Peach_iStock

Written by Nick Ackerman. This article was originally posted to members of Cash Builder Opportunities on July 3rd, 2022.

Dividend growth stocks aren’t always the most exciting investments out there. They often times aren’t grabbing the headlines; they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. There are definitely yield-traps out there, trust me – I’ve owned a few that I’m not particularly proud of.

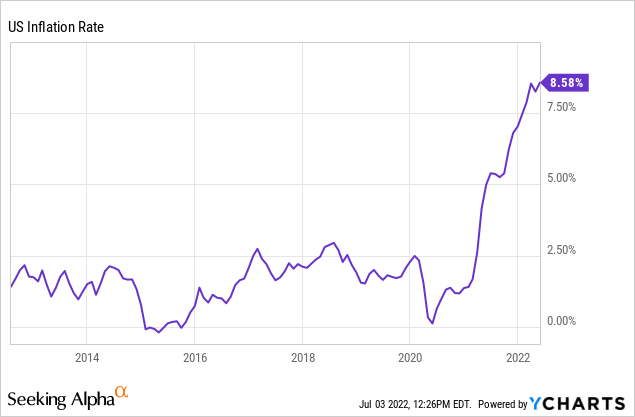

These dividend growth stocks can be even more critical in the current environment as it combats inflation. With the rising prices, an income investor needs a growing income to compensate for the price erosion.

In the last month, inflation ticked back higher after having a small decline the month before. This prompted the Fed to boost rates by 75 basis points. A level that was previously not being actively discussed in the prior meeting. More increases of between 50 and 75 basis points are expected in the next several meetings.

Ycharts

Inflation and interest rates continue to be the main focus. However, the discussion of a recession due to the very rate increases meant to tame inflation is also an increasingly main focus. It would seem that we’ve been trading as if we are in a recession already.

The market has been having a tough 2022. Energy has now been slipping along with the broader market more recently. That’s why it would appear that we have two energy plays show up on this list. Since we are sorting by higher yields, it’s natural that when the prices decline, the yields will increase.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all return back into your pocket from that point forward.

All of this being said is important to understand my approach to dividend stocks and why screening of dividend stocks can be important for income investors. These are July’s 5 dividend growth stocks that might be worthwhile for a deeper exploration. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors but earnings payout ratios, debt and free cash flow are amongst these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising year after year, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means that there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 551 stocks at this time—an increase from June’s 532 listings. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more obviously. I then sorted the list by forward dividend yield, highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

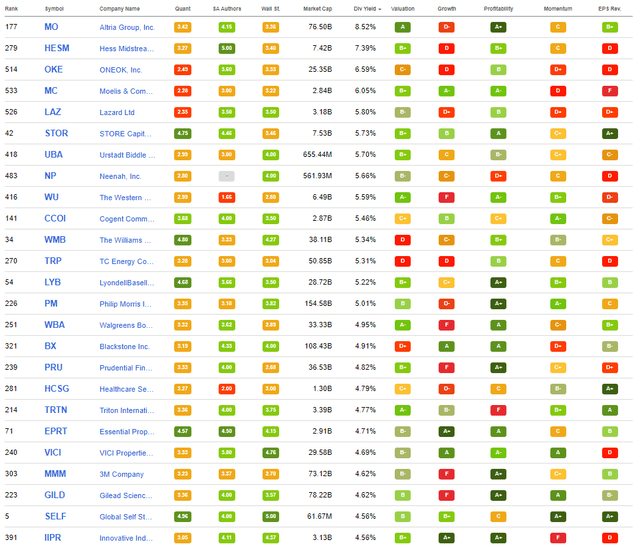

From there, I will share the top 25 that showed up as of 07/03/2022.

Top 25 From Screening (Seeking Alpha)

Altria (MO) we just discussed last month, as well as ONEOK (OKE), Lazard (LAZ), The Western Union (WU) and Cogent Communications Holdings (CCOI).

Moelis & Company (MC) is a name we covered in our May article.

With that, the names that we will be taking a brief look at for the month of July are; Hess Midstream LP (HESM), STORE Capital (STOR), Urstadt Biddle Properties (UBA), Neenah (NP), and The Williams Companies (WMB).

Hess Midstream LP 7.80% Yield

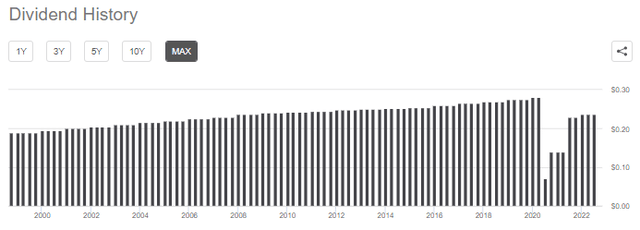

Starting the list off with one of those energy names we have, HESM. This is a midstream c-corp. They converted from an MLP in 2019. This means no K-1 come tax time. Instead, unitholders will receive a 1099, which most investors seem to prefer.

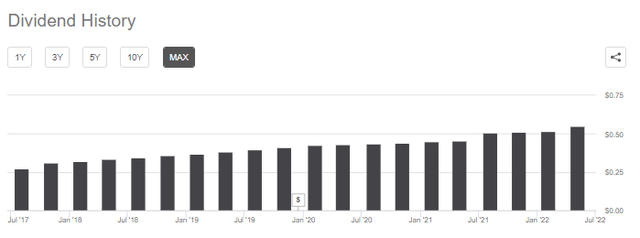

The units have a shorter history of trading, but during that time, the distribution has been heading steadily higher. That even includes during 2020, when so many other names in the energy space were cutting or freezing their payouts.

HESM Dividend History (Seeking Alpha)

HESM was able to continue raising through that period. That has kept their quarterly raises intact. This is thanks to their “fee-based, growth-oriented midstream company” operations. That often means steadier cash flows for the company and investors. Even the coveted Enterprise Products Partners (EPD) stopped with quarterly raises in favor of annual increases in 2020.

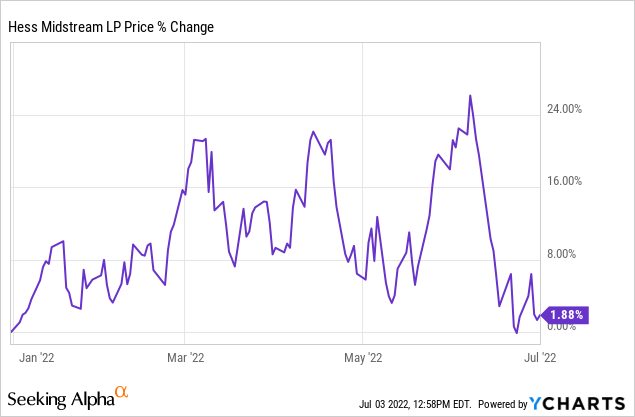

As we mentioned above, energy was a strong performer in 2022 but has succumbed to the bear market now. HESM’s performance reflects this.

Ycharts

HESM certainly seems like a position that would be worth exploring further.

STORE Capital 5.73% Yield

STOR is a REIT we’ve explored in a previous monthly screening article going back to April 2022. This diversified REIT owns nearly 3000 investment properties, with 573 customers in 49 states (that’s almost all of them!) They boast 99.5% occupancy. STORE stands for “single tenant operational real estate.”

The diversification through geography, property types and customers has allowed them to navigate through difficult periods such as 2020. They also didn’t freeze raising their dividend through that period, just as Hess Midstream didn’t.

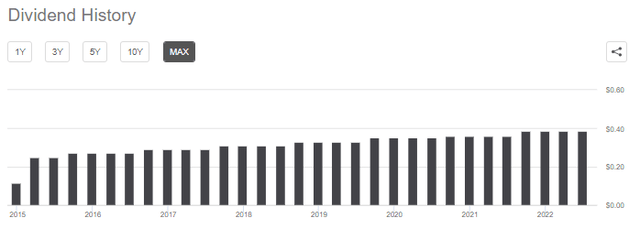

STOR Dividend History (Seeking Alpha)

They released their latest quarterly results since our last touching on this name. They had beat on both FFO and revenue. They had also raised their AFFO per share guidance for 2022. It wasn’t by a massive amount, but given the environment, some good news is always reassuring.

This is certainly good news. However, STOR might be susceptible to some pressures during a more prolonged recession. Several of their largest tenants would be considered places of discretionary spending.

STORE Capital Investor Presentation (STORE Capital)

Spring Education Group is a private school group. U.S. LBM distributes specialty building materials. Cadence Education, Ashley Homestores, Camping World (CWH), Bass Pro Shops, AMC Theatres (AMC), Zips Car Wash and at home, I would all consider being places that offer items and services that we could forgo during times of a recession. I’ll leave Fleet Farm in as somewhere that a recession wouldn’t hurt particularly hard.

Despite those potential risks, great management can navigate through such periods. Additionally, recessions tend to only be temporary economic events that can result in great buying opportunities.

Urstadt Biddle Properties 5.75% Yield

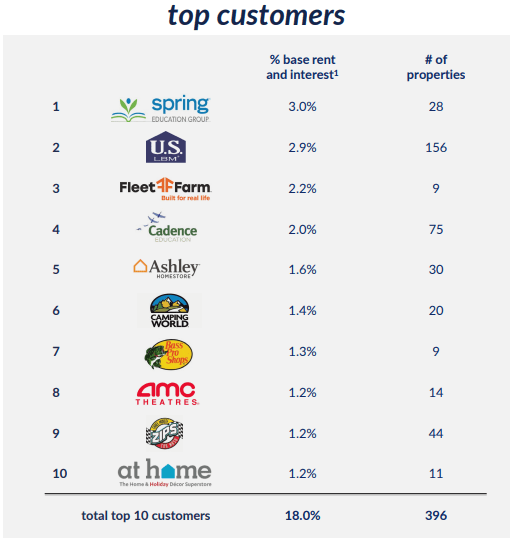

UBA is the other REIT that continues to show up regularly on this monthly article. The last time looking at the name was in April, along with STOR. They had cut their dividend in 2020 but aggressively raised it back. The latest increase was rather small, and we still aren’t at pre-pandemic levels either.

Before that latest turbulence to the payout, they had been a steady and regular raiser. So I feel that is why they continue to be appropriate for this type of list.

UBA Dividend History (Seeking Alpha)

The same cautions exist here that had previously. It is a smaller REIT with less diversification. They own 77 properties with a concentration in New York City. That leaves them more susceptible to economic slowdowns. Their top ten tenants account for 30% of their base minimum rents.

UBA Investor Presentation (Urstadt Biddle)

That alone doesn’t make them uninvestable but is just something to consider before investing. After all, they did survive through 2008/09 without having to cut their dividend at all. It was the latest 2020 shock that had a significant impact on their dividend.

Neenah 5.68% Yield

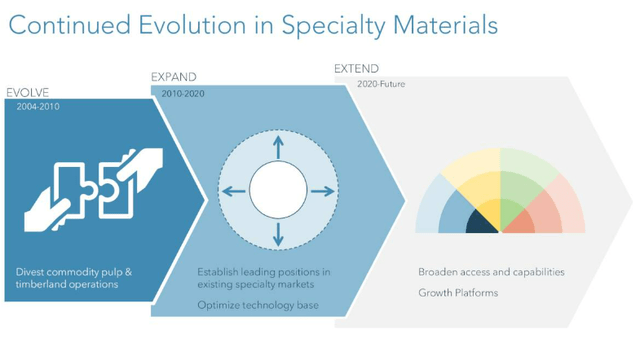

In my opinion, NP is quite an interesting name to have on this list. This is a specialty materials company with a focus on paper products. They are focused on “growing in filtration media, specialty coatings, engineered materials, as well as imaging and packaging solutions.” Keep in mind that this is a small-cap company. The market cap is only around $562 million.

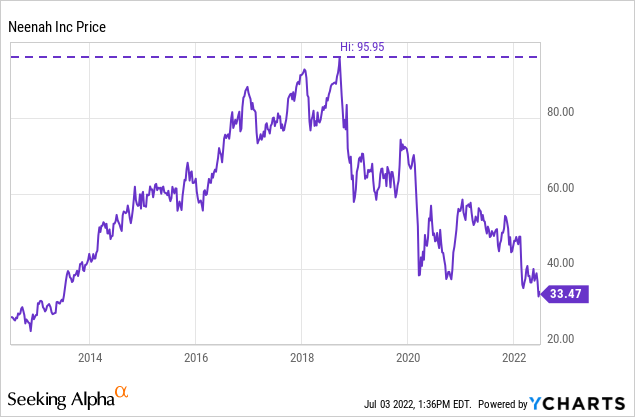

In a world that is becoming increasingly digital, paper products are on the decline. That seems evident since the stock has also declined since peaking in 2018.

Ycharts

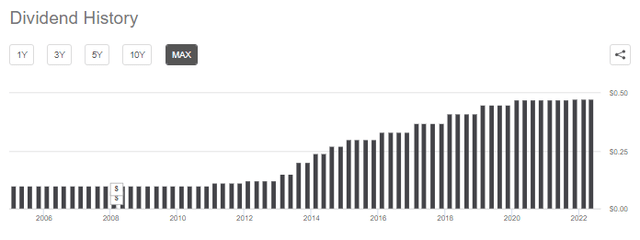

On the other hand, the dividend continued to increase during that time despite the sliding stock performance. I’d say fairly aggressively too. The raises froze in 2020 but then resumed with an increase at the end of 2021. A much smaller increase than the pace they were going before.

NP Dividend History (Seeking Alpha)

This year alone shows that NP is down around 30%. That’s one of the reasons they appear to be showing on this list in the first place: the price is declining, and the yield is rising. The dividend payout ratio comes to nearly 90%.

Over the years, they have transitioned into more growth-oriented places and acquired other companies to do so. The latest transformation has them merging with Schweitzer-Mauduit International (SWM). The name will switch to Mativ and trade under (MATV).

Neenah Investor Presentation (Neenah)

This position would be something to keep an eye on, but not something I’d personally run out and buy today.

The Williams Companies 5.43% Yield

This is the other energy name that has appeared this month. WMB is another midstream company that focuses on natural gas. As a C-corp, investors would receive a 1099.

In 2018, they merged Williams Partners with a subsidiary of Williams. This wasn’t the first attempt, though. In 2015, a previous deal to merge was terminated. This was around when they were going to merge with Energy Transfer Equity, which was also terminated.

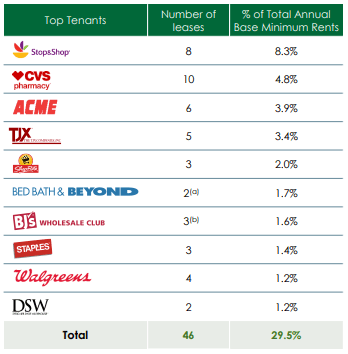

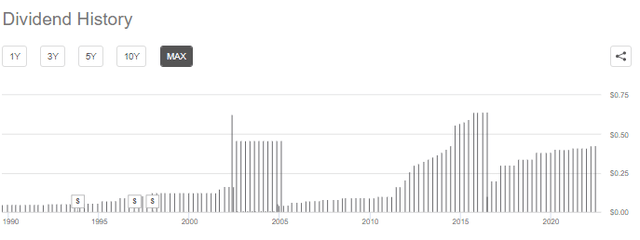

Their dividend history seems to be quite erratic, but more recently, they’ve been growing quite steadily. That includes a small raise in 2021, following the difficult 2020.

WMB Dividend History (Seeking Alpha)

Their latest earnings were a beat for EPS, but revenue came in-line. However, they also raised guidance for the year. The dividend coverage ratio based on AFFO was at 2.3x. This means they easily cover their payout for now and with anticipated growth well into the future. They shouldn’t run into risks of another cut at this time or in the case of a mild recession. It would appear they seem to be more conservative in their dividend increases with this latest cycle of raises.

Be the first to comment