turk_stock_photographer

It’s not hard to find doom and gloom in stocks these days, as it feels like the entire market is a proverbial falling knife. Most investors will shy away from buying in the current market, because it wouldn’t be a bear market otherwise. However, this is the time for contrarian investors with a long time horizon to shine. What’s even better is if they buy reliable dividend payers that offer a good yield in the interim.

This brings me to Air Products and Chemicals (NYSE:APD), which is a high quality company that’s been painted with a broad brush with the rest of the market. This article highlights why APD is a great long-term growth and dividend stock to buy at current levels, so let’s get started.

Why APD?

Air Products and Chemicals is a leading global industrial gases company that’s been around for 80-plus years, and is a Dividend Aristocrat that has grown its dividend annually for 40 consecutive years. Its essential industrial gases have applications in dozens of industries, including electronics, chemicals, manufacturing, refining, metals, and food and beverage. It operates in over 50 countries, and over the trailing 12 months, generated $12 billion in total revenue.

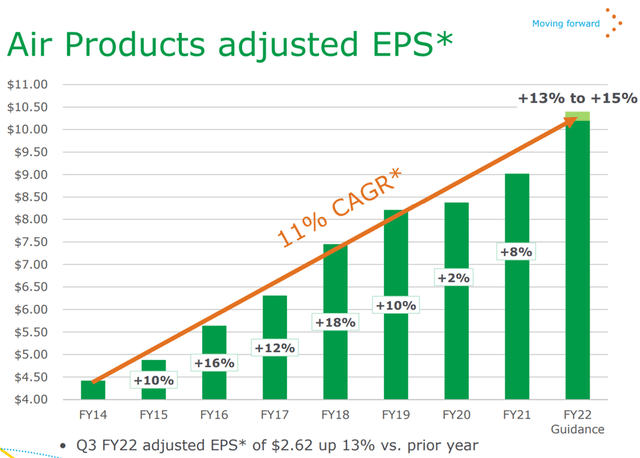

Unlike many companies that have their ups and downs, APD has demonstrated a fairly straightforward upward trajectory in earnings, with adjusted EPS growing by 11% CAGR since fiscal year 2014. This includes 13% to 15% adjusted EPS growth that management is guiding for the current fiscal year.

APD EPS Growth (Investor Presentation)

Moreover, unlike some businesses that grow but delay capital returns to shareholders, APD has grown its dividend at a similar rate to EPS growth, with a 10% dividend CAGR since FY 2014. Management appears to have the mindset, as they have expressly stated that cash flow drives long-term value, and what counts is the increase in per share value in stock, not size or growth.

Meanwhile, APD has lived up to management guidance with 13% adjusted EPS growth during its third fiscal quarter. This was supported in part by higher hydrogen volumes in the Americas, and positive pricing in Asia, Europe, and Americas. APD is also demonstrating a leadership position in the global energy transition, as its pipeline includes projects in Oman, the UK, and the Netherlands for the supply of low- and zero-carbon hydrogen.

Moreover, it recently signed long-term supply agreement with a company in India to build and operate a new industrial gases complex supplying hydrogen, nitrogen, and steam. Morningstar sees plenty of greenfield for the company due to its wide moat business model, as noted in its recent analyst report:

Air Products benefits from operating in an industry with a very favorable structure. Despite selling industrial gases, which are essentially commodities, public industrial gas companies have consistently delivered lucrative returns because of their economic moats. Industrial gases typically account for a relatively small fraction of customers’ costs but are a vital input to ensure uninterrupted production.

As such, customers are often willing to pay a premium and sign long-term contracts to ensure their businesses run smoothly. Long-term contracts and high switching costs contribute to industrial gas producers’ moats, helping them generate a predictable cash flow stream and lucrative returns.

Potential headwinds to APD include a slowdown in industrial activity due to a global recession. However, APD has no shortage of growth projects to invest in to grow externally. This is supported by an A rated balance sheet and a 45% payout ratio as a percentage of distributable cash flow, leaving $1.5 billion in retained capital over the trailing 12 months to invest in high return projects

I find APD to be attractively priced at $231.76 with a forward PE of 22.5. This is considering the moat-worthy enterprise, strong track record, and the 12-18% EPS growth rate that analysts estimate over the next 2 years. As shown below, APD sits well below its 52-week high of $316 and is again trading in a trough after falling from the recent bear market rally.

APD Stock (Seeking Alpha)

Morningstar has a $321 fair value estimate and sell side analysts have a consensus Buy rating with an average price target of $294, translating to a potential one-year 30% total return including dividends.

Investor Takeaway

Air Products and Chemicals is a global leader in the industrial gases business with a large and diversified customer base, long-term relationships, and an integrated asset base. The company has demonstrated a commitment to shareholder returns through its consistent dividend growth, and has plenty of capacity to fund its list of growth projects. I find the recent drop in price as presenting a great opportunity for growth and income investors alike.

Be the first to comment