Marcos Silva

Finding value in the stock market has been challenging in 2022. As of December 15, the S&P 500, the most diversified U.S. stock market index, was over 18.5% lower since closing at 4,766.18 on December 31, 2021.

Chinese stocks have done even worse, causing a continuation of underperformance by the iShares China Large-Cap ETF product (NYSEARCA:FXI). Meanwhile, FXI has lagged behind the U.S. stock market for the past decade and a half.

A review of 2022 validates FXI’s underperformance as many investors and traders shunned Chinese equities. However, past performance is never a guarantee of future performance, and Chinese stocks could offer compelling value in the current environment. While China continues to face geopolitical and economic challenges, it’s the world’s second-leading economy with the most substantial population. Risk always is a function of potential rewards in any market, and the high level of risk in Chinese equities comes with commensurate profit potential.

China and the FXI ETF are contrarian investment opportunities that could pay off in 2023.

There always are geopolitical and economic shocks

Chinese stocks faced a series of political and economic shocks in 2022. A handshake at the Beijing Winter Olympics opening ceremony in early February 2022 caused many U.S. and European investors to shun Chinese stocks. The “no limits” alliance between China and Russia set the stage for Russia’s invasion of Ukraine in late February after the Olympics’ closing ceremonies. Russia considers Ukraine western Russia, while China believes Taiwan is a breakaway Chinese territory. The U.S., Europe, Japan, and their allies respect Ukrainian and Taiwanese sovereignty. The bottom line is the handshake created a serious bifurcation between the world’s nuclear powers that led to the first major war in Europe since WW II. When it comes to China, President Xi has stated that it is not a question of if China will force reunification on Taiwan but when it will occur.

Chinese stocks have suffered from geopolitical events. Meanwhile, the Chinese COVID-19 lockdowns have added insult to injury for Chinese equities as they have weighed on China’s economic growth. Markets reflect the geopolitical and economic landscapes, and the Chinese stocks traded on the Hong Kong and international exchanges have faced political and financial travails.

Why underperformance since 2007 continued in 2022

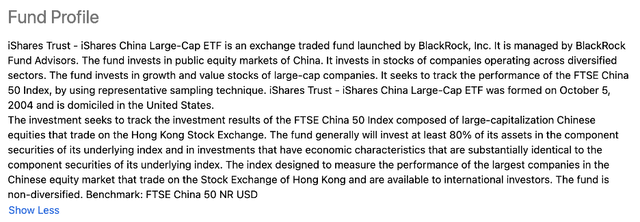

The FXI ETF is the most liquid Chinese Large-Cap product. FXI’s fund profile states:

Fund Profile for the FXI ETF Product (Seeking Alpha)

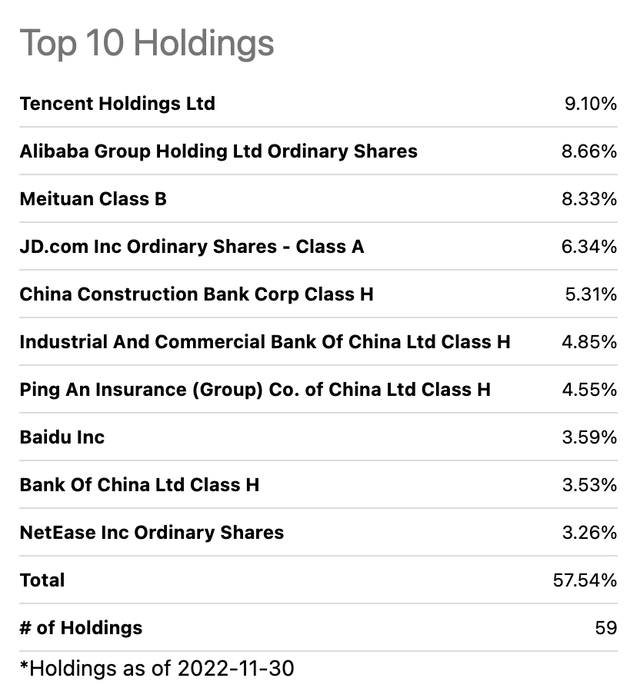

The most recent top holdings include:

Top Holdings of the FXI ETF (Seeking Alpha)

FXI holds 12.25% of its assets in Alibaba (BABA) and Baidu (BIDU), two popular Chinese large-cap stocks that have actively traded ADRs in the U.S. stock market. At $28.02 per share on December 15, FXI had $4.96 billion in assets under management. FXI trades an average of nearly 45 million shares daily and charges a 0.74% management fee. FXI has lagged U.S. stocks since reaching a record high in October 2007.

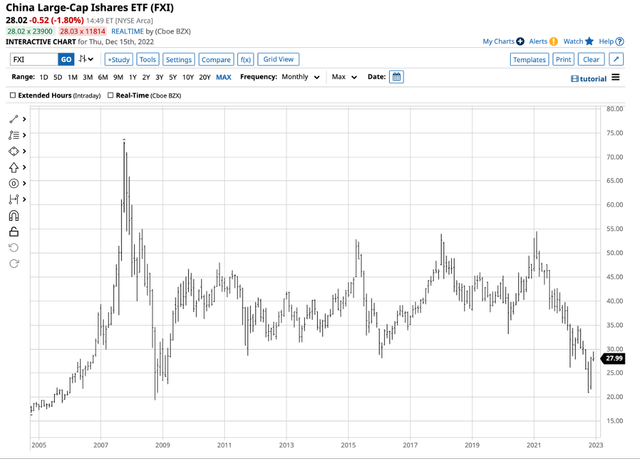

Long-Term Chart of the FXI ETF Product (Barchart)

The chart shows the all-time $73.19 peak in October 2007. At $28.02 on December 15, FXI was 61.7% lower. FXI closed 2021 at $36.58 per share and was 23.4% lower in 2022 as of mid-December.

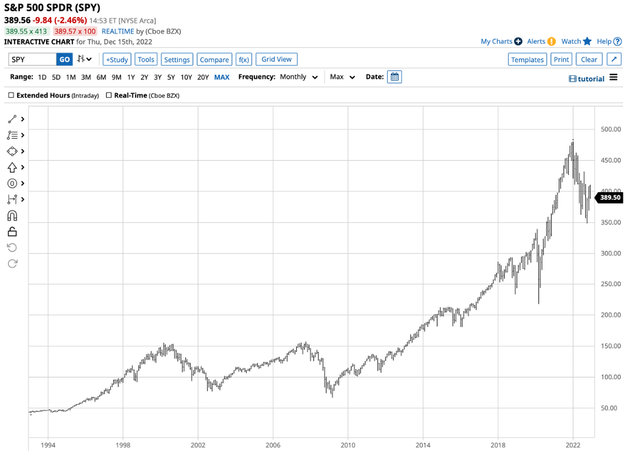

Long-Term Chart of the SPY ETF Product (Barchart)

The chart of the SPY ETF that tracks the S&P 500 index highlights the move from $157.52 in October 2007 to $389.56 on December 15, 2022, a 147.3% rise. SPY closed at $474.96 on December 31, 2021, and was 18% lower as of mid-December 2022. FXI has far underperformed SPY since October 2007, and the underperformance continues in 2022.

A new beginning? China emerging from COVID-19

The coming year could bring a new beginning for China’s economy. After experiencing demonstrations because of Chinese lockdowns, the government appears to be responding, and it may only be a matter of time before the end of the protocols.

An end to Chinese lockdowns would cause a sudden surge in economic activity in China and worldwide. The pent-up travel and economic demand could drive rapid economic growth in the world’s most populous country.

Meanwhile, the recent meeting between President Xi and Biden at the G-20 summit was a positive sign for relations. Moreover, China’s warning against nuclear conflicts could mean the alliance with Russia depends on the containment of the current conflict. China has repeatedly said it favors peace talks and an end to the war. While Chinese and U.S. interests are on opposite sides, President Xi could attempt to become a mediator in Ukraine in 2023, boosting his worldwide standing at the U.S.’s expense.

Charlie Munger and Warren Buffett look for value: BABA and FXI offer that value

Warren Buffett once said, “Price is what you pay, value is what you get,” and “Be fearful when others are greedy and greedy when others are fearful.” Investors and traders have shunned Chinese stocks because of the fear of the geopolitical and Chinese domestic landscapes.

Meanwhile, the Oracle of Omaha’s sidekick and partner has put words into action as he holds a significant position in Alibaba ADRs. As of the latest 13-F Q3 filing, Charlie Munger’s Daily Journal Corporation held 300,000 BABA shares, his third-largest holding.

Three compelling factors could cause the FXI to outperform in 2023:

- Value- FXI has a blended P/E ratio of 9.27 times earnings compared to the SPY’s 16.41 P/E ratio. SPY has a blended dividend yield of 1.54% compared to FXI’s 2.61% yield.

- A changing landscape- China is the world’s most populous country, and its economy is second only to the U.S. China’s international position. Future economic growth depends on cooperation with the U.S. and Europe. If the tense geopolitical landscape calms in 2023, Chinese equities should recover and likely outperform U.S. equities.

- Sentiment- While fundamentals are critical, sentiment drives asset prices. In a late November Seeking Alpha article, the author believes “allocating money to China makes sense.” Another Seeking Alpha author wrote, “valuations are extremely low, fundamentals looking forward look good, and the political direction is supportive, not the contrary.”

With investors searching for value after a year of double-digit percentage stock market losses, a shift in sentiment towards the Buffet-Munger school could cause a sudden rush of buying in Chinese shares and the FXI ETF product.

Risk always a function of the potential reward: FXI offers a compelling risk-reward dynamic

Seasoned investors and traders know that discipline and attention to risk-reward dynamics separate winners from losers in markets across all asset classes. Investors in Chinese equities have been suffering over the past fifteen years, but valuations have moved to compelling levels.

The potential for a significant recovery justifies the risk of a continued decline in FXI at the current price level. At around $28 per share on December 15, the long-term technical support level stands at the $19.35 October 2008 low. With $8.65 risk, the potential for a move to $36.65, a level traded on February 2022, is high as China emerges from its lockdowns. Moreover, an easing of worldwide tensions could cause an explosive move in the ETF that holds shares in the leading Chinese stocks that trade on the Hong Kong exchange and in ADRs in the U.S. markets.

Be the first to comment