Sundry Photography

Thesis

Okta, Inc. (NASDAQ:OKTA) is slated to report its FQ2’23 earnings release on August 31, as investors parse the continued recovery in its growth cadence since its security incident in early 2022.

We have been negative over OKTA’s valuations in our previous articles, as we were concerned with its unprofitability. Furthermore, we wanted to see a more robust stabilization in its buying momentum to suggest that it has bottomed out decisively.

Our analysis suggests that OKTA has likely formed its long-term bottom in May/June, in line with the recent bottom in growth stocks. We also revised our valuation parameters to factor in the bottom. We are also confident that OKTA could outperform the market if it is willing to re-rate it based on more aggressive growth assumptions.

Investors should also expect Okta to continue gaining leverage through FY26 (quarter ending January 2026), which should undergird the recovery in its buying sentiments.

Therefore, we revise our rating on OKTA from Sell to Speculative Buy.

Okta Needs To Grow Rapidly To Justify Its Growth Premium

Okta has continued its remarkable momentum (albeit unprofitable growth) in FQ1, as it posted organic revenue growth of 39% (excluding Auth0). Management has maintained that Okta is still very early in its TAM expansion, as it continues to be the pure-play leader in cloud security focused on identity solutions.

Therefore, management is confident it’s well-primed to compete against software behemoth Microsoft’s (MSFT) closed-ecosystem. CEO Todd McKinnon highlighted:

Microsoft probably has the most focus of the big platforms. And when someone chooses between Microsoft and something like Okta, they’re really making a choice between do they want independence and neutrality and do they want the technical choice with Okta or do they want to be constrained into the Microsoft ecosystem. And we think our strategy is right. We think our strategy is to be the neutral player and connect everything and have the best solutions across all of the identity use cases. (Okta FQ1’23 earnings call)

We think it’s important for investors to recognize that Microsoft’s challenge remains formidable, which was also highlighted by an analyst on the call. We saw in its recent FQ4 earnings card that most of its business segments are performing well (less the advertising ones and consumer-oriented ones) despite the macro headwinds. For example, its security business grew by 40% YoY, indicating that enterprise customers continue to put their faith in its closed ecosystem. Microsoft also highlighted that it’s still gaining market share, proving the resilience of its product suites.

Hence, investors must pay close attention to Okta’s growth cadence, given its growth premium. The company needs to continue demonstrating robust growth momentum to justify its valuation.

The Market Is Looking Past Its Current Struggles

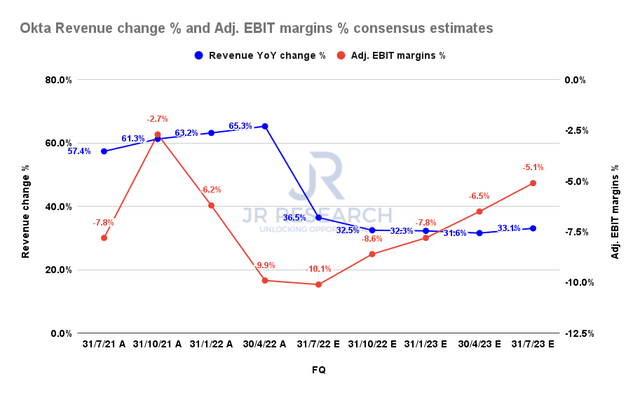

Okta revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that Okta’s adjusted EBIT margins could continue to improve as it scales. Okta would lap its Auth0’s integration from FQ2, and investors should expect to see a cliff over its revenue growth.

However, we believe the 30%+ revenue growth rates suggest that the company is still expected to execute well, despite the competitive headwinds against Microsoft. Furthermore, the company’s strong guidance indicates that its customers remain confident and assured of the company’s remediation efforts over its previous security incident. Hence, we are satisfied that the Street’s estimates are credible.

Is OKTA Stock A Buy, Sell, Or Hold?

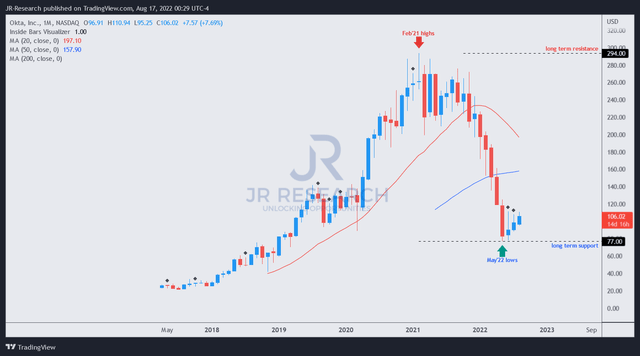

OKTA price chart (monthly) (TradingView)

As seen above, OKTA formed its long-term bottom in May/June and has attempted to recover from its basing action. We are confident that its price action suggests that OKTA is unlikely to breach its May lows moving forward as growth stocks recover from their battering.

Furthermore, the steep fall from Okta’s all-time highs in February 2021 looks to have been fully digested. The market looks ahead to a sustained topline growth through FY23, with improved profitability metrics.

As such, we revise our rating on OKTA from Sell to Speculative Buy, with a medium-term price target of $130, implying a potential upside of 22.6%.

Be the first to comment