Firn

Since previously covering BASF (OTCQX:BASFY, OTCQX:BFFAF), see here, I’ve been impatiently waiting to assess the effect of rising energy costs on the company. With the resumption of gas flows through the Nordstream 1 pipeline anything but certain, the effect of a cut-off has now been priced in. As such, it was about time to further explore the effect of energy costs on the performance of BASF. Additionally, the holding of BASF in oil and gas producer, Wintershall Dea, will be assessed.

1H22 Performance

Since the invasion of Ukraine the EU imposed sanctions on Russia, which in turn gradually choked gas supplies to Europe. Energy prices have been one of the drivers of massive inflation and with winter nearing, ‘insolvenz’ and ‘überschuldung’ (insolvency and over-indebtedness) have become trending topics on Twitter in Germany.

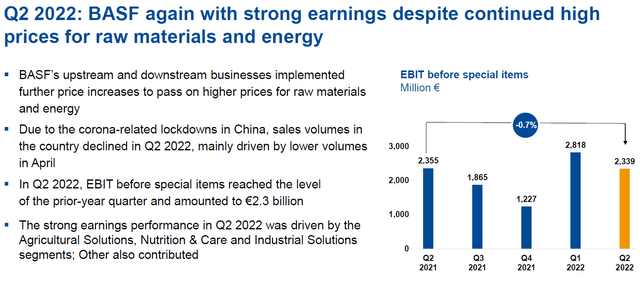

Before assessing the implications of the rising gas prices in the current quarter, it is worthwhile to gauge how the company performed in the second quarter. Against the backdrop of rising energy prices BASF has shown relative good performance as it has been able to pass-on higher raw material costs to customers, see figure 1.

Figure 1 – BASF 2Q22 performance highlights (BASF)

The figure shows quarterly performance, expressed in EBIT before special items, was slightly less compared to last year. This result however was achieved in an environment with significantly higher prices for raw materials, but without any major production cuts. Cuts which are expected to materialize in the second half of the year according BASF CEO Martin Brudermüller:

We are reducing production at facilities that require large volumes of natural gas, such as ammonia plants.

The problem with today’s headlines is the amount of fearmongering going on. Looking past the headlines, and listening to what the CEO had to say at the latest earnings call, the situation is not as bad as some commodity specialists believe. Key here is that BASF produces crucial products for society:

(…) when there is an unexceptionally high demand for natural gas, a significant disruption in natural gas supplies or other significant deterioration in the supply situation.

Then, according to the regulations, non-market-based measures must be taken to ensure natural gas supplies, in particular, to protected customers.(…)

In this process, certain consumer groups are particularly protected. These groups (…) also include industrial companies that manufacture products that are crucial for society. (…) Should the German government declare the third and final emergency stage, we currently expect that BASF would still receive sufficient natural gas to maintain operations at the Ludwigshafen site at reduced load.

(…) For BASF production sites outside of Europe, we expect hardly any impact in the event of a European gas shortage.

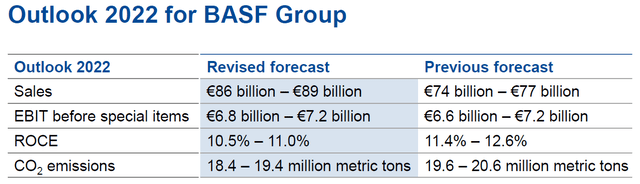

Obviously, energy concerns are on top of mind for the BASF executives and several scenarios are under consideration in the event gas supplies are reduced or disrupted all together. Taking all this into consideration the company only slightly amended the forecast for this year, see figure 2.

Figure 2 – BASF 2022 outlook (BASF)

Passing-on inflated cost of goods to customers has bumped forecasted sales by 16% to a lower end estimate of €86Bn. Simultaneously the lower end of EBIT was actually raised by €0.2Bn to €6.8Bn. As the company reduced expected CO2 emissions, it is clear the higher sales are booked against lower production volumes, especially considering BASF is replacing part of the gas consumption by fuel-oil as stated during the conference call.

Energy costs

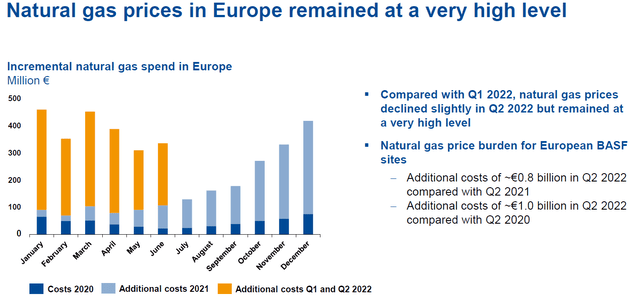

The revised forecast was made against a backdrop of rising energy prices. The effect of this was prominently visualized by the company in the second quarter earnings call, see figure 3.

Figure 3 – Incremental natural gas spend (BASF)

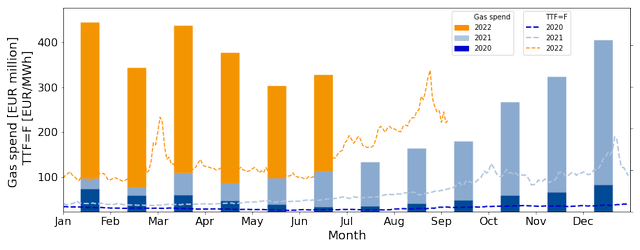

The additional costs of gas in the second quarter of 2022 were approximately €0.8Bn more than in 2Q21. Looking at the first half of 2022, the additional costs already amount to approximately €2Bn. This number will continue to rise as gas prices in the third quarter continue to increase. To substantiate this claim, the development of the Dutch TTF Natural Gas future (a leading European benchmark) has been referenced against the BASF gas spend, see figure 4.

Figure 4 – BASF gas spend versus gas price (yahoo.finance.com, nl.investing.com, BASF; chart by author)

This figure clearly shows gas prices went up significantly in the third quarter of this year. One could argue this does not bode well for the performance in the remainder of the year, but so far BASF has been able to offset inflation of raw material costs by price increases. Moreover, the CEO already signaled production cuts to materialize towards wintertime. Considering this information, the outlook will already account for these tough measures which will be taken over the coming months.

The Wintershall Dea dividend

BASF has a majority stake in oil and gas producer, Wintershall Dea. Before the start of the war in Ukraine BASF was pushing for an IPO of this company, but currently it has been put on the backburner. This means the added value of this shareholding has to come from dividend payments. BASF holds 72.7% of the shares in Wintershall Dea, and received a 2021 dividend of €488 million according the 2021 annual report.

The actual amount to be paid by Wintershall Dea in 2022 is still to be determined. Energy prices are at elevated levels, but with a substantial amount of production coming from Russia and sanctions in place, it is not clear how much dividend can be distributed this year.

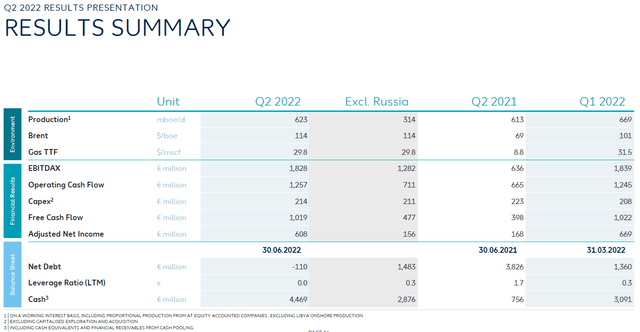

Wintershall Dea’s Q2 performance explicitly showed the impact of the exclusion of the Russian business, see figure 5. The data shows half the production of the company takes place in Russia and consequently free cash flow excluding Russia is less than half the total amount of over €1Bn.

Moreover, €1.6Bn of cash resides in Russia. As the Central Bank of Russia has restricted the movement of capital, it is currently unclear whether Wintershall has access to the cash and will be able to receive dividend from the Russian joint ventures.

Figure 5 – Wintershall Dea 2Q22 results presentation (wintershalldea.com)

Conservatively assuming the proceeds from its Russian operations will be inaccessible until further notice, the performance ex Russia is used to estimate the 2022 finances. Comparing Q2 performance in relation to last year, it is immediately clear the high energy prices more than offset the effect of ‘losing’ the business in Russia.

In spite of production being 50% less than last year, operating cash flow, free cash flow and adjusted net income ex Russia are at similar levels. This strong performance has been used to increase cash available by more than €2Bn over the course of a year.

These numbers potentially support a dividend payment in line with the 2021 amount of about €0.5Bn or more. Yet, putting this in perspective to the €0.8Bn in additional gas spend BASF incurred in 2Q22 compared to 2Q21, the potential dividend to be received will not even offset the increased energy costs of a single quarter.

Wintershall Dea valuation

The carrying amount of the shareholding in Wintershall Dea was €9.5Bn by the end of 2021. To put this in context of the valuation of this shareholding, two different valuation estimates will be presented.

A very rough estimate leads to an expected EBITDAX of €4.5Bn excluding Russia for the full year. As exploration expenses so far have developed in line with last year, an EBITDA of €4.3Bn is used to determine a valuation. With an EV/EBITDA ratio of 2.5 (based on (SHEL) and (TTE) ratios), this would lead to an estimated enterprise value of less than €10.7Bn.

One could argue the comparison of Wintershall Dea with majors such as Total and Shell is presumptuous. Therefore a better estimate may be obtained comparing the company with the NAM. Recently Shell and Exxon (XOM) launched the sale of their Dutch gas joint venture NAM. The NAM shows similarities to Wintershall Dea as it operates the largest gas field in Europe, but is only allowed to produce at low capacity by the Dutch government. Effectively both companies have to deal with choked production due to political constraints.

The 2021 EBITDA of the NAM was approximately €0.9Bn. This number is a rough estimate as the annual report is rather rudimentary. With owners Exxon and Shell hoping to fetch about €1Bn for this company, the EV/EBITDA ratio is 1.1. Applying this number to the EBITDA of Wintershall, the enterprise value becomes approximately €4.7Bn.

All in all the investment in Wintershall DEA only has a small hedging effect when dividends are considered. The real value of this hedge will materialize through an IPO. An IPO which was suspended as BASF felt recovered oil and gas prices had ‘not been fully reflected in earnings estimates by brokers and market valuations of oil and gas companies’. If these reasoning is followed, current earnings estimates and the valuation of the company are likely still not in line with the desire of management as the Russian operations need to be excluded, meaning an IPO will not take place any time soon.

The energy debate

Raw material prices and availability of natural gas remain a concern for investors especially for a company such as BASF which relies heavily on fossil fuels. To save gas, European countries have taken measures which would be unheard of a year ago. For example, Germany has already postponed closure dates for nuclear reactors, the Netherlands lifted a production cap on coal fired power plants, Britain will lift a ban on fracking and France decided to nationalise the fleet of nuclear power plants.

On top of this, European governments are frantically buying all the gas they can get their hands on. The consequence is consumers and companies are facing massive price increases for their heating bills leading them to ‘voluntarily’ cut energy consumption. This in turn helps to achieve the 15% reduction in gas consumption as imposed by the European Commission.

Ultimately, for Russia to weaponize gas supply with maximum effect it will need to take action this winter. Next year the EU, but also BASF, will have had another year to diversify energy sources and take other mitigating measures. Russia knows this and Europe knows this.

As coming winter will be pivotal, it was interesting to see the rhetoric coming from Europe, when the Nordstream 1 pipeline was shut for an indefinite period, signaled anything but despair. As a matter of fact, the European Commission showed further resolve announcing a price cap on Russian gas in spite of threats by the Russian president to halt supplies completely. My take is this resolve is likely bolstered by the knowledge of EU officials they can guarantee a certain baseload where energy prices are at a level that encourages industry and households to further reduce energy consumption, without having to shutdown entire parts of the economy. This would bode well for BASF as potential production cuts may be less than currently anticipated.

As for BASF, it is mainly the Verbund site in Ludwigshafen that will be affected by gas rationing. But even in the event Russia would cease supplies altogether, the site will remain operational albeit at a reduced load. Summarizing, the outlook may not as bleak as many like to believe, or quoting the CEO:

We are in crisis mode, but not in a panic mode

Conclusion

Since 2021 gas prices have been rising yet BASF booked good performance and has raised the outlook multiple times already. So far, the capability of the company to deal with higher prices has been remarkable, the pricing power is simply very strong.

Yet, the time of production cuts is nearing with the CEO going on record this would materialize towards winter. This information was shared at the same conference call where the company presented the revised outlook bumping the sales forecast by 16% while maintaining EBIT guidance. The takeaway is that the outlook is maintained while already accounting for a downturn in activity.

Performance is mainly driven by pricing power as the Wintershall Dea hedge against elevated energy prices has limited effect. If push comes to shove the company has the ability to divest the stake in Wintershall Dea which would support the bottom line, but honestly BASF appears not to be in a hurry.

With the effective loss of Russian gas supply, Europe has been backpedaling the planned closure of nuclear and coal-fired power plants, while diversifying the supply of natural gas. As these sources combined are not sufficient to replace Russian gas, and winter is nearing, we are now at the point of maximum uncertainty.

The development of the gas price is a perfect gauge of fear, and it has been climbing. Yet, as BASF has shown the ability to transfer costs to their customers, my main concern is not the gas price, but rather the capacity of customers to absorb higher prices as the EU is ever more likely to slide into a massive recession.

Fear is now compounding with high gas prices, record inflation and an imminent recession. With this much fear in the market the obvious question becomes if one should be greedy? In my previous coverage I noted headwinds are mounting for BASF and this process is still continuing. Therefore I will patiently watch fear grow before turning greedy and expand my long position.

Be the first to comment