Bet_Noire/iStock via Getty Images

Introduction

I used to be a shareholder of South African gold producer DRDGold (NYSE:DRD) until 2017 and I’ve been closely following the company over the past few months as it’s starting to look increasingly cheap based on fundamentals. My latest article on SA about DRDGold was written in August.

The company recently released its production results for the third quarter of 2022 (or Q1 for FY23), and I think they looked strong considering gold prices are sliding and South Africa is experiencing a challenging period of load shedding. Let’s review.

Overview of the Q3 2022 results

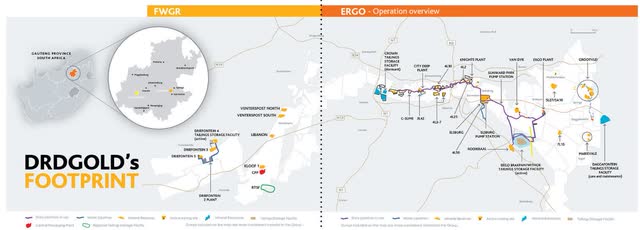

In case you haven’t read any of my previous articles about DRDGold, here’s a quick description of the business. The company owns two tailings retreatment complexes across the vast Witwatersrand Basin, where half of the world’s gold has been mined. Several decades ago, the average gold grades across the globe were much higher which means that the cut-off grades were also higher, and this led to the accumulation of a vast amount of mining waste (or tailings) that was left behind after mines shut down. DRDGold uses large hoses to slurrify slime or sand and then pumps this material through a network of pipes as far as 60 km away for processing in its facilities.

At the moment, the company has an annual production of about 180,000 ounces of gold while its mineral reserves stand 5.35 million ounces of gold, making it the largest gold producer in the world from tailings. The mine life (if you can call it that in this case) is thus over two decades. In my view, the main issue for tailings retreatment businesses is high unit costs as grades are low. However, there is no exploration risk and capital expenses are limited compared to traditional mines.

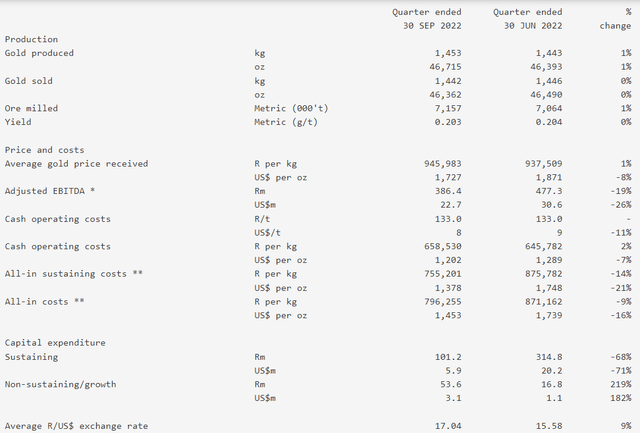

Turning our attention to the Q3 2022 production and financial results, you can see from the table below that gold production rates were stable as they inched up by just 1% quarter on quarter, mainly due to a 1% improvement in tonnage throughput. The yield was only 0.001g/t lower at 0.203g/t, which comes to show how consistent and predictable the production performance tends to be here. All-in costs declined by 14% in rands as a result of lower sustaining capital expenses and the decrease was even higher in US dollars thanks to the weaker rand. However, EBITDA slumped by 26% to $22.7 million due to an 84.7 million rand ($4.7 million) insurance claim recognized in Q2 2022.

Overall, I think it was a solid quarter from both production and financial standpoints despite several days in which there was load shedding announced by national electricity company Eskom. During these periods, DRDGold has to reduce the amount of power it draws from the grid and rely on expensive diesel generators. To avoid this in the future, the company plans to build a 20 MW solar power plant at the Ergo complex. However, I’m skeptical that DRDGold will be able to accomplish this anytime soon despite having the funding as securing permits to build a private power plant in South Africa is challenging. For example, South Africa-focused platinum group metals (PGM) producer Sibanye Stillwater (SBSW), which holds 50.1% of DRDGold, has been trying to build its own solar power plant since at least 2015.

Looking at the balance sheet, cash and cash equivalents decreased by 280.5 million rands ($15.6 million) quarter on quarter to 2.25 billion rands ($125.1 million) as the company paid out a 342.5 million rands ($19.1 million) final dividend during the period. Unfortunately, the cash and cash equivalents that DRDGold keeps are mainly in rands which means that its cash pile is decreasing in dollar terms. This cash pile is likely to diminish in the coming months as the company plans to make capital investments of about 1.4 billion rands ($78 million) in FY23 ending on June 30. However, keep in mind that this sum includes an undisclosed amount for the solar plant.

Looking at the future, DRDGold expects to produce between 160,000 ounces and 180,000 ounces of gold in FY23 at cash operating costs of 685,000 rands (38,180) per kg. Considering the company produced over 46,000 ounces of gold at cash operating costs of just over 685,000 rands per kg in Q1 FY23, the guidance looks easily achievable. Unless gold prices continue to slide, I think it could achieve EBITDA of over $100 million in FY23. This would mean that DRDGold is trading at less than 4x forward EBITDA as of the time of writing. Yes, I know that you shouldn’t look at EBITDA when calculating the value of a mining company, but I think it’s ok in this case as the mine life is over two decades.

Looking at the risks for the bull case, I think that the major one is weaker gold prices over the coming months. The sentiment in the gold sector is quite bearish at the moment as major central banks around the world are raising interest rates at a rapid pace. In addition, gold prices have a negative correlation to the US dollar, and they dipped below $1,700 per ounce near the end of September. Yet, they still remain at pretty high levels compared to the days before the COVID-19 pandemic.

Other near term potential risks that I can think of include a stronger rand, more load shedding from Eskom, and high summer rainfall levels.

Investor takeaway

In my view, DRDGold is a stable and predictable gold company from a production standpoint and has a healthy amount of cash in its coffers at the moment. I think it’s likely that a lot of the FY23 capital expenses could be delayed due to regulatory issues with the solar plant at Ergo.

However, margins could shrink significantly if gold prices continue to decline, and this is why I rate DRDGold as a speculative buy. In my view, the company could weather a long period of low gold prices thanks to its large cash position, but the share price is likely to fall. I think it could be best for risk-averse investors to avoid this stock.

Be the first to comment