wildpixel

The best revenge is to be unlike him who performed the injury.” – Marcus Aurelius, Meditations

Today, we put Ocugen (NASDAQ:OCGN) in the spotlight for the first time. The company has several early stage candidates in development. It is also seeking to enter the Covid-19 vaccine market with a license from a large drug concern in India. An analysis follows in the paragraphs below.

Company Overview:

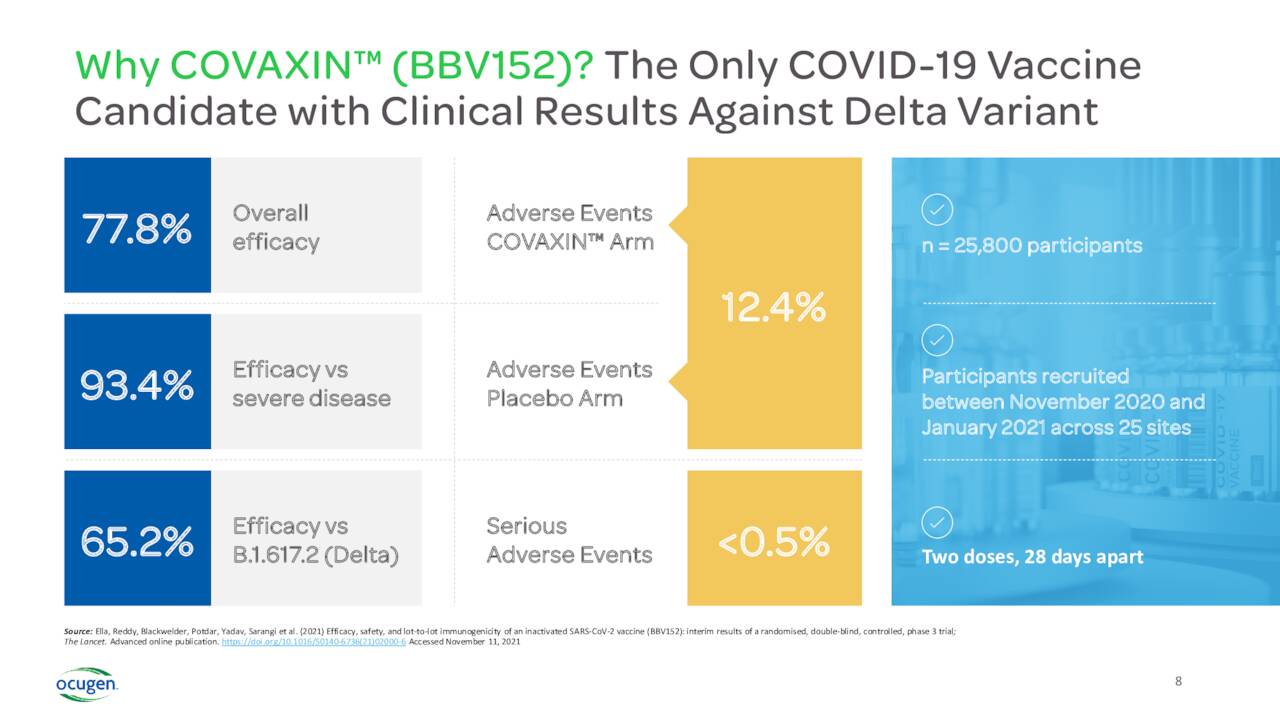

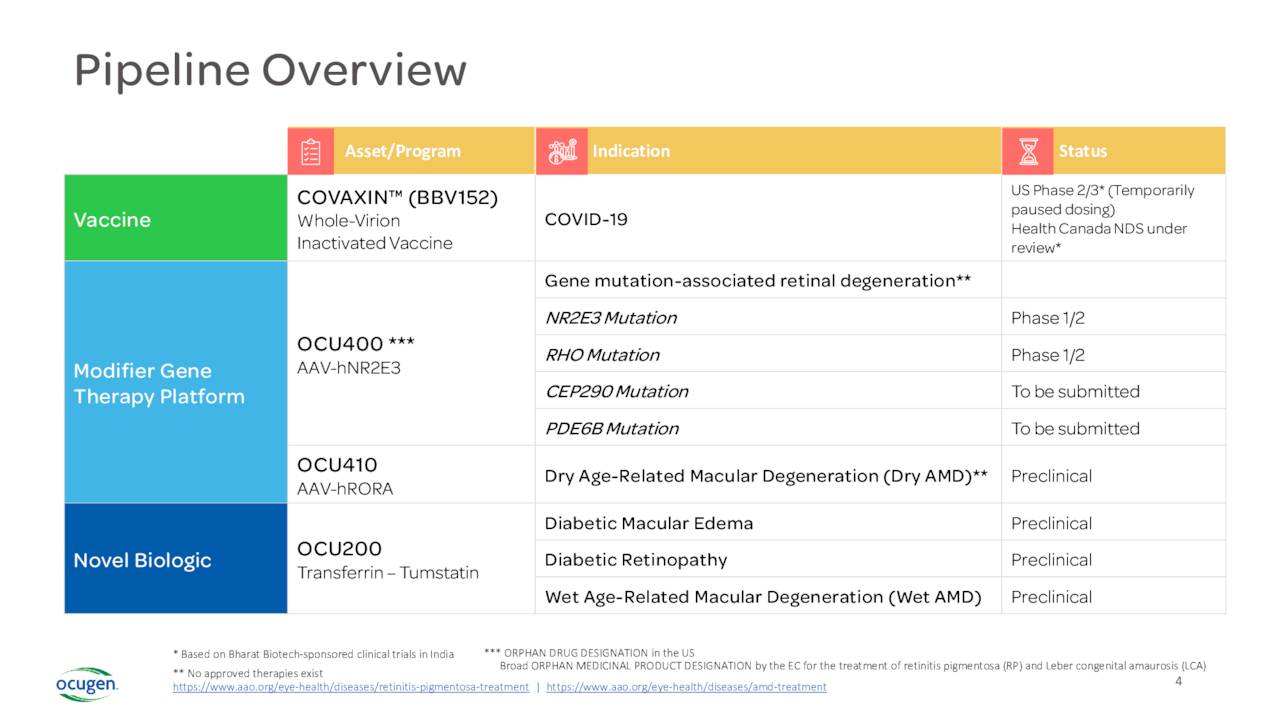

Ocugen is a clinical-stage biopharmaceutical company. The firm is focused on the developing gene therapies to cure blindness diseases. The company also has the license from Bharat Biotech to sell Indian COVAXIN vaccine in the US, Canada and Mexico, pending approval in those countries. Under this agreement, Ocugen would garner 45% of all profits of sales in these countries. Bharat has secured an Emergency Use Listing from the World Health Organization or WHO and the vaccine provided results against the Delta variant of the coronavirus.

In January, the company posted results that showed a booster dose of COVAXIN was effective against both the Delta and Omicron variants of Covid-19. In June, COVAXIN showed higher efficacy and superior response in children than what was seen in adults. In March, the FDA declined to issue an Emergency Use Authorization for the use of COVAXIN in those aged 2 to 18 years old in the U.S.

April Company Presentation

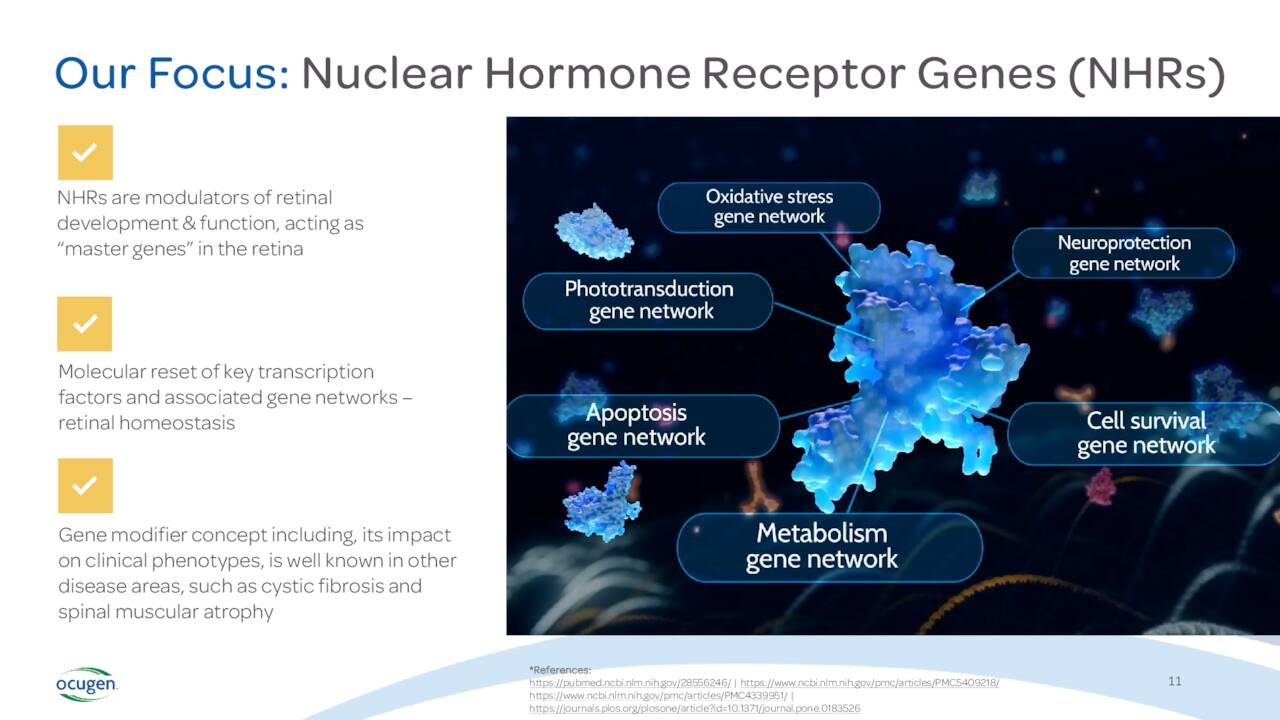

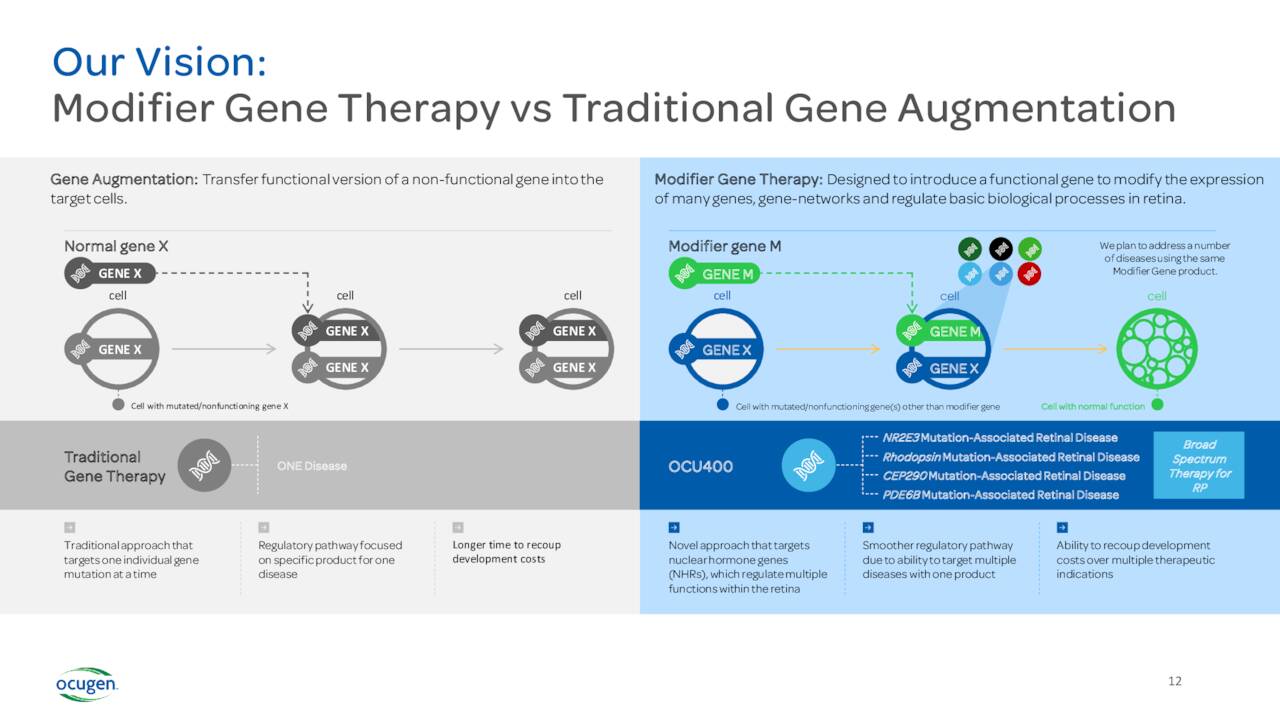

Outside COVAXIN commercialization, Ocugen is focused on inherited retinal diseases for which there are no options and only one gene therapy modality exists. According to their website:

Ocugen’s modifier gene therapy, unlike traditional gene therapy, as shown in preclinical models to effect the regulators of genes called nuclear hormone receptors, or NHRs. Activating these NHRs modulates gene activity and maintains homeostasis. When gene networks are not functioning properly, this unbalanced state can lead to disease.“

April Company Presentation

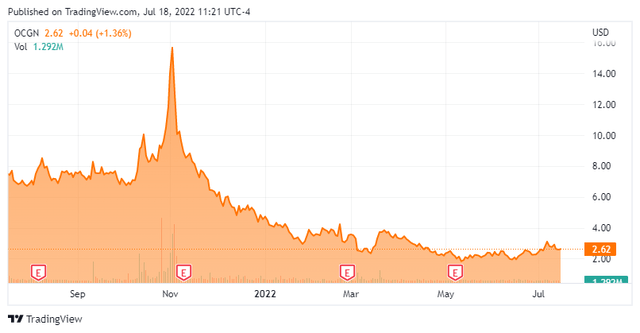

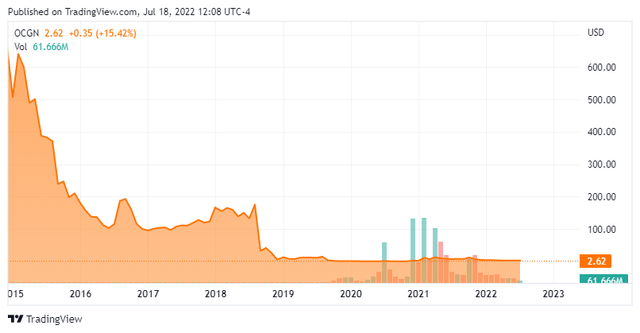

Currently, the stock trades just above $2.50 a share and sports an approximate $550 million market capitalization.

April Company Presentation

Recent Developments:

The company got some good news in late May when the FDA lifted the clinical hold on its Phase 2/3 clinical trial for COVID-19 shot, COVAXIN. This study involves 400 individuals in the study, 18 years or older.

In Canada, Ocugen is dealing with the governments’ objections to its rolling submission there which involve numerous ‘deficiencies‘. The company has provided responses to these requests, but there is no current timetable for resolution. Complicating things further, in early April, the WHO suspended COVAXIN from supplying United Nations agencies. Bharat has suspended the production of COVAXIN for export while it addresses WHO concerns about issues around its manufacturing facility producing these vaccines. Again, there is no firm timetable for resolution to this challenge.

COVAXIN does has Emergency Use Authorization in Mexico for adults and application for pediatric use, and the 2 to 18 year old age group is under review. Ocugen is in the process of commercialization in the country. Obviously, this effort is dependent on Bharat getting its manufacturing issues corrected and being able to export COVAXIN again.

April Company Presentation

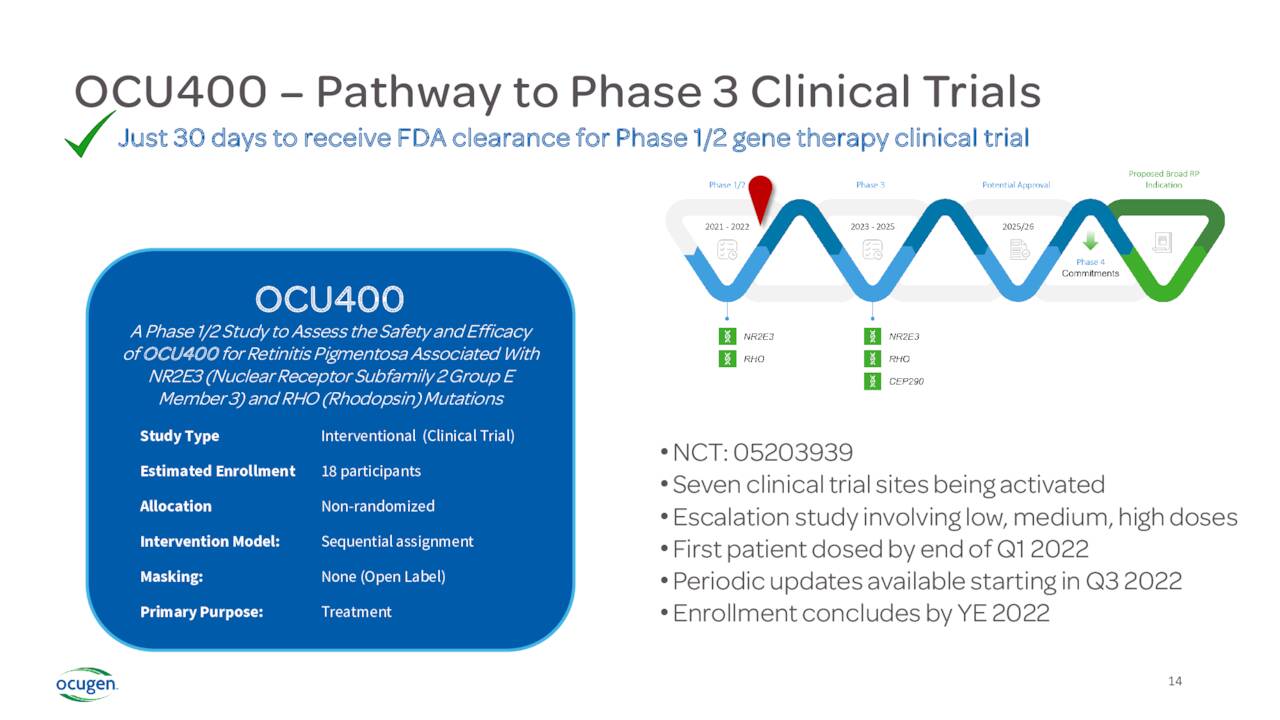

The company also has a couple of other focus areas that are in the early stages of development. The most advanced of these is a candidate called OCU400. The FDA has approved an IND for this therapy targeting Retinitis Pigmentosa. Currently, OCU400 is in ongoing Phase 1/2 safety and efficacy clinical trial. In May, the company dosed the second of 18 patients in this study, consisting of three cohorts of three different doses. If this trial is successful, the company will initiate a Phase 3 clinical trial which could then see a marketing application if results are positive. Approximately two million people globally struggle with this disease and there are no approved therapies to stop disease progression currently.

April Company Presentation

The other two candidates in the company’s potential arsenal are in the pre-clinical stage and are not germane to this analysis. The company does hope to move OCU410 and OCU200 into the clinic next year.

Analyst Commentary & Balance Sheet:

Over the past ten weeks, four analyst firms including Cantor Fitzgerald and Roth Capital have reissued or assumed Buy ratings on Ocugen. Price targets proffered have ranged from $4.50 to $15.00 a share. Chardan Capital seems to be the lone pessimist on the shares and has maintained a Hold rating and $3.50 price target on OCGN.

The shares have heavy short interest, with one out of every four shares currently held short. Insiders are not buying the dip in the stock either. Two insiders have disposed of over $1.2 million of shares in aggregate so far in 2022. The company ended the first quarter with approximately $130 million in cash and marketable securities on its balance sheet after ringing up some $18 million in expenses during the quarter.

Verdict:

I put little value on the company’s Covid-19 vaccine efforts. This is especially true in the U.S. which is dominated by two vaccines based on mRNA technology from Pfizer (PFE) and Moderna (MRNA). These are two of the three vaccines that have received Emergency Use Authorization. The other belongs to Johnson & Johnson (JNJ) and there are myriad other concerns trying to garner the fourth approval in the United States at the moment.

April Company Presentation

The rest of Ocugen’s pipeline is very early stage and is a couple of years and likely capital raises away from any potential commercialization. Given that, the huge short interest in the shares, as well as the company’s long history of destroying shareholder value; the prudent play is to avoid shares in Ocugen at this time.

Revenge proves its own executioner.” – John Ford

Be the first to comment