Lemon_tm

Our view

In our recent in-depth analysis of Meta Platforms, Inc (NASDAQ:META) (“Meta”) back in August, we rated the stock as a buy at around $165. Sine our rating was published, the company has released its third quarter earnings and its share price has fallen by over 40% to $91 – a 75% decline from its all-time high.

The company’s latest quarterly results show signs improvement in fundamentals such as user monetization, but currency headwinds and increased investment – including in its Reality Labs business – continue to weigh on profitability.

Meta is currently valued at around 8 times reported net earnings, which includes almost c$13 billion of operating losses incurred by the Reality Labs business. This implies that the Family of Apps business – including Facebook, Instagram and WhatsApp – is valued at just 6 times net income.

At the current valuation, investors can expect annual compound returns in excess of 15% in the next decade, even with only low-single digit earnings growth. And this is assuming that the company continues to invest around 20% of the profits from its traditional platforms into the metaverse at a complete loss.

In the short-term, the pressure on earnings will continue. However, for bullish long-term investors this presents an opportunity to buy more and for the company to deploy its significant liquid resources to aggressively buy-back its stock at what we consider a discounted price.

The recent release of Meta’s latest VR headset was not a catalyst for mainstream adoption like we had hoped. However, with the release of the next-gen Meta Quest and Apple’s (AAPL) rumored venture into the AR/VR space expected next year, 2023 could be the year VR goes mainstream.

If you do want to get exposure to the metaverse, why not buy Meta’s Family of Apps for 6 times earnings on the condition that 20% or so of the earnings are invested into the metaverse? Overall, that doesn’t seem like a bad deal to us, even if the metaverse ultimately comes to nothing. For that reason, we reiterate our “Buy” rating at the current price.

Business review

Meta reports its results across two segments: Family of Apps and Reality Labs. Family of Apps comprises all of the company’s well known social and messaging platforms including Facebook, Messenger, Instagram and WhatsApp, while Reality Labs encompasses the company’s expansion into virtual / augmented reality and the “metaverse”.

User base

Data from company reports. Prepared by author.

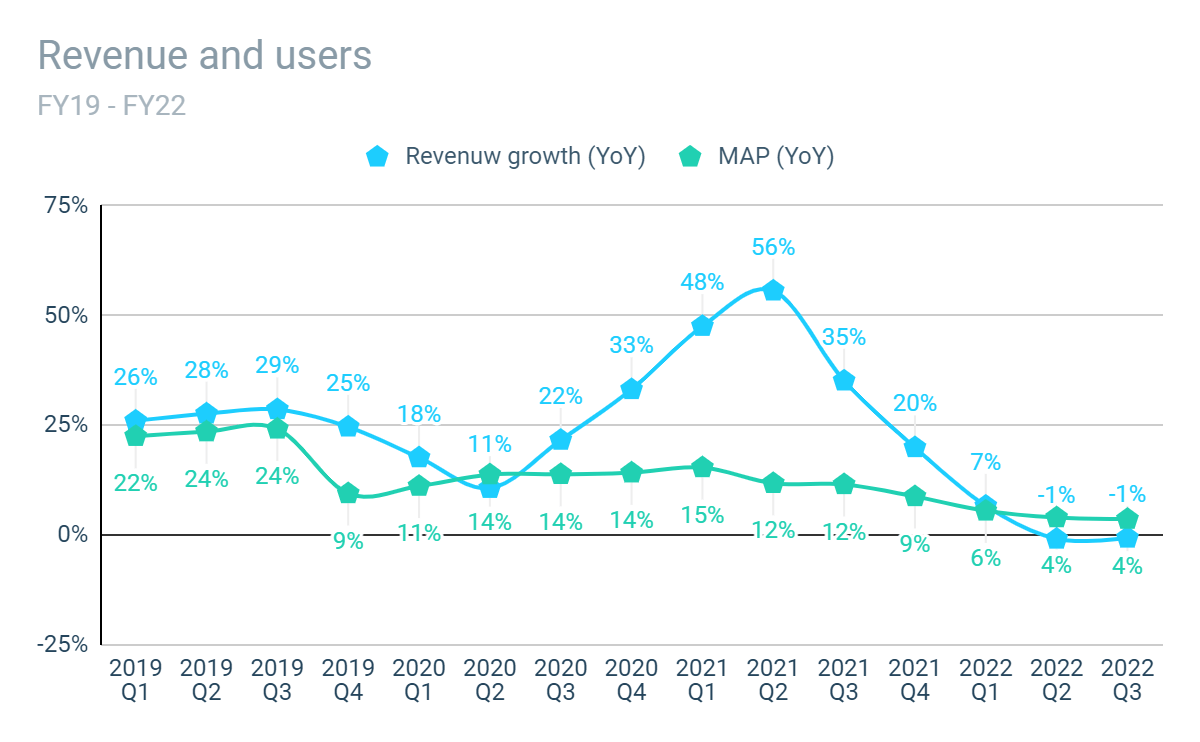

In the company’s most recent quarterly earnings update released on 26 October 2022, Meta reported continued growth users with both Monthly Active Users and Daily Active Users up by 4% versus the same quarter last year, albeit growth continues to be well below double-digit historical levels.

In our previous analysis, we highlighted that user engagement and monetization was an issue for Meta amidst competition from TikTok and the transition of users from the traditional news feed to Reels. The latest results show that the company is making progress in that area. Currently, there are approximately 140 billion Reels played across Facebook and Instagram each day, up 50% from six months ago. Meanwhile, ad impressions and price per ad increased by 17% and 18%, respectively, compared with the same period last year.

As a result of improving fundamentals, the company achieved year-over-year top line growth of 2% on a constant currency basis. However, the strength of the U.S. dollar meant the company reported a 4% year-over-year decline in revenue. While the underlying growth rate is minimal, it is a sign that the company is addressing the issues of competition and monetization.

The META-verse

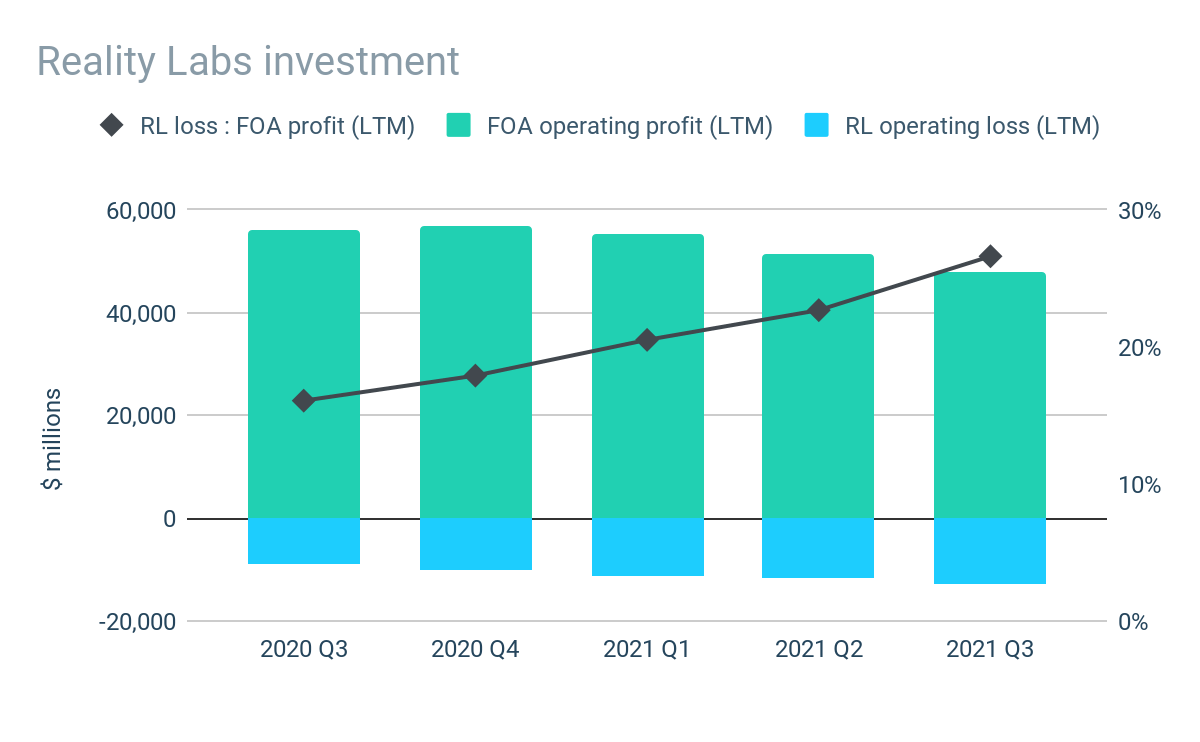

Data from company reports. Prepared by author.

Meta continues to invest in its metaverse vision. The level of investment in this area continues to increase in both absolute terms and relative to its Family of Apps profits.

In the latest quarter, Family of Apps operating profit fell by 7% while Reality Labs operating losses increased by 9%. As a result, the level of losses incurred by Reality Labs has increased from less than 20% of Family of Apps operating profits, to almost 30% in the past 12 months.

The increasing investment relative to overall profitability is not a cause for immediate concern. The underlying indicators of Meta’s traditional apps – such as user growth and monetization – are positive and the pressure on revenues is in part due to where we are in the macro-economic cycle.

It is also important to look beyond the headline earnings figure at the nature of the revenue and costs driving it. While it is accurate to say Reality Labs is loss making, it is important to differentiate between costs incurred to generate current revenues and those which have the potential to drive incremental future revenue. Much of the spending on Reality Labs falls into the latter category, though the future success of this investment is uncertain.

Meta Quest Pro

Meta’s latest venture into the VR hardware space is the Meta Quest Pro. Formally announced at the Meta Connect event in October and started shipping on 25th of October.

The price of the headset at $1,500 took us by surprise, with general rumors and expectations that it would debut at around half that price. At that price point, the headset is aimed at enterprise users and VR enthusiasts, so it won’t be the headset which drives mass adoption for everyday consumers.

It is not only Meta who are taking VR seriously. It is reported that Apple has a research unit with hundreds of employees working on AR and VR and that they are developing at least two AR projects that include an augmented reality headset set to be released in 2023, followed by a sleeker pair of augmented reality glasses coming at a later date. With the next-gen Meta Quest also expected to be released later in 2023, next year could be the first year in the multi-year journey to mass adoption of the technology.

Trading performance

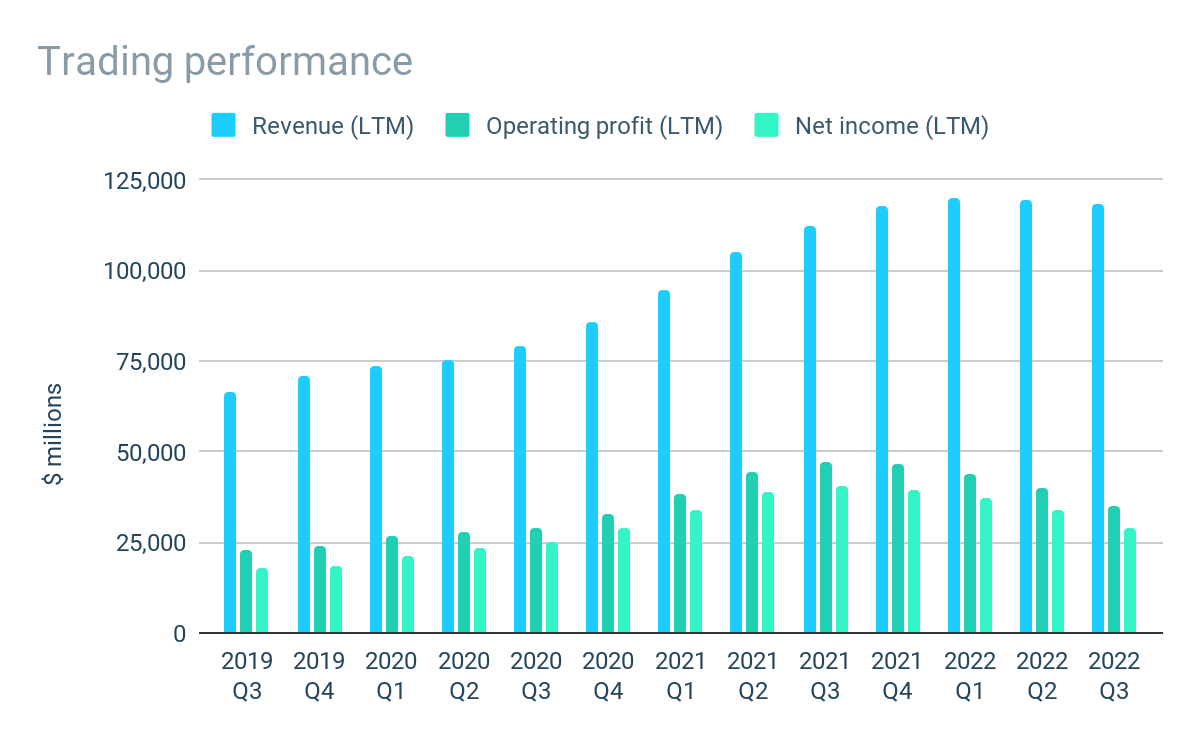

Data from company reports. Prepared by author.

As well as pressure on revenues, Meta is also contending with increasing operating costs. In the most recent quarter, total expenses were up 19% versus the same quarter last year. This follows a trend which has seen the company double its total expenditure in less than 3 years.

Unsurprisingly, this has resulted in a squeeze on profit margins. Net profit margins have fallen from 36% to 21% in the last 12 months alone. However, it is worth noting that we are comparing performance against a period where margins were benefiting from the tailwind provided by Covid in terms of increased user engagement and strong demand for digital advertising.

Overall, net income is down 28% in the last 12 months and there is little prospect of recovery in the short-term. However, the flip side of this is the potential for a strong rebound in future as returns from investment are realized and trading conditions improve.

Cash flow

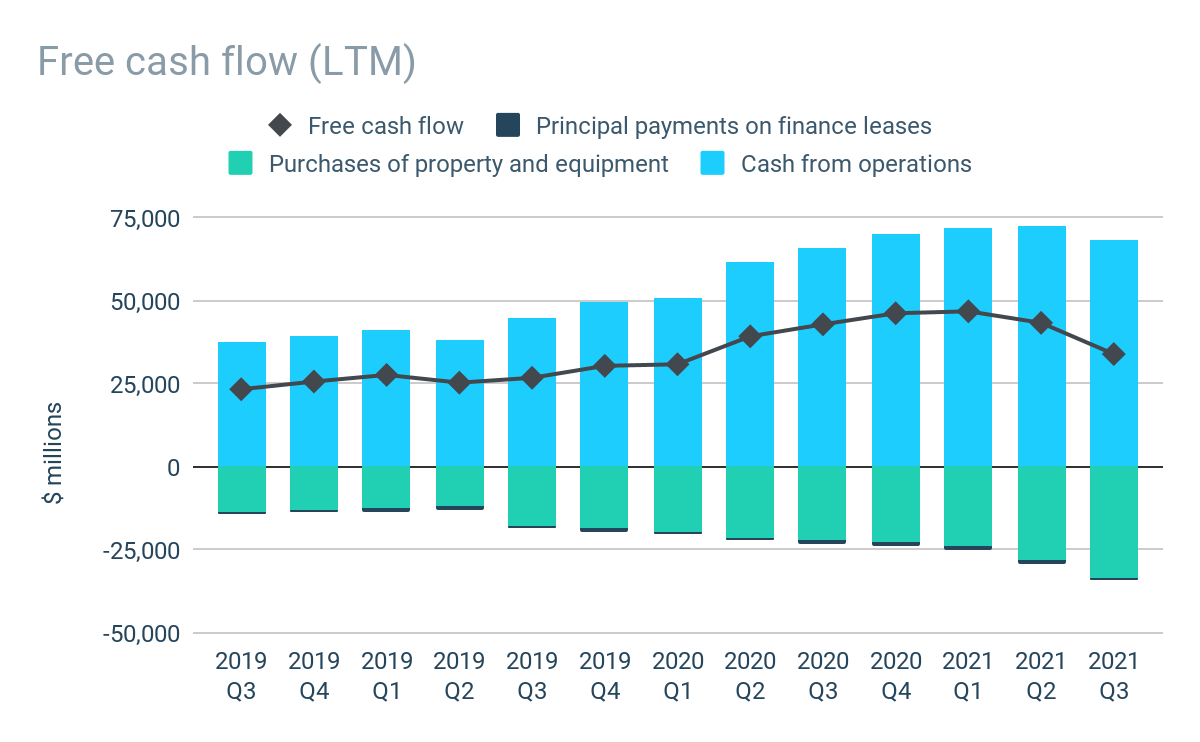

Data from company reports. Prepared by author.

In the most recent quarter, Meta was break-even on a free cash flow basis. This is reflective of the wider trend of declining free cash generation as the company faces a period of trading headwinds at a time of increasing investment in servers, data centers, and network infrastructure.

In Q3 2022, the company continued with its repurchase program, but activity more than halved to $6.55 billion compared with the previous quarter. As of September 30, 2022, the company had almost $18 billion available and authorized for repurchases. With the share price down 30% in the last 30 days and more than $40 billion of liquidity available, we would like to see aggressive repurchase activity in Q4 at the current price level. The company undertook its inaugural debt issue during the third quarter, raising $9 billion for general corporate purposes which should help support that repurchase activity and improve the company’s return on equity.

Outlook

As we highlighted in our in-depth analysis, there are a number of challenges which mean Meta is unlikely to see earnings improve in the short-to-medium term. Slowing user growth and pressure on corporate advertising budgets is likely to put pressure on revenues, while management expects that the U.S. dollar will be an approximate 7% headwind to year-over-year growth in the final quarter of the year.

The company’s total cost base for FY22 is forecast to be $85-$87 billion with a further increase of almost 13% higher FY23 as the full impact of recent investment feeds through. Capex is also expected to increase by about almost 15% next year, with all of the incremental investment being driven by the company’s investment in AI.

With pressure on margins, the company is rightly focusing on costs and headcount. In 2023, some teams will grow meaningfully, but most other teams will stay flat or shrink over the next year. In aggregate, management expects to end 2023 around the same size as they are currently.

While it is right to be mindful of margins, we strongly believe that businesses shouldn’t cut costs purely to improve short-term quarterly earnings figures. As much as Wall Street might like this, you can’t innovate for the long-term based on arbitrary quarterly targets or expectations on headcount or investments.

All of these factors taken together mean that likely only going to be further declines in earnings in the short-term at least. Beyond that, the extent to which Meta can grow its earnings will depend on its ability: (i) to attract and retain users of its Family of Apps (ii) monetize these apps at an increasing rate; and (iii) to successfully implement and monetize its metaverse vision.

Risks

The key risks are consistent with those set out in our previous in-depth analysis. A summary of these is as follows:

-

Competition – The competition for user attention is intense. However, the company has a proven ability to adapt, retain users and successfully transition them through new features amidst pressure from competition.

-

Reliance on third-parties – Meta’s apps are distributed through and run on third-party software operating systems and devices. As highlighted by the changes made by Apple in iOS 14, unilateral changes by these third-parties can impact the ability of Meta to monetize their products.

-

Metaverse investment – We believe the emergence of the metaverse is inevitable. However, it is in the early stage of development and it is difficult to know if Meta’s investment will be successful.

Valuation

Meta has three major components to it: its profitable Family of Apps business; its cash reserves and marketable securities; and the loss-making Reality Labs.

As of 7 November 2022, the company’s Class A shares trade at around $91, giving a total market capitalization of $241 billion. Excluding the company’s significant cash position (including short-term investments) of $42 billion, this implies a valuation of almost $200 billion for the combined operating businesses.

Our approach to valuing operating businesses centers around determining the true underlying earnings power of the business or “owner earnings.” In the case of Meta, we feel that reported net income is a reasonable proxy for owner earnings. Based on LTM net income as of the most recent quarter, the operating businesses are valued at 8 times owner earnings.

If we look at the Family of Apps business in isolation, we estimate that net income in the last 12 months for this business alone was around $35 billion. Even if we assume that the full $200 billion valuation of the operating businesses is fully attributable to Family of Apps, this would imply a price-to-earnings multiple of just 6 times.

Whilst Reality Labs is currently loss-making, in practice it would be reasonable to assume at least a small proportion of Meta’s market capitalization is attributable to the growth prospects of the business. In this case, the Family of Apps business is actually valued at less than 6 times owners earnings.

As always, we do not attempt to calculate a specific intrinsic value for Meta business but consider the implied returns under various scenarios:

| Valuation assumptions | Lower | Mid | Upper |

| Earnings growth | 5% | 8% | 10% |

| Re-investment rate | 40% | 30% | 20% |

| Price-to-earnings ratio | 15.0 | 17.5 | 20.0 |

| Total return (10Y) | 400% | 648% | 909% |

| Implied compound annual return (10Y) | 17% | 22% | 26% |

Our scenarios assume only modest growth in net income reflecting the slowing user base growth and the uncertainty of the metaverse investment. As a result of the reduced growth assumptions, we have also assumed that the company trades at a future valuation multiple of 12.5x – 17.5x earnings.

Based on the scenarios modeled, investors can expect to achieve an annual compound return of 17% at just 5% net earnings growth, even assuming the company continues to invest 20% of the Family of Apps profits into the metaverse with no return.

Conclusion

The short-term outlook for Meta and its investors is unlikely to be challenging as cyclical pressures and long-term investment continue to be a drag on earnings.

As an investment proposition, Meta is a story of two extremes: a highly-profitable cash generating business, with a loss making and uncertain metaverse vision. However, when you consider that you can get exposure to the potential of the metaverse while also getting the Family of Apps business for just 8 times earnings, its seems like a good “buy” to us.

Be the first to comment