sankai

Thesis

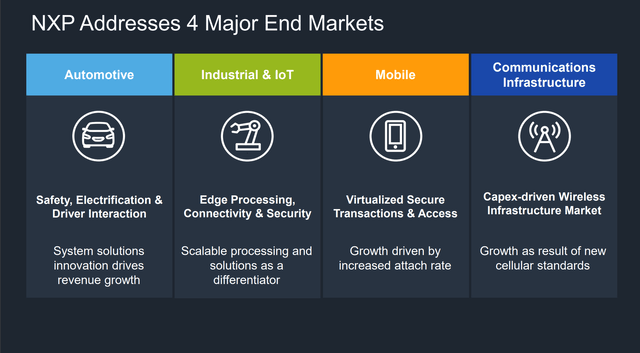

The market for semiconductors will arguably be one of the fastest growing markets until 2030, reaching an opportunity of $1 trillion in size. And the accelerated digitalization of the car (connected, autonomous and electric) will likely be one of the major drivers to push demand for semiconductors to new heights. NXP Semiconductor (NASDAQ:NXPI) a leading European chip maker with 50% revenue exposure to the automotive industry is poised to be a major beneficiary of these structural demand trends. And accordingly, it should come as no surprise that I am bullish.

I regard the current share price weakness for NXPI stock as a buying opportunity, being down about 35% YTD versus a loss of 25% for the S&P 500 (SPX).

About NXP

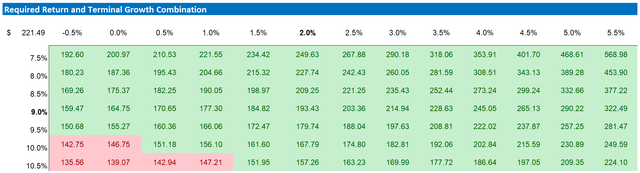

NXP NV is as a global semiconductor company. The firm researches, designs and manufactures semiconductors with a focus on automotive, wireless infrastructure, mobile, and computing applications. The company’s portfolio of semiconductor technologies include products such as microcontrollers, communication processors, security chips, connectivity chipsets, interface, and digital processing technologies.

NXP operates four major segments: Automotive, which accounts for about 50% of the company’s sales, Internet of Things technologies with about 20%, and Communication Infrastructure and Mobile both accounting for about 15% each.

Notably, NXP’s customers include some of the biggest and most successful firms in the world, including Apple, LG, Bosch, Samsung, BMW, Volkswagen and Siemens. Geographically, China is NXP’s most important end market, responsible for about 40% of total sales, followed by US (15%), Europe (15%), by Singapore (10%), and ROW (20%).

Structural Tailwind

As a leading semiconductor developer, NXP is poised to benefit from the global growing demand for chips, a market opportunity that is expected to grow at a CAGR of about 10% until 2030.

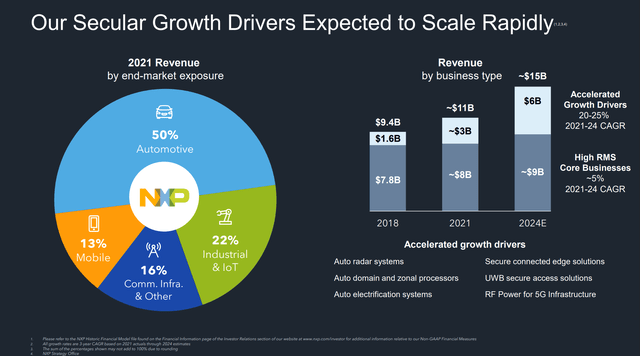

Moreover, NXP generates approximately 50% of revenues from the automotive end market. Accordingly, I believe NXP is well positioned to take advantage of the automotive industry’s digital revolution, meaning that cars are becoming increasingly a technology product that consume more semiconductors (CASE revolution: connected, autonomous, shared, and electric). NXP’s management team has estimated 20% – 25% topline growth through 2024 and I believe the company could very well achieve sales expansion at the top of management guidance.

Investors should also consider that together with Infineon and STMicroelectronics, NXP is one of the few major semiconductor companies in Europe. And as major economies are pushing to become ‘technology sufficient’, I believe it is not unreasonable to believe that the European union will increasingly start to support semiconductor research and manufacturing in Europe (like the CHIPS Act in the US).

Notably, at the Citi tech conference in early September NXP has indicated to expect demand in 2023 to remain above supply, despite the macro-economic weakness. Management has also said that the company will likely be able to mee no more than 80% of the demand, leaving a 20% supply shortage.

Strong Financials

From 2018 to 2022 (TTM reference), NXP expanded revenues at a compounded annual rate of about 8%. However, over the same period gross profit increased at a 11% CAGR, and net income increased at a CAGR of 44% respectively, reaching $2.7 billion for the trailing twelve months. Notably, NXP manages to claim a greater than 20% net-income margin, despite strong R&D expensing. For the trailing twelve months, the company has invested $2.1 billion in research, which equates to 16.3% of revenues.

NXP’s balance sheet is slightly stretched, but nothing of concern in my opinion. As of June 2022, the company had $3.5 billion of cash and short term investments versus a total debt position of $11.2 billion. Cash provided from operations for the trailing twelve months was $3.4 billion. Thus assuming a continuation of business trends, NXP could amortize its $7.7 billion of net-debt within less than 2.5 years.

According to the Bloomberg Terminal, analyst consensus estimates that NXP will grow revenues to $15.8 billion in 2025, and earnings to $4.4 billion or $16.6 per share. If consensus is correct, NXP stock would now effectively be trading at a forward 2025 P/E of about x9.

Target Price Estimate

To estimate a stock’s fair implied share price, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

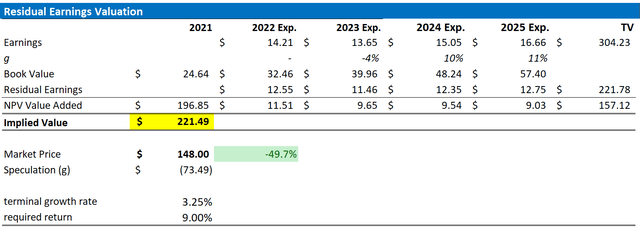

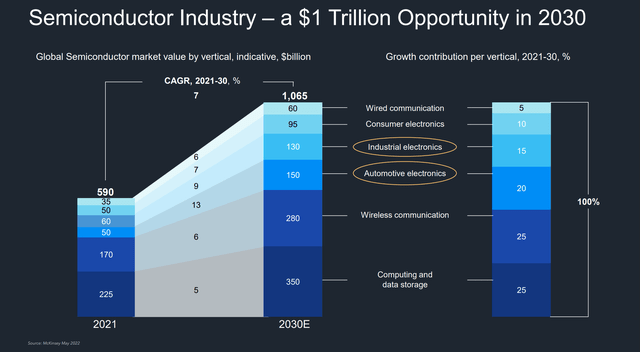

With regard to my NXP stock valuation, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise

- To estimate the capital charge, I anchor on NXPI’s cost of equity at 9% (in line with what is estimated by Bloomberg)

- For the terminal growth rate after 2025, I apply 3.25%, which is arguably very conservative (about one percentage point higher than estimated nominal global GDP growth)

Given these assumptions, I calculate a base-case target price for NXPI stock of $221.49/share (almost 50% upside).

Analyst Consensus EPS; Author’s Calculation

Notably, my bullish price target is not a reflection of a specific combination of growth and cost of capital. In fact, please find below a sensitivity analysis that supports different assumptions.

Analyst Consensus EPS; Author’s Calculation

Risks

Investors could argue that NXP’s business, with 50% exposure to the automotive industry is cyclical, and accordingly vulnerable to an earnings contraction that is driven by an economic slowdown. Moreover, investors should also note that the chip-maker industry is dynamic and competitive. Consequently, any loss/gain in market share could result in material downside/upwards revision for NXP’s earnings potential. Investors should also consider that sentiment towards risk assets such as stocks remains strongly depressed. And given multiple macroeconomic headwinds, NXPI stock may suffer from share price volatility even though the company’s fundamentals remain unchanged.

Conclusion

I am bullish on NXP, as I believe the company is well positioned to capture market opportunities in the strong growing semiconductor market. Moreover, the company’s valuation – priced at a one year forward P/E of about x15 – is attractive. Personally, I calculate a target price of $221.49/share.

Be the first to comment