JackF/iStock via Getty Images

A Quick Take On Olaplex Holdings

Olaplex Holdings (NASDAQ:OLPX) went public in September 2021, raising approximately $1.55 billion in gross proceeds from an IPO that priced at $21.00 per share.

The firm sells a family of hair care and repair products to consumers via an omnichannel approach.

OLPX has been a strong performer and the stock has been unduly punished by the market.

So, my outlook on OLPX is a Buy at its current price of around $9.20 per share.

Olaplex Overview

Santa Barbara, California-based Olaplex was founded to develop hair care products that repair damaged hair through professional hairstylists or for at-home use.

Management is headed by president and CEO JuE Wong, who has been with the firm since January 2020 and was previously CEO of Moroccanoil and president of Elizabeth Arden.

The firm pursues customers via an omni-channel approach through professional stylists, specialty retailers and direct-to-consumer [DTC].

Market & Competition

According to a 2018 market research report by Grand View Research, the global hair care market is expected to grow to $211 billion by 2025.

The main drivers for this expected growth are a growing demand for colored hair products and rising hair-related challenges.

Also, a growing number of independent hair salon services globally along with increased grooming interest by male consumers will add to demand.

Major competitive or other industry participants include:

-

Henkel AG

-

Kao Corporation

-

L’Oreal S.A.

-

Unilever

- K-18

Recent Financial Performance

-

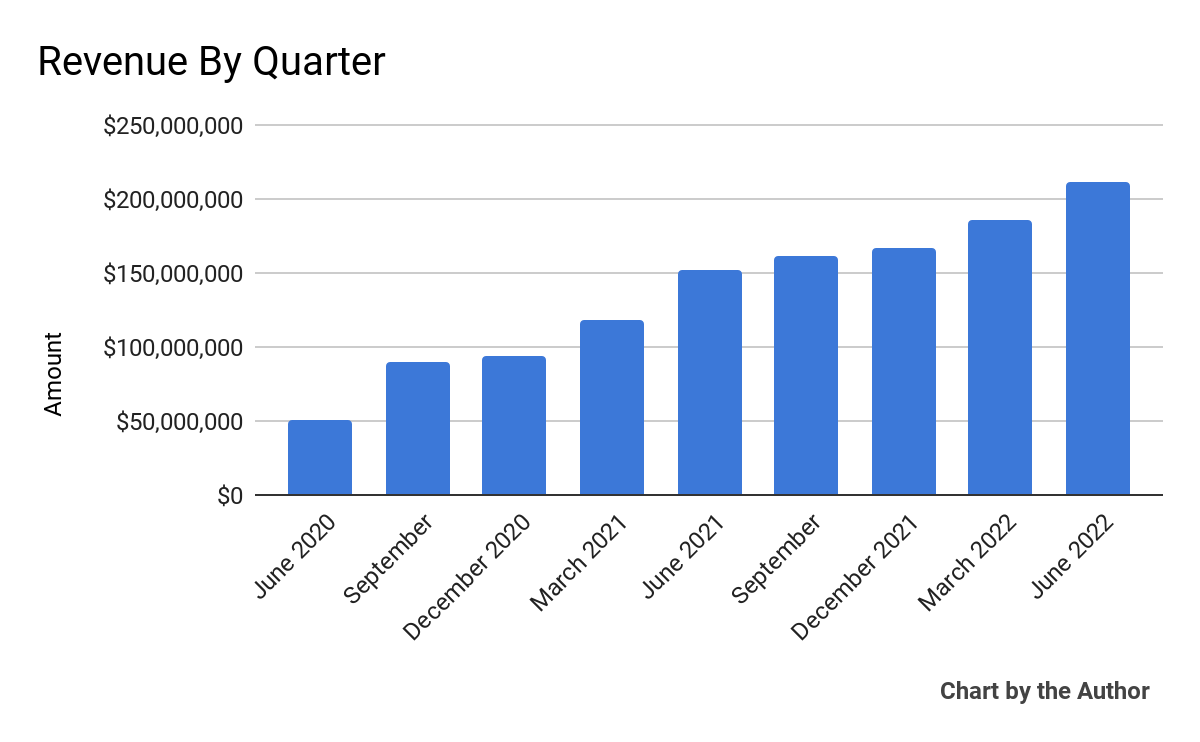

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

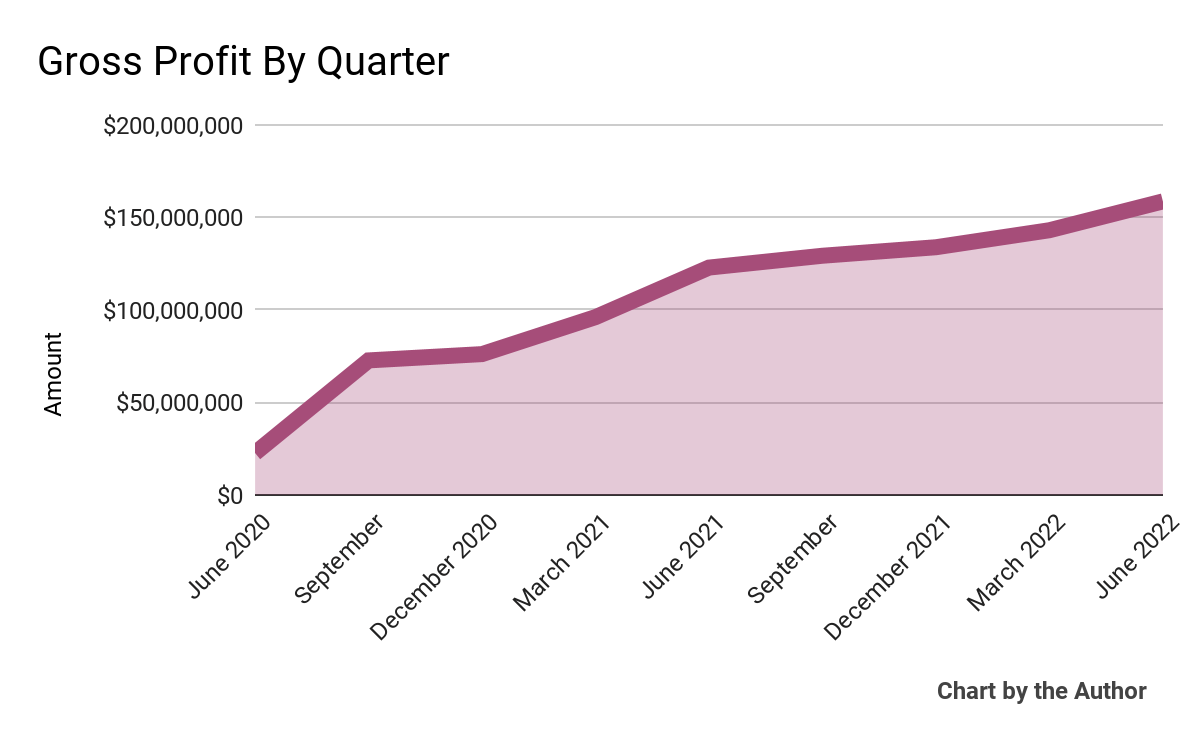

Gross profit by quarter has also grown substantially in recent quarters:

9 Quarter Gross Profit (Seeking Alpha)

-

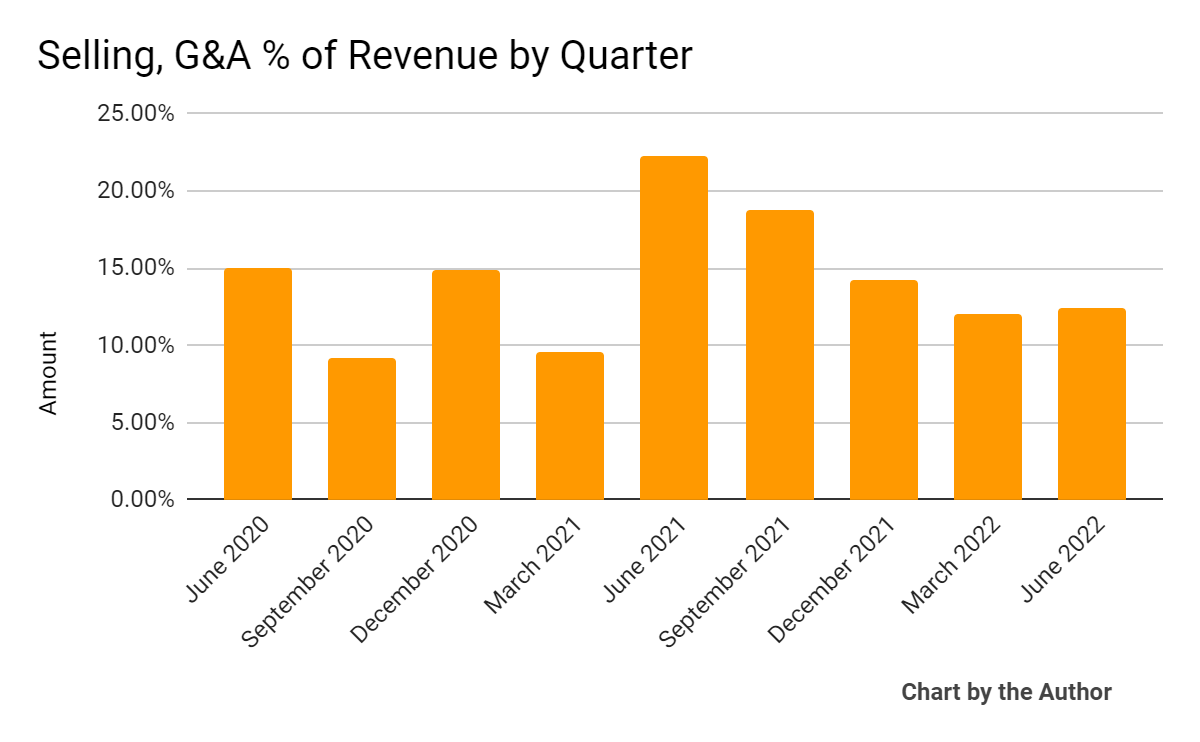

Selling, G&A expenses as a percentage of total revenue by quarter have followed the trajectory shown below:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

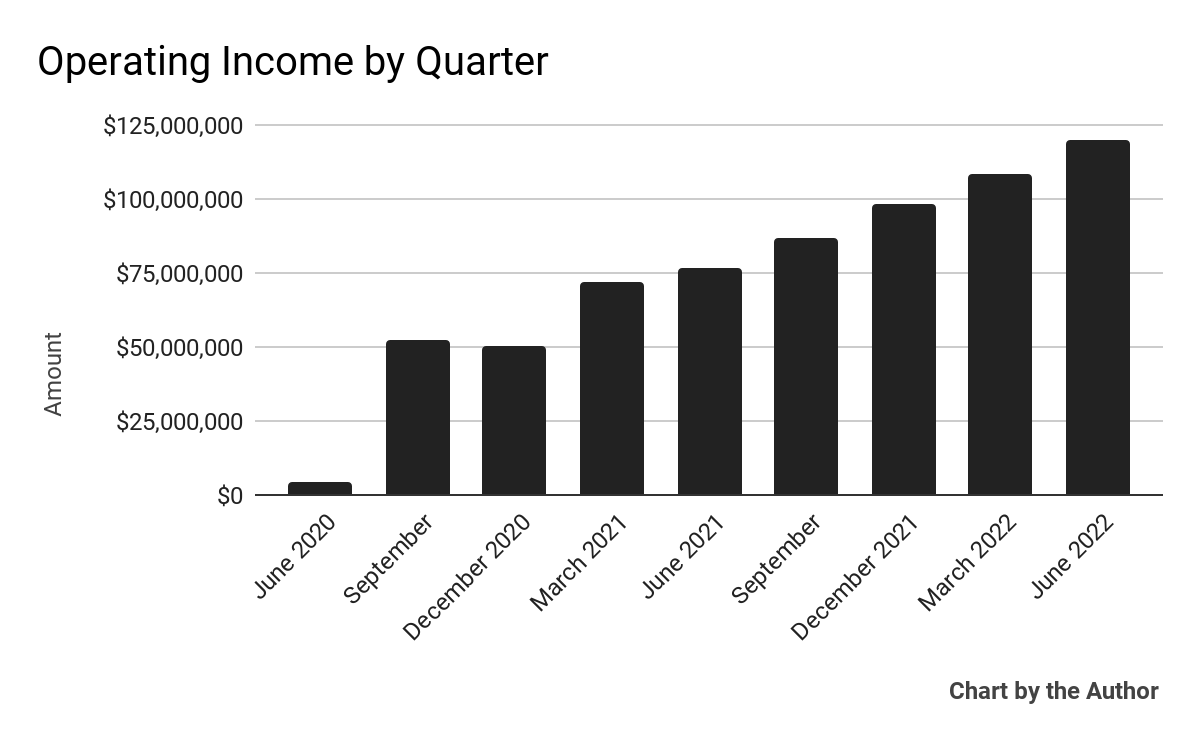

Operating income by quarter has risen markedly:

9 Quarter Operating Income (Seeking Alpha)

-

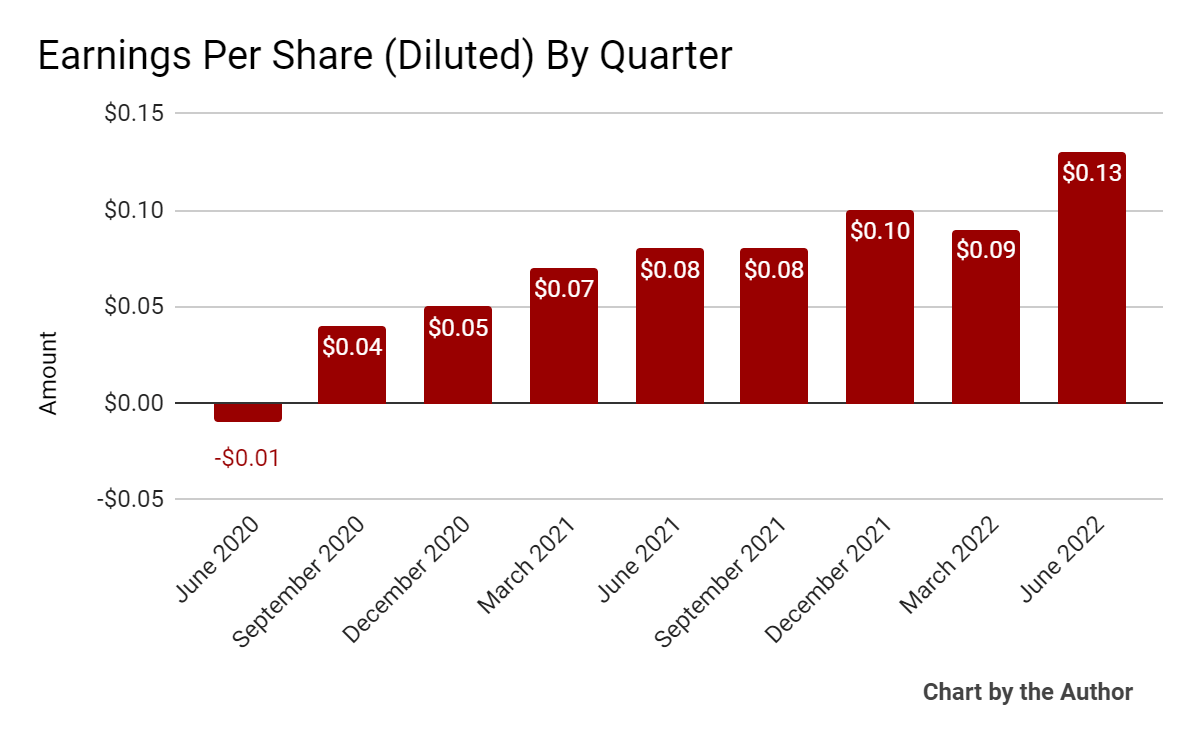

Earnings per share (Diluted) have grown as follows:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

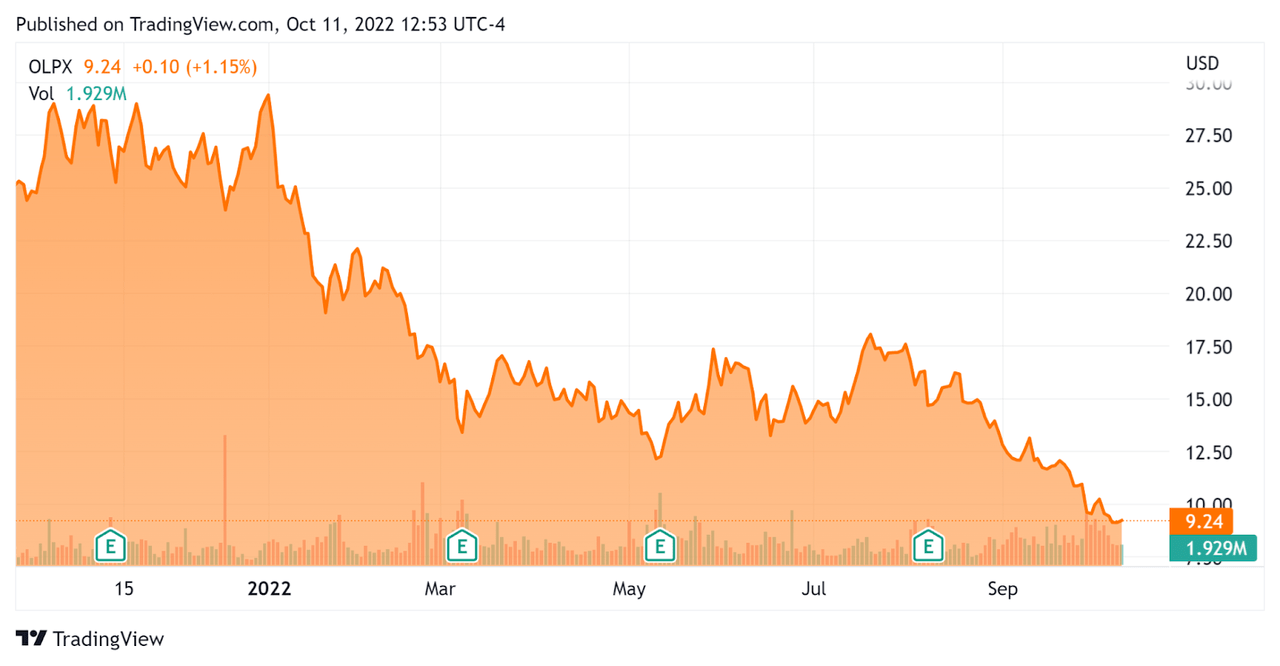

Since its IPO, OLPX’s stock price has fallen 62.9% vs. the U.S. S&P 500 index’ drop of around 16.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Olaplex

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

8.82 |

|

Revenue Growth Rate |

60.1% |

|

Net Income Margin |

38.0% |

|

GAAP EBITDA % |

63.8% |

|

Market Capitalization |

$5,930,000,000 |

|

Enterprise Value |

$6,400,000,000 |

|

Operating Cash Flow |

$253,130,000 |

|

Earnings Per Share (Fully Diluted) |

$0.40 |

(Source – Seeking Alpha)

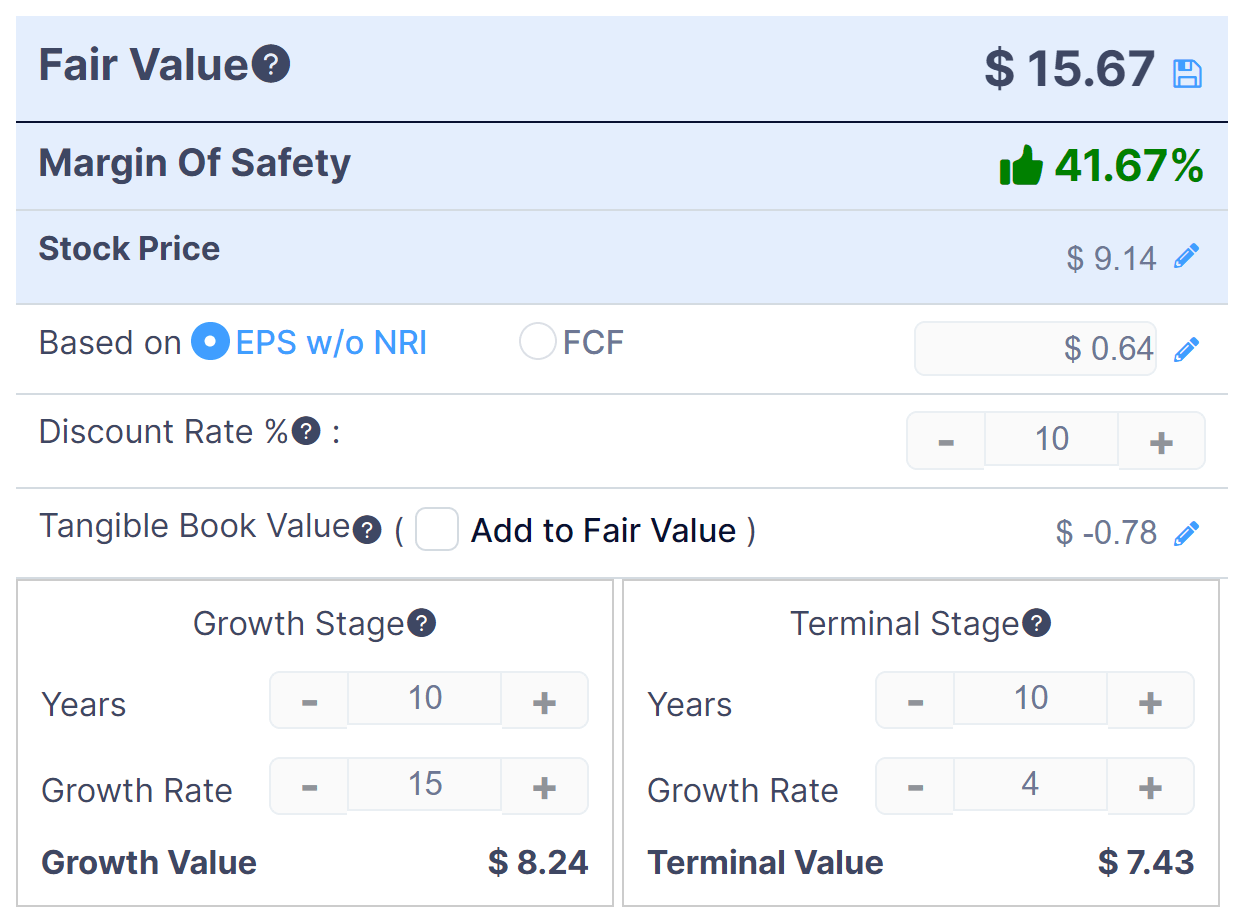

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Olaplex DCF (GuruFocus)

Assuming very conservative DCF parameters, the firm’s shares would be valued at approximately $15.67 versus the current price of $9.14, indicating they are potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On Olaplex

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the broad-based growth of its sales, ‘across products, channels, and geographies.’

The company’s products are aimed at prestige hair care professionals & consumers and management believes its products are recession-resilient as consumers continue to prioritize their personal well-being, ‘even during uncertain times.’

Additionally, the firm has plans to expand its portfolio through future product launches and to grow its distribution internationally, although ex-US economic weakness may be more pronounced as the US dollar increases in strength due to recent interest rate increases.

As to its financial results, net sales rose 38.6% and the firm instituted some price increases, likely due to inflationary cost pressures.

Notably, specialty retail sales increased 68.5% powering growth, while direct-to-consumer [DTC] sales rose 19.3%, in line with expectations.

Adjusted gross profit margin dropped 5.5% year-over-year due to increasing transportation and input costs as well as a change in channel mix.

Adjusted SG&A expenses rose 42.1% year-over-year due to higher sales & marketing costs and increases in headcount.

Inventory rose substantially year-over-year as management sought to maintain higher inventory due to supply chain uncertainties, a common condition now in product-heavy companies like OLPX.

In general, analysts are concerned about the inventory overhang from this build up, just as consumers are starting to pull back their purchases, which may lead to markdown pressures by companies.

However, management says it remains ‘comfortable with our inventory position and our ability to meet future demand.’

The company finished the quarter with $198 million in cash and equivalents and long-term debt of $657 million.

Over the trailing twelve months, free cash flow was an impressive $252.2 million, with $0.9 million in CapEx.

Looking ahead, management reiterated its full year guidance for revenue growth of 36% at the midpoint of the range and an increase in adjusted EBITDA (usually excludes stock-based compensation) growth of 26%.

Regarding valuation, my forward discounted cash flow analysis, with conservative growth estimates, indicates the stock may be materially undervalued at its current level.

The primary risk to the company’s outlook is a slowing macroeconomic environment which may lead consumers to substitute lower cost hair care for premium products like those produced by Olaplex, although management says it hasn’t seen this substitution behavior yet.

A potential upside catalyst to the stock could include a ‘short and shallow’ US downturn as the labor market remains robust despite interest rate hikes.

Although OLPX is exposed to consumer substitution behavior and analysts on the recent conference call pointed to this worry, so far the company’s financial results appear to be weathering the current environment well.

In my view, OLPX is a strong performer and the stock has been unduly punished by the market.

So, my outlook on OLPX is a Buy at its current price of around $9.20 per share.

Be the first to comment