DenisTangneyJr/iStock via Getty Images

Banks are Like Thumbprints

No two banks are the same. Each has a unique thumbprint.

Conventional wisdom suggesting “banks benefit from rising interest rates” is generally true but not specifically true for all banks.

In fact, some banks are hurt by rising interest rates.

This article highlights my observations about a Chicagoland bank that appears well-positioned for rising interest rates and higher inflation.

Screen for Banks Benefiting from Rising Rates

Once upon a time banks of all sizes and flavors worked mightily hard to gather deposits. But over the past decade as interest rates fell to zero, too many banks took deposits for granted.

Deposits are now the name of the game. This is especially true of cheap “core” deposits.

It was inevitable. Rates could not stay at zero for ever.

Nonetheless, some banks seem caught unaware, while others, like $6 billion Old Second Bancorp Inc. (NASDAQ:OSBC), are more than ready for rising interest rates and inflation.

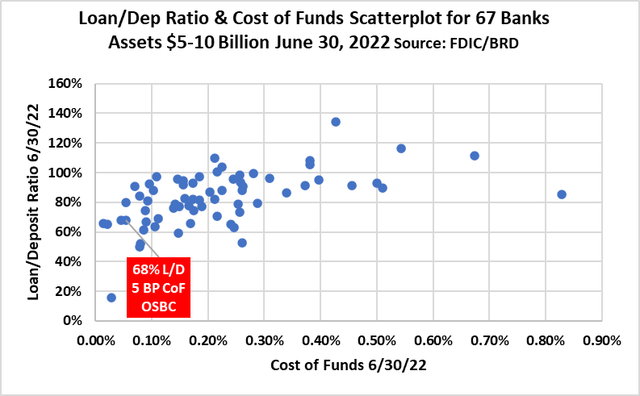

I first identified OSBC from the scatterplot below which examines the Loan-to-Deposit ratio and Cost of Funds for 67 U.S. banks with assets between $5 billion and $10 billion as of June 30.

Based on my 31-year experience as a banker, I know that banks with lower loan-to-deposit ratios, as a general rule, tend to be less vulnerable to rising rates than banks with higher loan-to-deposit ratios.

The scatterplot highlights several banks that have low loan-to-deposit ratios and low cost of funds. OSBC is one of those banks: 68% L/D ratio and 5 basis point (.05%) cost of funds at Q2 quarter end.

10-Q Market and Interest Rate Risk

However, to know for sure that OSBC, or any bank for that matter benefits from rising rates, a bank investor must examine a bank’s most recent 10-Q. Specifically, investors must turn to the section of the 10-Q labeled “Quantitative and Qualitative Disclosures about Market Risk.”

(Footnote: Some banks only report Market/Interest Rate Risk annually in the 10-K)

OSBC’s August 8th 10-Q provides an estimate of the impact higher interest rates will have on the bank’s future net interest income.

(Net Interest Income equals interest revenue from earning assets minus interest expense paid on sources used to fund those earning assets).

OSBC’s estimated benefit from rising rates is bullish: +24.2% ($48 million) annually from an immediate jump in rates of 200 basis points (2%).

|

Analysis of Net Interest Income Sensitivity |

|||

|

Immediate Changes in Rates |

|||

|

(Dollars in thousands) |

0 .5 |

% |

1.0 |

% |

2.0 |

% |

||||||||||||||||||||||||||||||||||||||

|

June 30, 2022 |

||||||||||||||||||||||||||||||||||||||||||||

|

Dollar change |

$ |

12,416 |

$ |

24,720 |

$ |

48,081 |

||||||||||||||||||||||||||||||||||||||

|

Percent change |

6.3 |

% |

12.5 |

% |

24.2 |

% |

||||||||||||||||||||||||||||||||||||||

But Read the Fine Print

Bankers do not have a crystal ball. The estimates provided in the 10-Q include caveats warning investors that the forecast is based on models. Here is the qualifying language from the OSBC 10-Q:

“The amounts and assumptions used in the simulation model should not be viewed as indicative of expected actual results. Actual results will differ from simulated results due to timing, magnitude and frequency of interest rate changes as well as changes in market conditions and management strategies. The above results do not take into account any management action to mitigate potential risk.”

To this point, in early August I spoke to the CEO of one of the banks with great upside from rising rates. He told me that their models are proving to be a work-in-process. Of course, this is no surprise, but investors beware.

Effects of Inflation: “Beneficial to us”

OSBC’s 10-Q offers the bank’s view on inflation-risk. Most banks do not provide this valuable insight to investors. This is an excellent write-up worthy of investor attention. From the 10-Q:

“In management’s opinion, changes in interest rates affect our financial condition to a far greater degree than changes in the inflation rate; however, we monitor both. The annual inflation rate in the U.S. accelerated to 9.1% in June 2022, the highest since December 1981. Management believes the inflation rate will remain elevated in the near term, which is expected to be favorable for the Bank. In general, we anticipate that higher inflation will increase borrowers’ needs for credit as a result of GDP growth. In addition, as interest rates are expected to rise to combat inflation, we also expect our net interest margin to be favorably impacted. The downside risks of high inflation puts upwards pressure to our expenses, which could impact profits. Furthermore, higher costs of living weaken the financial condition of our borrowers which could affect our credit profile. A financial institution’s ability to be relatively unaffected by changes in interest rates is a good indicator of its capability to perform in today’s volatile economic environment. We seek to mitigate the impact of interest rate volatility on the Bank by seeking to ensure that rate sensitive assets and rate sensitive liabilities respond to changes in interest rates in a similar time frame and to a similar degree. Overall, we expect the effects of higher inflation to be beneficial to us in the near term.”

In early August I spoke to the CEO of a bank well-positioned to benefit from rising rates. During this conversation, he noted that deposit costs and loan yields were not quite matching their forecasts. Much of the challenge was on the yield side where intense competition for earning assets has meant pressure on pricing.

But are the Insiders Buying?

Not all investors agree with me, but I place a great deal of emphasis in my bank equity selection on insider buying/selling. I love seeing an informed insider make a big bullish buy when their stock and the industry seem troubled. This is when real money can be made.

For that reason, I am constantly monitoring insider buying among bank insiders, especially CEOs and CFOs whose performance as investors appears from my data to be superior to other investors.

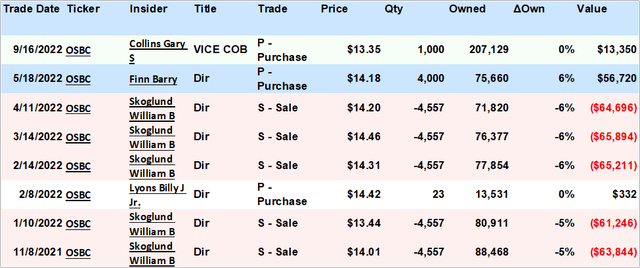

Here is a view of the insider buys and sales for OSBC during the past year.

Note that the vice chair picked up 1,000 shares at $13.36 on September 16. The one other insider buy was in May, 4,000 shares at $14.18.

Offsetting the two buys are five sales by one director. When I see this kind of sales activity, I try to dig into the details as provided in a bank’s Proxy Statement.

OSBC’s April Proxy informs investors that Mr. Skoglund is the bank’s chairman, as well as former long-time CEO. It also tells us he is 71-years of age and has been on the board for 30 years.

While I generally hate seeing insiders sell, especially someone with the clear-cut banking expertise that Mr. Skoglund no doubt has, I also recognize that at some point in a banker’s career that prudent risk management dictates a need to diversify personal investment holdings.

Insider Buys/Sales OSBC (Openinsider.com)

What I Like about OSBC

Bank is 150 Years Old

The bank was founded in 1871. Visit the bank’s website and you will find on the “front page” a link to a video of the bank’s history.

A 150-year history suggests management and directors recognize a responsibility to protect and preserve the bank’s rich legacy.

It also suggests that OSBC intends to not sell. I definitely prefer to own community banks that think decades, not quarters.

Board of Directors: Owners and Banking Expertise

- OSBC may have the most qualified banking experts of any bank board I have come across.

- I like the composition: Seven directors are real bankers with significant experience. Another director spent 30 years at the OCC. Several of the bankers serve on the Risk and Loan committees.

- The size of the board (15 directors) is bigger than I prefer to see as large boards can be unwieldly. It also can be associated with weak governance. I doubt this concern is true for OSBC.

- The directors own 5.5% of OSBC. That’s a decent percentage. Only one director has >$5 million in OSBC shares; this director’s shares were acquired last year when his bank was bought by OSBC. Ten directors own at least $1 million in shares; that’s an impressive number compared to most community banks.

Expense Discipline

I expect massive and rapid consolidation among banks over the next decade.

Banks that will emerge as successful consolidators must be able to create shareholder value (return profits greater than cost of capital). In practice, good acquirers buy banks at a fair price (not overpaying which is a serious problem for most acquiring banks) and drive out expenses in a disciplined manner that does not impede revenue growth.

There is evidence that OSBC is proving to be a good acquirer per its most recent FDIC Call Report:

- Headcount 830 FTE from 891 YE 2021

- Branch count from 69 to 54

Loan Mix

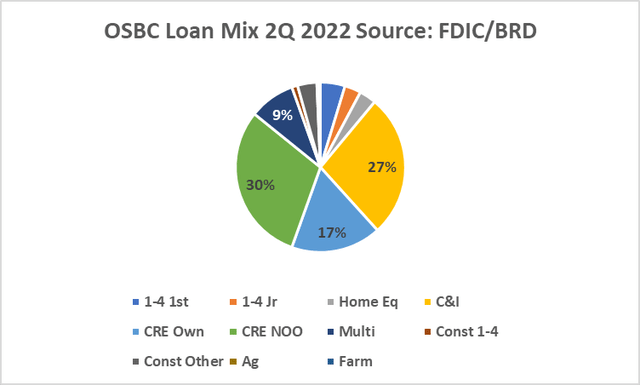

Anyone who has read my 2016 book on bank investing knows that I favor banks with a commercial and industrial (C&I) lending focus and disfavor banks engaged mostly in 1-4 family lending.

As the pie chart below shows, OSBC is primarily a commercial lender. I like the 27% C&I exposure and 17% exposure to owner-occupied commercial real estate. Add in the 9% exposure to multi-family, and we see that OSBC has >50% exposure to three loan categories with attractive risk-return histories.

I also view the bank’s low exposure to 1-4 family loans (first home mortgages 5% and junior lien home mortgages 3%) as a big positive.

Loan Mix OSBC 2Q 2022 (FDIC/BRD)

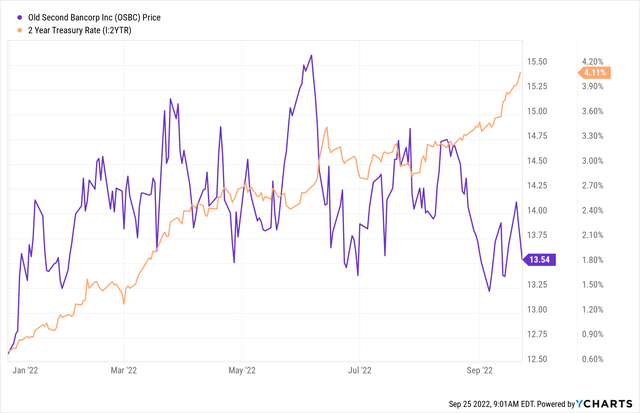

Stock Price Not (Yet) Linked to Pop in Treasury Rates

This next chart is important as it may indicate that the bank’s stock price has remained flat to declining (like almost all banks) during the past couple of months even as interest rates stepped up meaningfully. This may indicate that the market has not recognized the benefit rising rates will have on OSBC’s future income.

That said, the “market” rarely misses something so obvious. Something else may be going on.

OSBC Stock and 2 Yr. Treasury (Ycharts)

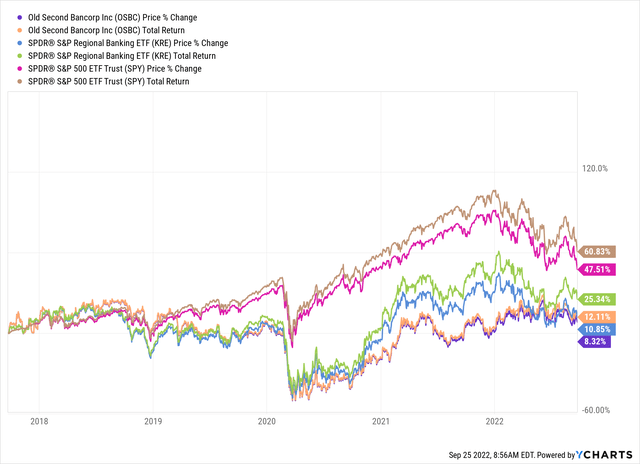

Here is another view of OSBC’s share price and total return over the past three years. It is pretty amazing to me that OSBC’s share price has barely been able to keep track with the SPDR S&P Regional Banking ETF (KRE) since OSBC, all things being equal, is much better positioned to rising rates than the industry as a whole.

Stock Price, Total Return Banks, S&P 500 (Ycharts)

Watch Items/Concerns

I have four material watch items.

Chicagoland Banking and Community Bank Profitability

My research (see 2016 book as well as subsequent studies) shows that community banks located in the nation’s most competitive urban MSAs (Metropolitan Statistical Areas), underperform community banks located in smaller urban MSAs and rural markets.

To that point, Chicago, LA, and NYC are the three most difficult markets, based on my research, for community banks to earn returns greater than the cost of capital.

The “market” has finally realized this fact, and as a result, community bank consolidation has accelerated in these markets. OSBC appears to be one of the few larger community banks in the nation’s most urban markets capable of navigating this paradigm. Having an astute board of directors with real world banking experience is essential for long-term community bank profitability.

With that so said, I am not averse to owning a Chicagoland bank. I was an investor in PrivateBank, a wonderful commercial lender based in Chicago that sold (sadly) to Canadian Imperial Bank of Commerce (CM) in 2016-17. PrivateBank is a great model for OSBC, though I see OSBC as more deliberate and cautious about growth, which is not necessarily a bad thing.

Risk-Adjusted Return on Equity: Fails to Meet Bar

My writing for Seeking Alpha is clear: I prefer to own banks with superior Risk-Adjusted Returns on Equity.

OSBC does not fit this bill. At least not yet. There is evidence that the bank is on the path to 10%+ RAROE, but the historic record shows that the bank struggled with credit issues a decade ago.

OSBC needs to prove its credit skills during the next downturn in the economy.

Questions about the State of Illinois, City of Chicago

Illinois is a high-tax state. OSBC (and other banks domiciled in Illinois) have tax rates among the highest in the country (~26-27). The state’s economic challenges (especially unfunded pension liabilities) are well-documented. I am concerned that imprudent politicians may try to increase corporate taxes in order to solve their many problems.

Chicago’s crime epidemic is worrisome. When the CEO of Chicago-based McDonald’s Corporation (MCD) recently expressed concerns about crime, city politicians pushed back, suggesting they are not serious about addressing a quality-of-life issue that appears to be front-burner for not only corporate CEOs but well-heeled taxpayers.

Will Illinois, and Chicago in particular, continue to see an exodus of well-paying jobs? If so, how does this risk impact OSBC short-term and especially long-term?

Prudent Acquisitions

OSBC appears to be on the constant hunt for acquisitions. My research indicates that most acquiring banks under-perform non-acquiring banks over a three-year period subsequent to an acquisition. The main reasons banks underperform are:

- Over-estimate projected revenue from acquired bank as well as revenue growth within its own legacy business.

- They overpay for acquisitions, not fully cognizant of the first fact.

- On the other hand, rarely does an acquirer fail to meet expense targets. On the surface, that’s great. But too often the acquirer is so focused on expense cuts that they take their eyes off of customers, particularly the most profitable ones who are actively prospected by competitors.

Closing Thoughts

OSBC is on my radar, but I am not ready to buy shares.

Here’s what I am looking for before buying:

- Evidence that the S&P 500’s recent swoon shows some evidence of slowing if not flattening.

- More insider buying.

- 3Q earnings report (October) showing evidence that net interest income improved directionally in line with the 10-Q forecast estimate.

- I am still sifting through analyses of other community banks in search of investments that meet all my criteria. A couple other Midwest community banks appear to be as or more attractive than OSBC.

- As a rule, before I invest in a community or regional bank, I like to personally know management. At this stage, I do not know anyone at OSBC, and if I were to proceed to a more complete due diligence on the bank, I would reach out to the bank’s leadership for a discussion about my concerns.

- Valuing OSBC is not easy given its history of acquisitions which result in material one-time expenses that cloud core earnings analysis. The bank’s current Price to Tangible Book is generally in line with history, suggesting shares are not cheap. Offsetting this concern is the likelihood that earnings improve materially with the rate bump.

- The dividend is not especially attractive at 1.45%. It appears the board is preserving capital for acquisitions.

- I prefer to own banks that buy back shares; OSBC is not in this mode given its apparent preference to use capital for acquisitions.

Caveat

All investors must determine their risk profile before investing. All investors must perform their own due diligence before investing by reading articles like this one as well as examining SEC filings, bank earnings reports, and quarterly transcripts of earnings calls.

Be the first to comment