ogichobanov

Investment Thesis

Vermilion (NYSE:VET) reports Q3 results that were a disappointment to me. Perhaps, the most pressing issue is that Vermilion didn’t return much capital to shareholders. And looking to Q4, buybacks are suspended.

Slightly more pressing, but nevertheless vexing, Vermilion’s acquisition of Corrib gets pushed back into 2023.

That’s the bad news. Bad news at a time, when investors are already skittish. But there are a lot of positive considerations too.

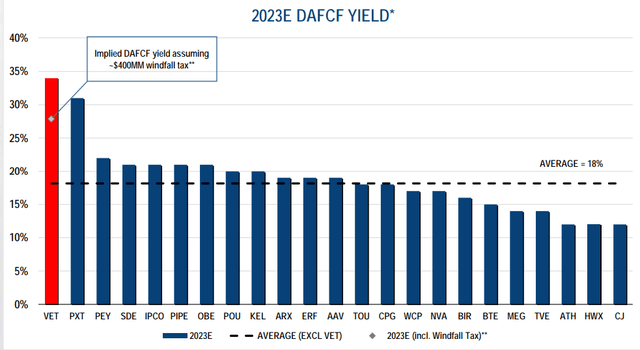

Asides from its very cheap valuation, investors have finally been given a figure to work off. Vermilion EU Windfall tax will be as much as $350 million in 2022 and $400 million in 2023.

For some investors, the EU Windfall tax is a setback. While for others, it’s the clarity that they needed.

We have a lot to get through, so let’s get to it.

What’s Happening Right Now?

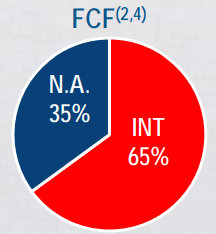

Approximately two-thirds of Vermilion’s business comes from International sources.

VET Q3 2022

That means that whatever happens in Europe, with respect to windfall taxes, will have an impact on the valuation that investors are willing to pay for the stock.

Indeed, anyone that has followed Vermilion knows that part of the reason why this stock hasn’t seen a commensurate multiple with other North American natural gas players has been this uncertainty around how much of an impact would Europe’s windfall tax have on the company.

Now, we finally get a figure. Vermilion’s exposure to the EU windfall tax could be in the range of CAD $250 to CAD $350 million for 2022. Let’s just say, it’s a CAD $350 million impact to free cash flow in 2022.

And then, looking ahead, Vermilion believes that next year, the windfall tax would be around CAD $400 million.

Including the windfall tax in 2023, Vermilion could make approximately CAD $1.5 billion.

Could 2023 Be Better for Vermilion?

Is there a likelihood that 2023 could be even better for Vermilion? Why? Two reasons, natural gas prices and hedges.

Whether or not natural gas prices, in winter 2023, end up higher or not is anyone’s guess.

Some could point to more ”normal” and cooler 2023 winter. As well as noting that Russia would not be refilling Nord Stream 1 anytime soon.

While others could remark that the Freeport LNG facility should be back up and running, and adding more natural gas supply to Europe.

For my part, I am agnostic. I know enough to know that I don’t know.

But what I do know is this:

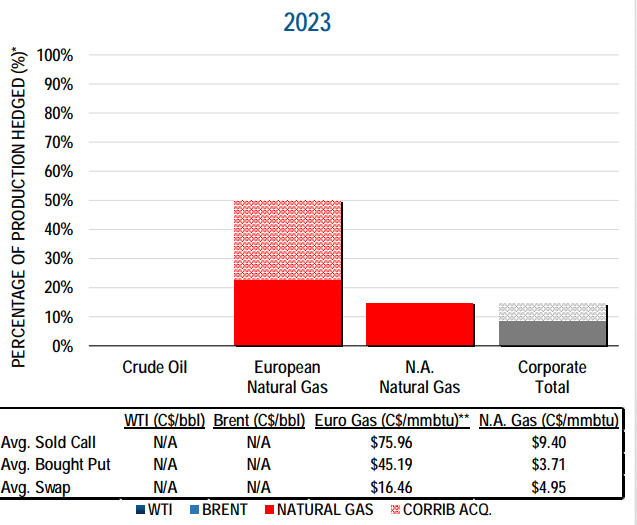

VET Q3 2023

Vermilion’s European natural gas for 2023 is only 50% hedged. That means that 50% is unhedged. And if one were to believe that natural gas prices stay around CAD $40, that would mean that Vermilion would do just as well in 2023 as in 2022.

And the longer Vermilion can earn approximately CAD $1.5 billion in free cash flow per year, the better the risk-reward will be for shareholders.

Capital Returns Take a Pause

The majority of Q3 2022 free cash was allocated to debt reduction, with 26% of its free cash flow returning to shareholders via share repurchase and dividends.

Put another way, Vermilion’s total shareholder return in Q3 was CAD $85 million, for a company with a market cap of CAD $5 billion, this annualizes at a 6.9% total yield.

However, looking ahead, Vermilion has suspended its share repurchase program, as it shores up its balance sheet to allocate capital to the EU windfall tax.

VET Stock Valuation – Approximately 3x Free Cash Flow

There are a lot of assumptions here. We have no idea what the impact of inflation will have on Vermilion’s cost basis in 2023. We also have no idea as to the sustainability of European natural gas prices.

Anyone that is able to speak with confidence about 2023 is speaking their book.

That being said, I’m inclined to believe that when all is said and done, paying 3x next year’s free cash flow is cheap enough.

The Bottom Line

The way I see it is this. If someone buys Vermilion today, they are essentially saying that they presume that over the next 3 years, an investment in this company pays for itself.

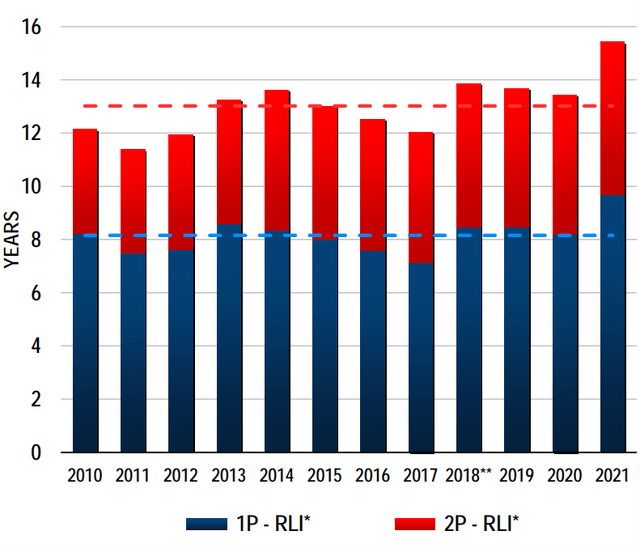

As you can see here, Vermilion has more than 9 years of premium, 1P reserves, and just over 5 years of 2P reserves. As a reminder, 1P reserves mean reserves that are proved. 2P reserves mean probable reserves.

Put another way, investors are paying for 3x years’ worth of reserves, and there are still a further 6 years left in the tank, coming totally for free. And on top of that, there’s a substantial likelihood that Vermilion could make further acquisitions such as Corrib. There’s a lot to like here. Whatever you decide, good luck.

Be the first to comment