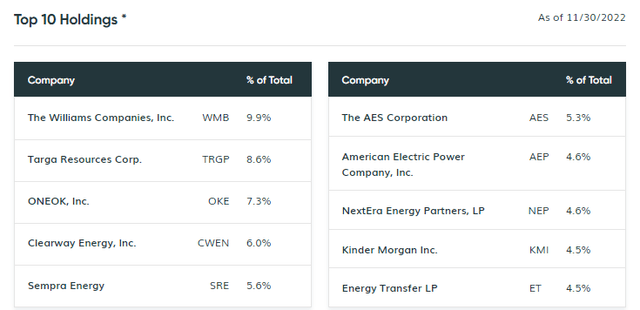

The top ten holdings provide the allocations as of the end of November 2022, so a bit more updated info.

Here we see plenty of the big names in energy and utilities that most investors will be fairly familiar with. We should also note that the top ten exposure is fairly hefty. It comprises 60.9% of the entire portfolio. TYG doesn’t have many holdings overall; there are just a total of 30 overall.

In looking at some of their holdings, you see some of the higher yielders, and it could be confusing why they can’t cover the distribution to shareholders. When mixing in leverage with these holdings, it could be fairly easy to get to the ~7% current NAV distribution. Of course, then you’d have to consider the expenses as well.

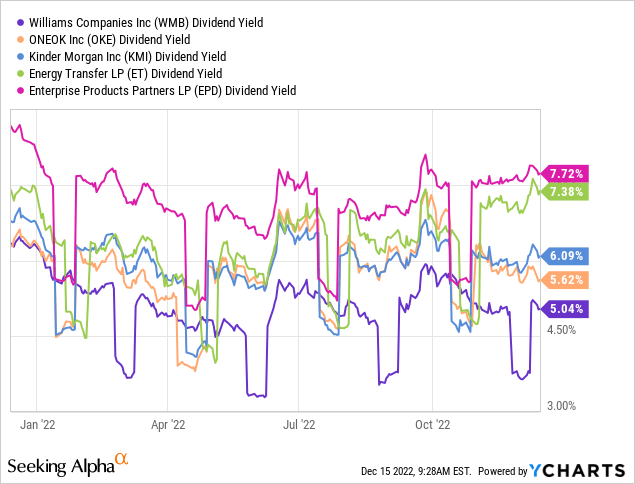

YCharts

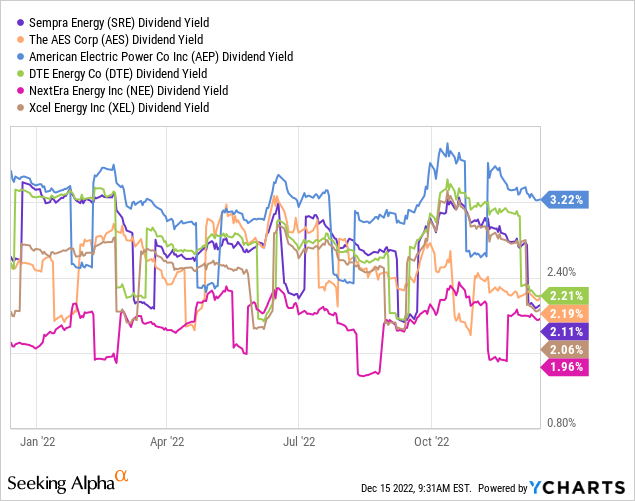

However, those are the higher yielders in the portfolio. For every higher yielder, there are also much lower yielders. These come primarily in the form of the utility plays here.

YCharts

Ultimately, the TYG portfolio is fairly attractive. In each of the positions in their entire portfolio, I could make a case for holding in my own individual portfolio. In fact, some of the positions I do hold as individual positions. Those include NextEra Energy Partners (NEP) for the top ten. Then they also hold the parent NextEra Energy (NEE); along with those, TYG also holds DTE Energy (DTE) and Enterprise Products Partners (EPD) in smaller allocations.

Conclusion

TYG continues to trade at a wider discount as investors shun energy CEFs. I don’t blame investors. Those that invested pre-COVID are unlikely ever to see positive returns, or it could take a significant amount of time. That’s not counting the future setbacks that could spiral the leveraged energy funds down again. For now, it seems that OPEC will be supporting the current price of oil, which should bode well for the energy space. If China comes back open next year and ends its COVID lockdowns, that should support the energy market if most other economies are in recession mode.

At the same time, TYG could still be something to watch for investors who prefer buying individual names – using them as a watchlist or shopping list. One can see what they are holding to get some ideas potentially.

Be the first to comment