jetcityimage

3M (NYSE:MMM) is a Dividend King that has increased its dividend for more than 60 years. It could be the time to buy the stock, which is down approximately 39% from its 52-week high.

It has a long history of operation with its roots going as far back as 120 years ago. In other words, it has survived through the ups and downs of economic cycles and grown into an industrial conglomerate.

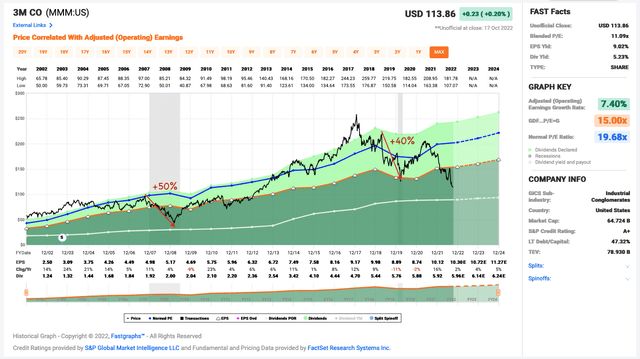

It can be difficult for large companies to grow. From 2011 to 2021, 3M increased its adjusted earnings per share (“EPS”) at a compound annual growth rate (“CAGR”) of 5.4%. From 2016 to 2021, the CAGR was 4.4%.

In the past 10 years, it increased its dividend per share at a CAGR of 10.4%, which increased its payout ratio from 37% to 58%. As a result, its dividend increases were much more moderate in the past five years — growing at a CAGR of 2.9%.

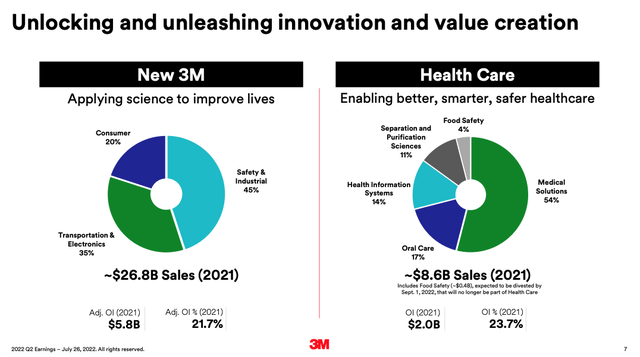

Because its growth has slowed, the company has been under some restructuring. Management believes that breaking up the company or spinning off some parts of it could create better value for long-term shareholders.

Reason 1: Company Restructuring

On September 1, 3M completed the spinoff of its food safety business and merged it with Neogen (NEOG). Now it’s in the process of spinning off its healthcare business and aims to complete the spinoff by the end of 2023.

The market doesn’t like uncertainty. The spinoff is another uncertainty among others that will be discussed later in the article. It’s anyone’s guess whether the spinoffs will drive real value for shareholders. It’s a wait and see story.

In any case, the new 3M will be focused on three areas: Safety & Industrial, Transportation & Electronics, and Consumer products.

To get a sense of 3M’s diversity, here are its underlying business groups. Safety & Industrial includes business groups: Abrasives, Automotive Aftermarket, Closure and Masking Systems, Electrical Materials, Industrial Adhesives & Tapes, Personal Safety, and Roofing Granules.

Transportation & Electronics consists of business groups Advanced Materials, Automotive & Aerospace, Commercial Solutions, Electronics, and Transportation Safety.

Consumer’s business groups are Consumer Health & Safety, Home Care, Home Improvement, and Stationery & Office.

Reason 2: Litigation

In a large portfolio of products (3M has over 60,000 products in its portfolio), sometimes, some may not work as they should.

The large-cap stock is partly depressed from lawsuits it face. Namely, 3M’s subsidiaries — Aearo Technologies and related entities — are filing for bankruptcy “to compensate veterans who say that earplugs made by Aearo caused hearing loss.” From a Reuters article on August 26, 2022,

3M Co must face more than 230000 lawsuits accusing it of selling defective earplugs to the U.S. military after a U.S. judge on Friday ruled that the bankruptcy of a subsidiary did not stop lawsuits against the non-bankrupt parent company.

Reason 3: Recession

Like many other industrial stocks, 3M stock does poorly in recessions. Around the last two recessions (illustrated by grey bars in the fundamental analysis graph below), the stock corrected more than 40% from peak to trough. However, investors should note that its adjusted EPS were much more resilient.

F.A.S.T. Graphs with author annotation

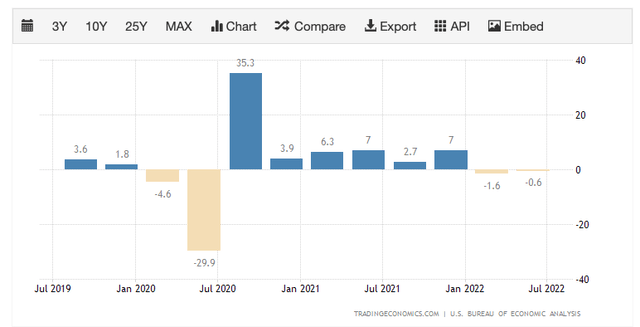

The U.S. has technically entered a recession with two consecutive quarters of GDP decline. Below, Trading Economics shows GDP growth in the U.S. Though, the recession appears to be mild so far, rising interest rates will likely further dampen GDP growth.

Reason 4: Rising Interest Rates

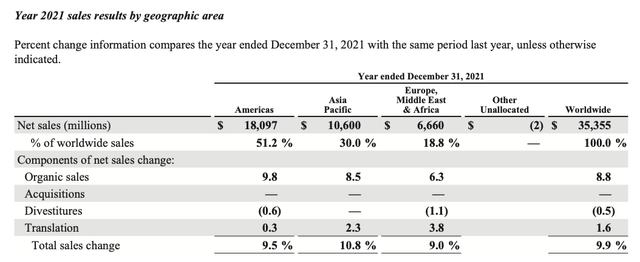

Here’s 3M’s 2021 sales diversification by geography:

Inflation is too high in many geographies that 3M operates in. Central banks are consequently increasing interest rates to curb inflation, which would discourage consumer spending and business investment, a drag on economic growth.

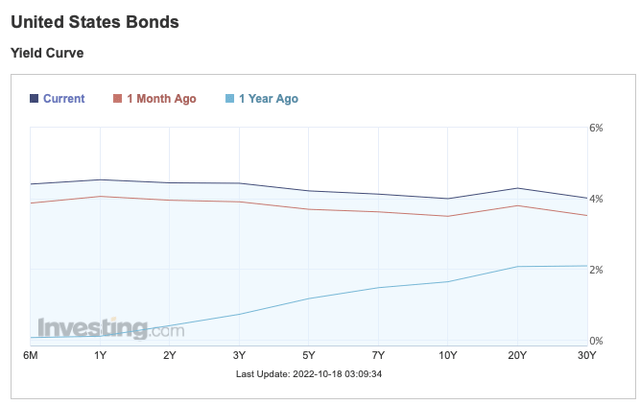

For example, the U.S., Canada, Brazil, Chile are experiencing flat or inverted yield curves. Short-term interest rates have been rising fast, making long-term bonds of the same credit quality unattractive for income. Here’s a graph showing the U.S. bond yield curve.

A year ago, the yield curve (with a positive slope) indicated a normal and healthy economy. A normal yield curve makes sense because longer-term debt pay out higher interest rates for the greater risk in interest rate changes or the possibility of a default. (The longer the duration of the debt, the higher the probability interest rates will change and the higher the uncertainty in a potential default where partial interests or partial/all of the principal is not repaid.)

Today, short-term interest rates are rising too quickly, which will drive bond prices lower. As well, historically, inverted yield curves have preceded recessions. As noted earlier, the U.S. is already in a recession. And RBC (RY)(TSX:RY:CA) anticipates a recession to arrive in Canada by Q1 2023.

In any case, central banks around the world raising their benchmark interest rates to curb high inflation is a factor that has been weighing on stocks, including 3M.

Reason 5: A High U.S. Dollar vs. Other Currencies

3M reports its results in U.S. dollars. The U.S. dollar has remained strong and even gained greater strength against many currencies lately.

Fidelity wrote:

The dollar has been gaining strength against the currencies of other major economies. The dollar is strong because the US economy is healthier than those of many other countries and because the Federal Reserve keeps raising interest rates.

Consequently, when translated into U.S. dollars, 3M’s results will be negatively impacted. In its Q2 earnings, the company noted that it now expects foreign exchange to impact this year’s sales by -4% versus -1% previously because the U.S. dollar is at a 20-year high.

Investor Takeaway

3M stock has declined substantially. It is a large and diversified business that enjoys resilient/quality earnings and an S&P credit rating of A+. Management’s latest projections for 2022 include organic sales growth of 1.5% to 3.5% and adjusted EPS of $10.30 to $10.80.

Based on the midpoint of $10.55 for its adjusted EPS, at $113.86 per share, the industrials stock trades at about 10.8 times earnings. This is a substantial discount of about 40% from its long-term normal P/E.

Understandably, because of the negative macro outlook, the analyst consensus price target of $132.18 per share, across 18 analysts, suggests a near-term discount of only roughly 14%.

For this reason, total-return investors should only take a position if they have a long investment horizon because it might take the macro environment to roll back into an expansion phase before the stock can command a premium valuation again.

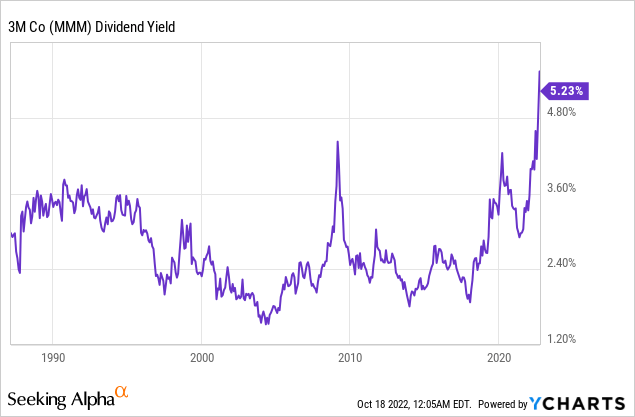

That said, 3M may appeal to income investors. Currently, it offers a dividend yield of 5.2% — the most attractive versus its historical yield range. Based on the midpoint adjusted EPS of $10.55, its payout ratio is estimated to be sustainable at about 56% this year.

Be the first to comment