anatoliy_gleb/iStock via Getty Images

OIS Is On A Speedy Track

Please read the background of Oil States International’s (NYSE:OIS) strategic moves in my previous article. My current bullish theorem revolves around deepwater projects’ lagged revival and accelerated investment in shorter-cycle onshore projects. It also leverages its competencies in offshore wind developments, subsea minerals, and clean tech energy systems. The Offshore/Manufactured Products segment’s revenue share can increase more in 2H 2022. During this period, the Well Site Services and Downhole Technologies segments are slated to become more profitable.

However, the adverse timing of the underlying project schedules can mitigate project revenues. Its debt-to-equity ratio, which is already quite low relative to its peers, can improve further following the issuance of shares. The stock is relatively undervalued at the current level. I think it holds upside potential in the short-to-medium term.

The Current Strategy

Since the energy recovery post the 2020 downturn, shorter-cycle investment in the US has accelerated. Eventually, this will precipitate longer-term investments, especially in deepwater, where long lead time projects are operational. Although OIS’s traditional projects vary from subsea, floating, and fixed production systems and drilling to military customers, it has expanded its core competencies into renewable, as I discussed in my previous articles. These include fixed/floating offshore wind developments, subsea minerals, and clean tech energy systems.

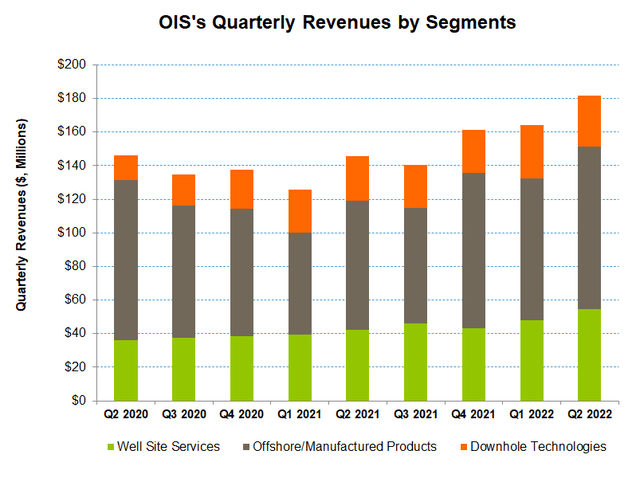

As estimated by Primary Vision, the frac spread count (or FSC) has gone up ~24% year-to-date. As a result, OIS’s Well Site Services and Downhole Technologies segments would contribute more to its margin growth. On the other hand, the Offshore/Manufactured Products segment should contribute more to the topline growth. In FY2022, the company’s management expects revenues to increase by 30% year-over-year. Higher sales will also add to the operating margin as the EBITDA guidance has been raised marginally (4%, at the guidance mid-point) to $70 million-$75 million.

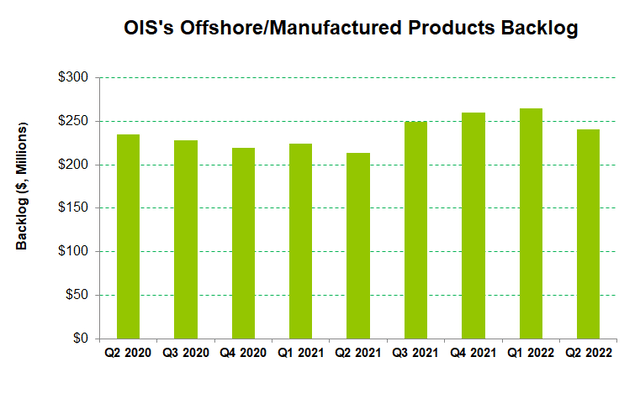

Backlog Goes Down But Can Improve

Oil States International’s Filings

One of the reasons the company’s outlook on the Offshore/Manufactured Products segment is slightly weak is the decline in backlog and book-to-bill ratio. In Q2, its book-to-bill ratio was 0.8x, a noticeable fall from 1.1x in Q1. Backlog decreased by 9%, quarter-over-quarter. The lower backlog indicates timing delays in certain contract awards and adverse exchange rate trends, which reduced its foreign backlog in orders.

However, the company expects bookings in 2H 2022 to improve compared to 1H 2022. Despite the decreased backlog levels, higher demand for short-cycle products should pull revenues back in the growth trajectory in 2H 2022.

Explaining Q2 Performance Drivers And Outlook

Oil States International’s Filings

In Q2, the Offshore/Manufactured Products and Well Site Services segment performed almost equally well (15%-15% up, sequentially) in Q2. The Well Site Services segment benefited from expanding activity levels in the US, recovery in its international operations, operational streamlining, and the exit of underperforming regions. The company will continue to pursue the profitable activity in its global operations and focus on core areas of expertise. It plans to differentiate offerings through improved completion service offerings.

In the Offshore/Manufactured Products segment, although revenues increased due to higher demand for short-cycle products, the EBITDA margin contracted by 320 basis points. The shift in product mix following the change in short-cycle products affected margin adversely.

The Downhole Technologies segment underperformed the other segments (revenues down by 4% sequentially) following the reduction in customer demand for perforating products. The supply chain disruptions caused by the COVID-19 pandemic, labor availability issues, and inflation affected energy production. Prices increased with a fall in crude oil inventory, and upstream operators’ capex plans were more aggressive. So, completions and offshore activities are expected to improve in 2H 2022, which should benefit the OFS providers in the downhole business.

Cash Flows And Leverage

OIS’s debt-to-equity was 0.26x as of June 30, 2022, which was lower than the peers’ average (0.62x). Its debt-to-equity ratio will decline further following the issuance of shares. Its liquidity was $84 million as of June 30, 2022. The proceeds would be used to repay debt related to the GEODynamics acquisition. Approximately 78% of the company’s debt repayment lies in 2026 and after that. So, with low leverage, the financial risks are down in the short term.

In 1H 2022, the company’s cash flow from operations (or CFO) deteriorated and turned negative compared to a positive CFO a year ago, associated with higher accounts receivable and inventories. So, free cash flow (or FCF) turned negative. The company plans to increase its capex budget for FY2022 by 14% compared to FY2021.

Target Price And Relative Valuation

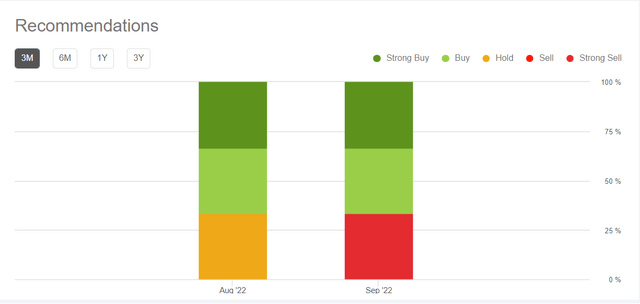

Over the past 90 days, two sell-side analysts rated OIS a “buy” (including a “Strong buy”), while one recommended a “Sell.” None recommended a “Hold.” The stock’s return potential using the sell-side analysts’ expected returns is 101% at the current price.

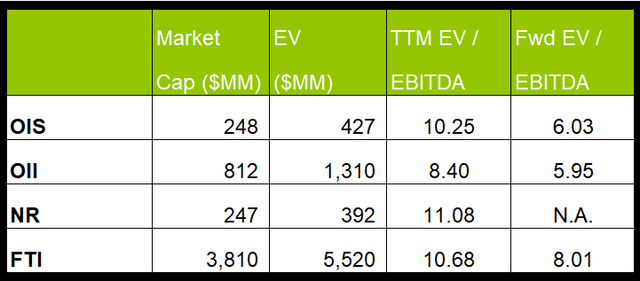

OIS’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than peers. This typically results in a higher EV/EBITDA multiple than the peers. The company’s EV/EBITDA multiple (10.3x) is in line with its peers’ (OII, NR, and FTI) average. So, I think the stock is marginally undervalued at this level.

Why Do I Change My Rating?

In my previous version, I pointed out the company’s near-term drivers and challenges. I derived that OIS would benefit from subsea floating and fixed production systems, while lower revenues from projects due to the adverse timing of project schedules would affect it. Although I figured the lower book-to-bill ratio would be a warning sign, I think I understated the risks. This is reflected in the stock’s underperformance relative to the industry in the past three months. I wrote:

Along with higher revenues, the company expects its EBITDA margin to expand significantly in 2022. Also, the company exited the nonperforming business in the recent past to achieve a higher operating margin. However, lower project revenues due to the adverse timing of the underlying project schedules can mitigate some of the topline growth potentials.

After Q2, I think the offshore drivers are more robust. Although a lower book-to-bill ratio remains a concern, I have confidence in seeing a higher demand for short-cycle products, which should pull revenues back in the growth trajectory in 2H 2022. Also, on a relative valuation basis, the stock appears undervalued. So, I upgraded my rating to a “buy.”

What’s The Take On OIS?

OIS leverages its competencies in offshore wind developments, subsea minerals, and clean tech energy systems in shorter-cycle onshore deepwater projects. The company plans to optimize operations and pursue profitable activity through its differentiated service offerings.

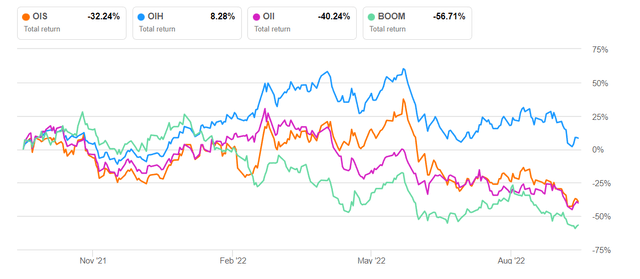

Cash flows stayed negative in Q1 and deteriorated compared to a year ago. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. However, it has a robust balance sheet with a low leverage ratio. I think the stock has a positive bias at the current price.

Be the first to comment