Ahmetov_Ruslan

Trinity Capital (NASDAQ:TRIN) is a business development company with a particular emphasis on extending secured loans and equipment financing to early growth companies backed by venture capital, technology banks, or other private equity. The BDC has loans to 85 portfolio companies as well as warrant positions in 77 companies and equity stakes in 25 companies.

These are companies that have already raised some equity from some source or another, have proven products, and are generating revenue but are still burning cash as they reinvest into themselves more than they make. Many of these companies have heavy capex requirements, including hardware, making TRIN’s equipment financing an attractive way to raise additional capital, using their physical assets as collateral.

TRIN’s investor presentation contains the obligatory “what makes us different” slide…

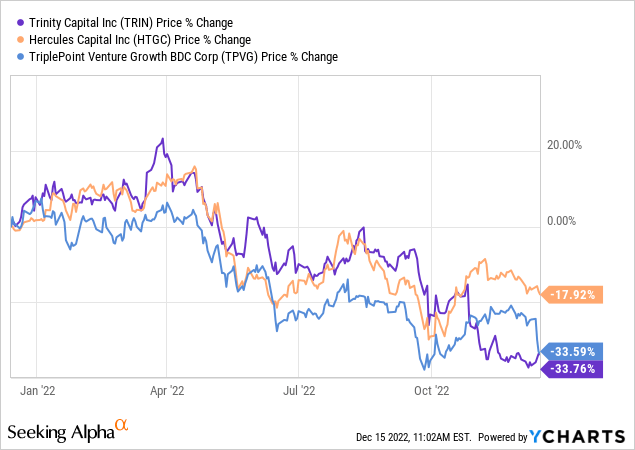

…but as far as I can tell, TRIN does not have any assets that make it head-and-shoulders above the competition, which in the public BDC space is Hercules Capital (HTGC) and TriplePoint Venture Growth (TPVG).

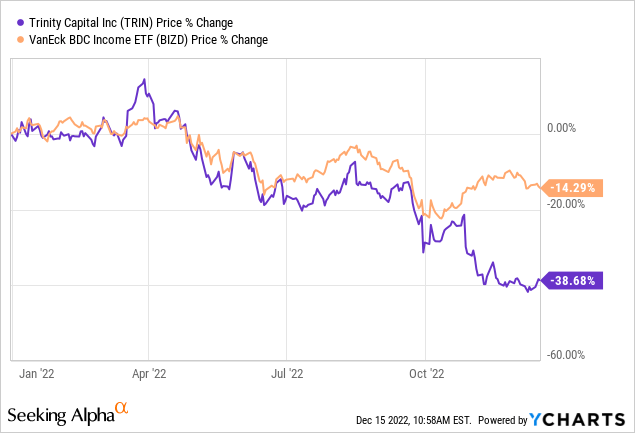

What makes TRIN particularly interesting is valuation. The BDC is valued much lower than its peers and has sold off much more than the broader BDC index this year. Compare TRIN’s YTD performance to that of VanEck’s BDC ETF (BIZD):

TRIN had been keeping its performance within a stone’s throw of BIZD for most of the year, but since early October the gap has widened.

As for its immediate venture debt BDC peers, TRIN is also the worst performer in the past year, but TPVG comes in a close second after a recent selloff.

In an environment where capital is drying up (or at least becoming much more expensive) due to the Federal Reserve’s aggressive rate-hiking and quantitative tightening regime, both TRIN itself and its cash-burning portfolio companies are not very well positioned.

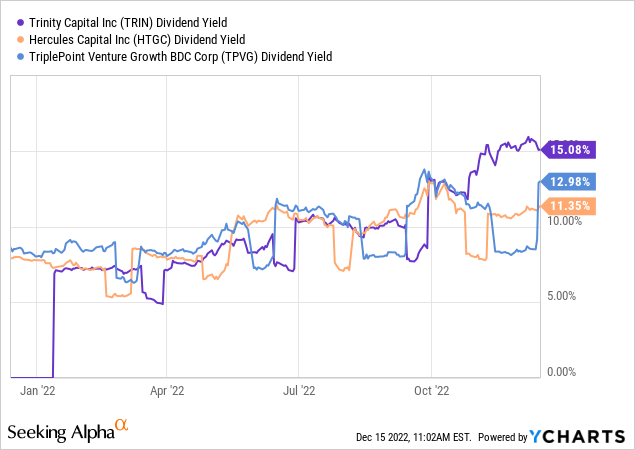

That has pushed TRIN’s dividend yield to the highest level in its short history as a public company, a meaningful tick higher than peers.

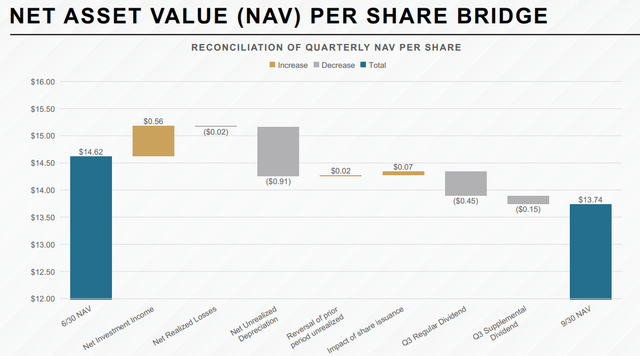

At $10.80, TRIN currently trades at an 11.5% discount to NAV per share of $13.74.

Compare that to a 28.2% premium to NAV for HTGC and a 12.3% discount to NAV for TPVG, as of midday on 12/15/22.

While TPVG has a larger discount to NAV right now, it is probably merited because it is externally managed while TRIN is internally managed.

Thus, TRIN looks like the cheapest option in the venture debt space relative to the quality and shareholder-alignment of management.

If you believe, as I do, that we are near the peak in the Fed’s rate-hiking cycle, with perhaps 25-50 basis points of further upside to the Fed Funds rate (if that), then now might be the ideal time to buy TRIN. Shares have been driven into the ground, and based on the regular quarterly dividend of $0.45 alone (without considering the supplemental dividend), TRIN offers a dividend yield of 16.7%.

Without a doubt, TRIN is a high-risk, high-reward opportunity. A recession and/or further drying up of capital could push many of its promising but as-yet unprofitable customers into bankruptcy, and in such a case TRIN’s collateral will be worth pennies on the dollar.

But if the Fed reverses course sometime in 2023 and decides to make the interest rate environment much more accommodating, TRIN’s customers could skate by relatively unscathed and able to keep servicing their debt.

TRIN looks like a buy for high-yield investors comfortable with above-average risk.

Fall 2022 Update

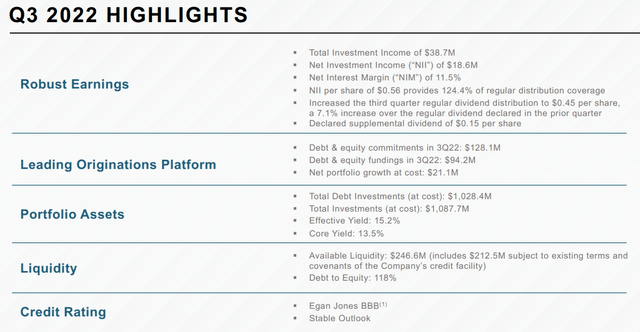

Though rising rates and falling asset prices have begun to bite TRIN through a spike in unrealized (and some realized) losses in its portfolio, the BDC still performed quite well in terms of income in the third quarter.

Net investment income per share of $0.56 covers the $0.45 regular dividend at a payout ratio of about 80%. Of course, the 15-cent supplemental dividend likely won’t be continued into future quarters, because realized gains have dried up and TRIN’s $34 million in cash would be better spent on investments.

Compare TRIN’s net interest margin (“NIM”) of 11.5% to HTGC’s 10.3%. This likely signifies that TRIN takes greater risks in its investments than HTGC, but TRIN gets higher yields and a higher NIM in exchange. Whether that higher risk is worth it will become clear over time, especially through recessions and downturns.

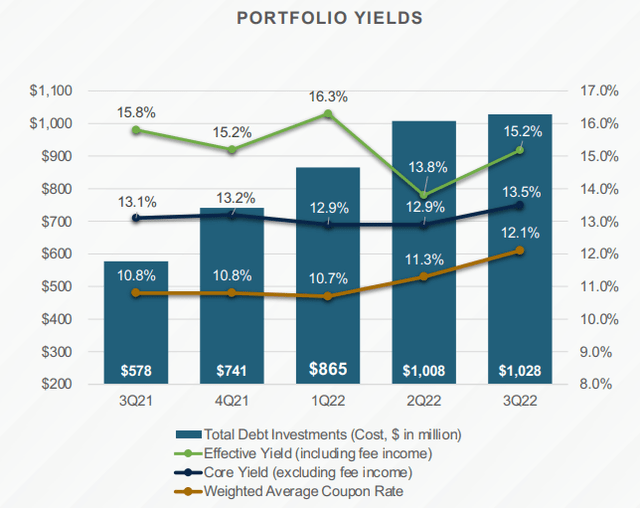

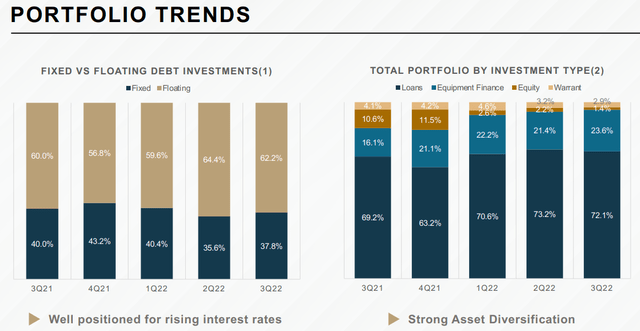

As interest rates have spiked this year, so also have TRIN’s average loan coupon rates.

Given TRIN’s ability to lift coupon rates and its high level of fixed rate debt, NII performance should continue without disruption as long as TRIN’s customer revenue and interest coverage holds up.

As for TRIN’s net asset value, it did decline from Q2 to Q3, mostly due to net unrealized losses in its portfolio.

Fortunately, debt to equity is reasonable at 118%. Ideally, that would be lower, but given TRIN’s discount to NAV, the BDC likely won’t be able to shift from debt to equity capital anytime soon.

Variable rate debt on the credit facility dropped as a share of total debt from 37.6% in the second quarter to 24.6% in Q3. The credit facility is TRIN’s only source of floating rate debt, with a formula of SOFR + 2.85%, and thus TRIN’s debt is split roughly 75% fixed and 25% floating.

Compare that to the ~38% fixed and 62% floating rate debt portfolio.

This means that, all else being equal, TRIN benefits from rising interest rates, at least in the short term.

But, of course, all else is not equal, and TRIN needs to worry about its portfolio companies potentially running out of cash in an environment in which capital is becoming increasingly expensive.

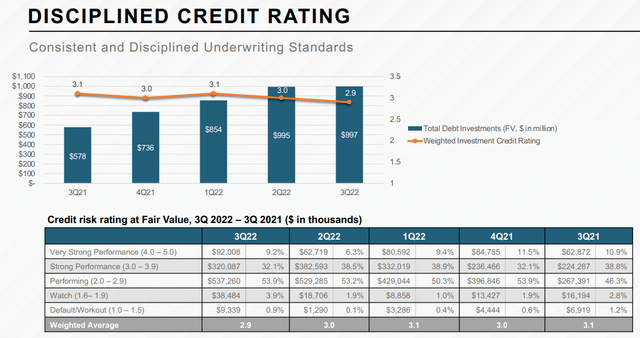

It’s notable, however, that according to TRIN’s in-house rating system, the vast majority of the portfolio remains at the level of “performing” or better, while slightly under 1% is in default or workout.

As a buffer against any potential weakness in its portfolio, TRIN enjoys $247 million in total liquidity, with $34.1 million of that in cash.

Bottom Line

How much risk is in TRIN’s portfolio and balance sheet? As for the portfolio, it’s difficult to say for sure without knowing its customers’ income and balance sheet strength. But as for TRIN’s balance sheet, it’s helpful to note that most of its fixed rate debt does not mature until 2025-2026. Thus, refinancing risk is low.

Meanwhile, TRIN is valued very cheaply at an 11.5% discount to NAV, compared to its nice premium to NAV in 2021 and early 2022. While the market is certainly right to see high risk in TRIN’s portfolio if rates keep rising, the possibility of rates falling by a meaningful amount next year seems high enough to justify holding TRIN as a speculative investment.

Be the first to comment