Fritz Jorgensen

Thesis

Buying Meta stock at levels < $200/share is arguably the best investment opportunity that I have seen for over a decade (read my article here). I believe the stock is deeply undervalued and I expect that the market will come to agree with my thesis within a reasonable period of time. Given the negative sentiment surrounding Meta’s advertising business and the perceived uneconomic metaverse fantasy, I believe the upcoming earnings release will be a key event to prove that the market has overreacted. I expect Q2 2022 will highlight the resiliency of Meta’s advertising revenue and attractive profitability, which consequently will open the potential for outsized share-holder returns.

That said, Meta Platforms is scheduled to report earnings on July 27th and I see four key levers where I believe the company can surprise to the upside. I advise to watch them like a hawk: (1) Meta’s top line, both in terms of MAU and revenue, (2) Meta’s level of R&D investment, (3) an acceleration/increase in Meta’s share repurchase program, (4) Meta’s competition with TikTok.

Meta’s Earnings Preview

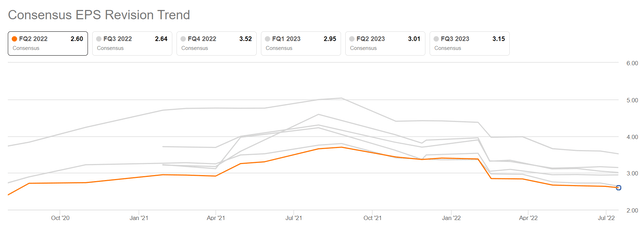

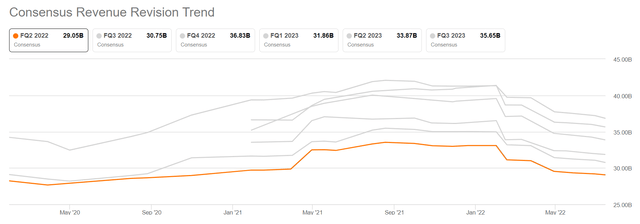

According to the Bloomberg Terminal as of July 20th, 31 analysts have submitted their estimates for Meta’s upcoming Q2 2022 results. Total sales are estimated between $27.68 billion and $30.0 billion, with the average estimate being $29.05 billion. Notably, if we take the average as the anchor, sales are estimated to decrease year-over-year by about 0.09 percentage points. Respectively, EPS are estimates $2.0 and $2.97 with an average of $2.6.

I would like to highlight that both revenue as well as EPS expectations for the Q2 2022 quarter have been revised downward multiple times by analysts. For reference, in September 2021 analysts thought that Meta could generate about $33 billion of sales and EPS of about $3.8. Now, the expectations have increased by more than 10% for revenues and more than 25% for EPS. This is bullish, actually, as the market is pricing in a lot of negativity and opens plenty of room for upside surprise.

Meta’s EPS estimates

Meta’s revenue estimates

Notably, Meta Platform itself guided Q2 2022 sales in a $28 billion to $30 billion range. The company expressed caution given currency headwinds, higher tax expenses as compared to the prior year and slight softness in advertising demand.

Key metrics to watch

Given the elevated level of negativity, I believe Meta has plenty of room to surprise the market to the upside. Specifically, I focus on four key levers: (1) Meta’s top line, both in terms of MAU and revenue, (2) Meta’s level of R&D investment, (3) an acceleration/increase in Meta’s share repurchase program, (4) Meta’s progress with Reels. let us look at them one by one.

(1) Meta’s top line

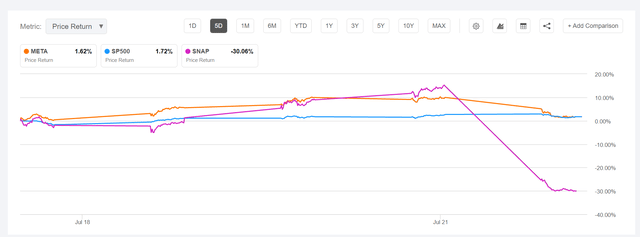

Revenue and earnings expectations for Meta are very pessimistic and as highlighted in the previous section, consensus estimates have steadily decreased. Snap recently posted negative earnings (surprised to the downside) and the stock fell about 40% on the news. Meta lost about 7% the same day as investors were cross-reading implications for the digital advertising space. Personally, however, I view it as wrong to compare Snap with Meta.

The recessionary environment does not impact all digital ad companies equally. I argue that budgets will be cut for more experimental outlets, e.g., Snap, while budgets will be increased for established solutions such as Meta’s platform. Meta’s return on advertising is amongst the highest in the industry, with arguably only Alphabet being able to match the ROI. As efficiency has become increasingly important, given the uncertain macro-environment, Meta will see resilient advertising revenue, in my opinion. Notably, Bank of America recently rated Meta as a top recession stock. However, it will be highly interesting to see how Meta has performed during the past 3 months in terms of sales volume. I believe there is ample room for upside surprise.

(2) Meta’s level of R&D investment

Meta’s elevated R&D investments have seen strong pushback from investors, as investors were worried that too much capital would be burned on the Metaverse fantasy. Notably, in 2021, Meta’s R&D investments as a percentage of revenues was more than 20%. Now, given that cost-cutting and efficiency is important, I believe Meta will please investors with reducing R&D expenses to a more adequate level–whatever that means for investors. Personally, however, I see a reduction of 3 – 5 percentage points as likely, which could translate to about $4 billion of additional cash-flow for the company. Such an announcement, or cross-read from the financial statements, would definitely delight investors and return confidence in management’s decision-making. If Meta has not decreased R&D as of Q2, the company may guide for such a R&D savings program in the earnings call.

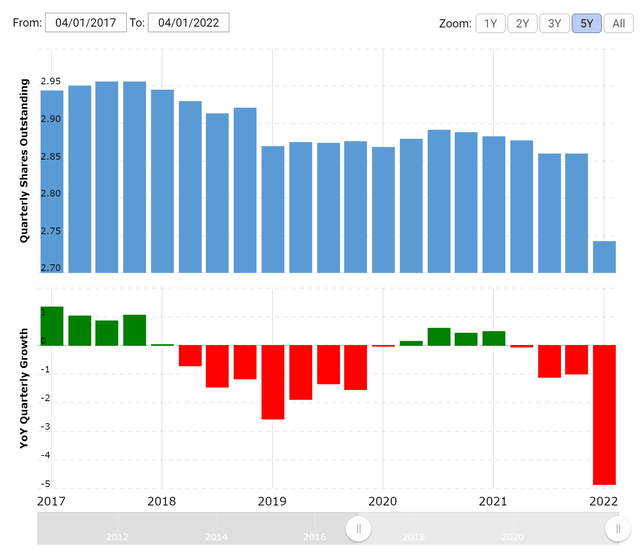

(3) Meta’s share repurchase program

Meta repurchased $9.39 billion worth of the company’s Class A common stock in the first quarter of 2022. This translates to about 1.7% of the company’s market capitalization–a considerable value distribution to shareholders. As of Q1 2022, Meta still had more than $43 billion of cash and cash equivalents on the balance sheet and I believe the company will take advantage of the depressed share-price and repurchase significantly more shares going forward. As of March 31, 2022, Meta had $29.41 billion available and authorized for repurchases. While there is no/little downside if the company doesn’t increase the program, there is attractive upside if Meta does. Personally, I view this as a free implied call-option going into earnings. Investors are advised to also monitor the management earnings call for any potential cross-reads.

(4) Meta’s competition with TikTok

Meta has strongly accelerated new initiatives to compete with TikTok in recent months. For example, Meta has recently changed its content discovery algorithms and strategy in order to work more like TikTok, e.g., providing content discovery vs social graph networking. Moreover, the company has pushed for the wide adoption and usage of Reels on Instagram, multi-clip videos up to 30 seconds. Finally, Meta has also pushed for initiatives to attract and retain content creators. All these efforts are ultimately aiming at competing with TikTok by improving Meta’s engagement numbers and attraction of the young generation. That said, it will be interesting to learn about Meta’s progress on all these initiatives and how it will ultimately translate into shareholder value.

Risks

Going into earnings, I see two major risks that might cause my thesis to break: First, there is of course the possibility that Snap’s results were not idiosyncratic, but indeed a guidance for the entire digital advertising space. Second, it could be that even though Meta delivers above expectations, that the market remains fearful with regards to the company’s 2H 2022 performance. In that case, investors would likely seek to take advantage of the stock price strength and sell Meta stock on the results. Meta’s guidance will be key to watch. But vice versa could also be thinkable: That even though Meta delivers weak results, investors seek to buy the name on share price weakness and pessimism.

How I Trade The Earnings

Snap’s revenue expectations were only about 2% below consensus. However, the stock lost 40% of market capitalization on the announcement. The market is very cautious and nervous regarding the digital advertising space–too pessimistic in my opinion. This negative set-up will make Meta’s share-price vulnerable to upside surprise. Personally, I am bullish on Meta’s Q2 potential and believe the company will surprise to the upside. All that said, going into earnings, I am increasing my exposure to META stock and buying time-sensitive call options as a short-term play.

Be the first to comment