onurdongel

(Note: This article was in the newsletter on July 29, 2022.)

Antero Resources (NYSE:AR) has long gotten better prices for its natural gas than have many operators in the basin. That may change in the future as some copy the successful strategy. But for the time being, this company is a selling price leader. This management has shown time and again that a company can sell prices for more than the hedging assumption prices to maintain a premium to many basin producers. Then when the hedges settle, management still has a higher average selling price than would be the case had the gas been sold in the hedging area. While this management makes the process look easy, the fact is that few companies in the industry sell their commodity products anywhere except where they have hedged. That superior execution earns shareholders a few extra pennies on the sales dollar to make for an above average profitability cycle.

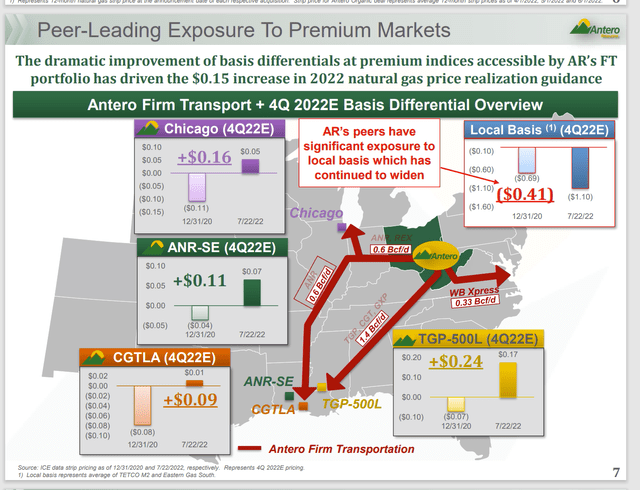

Antero Resources Map Of Sales Locations (Antero Resources Second Quarter 2022, Earnings Conference Call Slides.)

A logical assumption for any producer is to sell the production near where you produce it (or at least where “everyone” else does). This management “goes the extra mile” to hedge and then actually sell for a better price than is assumed by the hedges. The results are particularly dramatic from the winter storms a couple of years back. But this management posts less dramatic results year in and year out.

The result is not only an uplift in the selling price from the natural gas quality, but also an uplift in price because the production is sold to stronger markets. Now that may mean higher transportation costs than some of the competitors. But management is not going to incur those higher transportation costs unless the selling price more than offsets that higher cost.

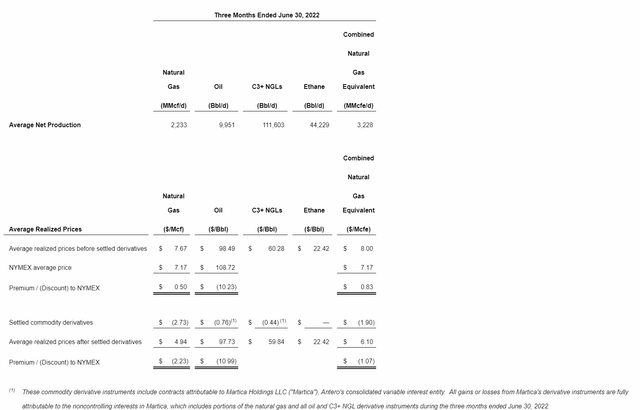

Antero Resources Selling Price Summary (Antero Resources Second Quarter 2022, Earnings Press Release)

The result of the selling price strategy is a natural gas average selling price that is higher than the NYMEX average price upon which hedges are settled. The derivatives clearly cost because natural gas prices have been unexpectedly strong. But the selling price strategy did partially offset that effect as shown above. In an industry where “every penny counts”, the selling price strategy was clearly worth more than a few pennies.

The strong market also makes it worthwhile for the company to pull some products out of the natural gas stream as shown above. Some of those products, like ethane, are part of the natural gas sold by many competitors. But ethane is a major raw material for the very fast-growing plastics market.

Management did mention that the Shell (SHEL) cracker will open a little later than expected. At that time, considerably more ethane will be sold to the cracker in the future to add still more profitability.

Commodity Prices

The strong commodity prices are likely to prevail for some time to come. The long-term reason would be that the United States is joining the considerably stronger world pricing market as the ability to export natural gas expands. In the short-term, a La Nina summer is definitely keeping prices high.

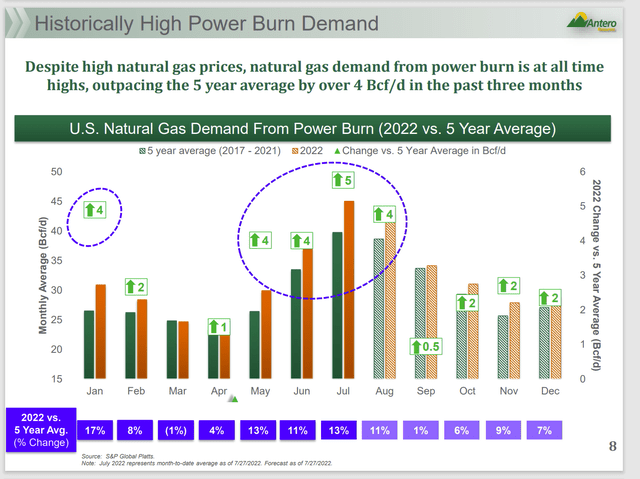

Antero Resources Presentation Of Natural Gas Use By Utilities (Antero Resources Second Quarter 2022, Earnings Conference Call Slides.)

There was some worry about a small amount of capacity going off-line that would lower natural gas prices in North America. But the big picture is that small setbacks are often offset elsewhere. In this case power companies have long converted to natural gas for obvious reasons. A La Nina summer that is living up to its hot reputation is providing a place for any potential excess natural gas to go (plus probably more than the excess assumed by the market).

Now the market is realizing that natural gas supplies are likely to remain tight thanks to the weather. Those prices are now rebounding. Seasonally, natural gas prices may decline somewhat before the heating season begins. But the long-term selling point of natural gas being a cheaper (less polluting) alternative makes for a built-in demand of considerable natural gas use that really will not be going anywhere in-spite of higher prices.

Financial Strength

This company has a very long history of debt rating upgrades while avoiding downgrades during industry recessions.

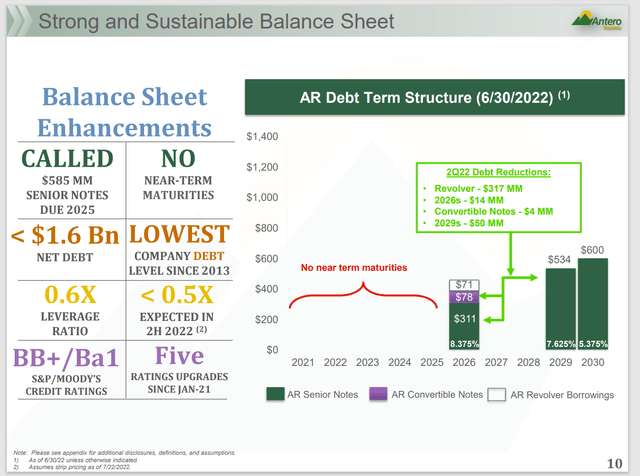

Antero Resources Debt Ratings And Debt Duration Profile (Antero Resources Second Quarter 2022, Earnings Conference Call Slides.)

Management is inching closer to the long-term goal of investment grade. The financial debt outstanding profile shown above is far more conventional than was the case in the past. The leverage ratio has come way down from the initial “going public” measure.

Management will now work to assure that the debt ratio remains conservative at far lower commodity prices than is the case at the present time. At the current rate of improvement, the company should achieve an investment grade debt rating within the next two years (unless commodity prices collapse).

Debt is now low enough that management can likely call some of the more expensive debt and then pay down the revolver. Banks love to lend money to companies that do not need the loan. This company is fast approaching that category because debt is now rapidly being repaid.

The Future for Antero Resources

The company is not planning a lot of production growth for the time being. However, there were some acquisitions of small holdings made. To the extent that these small acquisitions represent an increase in working interests of producing wells, the acquisitions could potentially augment the low production growth.

The company appears to be entering a mature phase where production growth will be in the low to mid-single digits. For the time being, the high commodity prices and the growing ethane market represent areas where income growth will likely outpace top line growth. An immediate profit improvement will happen as the Shell ethane cracker begins operations and then ramps up. Longer term, management will need to find more customers like the Shell cracker. That is highly likely because crackers supply the raw materials for plastics.

Management has set up the company to maximize the profitability advantage through better selling prices than many competitors. Despite the lack of production growth, the enhanced profitability that is likely to happen from selling more ethane from the natural gas stream along with the increasing ability to export natural gas appear to provide considerable profit growth for the next few years.

The Marcellus has really not consolidated into fewer but larger players the way that several other basins have. There is a possibility that this company will be sold at some point to a larger competitor for a good price. The excellent selling price strategy would make this company very attractive to an acquirer.

Be the first to comment