Robert Way/iStock Editorial via Getty Images

Article Thesis

XPeng Inc. (NYSE:XPEV) is one of China’s fast-growing EV players, along with NIO (NIO), Li Auto (LI), and BYD (OTCPK:BYDDY). Both its deliveries track record as well as its revenue performance are highly compelling, and with international expansion being a growth driver going forward, the business outlook is strong. Compared to other EV players such as Tesla (TSLA), XPeng is trading at a very undemanding valuation. That being said, commodity price inflation and China-related macro risks should not be disregarded completely.

XPeng Recent Earnings

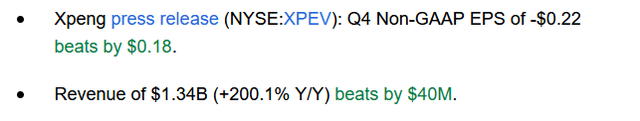

XPeng Inc. reported its most recent quarterly results on March 28. The company was able to beat estimates on both lines:

Revenue was up by an excellent 200% year over year, hitting $1.3 billion, or more than $5 billion on an annual run rate level. The company wasn’t profitable during the quarter, but that was expected. In fact, the net loss XPEV generated during Q4 was significantly smaller than what analysts had predicted, coming in at roughly half the forecasted level.

The market reacted very positively to these stronger-than-expected results, although it should be noted that XPEV is still down over the last year, as XPEV’s share price had been down considerably from recent highs prior to the earnings release.

XPEV Stock Key Metrics

During the fourth quarter, XPeng delivered 42,000 vehicles, which equates to an annual run rate of around 170,000 vehicles. For a not-yet-profitable electric vehicle company, the performance when it comes to growing production and delivery levels is all-important. These stocks are seen as growth investments primarily, as there are no dividends and since assigning a “value” rating isn’t easy due to non-existent profits and free cash flows. XPEV has performed very well when it comes to the especially important deliveries metric.

During Q4, deliveries were up by an outstanding 220% year over year. This is slightly more than the company’s revenue growth over the same time frame. While this translates into a declining average sales price, which generally isn’t a positive thing, the explanation is benign. Shifts in XPEV’s product lineup, such as the introduction of lower-priced models including the P5 sedan explain why average sale prices declined slightly compared to the previous year. Tesla experienced similar average sales price declines when it expanded its product portfolio by introducing new, less expensive vehicles such as the Model 3 over time.

Looking at XPEV’s deliveries performance in Q1, it seems pretty clear that the company remains on a growth track. Deliveries during Q1 totaled 35,000. That was down on a sequential basis, but that was expected already. Seasonal effects, including the timing of the Chinese New Year holidays play a role here. In fact, XPeng’s actual delivery performance during Q1 was better than the company’s own guidance and analyst estimates. On a year over year basis (which is more telling as it accounts for seasonal effects), XPEV also delivered great growth, as deliveries rose by 159% compared to 2021’s Q1.

In March, the most recent month, XPeng delivered 15,400 EVs, which makes for an annual run rate of 185,000 vehicles. This showcases what the company is capable of already, although more growth can of course be expected for the remainder of the year. If XPEV were to grow its deliveries during the remainder of the year by 159% (the Q1 growth rate) as well, relative to a 2021 baseline, deliveries during 2022 would total more than 250,000 vehicles this year. I do believe that this might be too aggressive, as growth should eventually slow down. But even if XPEV were to fall slightly short of this number, it is pretty clear that 2022 will be another strong year for the company in terms of growing the business.

At some point, that business growth should translate into earnings growth, of course. Without profits and positive free cash flow, a company is not delivering value for its owners. But as Tesla has proven in the past, earnings growth will eventually follow when business growth remains healthy. Growing manufacturing expertise, better conditions from suppliers due to larger volumes, and effects such as fixed cost digression will allow for growing margins over time.

We have already seen this at play during the most recent quarter. Even though XPEV did not generate any positive net profits yet, the company managed to expand its vehicle margin from 6.8% in Q4 2020 to 10.9% in Q4 2021. Another year of production growth, operating leverage and improving efficiency, and XPEV should be able to generate vehicle margins in the 15% range. With two more years of 400+ base point margin expansion, XPEV could be looking at vehicle margins in the 20% range, which would be quite attractive. Tesla broke even in 2020, a year during which the company sold half a million vehicles. If Tesla serves as the guide, XPEV is still at a stage where profitability is not expected, thus investors shouldn’t read too much into the fact that the company isn’t profitable yet. Instead, with ongoing growth, XPEV is on track to become profitable in the not-too-distant future, potentially at an earlier point than Tesla (relative to the vehicles being sold at that point).

For a company that isn’t profitable yet, balance sheet strength is highly important, of course. Expansion of manufacturing capacity, R&D efforts, etc. can’t be financed via profits if there are none, so cash positions being held on the balance sheet are the source of future investments. In that regard, XPEV looks well-positioned for the future. Between cash and cash equivalents, XPEV had $6.8 billion at its disposal as of the end of 2021. I believe that this will be sufficient to finance growth investments, R&D, etc. for the next couple of years. XPEV lost about $200 million in Q4. Annualized, that gets us to about $800 million. Even if that number were to rise to $1 billion in 2022, the current cash position would be sufficient for almost seven years. XPEV should be able to break even well before that as long as the company continues to execute well.

What Is The Prediction For XPeng?

XPeng is a fast-growing EV player with attractive products. Its brand and vehicles are not as high-end as those of NIO, for example, but the addressable market for lower-priced vehicles is very large and therefore attractive. XPEV’s P5 sedan, for example, sells for around $25,000, which is an attractive price for a well-designed electric vehicle. On top of that, the company’s products include strong autonomous vehicle tech, making them even more attractive for urban, “techy” consumers that put a lot of value on driver assistance systems and similar tech. XPEV’s autonomous vehicle tech is highly capable, showcased by the fact that the company plans to launch a robo-taxi program later this year.

XPeng should also benefit from its ongoing expansion in Europe. Recently, the company launched its first branded overseas store in Stockholm, Sweden. Europe is one of the largest markets for electric vehicles, and XPEV seeks to become a major market participant there. Thanks to strong demand for EVs, supply chain bottlenecks for many competitors that result in long wait times for their respective products, and generous subsidies in many countries, the outlook for XPEV in Europe is pretty solid. China will remain the most important market in the near term, of course, but international success will be an important growth driver for XPeng in the coming years. We have seen a similar trend play out at Tesla over the years, as entering new markets always went hand in hand with step-ups in deliveries and revenue. XPEV also has a cooperation deal in the Netherlands, and more countries should be on XPeng’s list for the coming quarters.

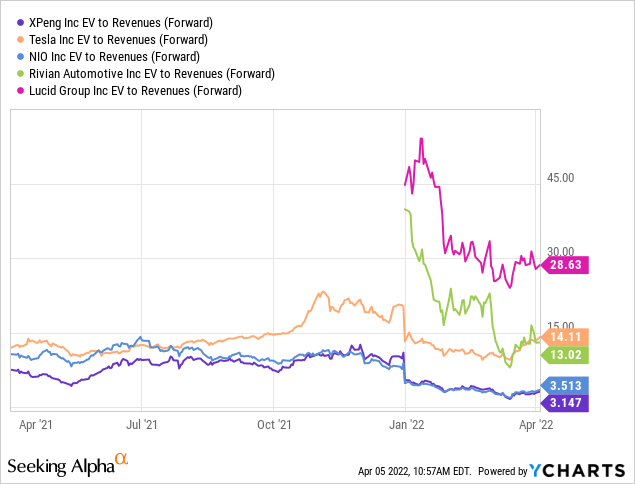

We can’t assign a value based on XPEV’s profits, as there are none to date. Nevertheless, we can look at how XPEV’s valuation stacks up compared to peers based on other metrics, such as the price to sales ratio:

On an enterprise value to revenue ratio XPEV looks quite inexpensive. Note that this metric accounts for differences in debt usage among competing EV players, which is why I think it is more telling than the market cap/revenue ratio. XPEV trades at a 3x sales multiple, while its Chinese peer NIO is slightly more expensive. Both trade at massive discounts to Tesla, the current market leader, and other US-based EV stocks such as Rivian (RIVN) and Lucid (LCID). To some extent, this discount seems warranted, e.g. due to regulatory uncertainties. But I do not believe that a 300%-800% premium for American EV stocks makes sense, relative to how XPEV, NIO, etc. are valued. The combination of a relatively inexpensive valuation, a compelling growth outlook, and strong execution bodes well for XPeng, I believe.

Is XPEV Stock A Buy, Sell, Or Hold?

The EV industry is highly competitive and faces pressures from rising commodity prices, such as Nickel and Lithium. This will be an issue for all players, however, and is thus not an XPeng-specific threat. I do believe that XPEV looks attractively priced relative to many other EV players, including the large US-based ones such as Rivian, Lucid, and market leader Tesla. For someone looking to buy an EV stock, XPEV is thus one of the best choices, I believe.

That being said, some investors may prefer not to own any EV stocks at all. Commodity price headwinds, growing competition, supply chain issues, and a cyclical business model may be a reason for some to avoid the industry altogether — in that case, XPEV isn’t a buy, of course.

Be the first to comment