Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 30.

Welcome to another installment of our CEF Market Weekly Review where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the last week of October. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

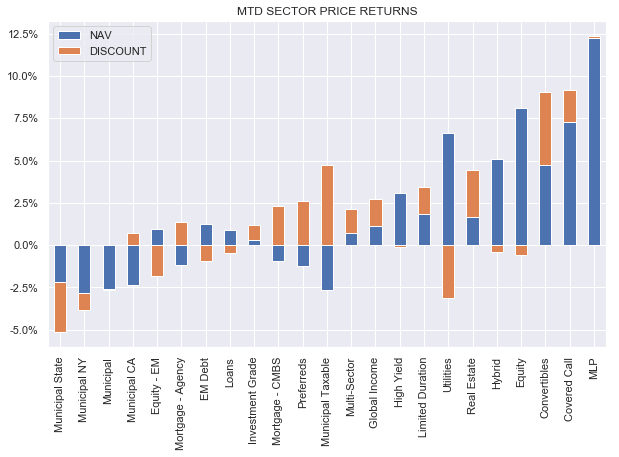

It was a strong week for the CEF space with nearly all sectors outside of Munis registering positive returns. Munis also underperformed over the month.

Systematic Income

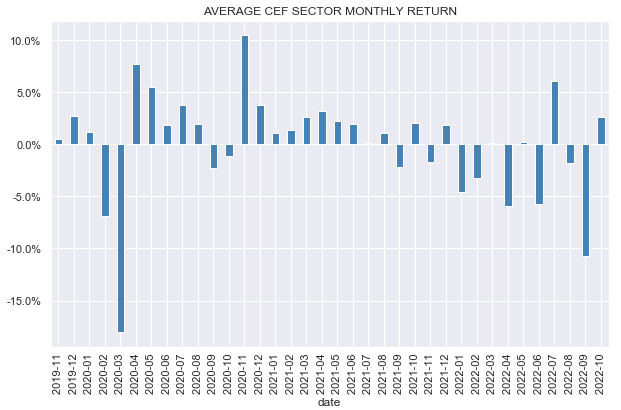

The average CEF sector gained around 2.5% in October though it wasn’t nearly enough to offset the double-digit drop in September.

Systematic Income

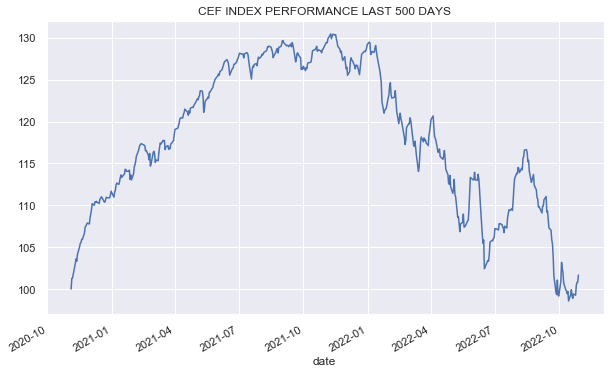

The broader CEF space is still below its June trough and only marginally in the green over the last two years.

Systematic Income

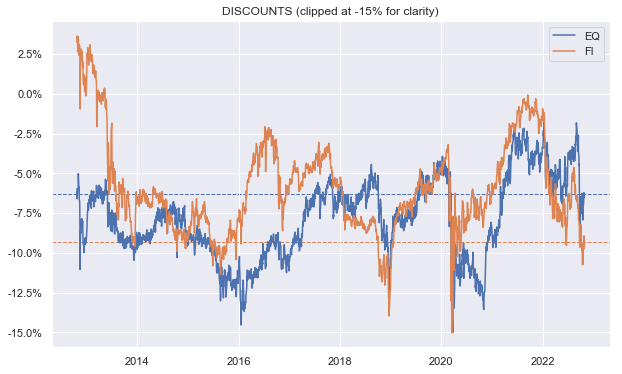

Discounts tightened on the week, however, fixed-income CEF sector discounts in particular remain wide by historical standards.

Systematic Income

Market Themes

Deleveraging continues to be a key theme this year across the CEF space. Recently, a number of Municipal and other fixed-income funds across Nuveen, PIMCO, Invesco, Neuberger Berman and other issuers have made SEC filings, indicating they are planning to partially redeem their preferreds.

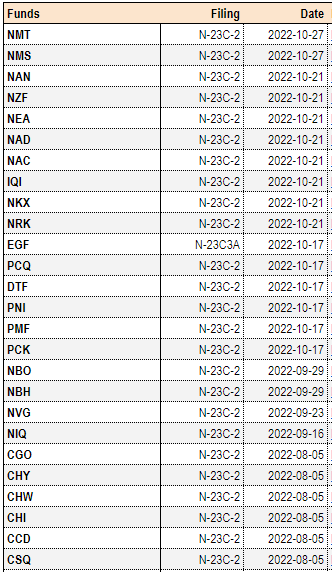

The following table from our CEF Tool filtered by SEC filing type N-23 which pertains to share repurchase offers by CEFs shows this development. Not all of these are repurchase offers of preferreds – the EGF filing has to do with a repurchase of common shares.

Systematic Income CEF Tool

Why are CEFs repurchasing their preferred shares? There are basically two reasons. We can use the Nuveen California Quality Municipal Income Fund (NAC) as an example.

First, it is a simple deleveraging story – the fund had leverage of 42.5% as of September which is high for Nuveen. Most Nuveen muni funds have deleveraged this year and the reason we don’t tend to see SEC filings when this happens is because muni CEFs tend to first use non-regulatory leverage instruments like tender option bonds to deleverage. When a fund uses regulatory leverage instruments like preferreds to deleverage it has to make an SEC filing. It’s also more operationally difficult which is why we don’t tend to see it immediately. NAC only uses preferreds for its leverage so it has no choice but to deleverage via preferreds.

And the second reason for a deleveraging is that leveraged assets contribute little yield to a very high-quality Muni fund after fees and leverage costs. This is because the Muni yield curve has flattened this year which means borrowing short to hold longer-dated assets is less appealing. The one potential downside is that investors may miss out on potential capital gains if yields start falling in which case it can make sense to tilt to higher leveraged funds such as the PIMCO funds which are leveraged to the hilt.

Market Commentary

There was a discussion on the service of allocating between the Invesco Senior Income Trust (VVR) and the Ares Dynamic Credit Allocation Fund (ARDC) in the context of rising rates. VVR is a more traditional loan CEF (90% allocation) while ARDC is a mixed credit CEF with allocations to loans, HY bonds, CLO Debt and CLO Equity.

In terms of likely performance going forward, if longer-term rates continue to head higher then VVR should outperform given its lower duration. It should also outperform if risk sentiment remains poor and asset prices move lower since ARDC is a higher-beta fund.

At the same time, longer-term rates are not necessarily going to rise along with short-term rates since a move to 5% by the Fed is fully expected. Plus, it’s probably reasonable to say that the bulk of the move in longer-term rates has been made. In other words, the risks to longer-term rates are likely pretty balanced as of today.

Overall, ARDC is generating a higher level of yield due to its higher-yielding securities like CLO Debt and CLO Equity. Its leverage cost is also lower due to its use of fixed-rate preferreds in its liability profile. Overall, we continue to favor ARDC between these two, however, VVR is a good option for a more focused loan CEF.

CEF Tool Update

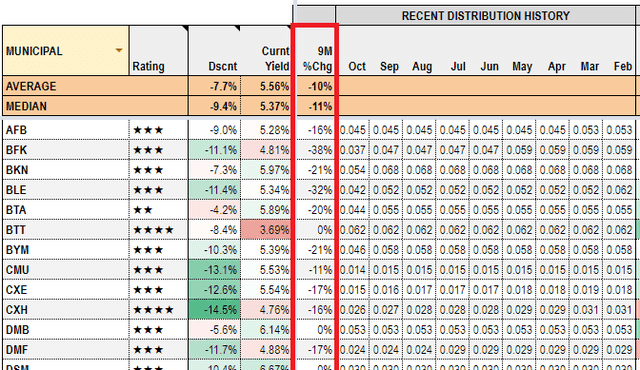

We added a new metric added to the CEF Tool – 9-Month change in the distribution. The idea is to capture how a given fund’s distribution has evolved over this period in standalone terms and relative to the sector average/median. The individual distributions are also shown in the adjoining columns. An example of the Muni CEF sector is shown below, allowing investors to gauge the recent distribution profile of a given fund.

Be the first to comment