Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

ServiceNow, Inc. (NYSE:NOW) is one of the leading workflow management platforms. Despite its robust FCF margins, NOW stock also came under significant pressure recently, in line with its SaaS peers. The company leverages the digitization trend in corporate IT spending. Furthermore, it has consistently posted 30+% topline growth while delivering FCF profitability over the last few years.

However, we think the competitive environment will likely get more challenging over time, as it operates in a market with “relatively low barriers to entry,” as highlighted in its 10-K.

In addition, high-growth SaaS stocks with high earnings multiples could continue to come under significant pressure as investors seek safety in more defensive plays.

Given its intensely competitive landscape and the current macro environment, we rate NOW stock as a Hold.

NOW Stock Is Not Cheap

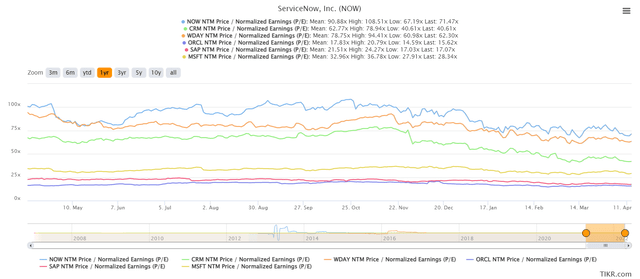

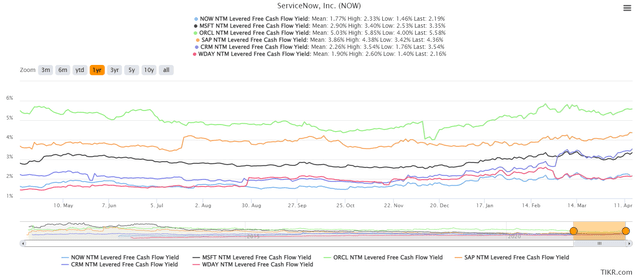

NOW stock NTM normalized PE Vs. peers (TIKR) NOW stock NTM FCF yield Vs. peers (TIKR)

As seen above, despite the recent value compression in SaaS stocks, NOW still traded at a premium against its enterprise SaaS peers. For example, NOW stock last traded at an NTM normalized P/E of 71.5x, well ahead of the King of SaaS, Microsoft (MSFT) stock’s 28.3x. It was also well above the software industry median P/E of 34.5x. In addition, it’s also well ahead of its peers [Oracle (ORCL), SAP (SAP), Workday (WDAY), Salesforce (CRM)] listed above.

Moreover, management has often lauded its FCF profitability. Yet, we also think that a marked growth premium has been priced into its stock. NOW stock last traded at an NTM FCF yield of 2.2%, in line with WDAY stock’s 2.2%. However, it was well short of the rest of its peers. So, ServiceNow investors must continue to have a firm conviction over the company’s growth execution. In addition, NOW investors must be prepared for significant value compression if the company falls short in a more risk-averse environment.

Why ServiceNow Could Potentially Underperform?

Given the high expectations embedded in the stock price, investors need to be wary of potential circumstances impacting its valuation. Notably, the company added a new risk factor in its recent 10-K that could shed some insights into the challenges of its enterprise penetration. ServiceNow added (edited):

As we target more of our sales efforts at larger enterprise customers, we may face heightened costs, longer sales cycles, greater competition, and less predictability in completing some of our sales.

Such sales require considerable time for the customer to evaluate and test our platform prior to making a purchasing decision, requiring us to provide greater levels of education regarding the use and benefits of our services.

These sales opportunities may require us to devote greater sales support and professional services resources to individual customers, driving up costs and time required to complete sales and diverting our own sales and professional services resources to a smaller number of larger transactions. (ServiceNow’s FY21 10-K)

Therefore, we think the company could face marked competition as it moves deeper into the larger enterprise space. Hence, the company needed to highlight these risks for investors to consider carefully in its strategic roadmap. In addition, we highlighted earlier that the company operates in a market with relatively low barriers to entry. Therefore, investors cannot discount the potential impact on its profitability, given its growth premium and its relatively low EBIT margins.

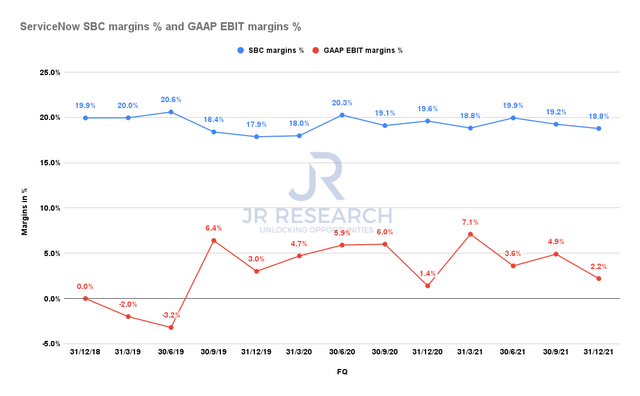

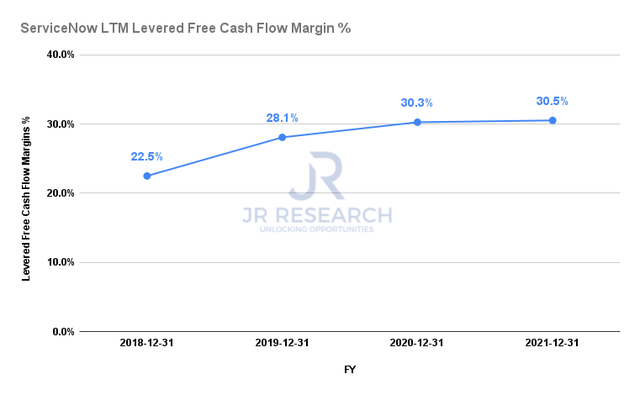

ServiceNow SBC margins % GAAP EBIT margins % (S&P Capital IQ) ServiceNow LTM FCF margins % (S&P Capital IQ)

Management prefers to use the adjusted operating profitability guide as it takes away the focus on its stock-based compensation (SBC) margins. However, we think it’s critical for investors to consider the company’s GAAP EBIT margins, given its growth premium and intensely competitive environment.

As a result, investors can observe that the ServiceNow GAAP EBIT margins are very low, as the adjustment from its SBC “obscured” its relatively weak operating profile. However, we need to highlight that such observations are not limited to ServiceNow. Many high-growth SaaS players use SBC to boost FCF margins and reduce cash burn. Therefore, it’s critical that investors invest only in the best-of-breed high-growth companies that can carve out their niche and competitive moat over time. These are necessary factors to justify their embedded growth premium and momentum.

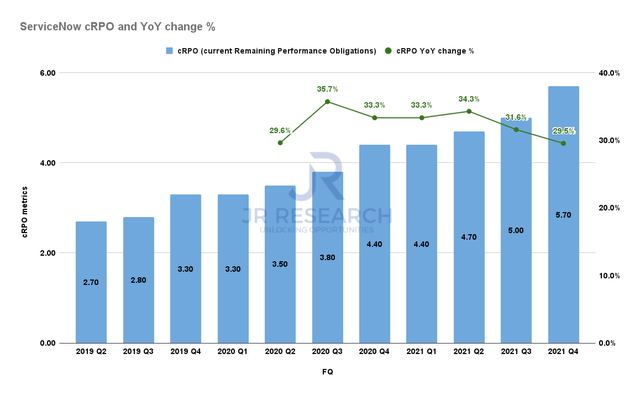

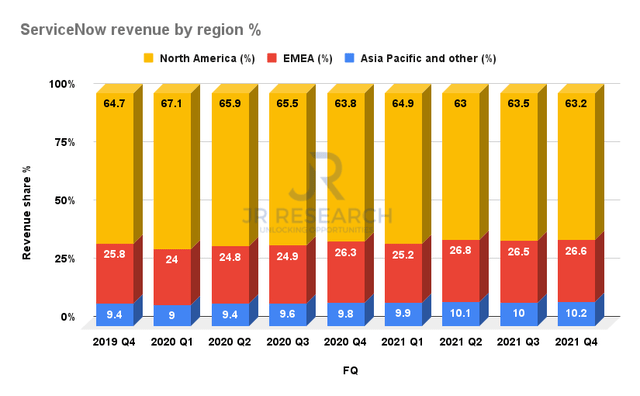

ServiceNow cRPO metrics (Company filings) ServiceNow revenue share by region % (Company filings)

Furthermore, ServiceNow’s current remaining purchase obligations ((cRPO)) metrics have started to show some growth digestion. For instance, NOW’s cRPO YoY growth has decelerated to less than 30% in FQ4, corroborating its moderation trend. As a result, investors should continue paying heed to this metric in the upcoming FQ1 earnings card.

Of course, the law of large numbers suggests a natural moderation of growth. But, NOW still traded at a marked premium against its peers. So, it’s imperative for management to maintain its growth cadence. Moreover, the company also has a sizeable exposure to the EMEA region (26.6% of revenue in FQ4). Therefore, investors need to monitor the impact of headwinds emanating from potentially weaker EU spending moving forward.

Is NOW Stock A Buy, Sell, Or Hold?

ServiceNow is scheduled to release its FQ1 earnings card on April 27. So, all eyes will be on its cRPO growth and whether there is a measurable impact on its EMEA region revenue.

While we think NOW stock valuation looks fair relative to its historical metrics, we are concerned with its operating environment. Furthermore, we also find it challenging to justify its growth premium against its peers.

Hence, we would require a steeper discount on its current price before considering it. A drop back to $400 (20% downside) would be more attractive to consider moving forward.

As such, we rate NOW stock a Hold.

Be the first to comment