Alex Kochev

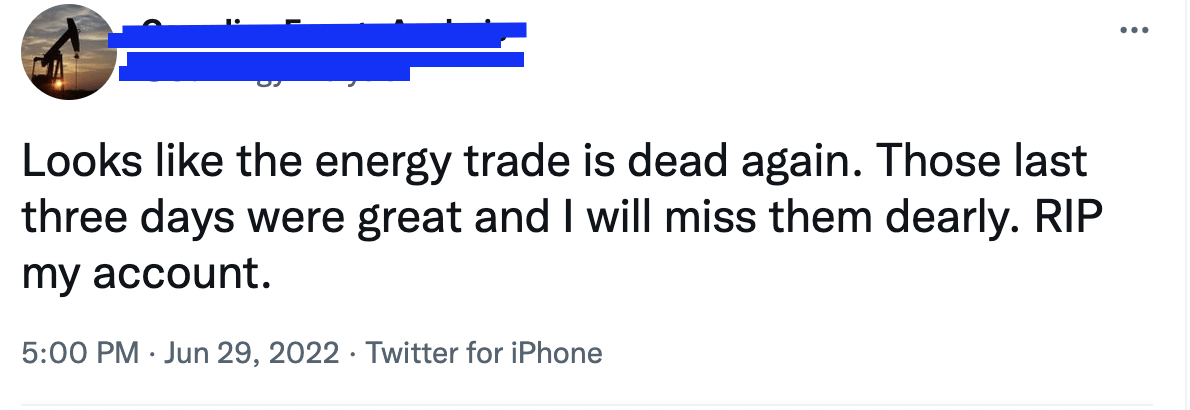

Recently on Twitter (TWTR), influencers announced the “death” of oil, after WTI crude prices experienced a bit of volatility. Posts ranged from bears declaring victory to bulls bewailing their losses. The post below accurately represents the mood on “Fintwit” the day oil hit $95.

Oil bull bemoaning losses (Twitter)

Evidently the bear market of 2022 has got investors feeling antsy–or in the case of shorts, euphoric. With the most profitable trade of 2022 faltering, people are increasingly getting worried. Dedicated oil bulls are concerned that their favorite investments are “dead,” while investors in general are losing faith that there are any opportunities in today’s market.

No doubt, the last few weeks’ price movements have been bad for oil stocks. Over the last month, the Energy Sector Select SPDR ETF (XLE) has fallen 18%. Some individual stocks have fallen more. If you’re a short term investor who bought the top, you’re hurting. But if we look at things from a long term perspective, we see that the oil trade is still good. The main factor taming the price of oil is Biden’s SPR release, and that’s scheduled to end in the fall. Once the release ends, prices could start climbing again.

And even if prices don’t climb that much, oil stocks could perform well. The bullish thesis on oil was never based on WTI Crude going to $380 or other such wild claims, it was based on the fact that oil stocks are cheap even with crude prices much lower than the current ones. These days you have oil stocks trading at four times TTM operating cash flow, and only two of the past four quarters featured very high oil prices. If oil just stabilizes at $100, and if stock prices don’t change, then these multiples will likely compress to shocking lows.

Will oil continue to dramatically rally and outperform the market? I can’t say that for sure. I recently exited the bulk of my oil positions after sensing that tech valuations were becoming attractive, but I still have a tiny amount of money in the trade. I continue to believe that oil stocks will deliver adequate returns over the long term, as I will explain in the ensuing paragraphs.

Oil Stock Valuations

One of the reasons to be bullish on oil stocks is that they do not actually require progressively higher oil prices to be good buys at today’s prices. They are actually pretty cheap even if you assume that oil prices go as low as $90.

Below, I’ve compiled some valuation metrics for three oil companies I’m familiar with–Suncor (SU), Occidental Petroleum (OXY), and Exxon Mobil (XOM). As you can see, their earnings and cash flow multiples are generally in the single digits.

|

SU |

OXY |

XOM |

|

|

GAAP P/E |

8.67 |

8.53 |

13.79 |

|

Adjusted P/E |

9.42 |

11.95 |

12.23 |

|

Price/cash flow |

4.14 |

4.2 |

6.53 |

|

Price/book |

1.32 |

2.35 |

1.86 |

|

EV/EBITDA |

4.7 |

5.84 |

7.44 |

These are all very low multiples. For reference, the S&P 500’s P/E ratio is 19.5, and its price/book ratio is 3.83. So the three energy stocks above are cheaper than the market.

Now, there is more to a valuation than just multiples. Growth has to be taken into account too. Therefore, we need a discounted cash flow analysis with projected future cash flows.

Oil prices will influence what growth we can get in the future. Many people think we’ve seen the highs for oil prices already. I don’t think that WTI Crude is going much higher than $120, and at any rate, conservatism demands that we assume only modest price gains. In the next section I’ll do a discounted cash flow analysis on one of the oil stocks above using a conservative estimate of future growth, with no assumption of oil rallying to extreme highs.

Exxon Mobil: Discounted Cash Flows

If we take Exxon Mobil as a pretty typical oil stock, we can use its fair value as a rough guide to the oil sector’s valuation. It’s a “conservative” example to work with, because it is more expensive than the other two stocks I looked at in the table above. By using XOM as a case study, we are therefore unlikely to get a fair value estimate that wildly exceeds reality.

First, we need to estimate five years’ worth of XOM’s cash flows. XOM’s free cash flow per share is $9.38, so we can start from there.

Next, we need to know how much XOM’s FCF can grow over five years. It’s difficult to estimate costs and other such factors, but we can use oil price growth as a starting point.

WTI’s highest price this year was about $123.70. The price as of this writing is $97.57. For the sake of conservatism, we’ll assume that $123.70 is the highest WTI can go in the next five years. The growth rate from $97.57 to $123.70 is 4.8% CAGR over five years. XOM’s FCF growth could easily exceed that, due to cost factors or high oil prices. But the goal is to be conservative, so I will slash 4.8% in half, using 2.4% as my estimate of XOM’s five year CAGR FCF growth. I’ll use XOM’s 8.3% weighted average cost of capital as the discount rate. The value of my projected cash flows are shown in the table below:

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

TOTAL |

|

|

Undiscounted cash flow (“CF”) |

$9.6 |

$9.83 |

$10.07 |

$10.31 |

$10.56 |

|

|

(1+r)^n |

1.083 |

1.17 |

1.27 |

1.375 |

1.49 |

|

|

Discounted CF |

$8.86 |

$8.4 |

$7.92 |

$7.49 |

$7.08 |

$39.75 |

So, we get $39.75 worth of discounted cash flows over five years. If we assume that growth slows to zero after six years, our terminal cash flow is $10.81. That divided by the 8.3% discount rate is $130. So we get a fair value estimate of $169, assuming barely any growth at all. XOM, therefore, is a good value even if the price of oil barely moves over the next five years.

The Bottom Line

The #1 thing to know about oil stocks is that they’re very cheap even with oil prices lower than today’s. They have extremely low cash flow multiples, and the trailing 12 month period only had two quarters of very high prices. Third and fourth quarter 2021 prices were much lower than today’s price. If oil companies can just match their first quarter earnings for the foreseeable future, they are undervalued. If they can grow earnings by a mere 2.4% per year, they are extremely undervalued. On the whole, the oil and gas sector looks very promising.

Be the first to comment