John Phillips

After the stock market’s closing bell, Kering (OTCPK:PPRUF, OTCPK:PPRUY) released its third-quarter reports. Yesterday, we already analyzed Hermès which achieved impressive results. Despite that, here at the Lab, we are more supportive of the Kering investment case. After our Capital Market day comment, our buy case recap was based on the following:

- Positive view on the luxury sector despite an inflationary environment;

- Ability to increase prices with Kering’s product offering thanks to customer’s inelasticity;

- The positive contribution from Kering’s other houses to lower Gucci’s profitability dependency. Indeed, based on an historical average, Gucci has contributed to more than 80% of the group’s operating profit and has led to a few Wall Street analysts’ criticisms;

- Better yield compared to its closest peers and a compelling valuation both on EV/EBITDA and P/E level.

Q3 Results

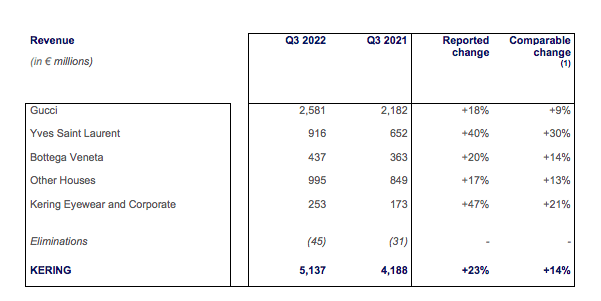

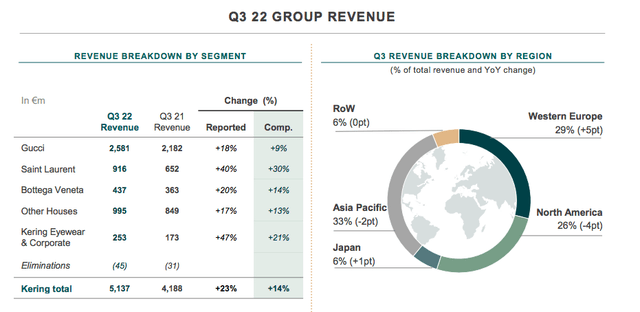

As customary, there is no disclosure of the company’s profitability. Versus the 2021 Q3, Kering Group reported a top-line sales increase of 23% and 14% at the current FX and at constant FX, respectively. Hermès was positively influenced by the euro weakness, and the luxury saddler voluntarily disclosed a positive effect of €451 million on the turnover line. While Kering just emphasized a “significant FX tailwind” without disclosing much more information. Aside from the currency development, Kering’s sales trend further accelerated compared to the first half-year performances. This positive outcome was affected by two factors: 1) EU travel recovery especially in France and Italy (as previously emphasized in many of Mare Evidence Lab’s analyses) and 2) lower outbreaks in China in the quarter.

All Kering division delivered a solid growth with exceptional performances in Kering Eyewear and Yves Saint Laurent division, both achieved a top-sales growth of more than 40% on a reported basis. Gucci is still an important key driver contributor and reinforce Mare Evidence Lab’s thesis on Gucci is here to stay.

Kering Brand performances

Looking at the geographical level performance, as already mentioned, the strongest sales growth was delivered by Western Europe, supported by tourism recovery and local demand.

Conclusion and Valuation

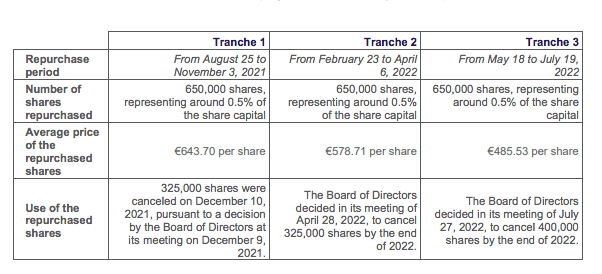

Here at the Lab, we very much welcomed Kering’s numbers. After our half-year report analysis, we confirmed our buy rating target. Today, we say no more – Mare Evidence Lab’s buy is reaffirmed. It is worth mentioning that the French luxury giant completed the first three tranches of its stock repurchase program. Cross-checking the Q3 press release, Kering announced another buyback plan covering up to 2.0% of Kering’s share capital over the next two years. Kering’s guidance was maintained as well as our valuation.

Be the first to comment