Spencer Platt/Getty Images News

When investing and stock-picking during this volatile market, caution is key. I prefer to invest heavily in beaten-down names, but those whose fundamentals are also above reproach. There are a number of tech stocks this year that are down on sentiment alone and have seen huge compressions in valuation – I would lean on these “growth at a reasonable price” stocks to play the rebound.

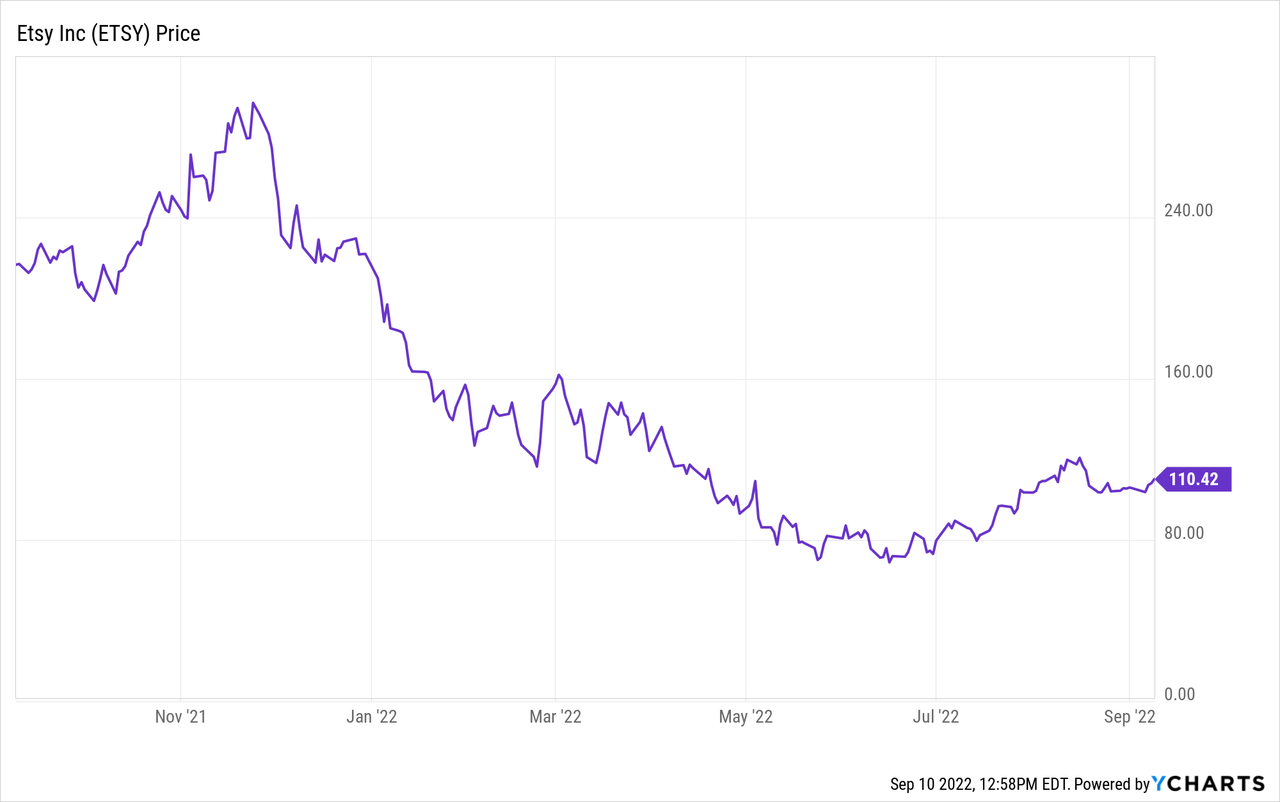

Etsy (NASDAQ:ETSY), on the other hand, has collapsed in a big way this year – but at the same time, its financials are also not looking as clean. Like many other e-commerce companies, Etsy received a big boost during the pandemic, but now in late 2022 as full normalization has almost completely settled in, those tailwinds are looking very one-time in nature.

Year to date, shares of Etsy have dropped nearly 50%. This has many investors hooked on the premise of buying Etsy at a huge discount – but I do think that Etsy’s current valuation, stacked up against its current demand headwinds, is already quite appropriate.

I remain neutral on Etsy and continue to view the stock as a mixed bag of positives and negatives.

On the bright side for Etsy:

- Etsy has proven itself distinguishable from Amazon (AMZN). While Amazon has its roots in being the “everything” store for which many consumers make targeted, price-conscious buying decisions, Etsy has amassed a unique offering of products that users can browse and buy. Its dominance in certain categories, like crafts, jewelry, and housewares gives it an edge over generalists like Amazon.

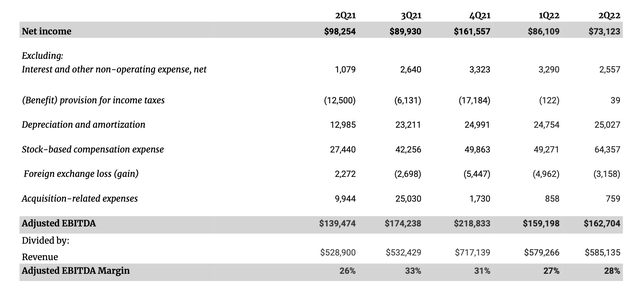

- Profit margins have remained high. Thanks largely to the company’s seller fee increases (which, at 6.5%, is still quite a bit lower than both Amazon and eBay’s (EBAY) seller fees), Etsy has managed to hold onto a near ~30% adjusted EBITDA margin. Enthusiasm for Etsy’s profitability is what helped spark a bear market rally in the stock in July, though I think it is still quite a ways until Etsy can be valued based on adjusted EBITDA or any earnings metric alone.

At the same time, however, we need to be mindful of the risks:

- Demand slowdown. We have seen numerous indicators for Etsy’s demand slowdown, including contraction in GMV, losses in the active buyer base, and a slowdown in new buyer acquisition. Consumers are belt-tightening, and globally, unfavorable FX is also playing a hand in warding off consumer spending.

- Unfavorable macro. It’s not just the stronger dollar, however – the pandemic-era boom in moving to new homes is seeing a drastic chill, which is impacting Etsy’s largest category – furniture and housewares. In my view, these downside catalysts don’t have any near-term cure.

What’s more, Etsy’s valuation can no longer be considered truly cheap, either. At current share prices near $110, Etsy has a market cap of $13.98 billion. After we net off the $1.05 billion of cash and $2.28 billion of debt on Etsy’s most recent balance sheet, the company’s resulting enterprise value is $15.20 billion.

Versus Wall Street’s FY22 revenue outlook of $2.77 billion (+12% y/y; data from Yahoo Finance), meanwhile, Etsy trades at 5.5x EV/FY23 revenue – which I think to be a steep multiple for a company currently at roughly zero GMS growth. Recall that most of Etsy’s current revenue growth is driven by a seller fee increase (which provides a one-time kick in growth, but cannot be indefinitely repeated). There are plenty of other tech stocks in the market growing in the 20-30% range trading at similar multiples to Etsy right now.

Continue to deploy a watch-and-wait stance here: I don’t see the advantages in rushing in to buy Etsy at current levels.

Q2 download

Let’s now highlight some of the risks that emerged in Etsy’s second-quarter results, starting with revenue and GMS trends:

Etsy revenue/GMS (Etsy Q2 earnings deck)

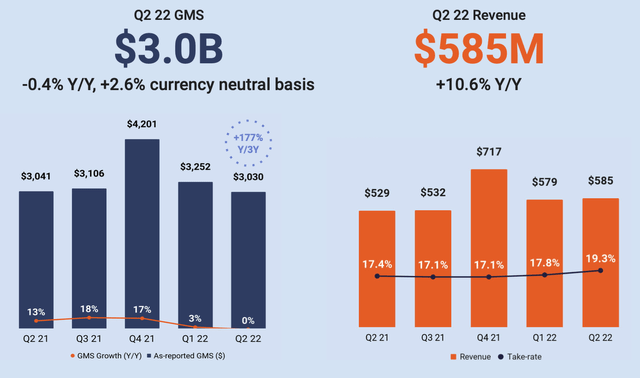

Etsy’s revenue in Q2 grew 11% y/y to $585.1 million in the quarter, and a previously noted, this revenue growth was driven primarily by the company’s seller fee increasing from 5.0% to 6.5%, which was enacted in April. This is also reflected in the company’s increase in take rate to 19.3%, nearly two points higher than 17.4% in the year-ago quarter. Another “unnatural” revenue benefit from a y/y comp perspective are the acquisitions of Depop and Elo7, which had no revenue contribution in the year-ago Q2.

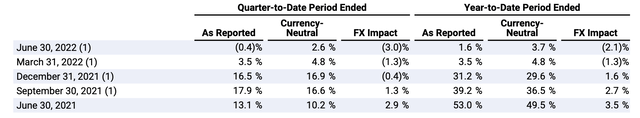

Underlying GMS growth, meanwhile, contracted -0.4% y/y to $3.03 billion. Now, there were three points of currency impact here. On an FX-neutral basis, Etsy’s GMS would have grown 2.6% y/y. This being said, however, the company has experienced significant deceleration regardless of FX impacts. Even on a currency-neutral basis, GMS growth would have decelerated 220bps from 4.8% y/y in Q1, and 16.9% y/y in Q2.

Etsy GMS trend (Etsy Q2 earnings deck)

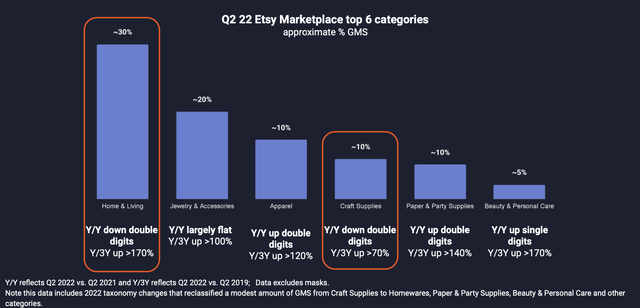

Weakness in pandemic-lifted categories is part of the driver here. As previously noted, Etsy and other housewares companies like Restoration Hardware (RH) and Wayfair (W) experienced a huge boom during the pandemic as a nationwide moving craze swept the United States. Now no longer the case with companies calling workers back into the office, and with home buying in a stalled period with rising interest rates, these categories are experiencing a tremendous chill. As seen in the chart below, the home and living category – representing 30% of Etsy’s GMS and its largest category – saw a double-digit y/y decline. Interestingly, craft supplies also saw a similar decline and is the weakest category from a three-year stack perspective as well – perhaps a reflection of lower at-home free time in the post-pandemic era.

Etsy GMS by category (Etsy Q2 earnings deck)

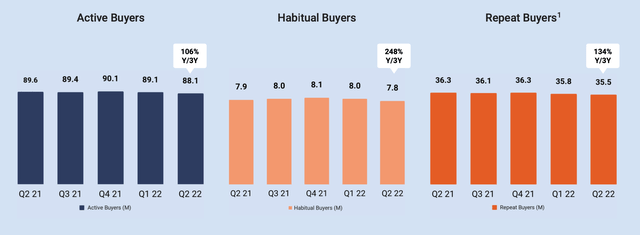

In Q2 as well, Etsy’s active buyer base shed 1 million buyers to end at 88.1 million; the second straight quarter of sequential decline. Habitual and repeat buyers also fell:

Etsy buyer base (Etsy Q2 earnings deck)

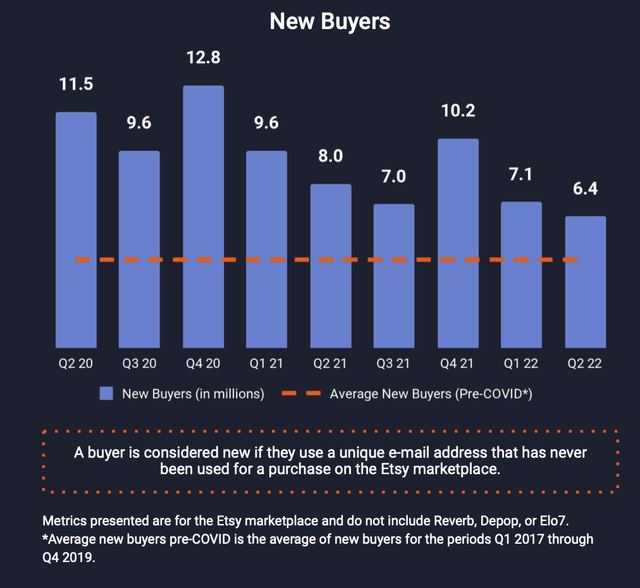

New buyer acquisition is also seeing weakness. The 6.4 million new buyers added in Q2 is the worst quarter for customer additions in three years, though the company still notes that new buyer trends are above the pre-COVID baseline:

Etsy new buyer acquisition (Etsy Q2 earnings deck)

One “saving grace” for Etsy is that the company still managed to maintain a 28% pro forma adjusted EBITDA margin, up two points y/y versus 26% in the year-ago Q2. This is, however, lower than FY20 and FY21 margins above 30%.

Etsy adjusted EBITDA (Etsy Q2 earnings deck)

Acquisitions presented a 400bps headwind here. In Etsy’s eagerness to grow its category appeal, the company took on unprofitable subsidiaries that are also performing below expectations in the current macro environment. Per CFO Rachel Glaser’s remarks on the Q2 earnings call:

Our three subsidiaries were more than a 400 basis point headwind to our consolidated adjusted EBITDA margin, with Depop representing the primary drag. We have a lot of conviction that the strategic rationale for acquiring Depop and Elo7 is sound, providing us access to the large resale apparel market and opening up an untapped market opportunity in Brazil.

It’s also fair to say that given current significant macroeconomic headwinds, both companies have to-date performed below the financial expectations that we had a year ago.”

Key takeaways

With slowing organic GMS growth, a profitability drag from underperforming acquisitions, and a debt-laden balance sheet on top of a reasonably rich valuation, I can’t think of any reasons to be gung-ho on Etsy at the moment. Stay on the sidelines here until the stock price recedes further.

Be the first to comment