adaask

Both Main Street Capital (NYSE:MAIN) and Oaktree Specialty Lending (NASDAQ:OCSL) are high-yielding investment grade business development companies (i.e., BDCs) (BIZD). MAIN has a tremendous track record whereas OCSL pays out a much higher dividend yield. In this article, we will compare them side by side and offer our take on which one is a better buy.

MAIN Vs. OCSL – Balance Sheet

Both MAIN (BBB- with a stable outlook) and OCSL (Baa3 Stable from Moody’s) have investment grade credit ratings which implies they both have solid balance sheets.

As of the end of its most recently reported quarter, MAIN had a leverage ratio of 0.98x and $518.4 million of liquidity to go along with it. Perhaps most importantly in the current rising interest rate environment, only 20% of MAIN’s total debt is floating rate.

Meanwhile, OCSL had $489 million in total liquidity and a leverage ratio of 1.08x as of the end of its most recently reported quarter. However, a whopping 78.5% of OCSL’s debt had a floating interest rate. The reason for this is because OCSL tries to remain as macroeconomically neutral as possible, so that – whether interest rates are rising or falling – its spreads are pretty stable.

While we certainly understand OCSL’s approach, in the current environment, we favor MAIN’s approach, and therefore give it the edge here.

MAIN Vs. OCSL – Investment Portfolio

69% of MAIN’s portfolio is invested in senior secured debt with 59% positive exposure to rising interest rates. On top of that, MAIN has excellent underwriting performance, with a mere 0.7% non-accrual rate at fair value. One thing to keep in mind, however, is that a significant percentage of MAIN’s portfolio is also invested in equity in middle market businesses. While this has contributed to phenomenal returns for the company during the recent economic boom, with the economy heading into a downturn, this greatly increases the risk for the business.

In contrast, OCSL’s portfolio consists of a higher percentage of debt relative to equity, positioning it as a more conservative alternative. In fact, roughly 87% of its portfolio is invested in senior secured debt and ~79% of the total investment portfolio benefits from rising interest rates. OCSL’s underwriting expertise is evident in the fact that it has no investments on non-accrual.

Both businesses are also heavily weighted towards more defensive sectors, with OCSL being particularly defensive given its focus on proprietary life science loans.

If we were in an economic boom period, MAIN’s portfolio would likely be a more attractive choice. However, given that we are not, OCSL’s more conservative posturing is preferred. As a result, we give OCSL the edge here.

MAIN Vs. OCSL – Dividend Safety

OCSL’s dividend coverage ratio is currently fairly tight at 1.06x. However, given its excellent underwriting, interest rate agnostic investment spreads, and relatively low leverage, its dividend is not as risky as it might first seem. Furthermore, OCSL has been growing its dividend aggressively over the past two years, which implies that it is actually quite safe. As the saying goes:

The safest dividend is the one that has just been raised.

MAIN’s dividend coverage, meanwhile, is quite strong at 1.21x. As a result, management was able to issue a special dividend. As it explained on MAIN’s Q2 earnings call:

Based upon our results for the second quarter and the positive performance of our existing portfolio of companies, combined with our favorable outlook in each of our primary investment strategies and for our asset management business and the benefits of our efficient operating structure, earlier this week, our Board declared a supplemental dividend of $0.10 per share payable in September and an increase in monthly dividends for the fourth quarter of 2022 to $0.22 per share payable in each of October, November and December. These monthly dividends represent a 4.8% increase from the fourth quarter of 2021 and a 2.3% increase from the third quarter of 2022.The supplemental dividend for September is due to our strong performance in the second quarter, which resulted in DNII per share, it was over $0.13 or 21% greater than the monthly dividends paid during the quarter. This represents our fourth consecutive quarter of paying a supplemental dividend and result in total supplemental dividends paid over the last year of $0.35 per share, representing an additional 13% paid above our monthly dividends and an increase in total dividends paid for the trailing 12-month period of 18.5% over the prior year. We are pleased to have been able to deliver this significant additional value to our shareholders.

While we think both companies have exercised prudence in managing their dividend policies, we are going to give a slight edge to MAIN here in terms of dividend safety given that its coverage ratio is meaningfully superior.

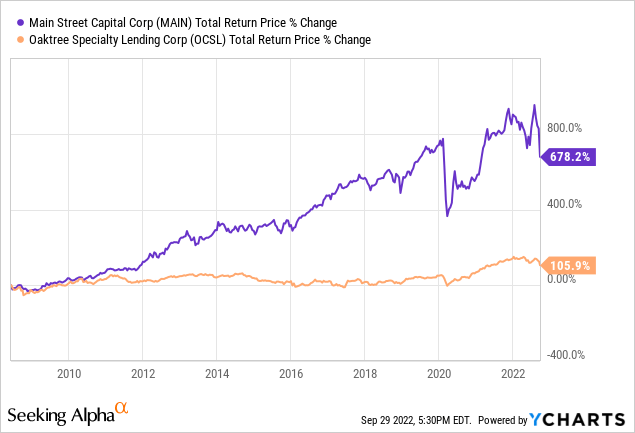

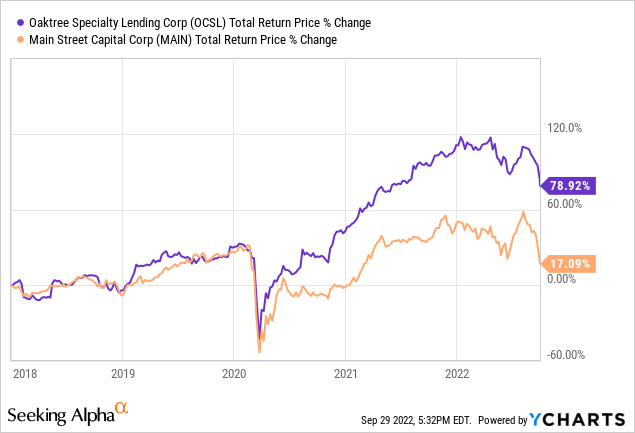

MAIN Vs. OCSL – Track Record

When it comes to track record, MAIN’s total returns have crushed OCSL’s:

However, we need to recognize that OCSL has changed a lot over the years, particularly since being acquired by Oaktree at the end of 2017. In fact, since then OCSL’s total return performance has crushed MAIN’s:

As a result, we consider this category to be a draw, especially given that we believe that OCSL is more conservatively positioned for an economic downturn.

MAIN Vs. OCSL – Risks And Catalysts

MAIN and OCSL both operate in the same industry with fairly similar business models. As a result, they face many of the same risks and catalysts. In particular, if the economy were to undergo a steep and prolonged recession, both businesses would likely suffer meaningful losses due to many of their middle market counterparties having to default on or at least restructure their loans.

Given that OCSL places a much greater focus on senior debt compared to MAIN’s greater relative exposure to equity, OCSL will likely outperform MAIN during an economic downturn, whereas MAIN will likely outperform OCSL during an economic expansion. However, it is also worth remembering that OCSL has a pretty balanced exposure to rising interest rates on both its asset and liability sides of the balance sheet. In contrast, MAIN has much greater exposure to rising interest rates on the asset side of its balance sheet relative to the liability side of its balance sheet. As MAIN’s CEO stated on its Q2 earnings call:

One additional item that I wanted to touch on is the impact of rising interest rates. During the quarter, LIBOR rates increased by approximately 130 basis points from those in effect as of March 31st to June 30th. At the end of the second quarter, 80% of our outstanding debt obligations maintain fixed interest rates. On the other hand, approximately 75% of Main’s debt investments for interest rates at floating rates with weighted average contractual interest rate floor of low current market index rates. As a result, in a rising interest rate environment, our exposure to higher interest expense is largely mitigated and over time, increases to our interest income will exceed the increases to our interest expense. It is important to note that the majority of our variable interest rate investments are based on contracts which reset quarterly, whereas our credit facility resets monthly. As a result, we generally will have a quarterly lag in the realization of benefits from rate increases in our interest income and net investment income.

MAIN Vs. OCSL – Valuation

When it comes to their relative valuations, OCSL looks clearly cheaper. Its dividend yield is substantially higher and its price to NAV is massively cheaper than MAIN’s are. As a result, we give a decisive win to OCSL here.

|

Valuation Metric |

MAIN |

OCSL |

|

Dividend Yield |

7.45% |

11.31% |

|

Dividend Yield (5-Year Average) |

7.18% |

8.44% |

|

P/NAV |

1.40x |

0.89x |

|

P/NAV (5-Year Average) |

1.63x |

0.85x |

Investor Takeaway

MAIN’s long-term track record is extraordinary and should not be minimized. On top of that, it has more favorable exposure to rising interest rates than OCSL does. Finally, its dividend coverage is a bit stronger.

That said, OCSL’s total return track record under Oaktree’s expert management has actually run laps around MAIN’s over that same time period. On top of that, OCSL’s dividend yield and price to NAV are far more attractive than MAIN’s are. Last, but not least, its investment portfolio is better positioned to weather an economic downturn than MAIN’s is, given that MAIN puts a greater relative emphasis on equity whereas OCSL puts a greater relative emphasis on senior secured debt.

As a result, we give OCSL stock the edge here, rating it a Buy and MAIN stock a Hold.

Be the first to comment