Zhanna Hapanovich/iStock via Getty Images

Despite the tightening financial market, oncology is anticipated to remain front and center of healthcare, and the successful emerging biotechs will continue to blaze new trails in driving advancements. Similar to other sectors with rapid growth, biotechnology stocks have been adversely affected by rising rates (broadly, the SPDR S&P Biotech ETF (XBI/US) has declined c 40% from 31 December 2021 to 15 June 2022.). As seen in prior cycles, we expect that companies with the most robust science will continue to advance despite the challenging macro environment.

Finding a needle in a haystack

Oncology remains the fastest growing pharma segment, where innovation is largely driven by emerging small companies. However, among this highly concentrated group, each has a different approach. These variables create a very dynamic and complex sub-segment to track especially for those not involved in the day-to-day across the various silos (even within oncology).

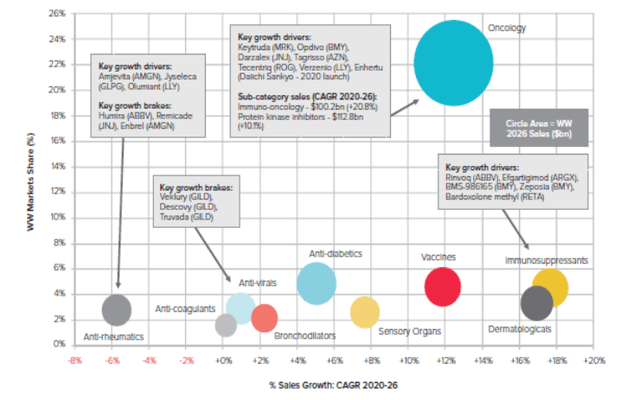

Exhibit 1: Evaluate Pharma growth forecasts by therapeutic area

Evaluate Pharma growth forecasts by therapeutic area (Evaluate Pharma World Preview 2021, Outlook to 2026)

This series will aim to outline the rapidly evolving oncology pharma landscape by taking a deep dive into the key mechanisms and science within the overall pharma backdrop. The concepts and treatment approaches have changed so dramatically that we believe a recap, highlighting differentiated approaches, is a timely exercise.

To begin unpacking the niche categories where pioneers are concentrated, we have isolated roughly 110 publicly listed biotech companies with market capitalizations ranging from US$50m to US$150m. Although the landscape is likely to further evolve, we wanted to capture a snapshot of the progress made to date across what we view to be three niche categories:

- small molecules

- immunoncology (IO)

- non-immunogenic protein therapies

The tail wags the dog: Oncology

As cancer incidence rates continue to be a worldwide concern, with the overall rising median (global) age as people are living longer, oncology remains the largest and most competitive segment in the pharmaceutical industry, chasing after therapies to address a growing number of cancer indications with significant unmet needs. As observed in Exhibit 1, this trend is set to continue, with Evaluate Pharma forecasting cancer to remain the largest therapy area by 2026, accounting for 22% of all prescription drug sales, worth approximately $319bn.

The global oncology market is estimated at c US$175-180bn1 and is anticipated to more than double from current levels within the next seven years to address the rising incidence rates. Similarly, oncology clinical trials increased 56% in 2021, over double the growth of the prior year.2 The majority of these trials are highly specialized and target very small populations, focusing on rare cancers, which further increase complexities in clinical trials (numbers of eligibility criteria, endpoints, trial sites, countries, clinical subjects, etc). However, there is an upward trend in new oncology drug launches, with approximately half (104) of global launches over the last 20 years (215) occurring in the last five years.2

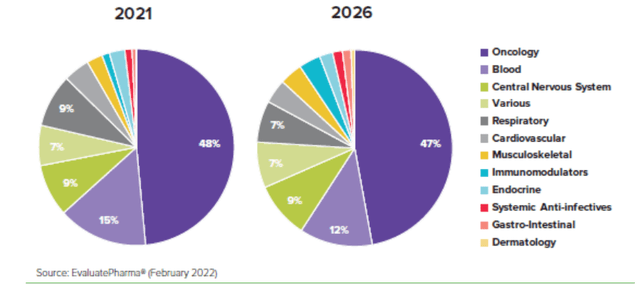

Most new oncology medicines that have been developed in recent years have focused on these smaller patient populations, with 76% of approved oncology medicines launched in the last five years receiving one or more orphan designations. Cancer is currently the dominant therapy area for orphan drugs, accounting for six of the 10 top-selling orphan drugs in the world and projected to continue into 2026 (source: Evaluate Pharma). This further exemplifies the necessity for novel cancer therapies to address these areas of still highly unmet need, Exhibit 2.

Exhibit 2: Share of worldwide orphan drug sales by therapeutic category

Exhibit 2: Share of worldwide orphan drug sales by therapeutic category (Evaluate Pharma (February 2022))

Smaller and nimbler

Due to the complexity of the subject matter, smaller, nimbler biopharma companies with dedicated and highly specialized scientists will continue to blaze the trails and perform the rigorous and tedious legwork to meet the necessary regulatory hurdles. These companies tend to challenge traditional thinking and develop ideas independently. Once the science is more vetted and mature, the successful companies eventually partner with or are acquired by large pharmaceutical companies with the resources and platforms needed to commercialize drugs globally. In 2021, roughly 68% of Phase I to regulatory submission oncology pipeline product candidates were independently developed by smaller biopharma companies. In many cases, a new emerging technology is used in combination with existing more broad-based therapies already owned by large pharmaceutical companies.

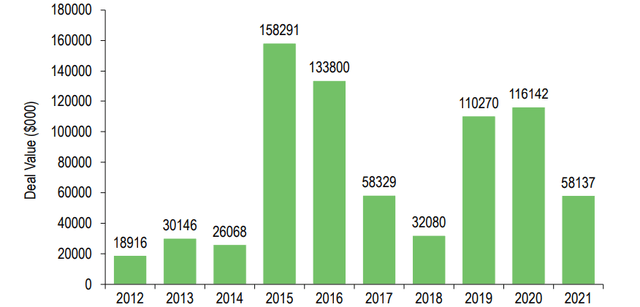

This clearly underpins the significance of emerging biopharma in the marketplace and is also reflected in the amount of capital big pharma has invested in M&A in recent years. The slight M&A downtick in 2021 could have been due to the slower progression of clinical studies with fewer screenings and challenges in patient recruitment during the pandemic. However, 2020 saw a transaction value of approximately $116bn in oncology alone. On average, from 2019 to 2021, roughly half of all pharmaceutical deal activity was driven by oncology-related transactions, demonstrating the importance of this space. With small pharma holding the keys to innovation, collaboration with big pharma through deals, licensing, strategic partnerships, and acquisitions will ultimately determine the success of capital-intensive clinical development and full-scale commercialization.

Exhibit 3: M&A pharmaceutical deal activity – oncology assets

Exhibit 3: M&A pharmaceutical deal activity – oncology assets (Evaluate Pharma: M&A target by therapy area)

Recently, there has been much activity involving big pharma that has and should continue to enable the group as a whole to build on already significant cash positions. Novartis (NVS) received US$20.7bn from selling its longstanding share in Roche (OTCQX:RHHBY) (OTCQX:RHHBF) in Q421, while Pfizer valued its holdings in Haleon (a consumer health business held jointly with GSK (GSK)) at $16bn in April 2022 and plans to sell its stake in a disciplined manner. In a similar fashion, Johnson & Johnson (JNJ) has announced that it is set to spin off its consumer health business, a move that will potentially provide a large cash inflow for the business. The pandemic has also brought significant rewards to Pfizer, BioNTech (BNTX), Moderna (MRNA), and AstraZeneca (AZN), which have received heightened sales from COVID-19 vaccines and treatments. The combination of a recent sharp correction to the biotech market and cash-positive big pharma players looking for the next generation of innovative therapies sets up what could be a potentially exciting time for the industry, with a flurry of deal activity (licensing, M&A) and biotech exit strategies being realized on the horizon.

Small Molecules: Not always chemotherapy

Historically, cancer treatments have primarily been comprised of surgery, radiotherapy, and chemotherapy. Traditional chemotherapy agents such as doxorubicin suffer from extreme toxicity, targeting both cancerous and healthy cells in patients. While these remain important treatment options, therapies continue to increasingly evolve into more targeted small molecule therapies. Bayer’s (OTCPK:BAYZF) Nexavar (first approved in 2005) was one of the first generations of FDA-approved targeted small molecule drugs and the first to be approved across three advanced forms of carcinoma, achieving sales of US$1bn in 2011.

The next generation of small molecule drugs is looking to utilize novel mechanisms of action such as PROTACs, molecular glues, epigenetic modulators, and immune response stimulators. These new modalities are still in their clinical infancy; however, they are being developed with the aim of producing drugs with increased efficacy and specificity and fewer off-target side effects. While overall survival (OS) rates are considered the most meaningful clinical endpoints in cancer research, many new drugs will aim to target improved safety profiles by way of creating a competitive advantage. We believe the FDA is likely to expedite the approval of new therapies that demonstrate equivalent efficacy, but fewer cytotoxic drug-related adverse events compared to the current standard of care treatments.

Immunoncology: Targeted therapies

Small molecule drug discovery will continue to play an important role for years to come; however, we have seen a paradigm shift from classical small molecules towards IO therapies in the past decade and they now feature in many companies’ development pipelines. IO has emerged as a novel and important approach to cancer treatment; it involves stimulation of the body’s own immune system to target cancerous cells. As this area of research has matured, several distinct therapeutic classes within IO now exist. Of note, immune checkpoint inhibitors have had profound success in recent years. Merck’s (MRK) blockbuster programmed death receptor 1 (PD-1) checkpoint inhibitor pembrolizumab (Keytruda, US$17.2bn sales in 2021) continues to dominate the immunotherapeutic market, having now received FDA approval for the treatment of 19 cancer types across 40 indications.

Other IO therapies include immune cell therapies such as CAR-Ts as well as cancer vaccines. While IO therapies are quickly changing the standard of care for cancer patients, there remain many challenges to overcome including, managing toxicities, high cost, difficult quality control, and lengthy manufacturing times. Despite this, we highlight the success seen in the use of IO medicines in combination with conventional chemotherapies, which has resulted in more desirable patient outcomes. This provides a further market opportunity for IO agents in what is an ever-expanding field of cancer treatments.

Non-immunogenic protein therapies: Alternatives

The remaining oncology drug classes can be grouped under protein therapeutics, which are those that do not elicit an immune response. One of the more advanced subgroups within this field is antibody-drug conjugates (ADCS). These primarily function by binding selectively to tumor cells and, once embedded, release a cytotoxic payload, which is often a small molecule, to induce tumor cell death. The FDA has currently approved 11 different ADCs. Seagen (SGEN) is currently one of the leaders in ADC development, with Adcetris for some patients with Hodgkin lymphoma, and Padcev, for third-line metastatic or locally advanced bladder cancer, both contributing significantly to the company’s US$1.6bn FY21 net sales figure (US$705m and US$340m, respectively, in FY21). With many ADCs in the development pipeline and other classes of protein therapeutics beginning to appear, this will be yet another market to monitor closely.

What’s next

This introduction kicks off the groundwork for deeper dives into the mechanisms and science across the three emerging subsegments within oncology, namely IO, targeted small molecule, and non-immunogenic targeted antibodies. We aim to better understand how these therapies work and recent developments that may drive differentiation among innovative pioneers. As we further press into the science and the emerging companies in this series, we will likely uncover (potential) natural alignments either in combination therapies or complementing strategies that make the most sense based on strengths, positioning, and approach. Through the series, we will highlight certain early-stage biotech companies that are of particular interest.

1 Evaluate Pharma oncology therapeutic sales were estimated at $173.9bn in 2021 and is anticipated to more than double by 2028 to $381.1bn by 2028. Iqvia institute estimates global 2021 cancer medicine spending to be $185Bn and forecasts it to reach more than $300Bn by 2026.

2 Global Oncology Trends 2022 – IQVIA

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment